Five of the 11 ratings downgrades were linked to a review by Macquarie of REITs under its research coverage. The broker continues to prefer defensive stocks in the sector in light of its forecast for a US recession in the second half of 2023.

Recessions typically leads to underperformance by REITs in the early stages. The analysts expect weaker economic growth, widening credit spreads, falling asset values and downside risk to FY24 consensus expectations.

Overall, Macquarie likes industrial REITs the most and office the least. The five REITS downgraded were: Centuria Capital; Charter Hall Retail REIT; HMC Capital; Scentre Group; and Charter Hall Long Wale REIT.

Charter Hall Long Wale REIT also received a rating downgrade from Ord Minnett as its debt profile is likely to detract from short-term performance, backing up Macquarie’s caution around headwinds to earnings from higher debt costs.

While it is reported the REIT is looking to divest assets, a sale may be difficult as transaction volumes for such assets remain low. Accordingly, the broker expects slow progress on capital management initiatives.

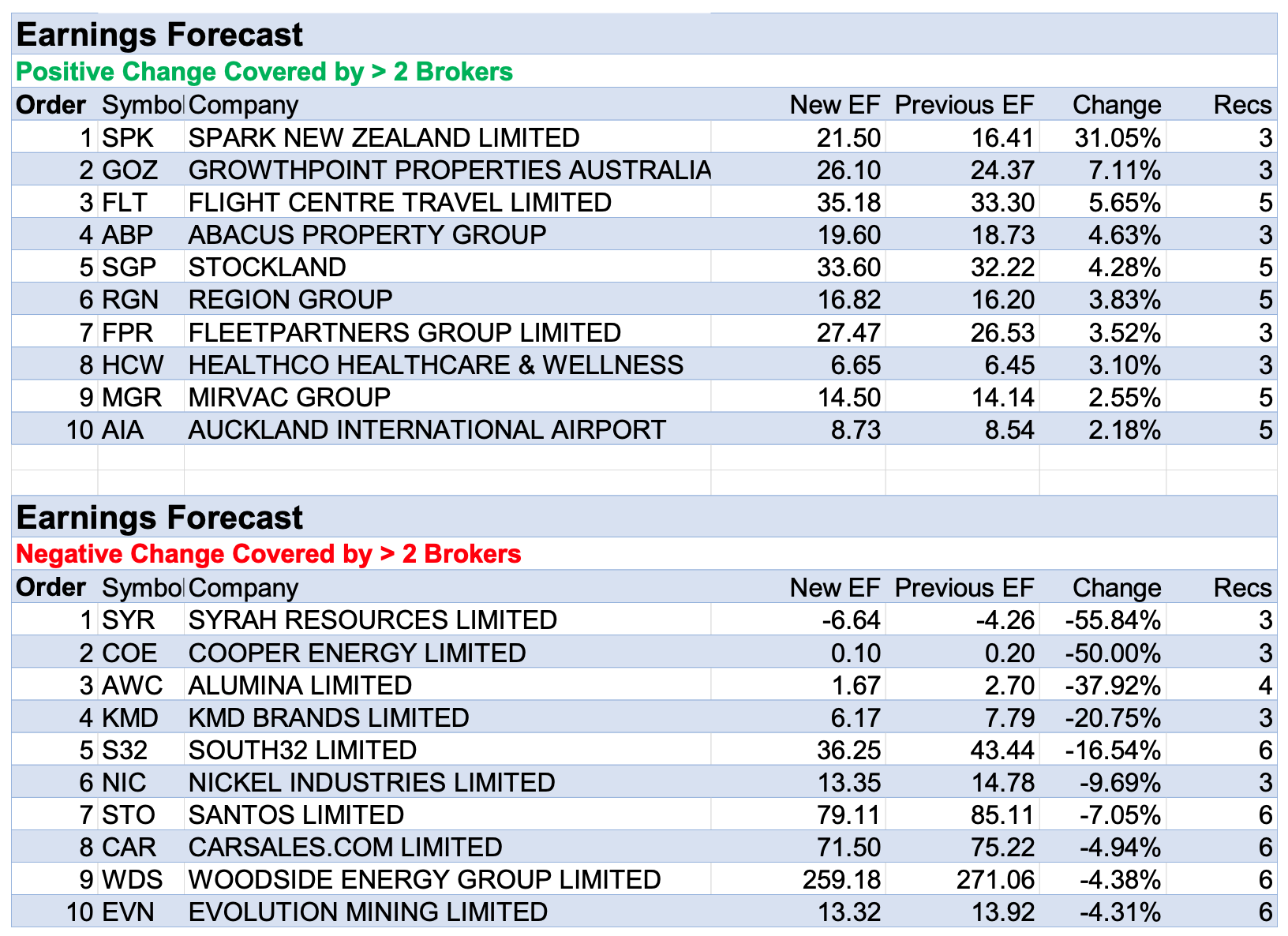

Syrah Resources received the largest (-56%) percentage downgrade to forecast earnings after revealing lower June quarter production and sales.

Operations are currently paused at the company’s Balama mine in Mozambique, the world’s largest graphite resource, due to a weak graphite market, though analysts remain upbeat.

Three brokers covered daily by FNArena updated research on Cooper Energy last week, and noted fourth quarter gas production was largely in line with expectations, despite planned maintenance at the Orbost Gas Plant which processes production from the Sole gas field in the Gippsland Basin.

There were also some mechanical failures at the Athena Gas Plant which processes gas and liquids from the offshore Casino, Henry, and Netherby fields in the Otway basin.

Morgans forecast a turnaround in FY24 and noted the stock is currently trading at “deep value levels”, though other brokers held various concerns.

Macquarie noted gearing for Cooper Energy had risen to 30% from 11% and felt investors are now exposed to risk over the next 6-12 months, with the key swing factor being improvements at the Orbost plant, while Bell Potter also believed the near-term outlook was uncertain around meeting production targets in the Gippsland Basin and taking a final investment decision on Otway phase 3.

Resource companies Alumina Ltd and South32 also featured on the earnings downgrade table below.

