For the week ending Friday January 17, 2025, FNArena recorded eleven ratings upgrades and six downgrades for ASX-listed companies by brokers monitored daily. Among industrials, Star Entertainment and Premier Investments suffered the largest percentage falls in average earnings forecasts and target prices.

For Star Entertainment, brokers were reacting to a negative update by management the prior week on the company’s cash and liquidity position. Morgans felt the risk/reward payoff for holding Star stock was “unfavourable,” citing a lack of short-term funding options, a lack of state government support, risks of more dilutive equity issues, and weakness in the overall market. This broker lowered its target to 12c from 22c, while Ord Minnett arrived at 17c, down from 30c.

Premier Investment’s first half trading update indicated sales missed the consensus forecast by -3%, with higher costs resulting in a more significant impact at the EBIT line, explained Macquarie. The analyst anticipates ongoing headwinds for Smiggle, with customers still facing higher cost-of-living and interest rate pressures.

UBS retained its Neutral rating for Premier, citing the growth outlook across all divisions, especially Peter Alexander, and the company’s previous cost management performance.

The largest falls in average earnings forecasts by analysts befell Coronado Global Resources and Mineral Resources.

While lowering its target for Coronado, partly due to lower hard coking and thermal coal price forecasts, Bell Potter (Buy) noted the company’s production profile has de-risked with the commencement of ramp-up of saleable production from its lower cost and less weather-affected Mammoth underground mine.

Outperform-rated Macquarie predicted volumes will be “solid” in the December quarter, with both production and sales rising quarter-on-quarter by 4% and 14%, respectively.

Ord Minnett also lowered its 2025 forecasts for hard coking coal and thermal coal by -9% and -8%, respectively, due to weaker commodity demand, higher-for-longer interest rates, and anticipated impacts of Trump tariffs and other trade barriers.

Prior to production results on January 29, Macquarie lowered its FY25 EPS forecast for Mineral Resources by -75% due to higher lithium and iron ore costs. More positively, the broker’s FY26 EPS forecast declined by less than -1%.

On the flipside, average target prices rose materially for Insignia Financial, Genesis Minerals, and global mining services provider, Perenti.

Insignia has received a cash bid from CC Capital at $4.30 per share, up from Bain Capital’s December bid of $4.00 per share, which was rejected by the board. UBS kept its $4.05 target and Neutral rating, believing the competing offer is opportunistic and unlikely to change the board’s view.

In the prior week, Macquarie raised its target price by 64% to $4.40 on higher earnings and buyer interest and noted longer-term potential in the wealth landscape. This broker’s rating was also upgraded to Equal weight from Underweight.

Genesis Minerals released its December quarter activities report last week to general acclaim by analysts covering the company. Production of 57koz significantly outperformed the UBS forecast of 46koz due to the Gwalia operations mining a bulk high-grade stope and the Laverton mill restart exceeding expectations. The analyst increased the target to $3.00 from $2.80 and downgraded to Neutral from Buy on valuation.

Accumulate-rated Ord Minnett raised its target to $3.15 from $2.90 and now believes FY25 production could exceed management’s guidance.

In research penned on January 6, Citi expected another “solid” upcoming first half result for Perenti, underpinned by contract mining and potential for some improvement in its Drilling Services margin due to improvement in rig utilisation. The analysts felt an upgrade in earnings guidance is likely in the near-term and raised their target price to $1.60 from $1.15.

Several companies received positive earnings revisions last week, including Capricorn Metals, following a strong operational report the previous week; Ventia Services, after Morgans moderated the expected negative earnings impact from ACCC civil proceedings; and Perseus Mining, which benefited from Macquarie’s revised lower Australian dollar forecast.

Earnings forecast for Atlas Arteria also received a boost from Macquarie’s new currency forecast and prospects for slightly better French traffic flows based on recent reporting by peers. Traffic is also running a little better at Dulles Greenway (a 22-km toll road in northern Virginia, USA).

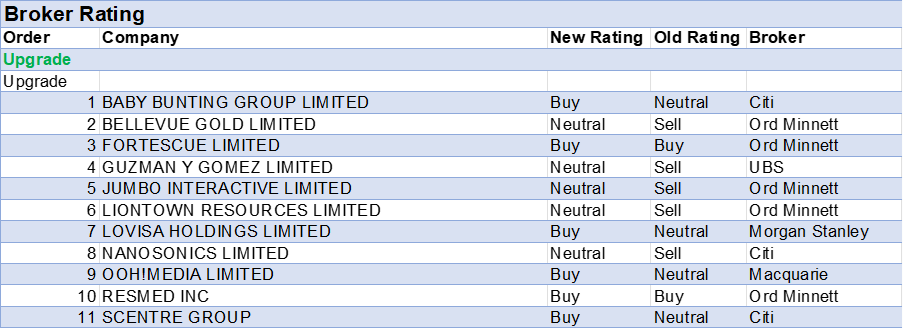

In the good books: upgrades

BABY BUNTING GROUP LIMITED ((BBN)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/2/0

Following on from Citi’s first impressions of Baby Bunting’s 1H update yesterday, the broker raises its target to $2.01 from $1.98 and upgrades to Buy from Neutral. The analysts anticipate further upside from the company’s store refurbishment program and new store formats. It’s also thought margins will continue to surprise on the upside via the delayed impact of supplier renegotiations due to stock turns and annualisation benefits.

