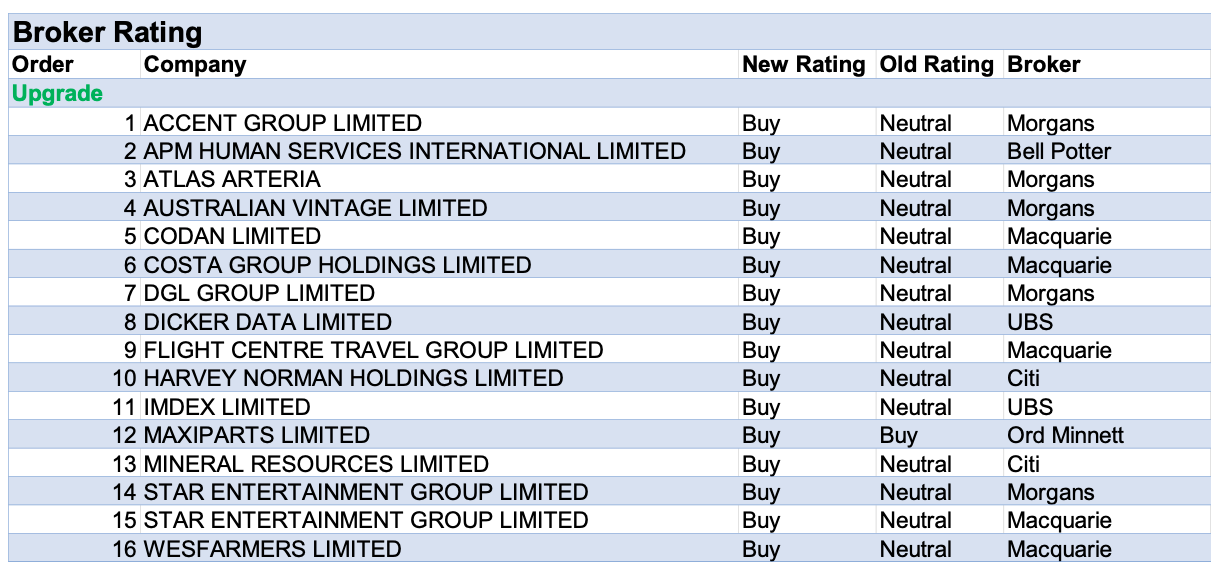

In the good books: Upgrades

-

ATLAS ARTERIA ((ALX)) was upgraded to Add from Hold by Morgans. B/H/S: 1/4/0

Atlas Arteria’s 1H earnings growth was broadly in line with Morgans’ forecast. Traffic and toll revenue numbers had been pre-released. The broker highlights around 64% of its valuation for Atlas Arteria is derived from the APRR motorway network in France.While there is a political risk of an additional toll road tax for APPR, it’s felt the current overall company valuation represents value and the broker’s rating is upgraded to Add from Hold.

The target edges up to $6.44 from $6.43.

- APM HUMAN SERVICES INTERNATIONAL LIMITED ((APM)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 4/0/0

APM Human Services International posted a good set of results, Bell Potter suggests, showing strong revenue growth, strength in underlying earnings and an improvement in cash generation.

Profit was down -13% in A&NZ due to investment, and down -13% in rest-of-world, but up 275% in the US due to the acquisition of Equus. Earnings margins reduced to 19.2% in FY23 from 23.1% in FY22 and deteriorated further in the second half.

This is attributed to inflation, costs of staff retention/recruitment, build out into new areas, and acquisitions, the broker notes.

Bell Potter continues to see an attractive medium to long term investment case from rising unemployment, new contracts, growth in the health business and opportunities within NDIS, all of which should drive profit growth and a gradual re-rating.

Rating is upgraded to Buy from Hold and target rises to $2.21 from $2.04.