Every quarter in the US, Alcoa provides updates on its Alcoa World Alumina and Chemicals (AWAC) joint venture with Alumina Ltd (40% share).

While the second quarter revealed a 1% increase in bauxite production at AWAC, alumina output of 2.4mt was -5% adrift of Macquarie’s forecast for 2.5mt. FY23 alumina production guidance was maintained at 10.3mt.

More positively, AWAC’s cash costs were -5% lower than the broker’s estimates, reflecting the normalisation of key input material costs.

Macquarie cautioned over the outlook, amid concerns about the timing of mining approvals and the potential impact on production and suggested there will not be a dividend payment in 2023, while Ord Minnett felt current bauxite access issues and refinery curtailments are only temporary problems.

As part of a broad sector update, Ord Minnett reduced its fair value estimate for South32 by -7% after incorporating management’s latest medium-term guidance, and lower forecast prices for aluminium, metallurgical coal, copper, nickel and silver. Forecast production volumes were also reduced for metallurgical coal and nickel.

KMD Brands also received earnings downgrades from brokers and had the second largest percentage fall in average target price for the week, behind Syrah Resources.

FY23 guidance for KMD Brands missed broker forecasts due to weak Australasian winter trading for the Kathmandu brand. Macquarie (Neutral) was cautious around the outlook for FY24 amid ongoing macro pressures and lowered its target to 90 cents from 97 cents.

Moreover, the broker explained Rip Curl and Kathmandu will be cycling comparable sales growth of 13.9% and 48.8%, respectively, over the first half of FY24.

On the flipside, telecommunications and digital services company Spark New Zealand received the largest percentage upgrade to average forecast earnings by brokers last week.

Over a month ago, infrastructure investment company Infratil revealed plans to take full control of One New Zealand, New Zealand’s second-largest telco, after reaching a deal to acquire Brookfield Asset Management’s stake in the operator.

In updating research this week, Ord Minnett felt this new ownership structure would not have any impact on the valuation of Spark New Zealand, which competes in the small Kiwi mobile market where it generates well over half of its total operating earnings.

The Hold-rated broker noted the company’s shares are slightly overvalued though envisaged a harmonious competitive environment in the mobile market, along with a stable industry structure which can help satisfy the company’s dividend-dependent investor base.