BELLEVUE GOLD LIMITED ((BGL)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 3/1/0

Ord Minnett marks to market commodity prices for the December quarter. The broker downgrades the 2025 copper price forecast by -14%, hard coking coal by -9%, thermal coal by -8%, and aluminium by -8% due to weaker commodity demand, higher-for-longer interest rates, and the impacts of Trump tariffs and other trade barriers. Ord Minnett upgrades Bellevue Gold to Hold from Lighten, with a lower target price of $1.15, down from $1.35. EPS forecasts are reduced by -38.1% in FY25 and -25.7% in FY26.

FORTESCUE LIMITED ((FMG)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 2/2/3

Ord Minnett marks to market commodity prices for the December quarter. Fortescue is upgraded to Buy from Accumulate, with the target price raised to $21.10 from $20.50. The company is seen as attractively valued among iron ore producers during a seasonally stronger production period for Chinese steel production. Ord Minnett raises EPS forecasts by 9.7% and 17.5% for FY25 and FY26, respectively.

GUZMAN Y GOMEZ LIMITED ((GYG)) was upgraded to Neutral from Sell by UBS. B/H/S: 1/3/0

Due to higher forecasts for Australian same-store sales growth and adjusted earnings (EBITDA) margins, UBS raises its target for Guzman y Gomez to $40 from $37 and upgrades to Neutral from Sell. The analysts believe the company can beat current market expectations due to menu innovation, delivery, extended hours, along with daypart. A daypart refers to a specific segment of the day during which distinct menu items are typically promoted or consumed.

JUMBO INTERACTIVE LIMITED ((JIN)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 4/2/0

Ord Minnett highlights that prize pools in the first half of FY25 fell by -4% year-on-year, driven by a lack of jackpots above $100m and a -10% decline in overall jackpot prize pools. As expected by the broker, lower jackpot pools also slowed the rate of digital penetration. The analyst still anticipates long-term growth for lotteries of around 4%, compared to growth of 7% per annum over the past five years. The target for Jumbo Interactive is lowered to $12.70 from $13.10. The broker’s rating is upgraded to Hold from Lighten due to recent share price weakness.

LOVISA HOLDINGS LIMITED ((LOV)) was upgraded to Overweight from Equal weight by Morgan Stanley. B/H/S: 3/2/2

Morgan Stanley upgrades Lovisa Holdings to Overweight from Equal-weight, identifying it as the fifth key small/mid-cap idea where the broker has conviction on earnings, and the stock has underperformed heading into 2025. The analyst sees upside to store growth in FY25/FY26, based on an acceleration in January from website data. Sustaining this run rate would benefit the stock, as store growth is a “key driver” of the share price. Lovisa is expected to report in late February, with the broker anticipating an improvement in gross margins to 20.8% from 19.5% due to operating leverage. Overweight rating with a $33.25 target price. Industry view: In-Line.

LIONTOWN RESOURCES LIMITED ((LTR)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 1/3/2

Ord Minnett marks to market commodity prices for the December quarter. Liontown Resources is upgraded to Hold from Lighten, with the target price lowered to 62c from 74c. Ord Minnett lifts the FY25 EPS forecast by 14.3%.

NANOSONICS LIMITED ((NAN)) was upgraded to Neutral from Sell by Citi. B/H/S: 2/2/0

Citi’s healthcare sector preview to the February reporting season includes an upgrade to Neutral from Sell for Nanosonics. The broker’s price target has improved to $3.40 from $3.15 on higher forecasts. The upgrade is also in response to recent share price weakness.

OOH! MEDIA LIMITED ((OML)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/1/0

Macquarie upgrades oOh!media to Outperform from Neutral, citing expectations that out-of-home growth will exceed other advertising categories, with forecast rate cuts likely to support higher ad spending. The company is also expected to benefit from cost-out programs, and Macquarie believes the valuation remains appealing. Management has pointed to more rational competitive behaviour, which should alleviate pressure on gross margins. The company is expected to report 2024 results on February 24. Macquarie lifts EPS estimates by 7% and 11% for 2025 and 2026, respectively. The target price decreases to $1.45 from $1.56, based on a 12.5x price-to-earnings valuation. Outperform rating maintained.