- AUSTRALIAN VINTAGE LIMITED ((AVG)) was upgraded to Add from Hold by Morgans. B/H/S: 1/1/0

While FY23 results were weak, as expected by Morgans, there were 2H signs of an easing in inflationary cost pressures which materially impacted FY23 margins. It’s now felt FY23 will be as worse as it gets for Australian Vintage.

These easing inflation pressures along with management’s -$9m cost-out program, should result in a material earnings recovery in FY24, suggest the analysts. Consequently, the target is increased to 58c from 46c, and the rating upgraded to Add from Hold.

The broker points out shares are trading at a material discount to pre-covid multiples despite being a higher quality, branded business.

- ACCENT GROUP LIMITED ((AX1)) was upgraded to Add from Hold by Morgans. B/H/S: 3/1/1

FY23 earnings for Accent Group beat Morgans forecast driven by strong sales growth and better-than-expected management of costs, due to operational efficiencies achieved through successful management of store rostering.

In the face of a weaker Australian dollar and increased 2H promotional activity, observe the analysts, the gross profit margin improved by 100bps year-on-year via growth in distributed and owned vertical brands.

Trading for the first seven weeks of FY24 has started well, in the broker’s opinion, as the group pivots to selling at full price. Morgans upgrades its rating to Add from Hold and raises its target to $2.40 from $1.80 on higher forecasts and higher peer multiples.

- CODAN LIMITED ((CDA)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 1/0/0

Codan reported in line with its pre-release which featured a 2% beat on profit to Macquarie’s forecast, with metal detection a strong beat thanks to the rest-of-world recreational market, and communications in line. Nebt debt has reduced and should continue to decline in FY24, the broker suggests, driven by a stronger financial performance and inventory unwind.

There was no new information provided on recent Eagle acquisition, nor any FY24 guidance, with updates expected at the AGM in October. Target rises to $8.20 from $8.10. Following the pullback in the share price the broker upgrades to Outperform from Neutral.

- COSTA GROUP HOLDINGS LIMITED ((CGC)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 1/4/0

First half operating earnings (EBITDA-S) were largely in line with expectations. The outlook for citrus in 2023 has deteriorated, largely weather-related. The problems are not considered structural and the productive capacity of the trees unaffected.

Macquarie assesses the commentary from Costa Group was not ideal in the context of the Paine Schwartz Partners bid, but the suitor is likely to have a “through the cycle view” on the business.

The latter has been advised of the latest trading conditions as part of due diligence and, while it remains uncertain if a transaction will eventuate and at what price, discussions are continuing. Macquarie upgrades to Outperform from Neutral. Target is reduced to $3.19 from $3.43.

- DICKER DATA LIMITED ((DDR)) was upgraded to Buy from Neutral by UBS. B/H/S: 2/0/0

Dicker Data’s June first-half result appears to have pleased UBS, despite a miss on operating expenditure, the broker observing momentum in most businesses, excluding PC sales (which were lower but in line).

The broker expects growth to rally to 11% in FY24, driven by a rebound in PCs, and ongoing strength in security and software.

UBS forecasts an FY23-FY26 EPS annual compound growth rate of 12% and a 5% yield (although the broker thinks a reduction in the payout ratio would be preferable in order to service debt and cut interest expense). Rating is increased to Buy from Neutral, UBS perceiving the earnings profile to be derisked. Target price rises to $9.60 from $8.40.

- DGL GROUP LIMITED ((DGL)) was upgraded to Add from Hold by Morgans. B/H/S: 2/1/0

While FY23 results for DGL Group were broadly in line with guidance and consensus expectations, Morgans upgrades its rating to Add from Hold after management flagged better times in FY24. The broker considers the 2H of FY23 sets a reasonable baseline for FY24 earnings and management can grow these earnings at around 10-15% per year over the medium term. Morgans target rises to $1.10 from $1.00.

- FLIGHT CENTRE TRAVEL GROUP LIMITED ((FLT)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 4/1/0

Flight Centre Travel delivered a “solid” result, Macquarie observes, slightly above guidance at the EBITDA level and with leisure profitability surprising to the upside. On further analysis the broker assesses the business has good momentum into FY24, as solid profit margin improvement is expected in corporate after heavy investment.

