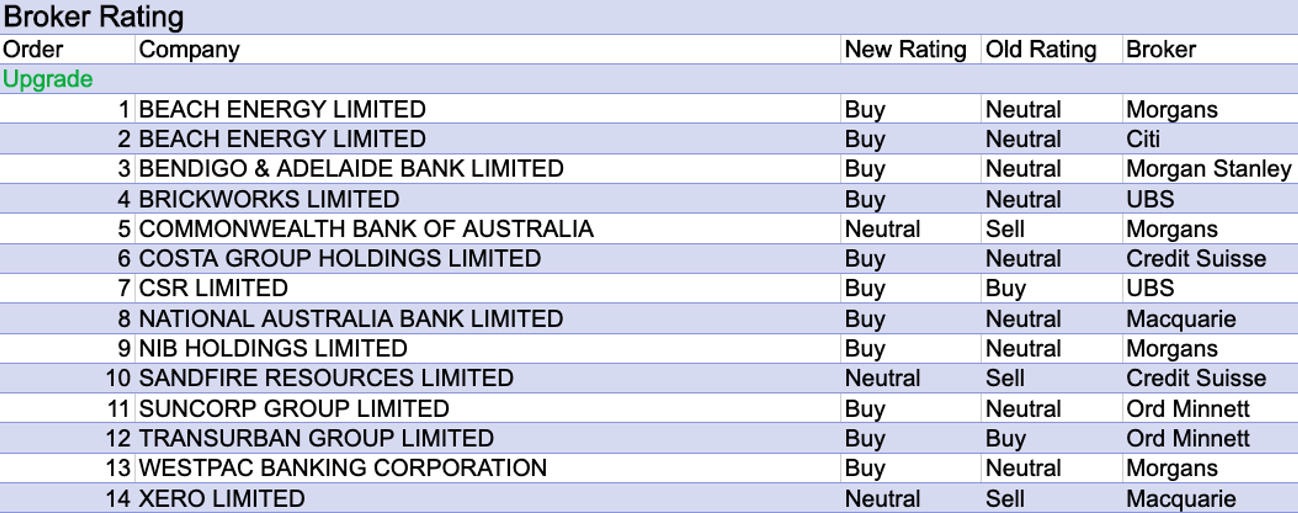

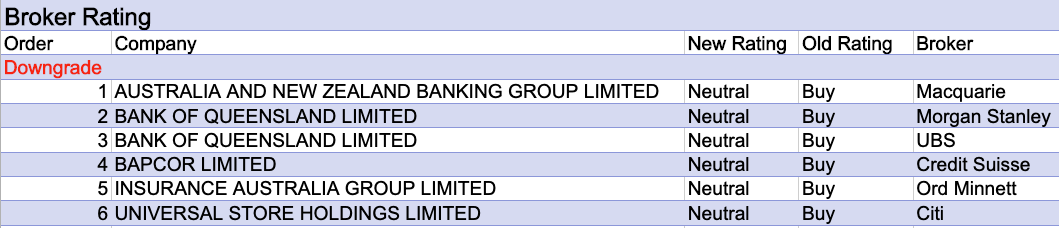

For the week ending Friday October 21 there were fourteen upgrades and six downgrades to ASX-listed companies covered by brokers in the FNArena database.

While several brokers covering Megaport were surprised by the extent of the negative share price reaction to a first quarter trading update, the company still experienced the largest percentage fall in average target price last week.

The average 12-month target set by the six covering brokers fell to $10.27 from $10.93.

Free cash flow was a solid miss compared to Credit Suisse’s expectations due to a blowout in capital expenditure, and management guided to a further increase in capital expenditure in FY23 to -$38m from -$30m.

Citi felt part of the market’s concerns centred around the capital-intensive nature of Megaport’s business and the balance sheet, though UBS noted sufficient funding up until break-even is achieved in the second half of FY24. The company also has access to a $25m credit facility, noted the analyst.