RESMED INC ((RMD)) was upgraded to Buy from Hold by Ord Minnett. B/H/S: 3/2/0

Ord Minnett has revised earnings models for healthcare companies following changes in forex assumptions in the December quarter. The broker raises the target price for ResMed to $43.90 from $40.05 and upgrades the rating to Buy from Hold. CSL and ResMed remain the top stock picks in the sector, with double-digit EPS growth expected across the analyst’s investment horizon.

SCENTRE GROUP ((SCG)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/0/1

2025 is viewed as an “inflection” year by Citi for Australian real estate stocks, with expectations of an interest rate cut in May. The broker believes the outlook remains robust for high-growth sectors like data centres, self-storage, retail, and land lease. Falling financing costs are also seen as a positive for the industry. A slower recovery in the domestic office market is anticipated due to higher vacancy rates and ongoing tenant incentives. Citi’s analyst prefers Goodman Group ((GMG)), National Storage ((NSR)), Ingenia Communities ((INA)), Stockland ((SGP)), Scentre Group, and GPT Group ((GPT)). Scentre Group is upgraded to Buy from Neutral. Target price rises to $3.91 from $3.60.

In the bad books: downgrades

BEACH ENERGY LIMITED ((BPT)) was downgraded to Sell from Neutral by Citi. B/H/S: 4/1/2

Citi downgrades Beach Energy to Sell from Neutral and raises the target price to $1.30 from $1.20. The analyst believes the market is not fully accounting for risks associated with Waitsia. Following a December site visit, Citi identifies potential issues with introducing high-pressure gas into the plant and notes a new operator is taking control. Citi also reviews the outlook for crude oil, forecasting a surplus from 2Q 2025. Historically, the broker points out, the Energy and Production sector underperforms the ASX by -30% during periods of crude oversupply.

CAR GROUP LIMITED ((CAR)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 4/2/0

Due to recent share price strength, Ord Minnett downgrades CAR Group to Hold from Accumulate, retaining the target price at $39. The broker notes management reconfirmed FY25 guidance for revenue and earnings, including the closure of its wholesale and retail online tyres business following a strategic review. There are no changes to the analyst’s earnings estimates.

DETERRA ROYALTIES LIMITED ((DRR)) was downgrade to Accumulate from Buy by Ord Minnett. B/H/S: 3/2/0

Ord Minnett marks to market commodity prices for the December quarter. The broker downgrades the 2025 copper price forecast by -14%, hard coking coal by -9%, thermal coal by -8%, and aluminium by -8% due to weaker commodity demand, higher-for-longer interest rates, and the impacts of Trump tariffs and other trade barriers. Deterra Royalties is downgraded to Accumulate from Buy, with a $4.40 target price. Ord Minnett lifts EPS forecasts by 8.8% and 9.7% for FY25 and FY26, respectively.

GENESIS MINERALS LIMITED ((GMD)) was downgraded to Neutral from Buy by UBS. B/H/S: 5/1/0

Genesis Minerals’ December quarterly activities report revealed production of 57koz at a cost (AISC) of $2,202/oz, significantly outperforming UBS’s forecast of 46koz. The broker attributes the beat to Gwalia mining a bulk high-grade stope and the Laverton mill restart exceeding expectations. The analysts raise the FY25 outlook to 217koz, 9% above the midpoint of production guidance, with an AISC of $2,244/oz. UBS downgrades the rating to Neutral from Buy following the recent strong share price. The target price increases to $3.00 from $2.80.

MONADELPHOUS GROUP LIMITED ((MND)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/4/0

While a positive outlook for Monadelphous Group supports Macquarie’s forecast for low double-digit earnings growth over FY25/26, the broker downgrades to Neutral from Outperform after a strong share price performance. The target rises to $14.80 from $14.44 on the analyst’s slightly higher EPS forecasts.

NETWEALTH GROUP LIMITED ((NWL)) was downgraded to Sell from Neutral by Citi. B/H/S: 1/5/1

Citi highlights the platform industry recorded the second-highest quarterly net flows for the September 2024 quarter in the last 10 years. The strength is attributed to robust equity markets boosting incremental fund inflows and slowing headwinds from losing market share to industry funds. Citi downgrades Netwealth Group to Sell from Neutral due to its high valuation and expectations of downside risk to earnings. The analyst’s earnings before depreciation and amortisation forecasts are below consensus by -2% for FY25 and -6% for FY26. Target price lifts to $28.90 from $27 due to a roll forward of the valuation.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.