While some are focused on the pre-tax profit margin target of 2% for FY25, Macquarie prefers that attractive growth opportunities are prioritised, including lower-margin business.

The capital management plan has been reinstated with 50-60% net profit to be returned to shareholders via various means. Rating is upgraded to Outperform from Neutral. Target is lifted 8% to $24.85.

- HARVEY NORMAN HOLDINGS LIMITED ((HVN)) was upgraded to Buy from Neutral by Citi. B/H/S: 1/3/1

Harvey Norman’s FY23 EBIT was ahead of Citi’s estimates. The broker observes comparables for Australia will become significantly easier from November.

On further analysis, numerous tailwinds are seen supporting a house price recovery while a warmer summer should enable sell-through of excess seasonal inventory.

The broker recognises the stock has rallied hard from its lows but significantly underperformed peers such as JB Hi-Fi ((JBH)) and Super Retail ((SUL)). Further upside is envisaged given the improved outlook and a “very reasonable” valuation. Rating is upgraded to Buy from Neutral and the target lifted to $4.60 from $3.70.

- IMDEX LIMITED ((IMD)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/1/0

UBS upgrades Imdex to Buy from Neutral, believing the recent sell-off has been overdone, spying an inflection point in global mineral exploration activity. The broker notes the share price retreat was driven by the tapering off of exploration activity this year.

The broker appreciates the company’s strong balance sheet exposure to critical metals with a proven track record.

On the downside, the company’s June half result missed consensus forecasts by -7%, observes UBS, due to higher employee costs related to digital and IMT growth spend.

EPS forecasts fall -10% in FY24 and -7% in FY25, which UBS says are offset by mark-to-market target multiples, resulting in a steady target price of $2.10.

See also IMD downgrade.

- MINERAL RESOURCES LIMITED ((MIN)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/2/1

Further to the FY23 results, which were in line, Citi upgrades to Buy from Neutral, believing expectations for the lithium business are likely to reset and the consensus downgrade cycle is close to its end.

The broker acknowledges the heavy capital expenditure in the current year but expects the stock to outperform as a less-leveraged lithium exposure.

Mineral Resources has indicated it has no plans for a capital raising, reiterating its assertion the market should not be concerned about the balance sheet. Citi raises the target to $79.00 from $75.50.

- MAXIPARTS LIMITED ((MXI)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 1/0/0

MaxiPARTS delivered a FY23 net profit that was ahead of forecasts. The result benefited from a 28.1% increase in revenue, that was also ahead of expectations.

Ord Minnett finds the outlook favourable amid synergies from the Truckzone acquisition and the benefit from the high-margin Forch business. Earnings for FY24 and FY25 are upgraded by 5% and 8%, respectively.

The company has significantly strengthened both its market and financial position over the past 12 months and the broker upgrades to Buy from Accumulate. Target rises to $3.30 from $3.00.

- STAR ENTERTAINMENT GROUP LIMITED ((SGR)) was upgraded to Outperform from Neutral by Macquarie and to Add from Hold by Morgans. B/H/S: 4/0/0

Macquarie considers the June quarter of FY23 the low point for Star Entertainment. The company reported a 34% increase in EBITDA for FY23, ahead of guidance and the broker’s estimates. The beat was largely stemming from completion of the cost reduction program.

Macquarie now expects $270m in EBITDA in FY24, implying a -15% decline as revenue trends are below what was seen in early FY23.

Completion of debt refinancing is the next hurdle for the business, expected to be done and dusted in the December quarter.

The business is “not out of the woods” the broker points out but there is enough margin of safety to upgrade to an Outperform rating from Neutral. Target is $1.25.

FY23 results for Star Entertainment were broadly in line with Morgans forecasts. Earnings (EBITDA) of $317m landed slightly above $310m, the top end of the guidance range.