In the good books

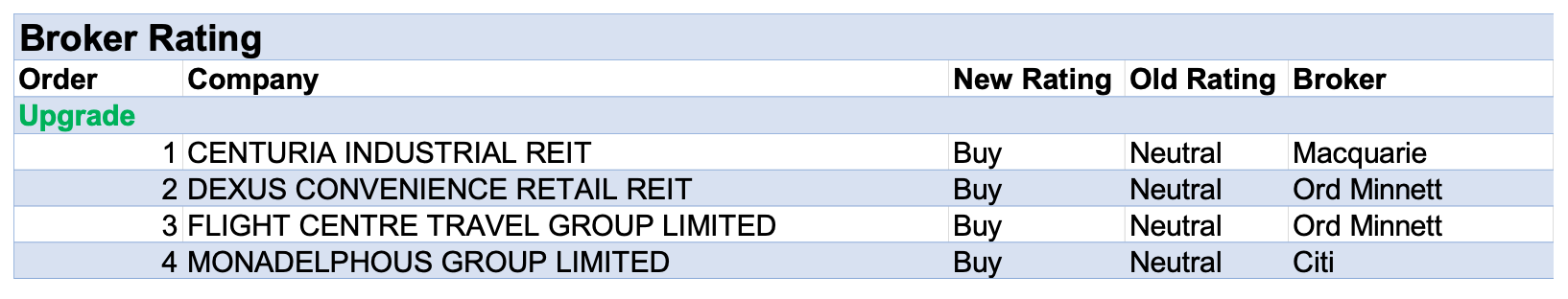

Upgrades

CENTURIA INDUSTRIAL REIT ((CIP)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/3/0

Macquarie continues to prefer the defensive stocks among A-REITs, forecasting the US to enter recession in the second half of 2023 and noting A-REITs typically underperform in the early stages of a contraction.

The sector is expected to be hit by weaker economic growth, widening credit spreads, falling asset values and downside risk to FY24 consensus expectations.

Industrial stocks are the most preferred and office the least. Macquarie upgrades Centuria Industrial REIT to Outperform from Neutral, believing the business can benefit from strong leasing conditions in industrial, while reducing the target to $3.32 from $3.40.

DEXUS CONVENIENCE RETAIL REIT ((DXC)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 2/0/0

Dexus Convenience Retail REIT is upgraded to Accumulate from Hold as Ord Minnett believes the stock is trading at a significant discount to its net tangible assets, despite property fundamentals remaining firm for the convenience retail and healthcare sector.

The broker expects the upcoming reporting season will focus on A-REIT sector initiatives, as capital remains constrained, as well as property valuations as capitalisation rates soften. The broker reduces the target to $2.95 from $3.18.

FLIGHT CENTRE TRAVEL GROUP LIMITED ((FLT)) was upgraded to Buy from Hold by Ord Minnett. B/H/S: 3/2/0

Ord Minnett is now more confident of the buying opportunity that is emerging in Flight Centre Travel with the latest update providing another input regarding future revenue margins for both the corporate and leisure divisions.

The company expects transaction value in leisure in FY23 of around $10bn, underpinned by the strong demand for outbound travel from Australian consumers.

The broker still believes legacy systems in travel are under attack but, while revenue margins will settle well below pandemic levels, its prior revenue margin assumptions in FY25 and beyond are too conservative.

Hence, the rating is upgraded to Buy from Hold and the target lifted to $26.75 from $19.71.

MONADELPHOUS GROUP LIMITED ((MND)) was upgraded to Buy from Neutral by Citi. B/H/S: 2/2/0

Citi notes Monadelphous Group shares are 10% higher since the beginning of July, reflecting improving sentiment towards engineering and contracting.

The broker believes the Christmas Creek contract has set a positive tone leading into the full year result and upgrades to Buy from Neutral.

Management is expected to reaffirm the FY24 ramp up in E&C revenue. The broker’s FY24 and FY25 EBITDA forecasts are raised by 2-2.5% and the target is lifted to $14.45 from $12.80.