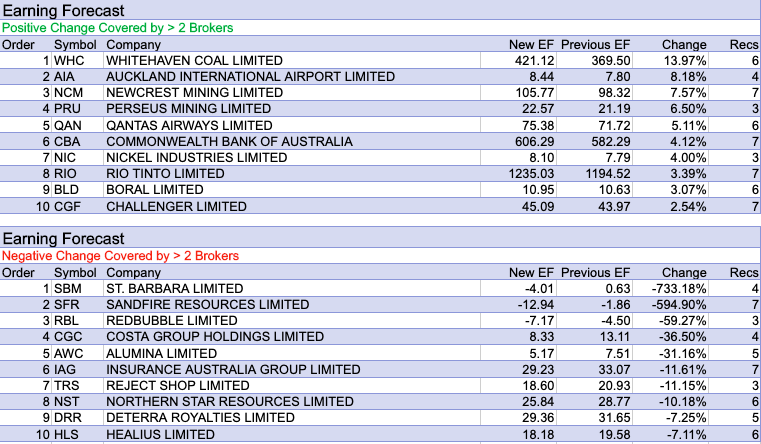

As may be seen in the table below, St Barbara received the largest percentage decrease in forecast earnings last week, after September quarter production missed consensus forecasts by -10%.

Production declined by -26% quarter-on-quarter, while logistical problems with the Gwalia mine in Western Australia led Citi to downgrade guidance for the mine to 950,00 tonnes from 1.1m tonnes.

Management downgraded full year production guidance and raised all-in sustaining costs estimates.

Ord Minnett noted potential for more near-term downside from cost inflation, labour shortages, delays at the Atlantic operations in Canada and headwinds at the Simberi project in Papua New Guinea.

Sandfire Resources also received lower earnings forecasts from brokers last week following first quarter results. Credit Suisse pointed to higher costs and lower copper production and remained cautious over funding requirements and balance sheet exposure to lower commodity prices.

Outperform-rated Macquarie noted mixed first quarter results with solid copper production from both DeGrussa in Western Australia and Matsa in Spain, but at higher cash costs than expected.

More positively, management retained FY23 guidance and UBS (Buy) noted the current share price is simply too cheap. Buy-rated Citi also observed Sandfire Resources shares are trading at almost half the value of what was paid for the purchase of Matsa.

Following first quarter results for Redbubble that missed consensus expectations, Morgan Stanley noted revenues continue to decline and the path back to earnings profitability looks increasingly uncertain.

The broker is concerned about the viability of the company’s business model, given consecutive quarters of low to declining revenue growth, coupled with escalating costs. The broker’s price target was reduced to $0.55 from $1.00 while the Equal-weight rating was maintained.

Earnings forecasts also fell for Costa Group last week following a weaker than expected trading update.

Management lowered FY22 earnings guidance as wet weather and colder temperatures impacted on the quality of citrus products, even though volumes remained in line with budget.

While UBS lowered its target to $2.20 from $2.80, the longer-term growth outlook is considered positive for the Australian, Moroccan and Chinese markets. Credit Suisse agreed on the outlook and felt the 2022 disease and quality issues will abate in 2023 and fruit production should rise against a backdrop of strong demand.

Alumina Ltd also experienced a material downgrade to broker earnings forecasts last week. A September quarter market update showed the AWAC joint venture with Alcoa experienced ongoing cost pressures from higher gas and caustic soda prices. Lower alumina prices also contributed.

On the flipside, there was only one material increase in earnings forecasts last week in the FNArena database.

Despite a dip in September-quarter production at Whitehaven Coal due to wet weather, realised coal prices rose to a record US$581/t compared to US$514/t in the June quarter.

Sales weakened by less than production, thanks to a stock drawdown at the Maules Creek operations, noted Morgan Stanley, while an improved coal mix more than offset the production loss.

Total Buy recommendations comprise 56.32% of the total, versus 36.49% on Neutral/Hold, while Sell ratings account for the remaining 7.18%.

In the good books

BEACH ENERGY LIMITED (BPT) was upgraded to Buy from Neutral by Citi and upgraded to Add from Hold by Morgans, B/H/S: 5/1/1

Citi has upgraded Beach Energy to Buy from Neutral. Target price lifts to $2.10 from $1.88. Beach Energy’s production declined in the quarter across all basins bar Perth, due to either wet weather or natural field declines, Morgans notes. Sales revenue was -13% lower. The broker expects declines to continue through this quarter and possibly the next until new well connections are made, having been held up by the weather. The outlook for FY24 remains bright with spot LNG exposure and production increases but those are still some time away. Upgrade to Add from Hold on valuation, target falls to $1.69 from $1.74.