Higher earnings forecasts combined with a favourable NSW duty rate outcome lifts the broker’s rating to Add from Hold. Following the duty result and a reduction in debt following a capital raise, it’s thought the upcoming refinancing of debt has been de-risked.

The $1.20 target price is unchanged.

- WESFARMERS LIMITED ((WES)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 3/1/1

Macquarie observes FY23 results were strong across the Wesfarmers group. The major earnings driver continues to be Bunnings and its push to attract trade customers has been successful with 2.1% sales growth in the second half despite DIY pulling back.

Macquarie was surprised at the strength in demand across Bunnings and Kmart in particular.

The first seven weeks of trading into FY24 has also been strong, with the broker lauding the “best-in-class offerings” in each of the divisions. Rating is upgraded to Outperform from Neutral, and the target rises to $54 from $52.

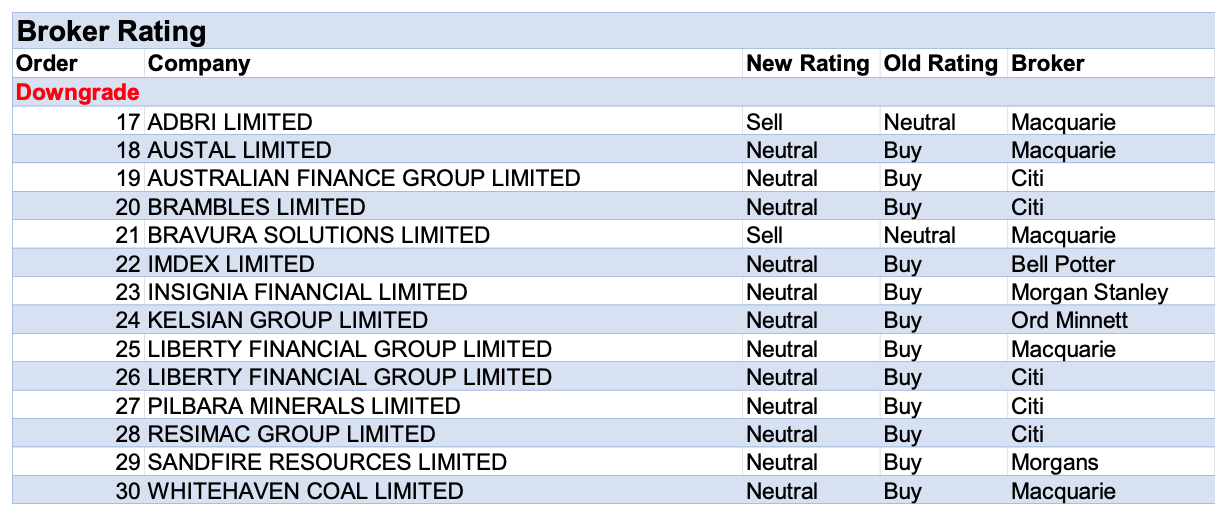

In the not so good books: Downgrades

- ADBRI LIMITED ((ABC)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 0/2/2

First half results were weaker than expected and volume was the main concern for Macquarie, with Adbri flagging emerging softness in residential activity, expected to worsen as the pipeline of work thins out.

Modest sequential earnings growth is expected in the second half yet the outlook beyond this is unclear, the broker asserts. Rating is downgraded to Underperform from Neutral. Target is reduced to $2.00 from $2.45.

- AUSTRALIAN FINANCE GROUP LIMITED ((AFG)) was downgraded to Neutral from Buy by Citi. B/H/S: 0/2/0

It is Citi’s conclusion Australian Finance Group released FY23 financials slightly below expectations. The net interest margin (NIM) contracted on top of churn in the manufacturing business and a higher payout ratio for the aggregation business.

Management flagged further investments, with no relief in sight for the payout ratio. Guidance is for the NIM to contract in FY24.