In the not so good books

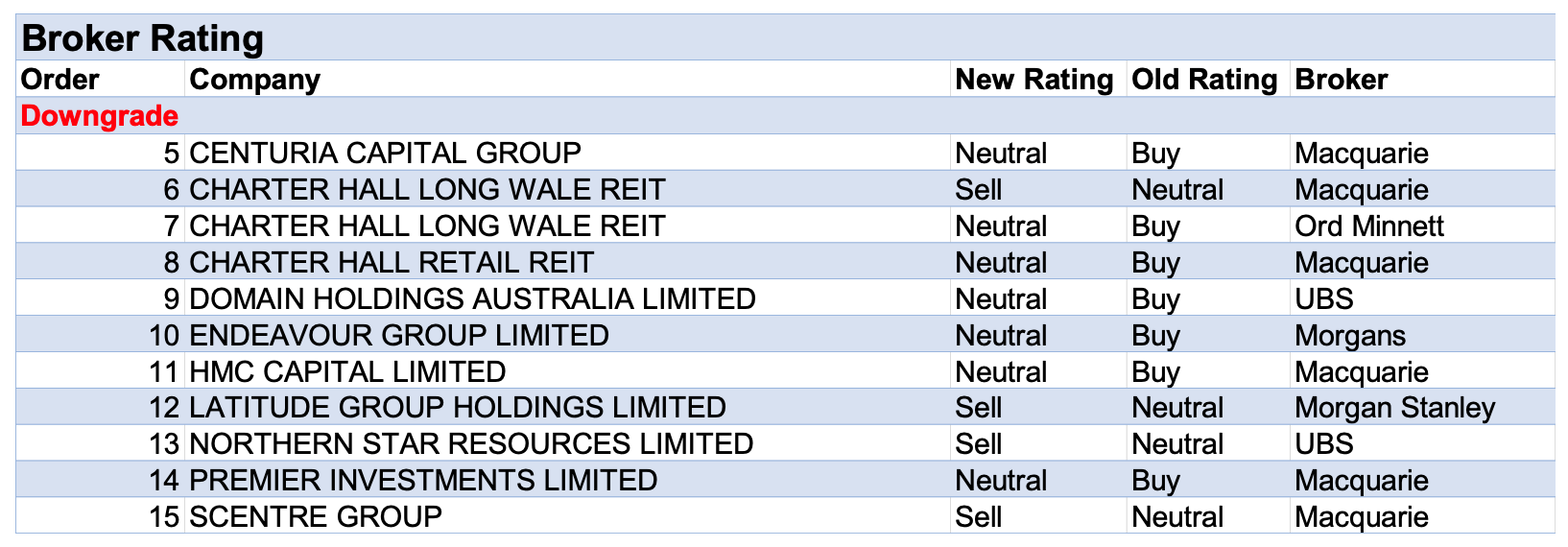

Downgrades

CHARTER HALL LONG WALE REIT ((CLW)) was downgraded to Hold from Buy by Ord Minnett and to Underperform from Neutral by Macquarie. B/H/S: 0/4/1

Ord Minnett expects the upcoming reporting season will focus on A-REIT sector initiatives, as capital remains constrained, as well as property valuations as capitalisation rates soften.

Charter Hall Long WALE REIT’s rating is downgraded to Hold from Buy, as the debt profile is likely to detract from its performance in the short term.

While it is reported that the company is looking to divest assets, transaction volumes for these assets remain low and as such Ord Minnett expects slow progress on capital management initiatives. Target is reduced to $4.40 from $4.89.

Macquarie continues to prefer the defensive stocks among A-REITs, forecasting the US to enter recession in the second half of 2023 and noting A-REITs typically underperform in the early stages of a contraction.

The sector is expected to be hit by weaker economic growth, widening credit spreads, falling asset values and downside risk to FY24 consensus expectations.

Industrial stocks are the most preferred and office the least.

The broker downgrades Charter Hall Long WALE REIT to Underperform from Neutral and lowers the target to $3.77 from $4.65. Macquarie is cautious about the headwinds to earnings from higher debt costs.

CENTURIA CAPITAL GROUP ((CNI)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/2/0

Macquarie continues to prefer the defensive stocks among A-REITs (see Charter Hall Long WALE REIT (CLW) above.)

The broker downgrades Centuria Capital to Neutral from Outperform, mainly because of a lower funds management EV/EBITDA multiple amid challenging operating conditions and incremental devaluations. Target is lowered to $1.60 from $1.79.

CHARTER HALL RETAIL REIT ((CQR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/2/0

Macquarie continues to prefer the defensive stocks among A-REITs (see Charter Hall Long WALE REIT (CLW) above.)