COMMONWEALTH BANK OF AUSTRALIA (CBA) was upgraded to Hold from Reduce by Morgans, B/H/S: 0/5/2

A reassessment of Morgans’ bank valuations under a new analyst, ahead of the upcoming reporting season, sees an upgrade to Hold from Reduce for CommBank and a target price increase to $94.57 from $77.00. Morgans sees CommBank as the highest quality, with the strongest return of equity, but all priced in, and is forecasting a 0% total shareholder return over 12 months, inclusive of a 6% yield and franking. Note CBA provides only a quarterly update in the season.

COSTA GROUP HOLDINGS LIMITED (CGC) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 3/1/0

Credit Suisse upgrades Costa Group to Outperform from Neutral, expecting a recovery in citrus crops; and the target price falls to $2.50 from $2.90. The disease and quality issues that have dogged the 2022 season’s crops (resulting in a cut to guidance – EPS forecasts fall -33%), are expected to abate in 2023 and fruit production to rise against a backdrop of strong demand. Meanwhile, the company’s investor tour of its biggest mushroom farm appears to have pleased Credit Suisse, the farm proving a low-cost operation requiring one-third the labour, and the broker expects mushroom growth to continue to be a feature of the company going forward.

SUNCORP GROUP LIMITED (SUN) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 5/0/1

Ord Minnett has adjusted earnings forecasts for Suncorp to incorporate the business interruption provision release, mark-to-market, weather and flood costs, interest rates, and premium rates. This results in 5% earnings upgrades in FY24. The broker upgrades to Buy from Hold on valuation grounds, having downgraded Insurance Australia Group to Hold from Buy for the same reason. Target unchanged at $13.25.

TRANSURBAN GROUP LIMITED (TCL) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/4/0

Transurban’s September quarter traffic report showed traffic grew strongly year-on-year, Ord Minnett notes. Incremental traffic has continued to improve month-on-month, as trends noted at its recent FY22 result persist. Inflation and interest rates are likely to remain elevated, resulting in the broker’s risk-free rate lifting from 3.0% to 3.5%, but 70% of assets having embedded CPI-indexed escalations. On a valuation basis, Ord Minnett upgrades to Buy from Accumulate. Target falls to $15.00 from $15.80 on the higher risk-free rate.

WESTPAC BANKING CORPORATION (WBC) was upgraded to Add from Hold by Morgans, B/H/S: 4/3/0

A reassessment of Morgans’ bank valuations under a new analyst ahead of the upcoming reporting season sees an upgrade to Add from Hold for Westpac and a target price increase to $26.71 from $24.00. Morgans sees Westpac as the greatest value on a medium term view, forecasting a 12 month total shareholder return of 22%, inclusive of a 9% yield with franking.

In the not-so-good books

BAPCOR LIMITED (BAP) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 4/3/0

Bapcor’s AGM trading update reveals revenue is growing at a double-digit pace, and profit in the mid-single digits, and management guided to a solid FY23 result. But Credit Suisse spies areas of concern (primarily higher costs in a bid to deliver on strategy) and lowers EPS forecasts -4.8% in FY23 and -5.9% in FY24. The broker says investors are likely to want to see proof of strategic success to justify rising costs over the next year and the feeling is that may be slow in coming – although strong revenues remove some pressure. Rating is downgraded to Neutral from Outperform. Target price falls to $6.60 from $7.50.

INSURANCE AUSTRALIA GROUP LIMITED (IAG) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 3/2/2

Ord Minnett has adjusted earnings forecasts for Insurance Australia Group to include the business interruption provision release, share buyback, mark-to-market, weather and flood costs, outlook for reinsurance and interest rates. The result is a downgrade to Hold on valuation grounds following recent share price performance. There is more upside on offer for Suncorp, the broker believes, and the latter is upgraded to Buy. IAG target unchanged at $5.40.

UNIVERSAL STORE HOLDINGS LIMITED (UNI) was downgraded to Neutral from Buy by Citi, B/H/S: 2/2/0

The Thrills acquisition by Universal Store is considered as positive assesses Citi, as the accretive earnings may offset the more challenging macro environment. Citi views the retail expertise of Universal Store management should assist the existing Thrill’s stores as well as the two new stores in November. Citi adjusts earnings estimate by -13% in FY24 while FY23 remains largely unchanged. The rating is downgraded to Neutral from Buy due to concerns over the consumer outlook as well as lower earnings and a lower valuation. Accordingly, the target is adjusted to $4.55 from $5.75.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.