Citi has responded through a downgrade to Neutral from Buy. The broker observes the pendulum has swung in favour of mortgage brokers taking larger market share in a competitive market. The broker sees ongoing challenges in distribution and lowers forecasts by -21%/-14%/-4% for FY24-26. Target price tumbles to $1.70 from $2.

- AUSTAL LIMITED ((ASB)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/1/0

The FY23 loss of -$4.8m at the EBIT line was disappointing and Macquarie notes it excluded losses on the T-ATS program, where an onerous contract provision had been previously flagged. Austal is continuing to seek recovery of some of the additional costs incurred in the project.

A record order book of $11.6bn should be supported by the company actively applying what it has learned from T-ATS, the broker asserts.

While the company has made solid progress in diversifying its business, the T-ATS issues plus margin guidance lowers visibility for the short term and Macquarie downgrades to Neutral from Outperform. Target is lowered -25% to $1.95.

- BRAVURA SOLUTIONS LIMITED ((BVS)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 0/0/1

FY23 results were in line with guidance and Macquarie considers this a credible result although organic cost growth remains an issue. No FY24 guidance was provided although Bravura Solutions expects to return to profitability by the end of FY24.

The broker observes guidance for cash burn of a maximum -$10m signals there is sufficient support in the balance sheet to execute on the cost reduction program.

The stock is still trading above fundamental valuation and the broker downgrades to Underperform from Neutral. Target is reduced to $0.48 from $0.65.

- BRAMBLES LIMITED ((BXB)) was downgraded to Neutral from Buy by Citi. B/H/S: 1/5/0

Citi labels Brambles FY23 profit result “solid”, with operating profit at the top-end of 17%-19% guidance range while, compositionally, the operating performance was strong.

Upon further reflection, the broker has come to the conclusion that Brambles has been operating inside a sweet spot of macro conditions, but things will get less accommodative from here onwards.

Hence the downgrade to Neutral from Buy. Target lifts to $16 from $15.65. Only small amendments have been made to forecasts.

- INSIGNIA FINANCIAL LIMITED ((IFL)) was downgraded to Equal weight from Overweight by Morgan Stanley. B/H/S: 1/3/0

Insignia Financial’s FY23 underlying net profit beat Morgan Stanley’s forecast by 3% and was in line with consensus. Asset Management and Advice were beats against consensus, but the Platform and Corporate divisions were misses.

FY24 guidance is for group revenue margins to fall by -1.5-2.5bps versus the 47.3bps margin achieved in FY23 due to ongoing re-pricing. Earnings guidance suggests to the broker upcoming downgrades to consensus estimates.

The company will also incur -$20m of extra ongoing costs for cyber and governance.

The broker downgrades its rating to Equal weight from Overweight on lower profit forecasts and the target falls to $2.85 from $3.50. Industry view: In-line.

- IMDEX LIMITED ((IMD)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 3/1/0

Imdex reported FY23 results that were in line with expectations although weaker exploration activity in the second half affected sensors on hire.

An unfavourable move in product mix, away from higher margin tool rentals, along with increased R&D drove lower second half EBITDA compared with the first.

Demand is expected to remain steady in FY24 and Bell Potter adopts a more cautious stance, while remaining positive on the longer-term outlook. Rating is downgraded to Hold from Buy and the target lowered to $1.70 from $2.50.

See also IMD upgrade.

- KELSIAN GROUP LIMITED ((KLS)) was downgraded to Hold from Buy by Ord Minnett. B/H/S: 2/1/0

The Kelsian Group net profit was ahead of forecasts for FY23, the results reflecting a business that is looking offshore for growth and “betting big” on the AAAHI acquisition, Ord Minnett observes.

The main driver of earnings was tourism & marine, benefiting from a surge in domestic travel post the pandemic.

Australian bus division earnings declined -5% with the company citing labour shortages as the primary reason. While acknowledging new contracts and improved labour availability, Ord Minnett remains cautious about the outlook.