Macquarie downgrades Charter Hall Retail REIT to Neutral from Outperform. Target is lowered to $3.71 from $4.33.

While attracted to the resilience of convenience retail income, the broker assesses there is limited earnings growth because of a material rolling off the hedge profile.

DOMAIN HOLDINGS AUSTRALIA LIMITED ((DHG)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/3/0

UBS observes valuation multiples for the real estate sector are trading in line with historical averages, given the market’s confidence in double-digit yield growth into FY24 and underpinned by recent price increases.

The main issue is whether volumes will grow in FY24 amid any consequent impact on the depth uptake for Domain Holdings Australia.

The broker downgrades to Neutral from Buy, believing at current levels the market is adequately pricing in a step up in yield growth to average 15% per annum over FY24-25, as property market conditions normalise. Target is raised to $4.00 from $3.75.

ENDEAVOUR GROUP LIMITED ((EDV)) was downgraded to Hold from Add by Morgans. B/H/S: 2/2/1

Regulatory risk is now heightened, observes Morgans, after the Victorian government announced reforms to the electronic gaming industry. The aim of the reforms is to reduce gambling related harm and money laundering across the state.

The timing of the reforms remains unknown. In the event Endeavour Group’s earnings in Victoria are reduced by -50%, the analyst predicts FY25 group earnings (EBIT) would fall by -5-6%.

No material changes are made to the broker’s earnings forecasts at this stage, but the price earnings-based target falls to $5.87 from $7.30 on the increased risk, and the rating is downgraded to Hold from Add.

HMC CAPITAL LIMITED ((HMC)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/3/0

Macquarie continues to prefer the defensive stocks among A-REITs (see Charter Hall Long WALE REIT (CLW) above).

Macquarie downgrades HMC Capital to Neutral from Outperform on valuation grounds and lowers the target to $4.99 from $5.20. A modestly lower funds management EV/EBITDA multiple is incorporated in the assessment to reflect the challenging macro environment.

LATITUDE GROUP HOLDINGS LIMITED ((LFS)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 0/0/3

Morgan Stanley downgrades its rating for Latitude Group to Underweight from Equal-weight due to the ‘higher-for-longer’ interest rate environment. Lower margins from a delay in re-pricing products, slowing volume growth and elevated bad debts are expected.

Moreover, volume growth has been halted as a result of the March-2023 cyber-attack, which the analyst believes has reduced confidence in the company’s products both from merchants and customers, e.g., Harvey Norman’s ((HVN)) decision to offer Afterpay as an alternative.

The target falls to $1.00 from $1.10. Industry View: In-line.

NORTHERN STAR RESOURCES LIMITED ((NST)) was downgraded to Sell from Neutral by UBS. B/H/S: 2/2/1

Northern Star Resources produced 426,000 ounces at AISC of $1700/oz in the June quarter, in line with expectations and supported by strong finish at Pogo, although UBS believes this has been overshadowed by a downgrade in guidance.

The broker is disappointed with FY24 guidance as production of 1.6-1.75m ounces is below forecasts and AISC of $1730-1790/oz is 9% higher. Growth expenditure of $1.15-1.25bn is significantly ahead of forecasts.

UBS downgrades to Sell from Neutral as the increased expenditure means the pressure on cash flow and margins has been previously underestimated. Target is reduced to $11.70 from $13.00.

PREMIER INVESTMENTS LIMITED ((PMV)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/1

Macquarie observes margin gains from the pandemic are poised to unwind while a weak macro environment is producing downside risk. As a result, the rating for Premier Investments is downgraded to Neutral from Outperform.

While rents and wages are driving the unwinding of the margin gains, a greater online mix should mean margins stay ahead of pre-pandemic levels.

The business is likely to cycle tough comparables over the next 6-9 months and the broker reduces the target to $21.00 from $30.50.

SCENTRE GROUP ((SCG)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 2/2/1

Macquarie continues to prefer the defensive stocks among A-REITs (see Charter Hall Long WALE REIT (CLW) above.)

In the case of Scentre Group, softer retailer updates are expected to weigh, along with gearing, and the rating is downgraded to Underperform from Neutral. Target is lowered to $2.48 from $2.89.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.