Given a modest outlook, the broker downgrades to Hold from Buy pending further industry work on the US bus segment and AAAHI. Target is reduced to $6.27 from $6.88.

- LIBERTY FINANCIAL GROUP LIMITED ((LFG)) was downgraded to Neutral from Buy by Citi and to Neutral from Outperform by Macquarie. B/H/S: 0/2/0

Liberty Financial’s FY23 result largely met consensus and Citi’s forecasts. Net interest margins fell shy but bad and doubtfuls proved a small beat.

Common to the industry, exit net interest margins weakened due to funding costs and the company forecast a lower distribution in FY24.

The broker believes the latter reflects growing capital intensity and that higher funding costs, a weak mortgage context and intensifying competition will continue to suppress earnings.

Rating downgraded to Neutral from Buy. Target price eases to $4.10 from $4.15.

Liberty Financial reported an “adequate” result in line with Macquarie at the underlying profit level. Despite the challenging operating environment, Liberty recorded stronger lending volumes than peers, albeit with considerable margin pressures, the broker notes.

While margin pressures are likely to persist in the near term as funding spread benefits normalise, Macquarie continues to prefer Liberty to non-bank peers given superior lending trends, which leave less franchise risk over the longer term than peers.

But the broker sees valuation as appropriate in the current environment. Downgrade to Neutral from Outperform. Target falls to $3.65 from $4.05 in line with longer term earnings forecast changes.

- PILBARA MINERALS LIMITED ((PLS)) was downgraded to Neutral from Buy by Citi. B/H/S: 2/2/1

Judging from Citi’s assessment, Pilbara Minerals’ shares came under pressure on Friday because management issued guidance for higher capex and less free cash flow.

Citi argues the story hasn’t changed; Pilbara still has the operational advantage over its peers, with a Tier 1 asset and a war chest in excess of $3.4bn. It has the option for a buyback or pay a fully franked special dividend.

Citi downgrades to Neutral from Buy while trimming its valuation by -30c to $4.80. The broker describes FY24 as a transitional year.

FY23 financials were otherwise broadly in line with the broker’s and market consensus forecasts, with a slightly better dividend payout.

Were one to apply the US$1450/t spodumene price versus the long-term price forecast of US$1200/t, the broker’s NAV would lift to $5.33/sh from $4.82/sh the report highlights.

- RESIMAC GROUP LIMITED ((RMC)) was downgraded to Neutral from Buy by Citi.B/H/S: 1/2/0

FY23 results slightly beat expectations although Citi expects the reaction in the share price, up 20%, reflected a reversal of the fears regarding exit net interest margins.

Relative to peers, the broker believes management has exhibited strong pricing discipline and Resimac Group remains relatively resilient in terms of margins in the face of volume attrition.

Margins are expected to stabilise in the first half and the business will re-base assets under management in FY24. Amid risks around funding costs and rising arrears, Citi downgrades to Neutral from Buy and lowers the target to $1.10 from $1.20.

- SANDFIRE RESOURCES LIMITED ((SFR)) was downgraded to Hold from Add by Morgans.B/H/S: 3/3/0

While key FY23 financials were largely in line due to quarterly reporting, Morgans downgrades its rating for Sandfire Resources to Hold from Add due to short-term macro headwinds for metals.

The analysts believe the market might be slightly disappointed by the lack of news on Motheo’s life-of-mine (LOM) costs and the FY24-28 capex schedule.

Strong execution at Motheo has reduced earnings risk/uncertainty, in Morgans opinion, and new management has reduced balance sheet risk and simplified the overall strategy.

The broker’s target falls to $6.35 from $6.50. It is thought internal growth options are more appealing/digestible than potentially expensive copper M&A activity.

- WHITEHAVEN COAL LIMITED ((WHC)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 3/3/1

FY23 results were in line with forecasts driven by buoyant coal prices. The dividend was greater than Macquarie expected.

Whitehaven Coal provided mixed FY24 guidance, with production in line with expectations but coal sales weaker and costs higher than the broker anticipated.

The company has temporarily suspended its share buyback program while it considers capital allocation and M&A opportunities.

Incorporating the FY23 result, FY24 guidance and rolling forward higher costs means material downgrades to Macquarie’s earnings estimates. Rating is downgraded to Neutral from Outperform. Target is reduced to $6.00 from $7.70.

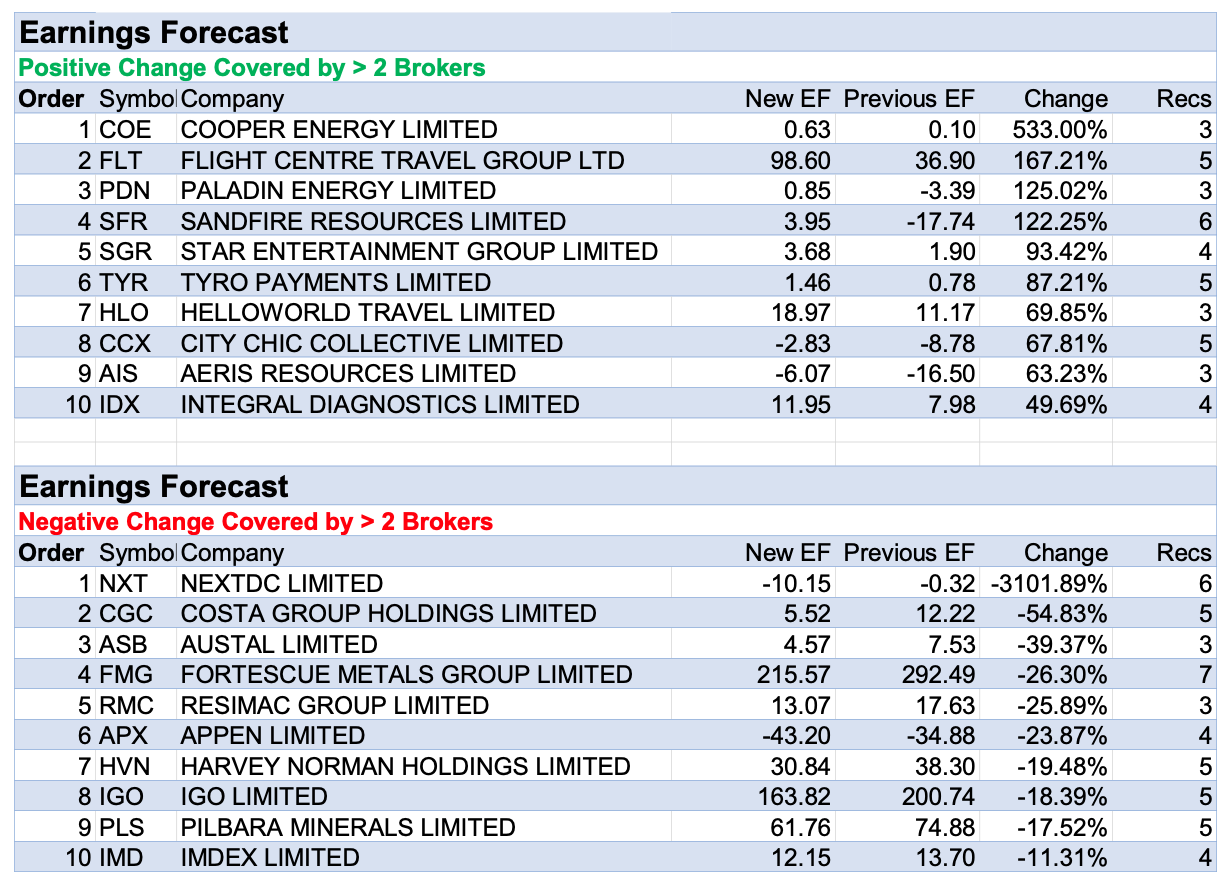

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.