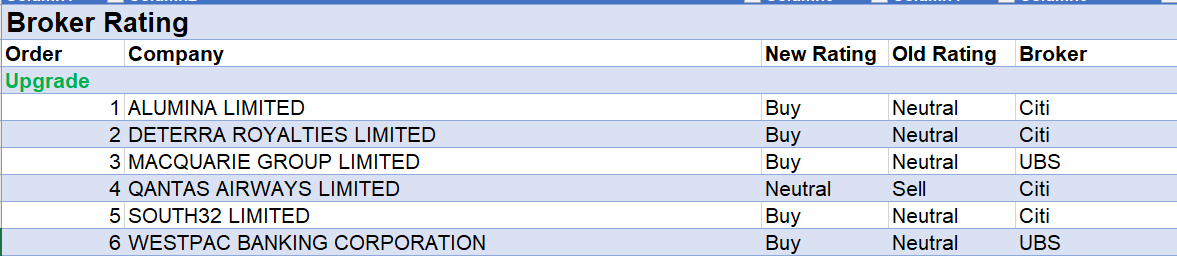

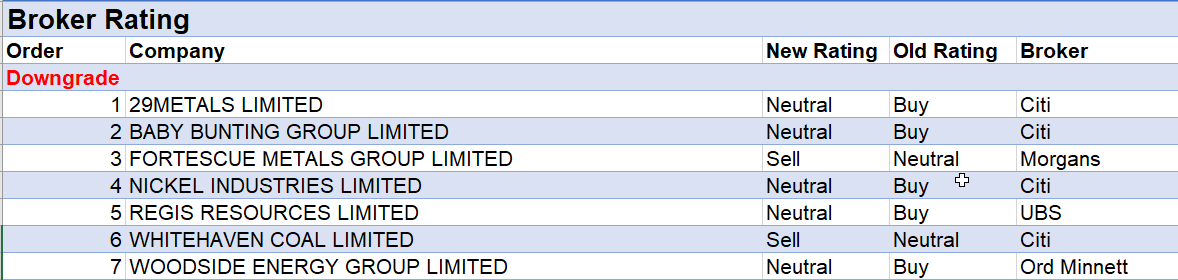

For the week ending Friday October 14 there were six upgrades and seven downgrades to ASX-listed companies covered by brokers in the FNArena database.

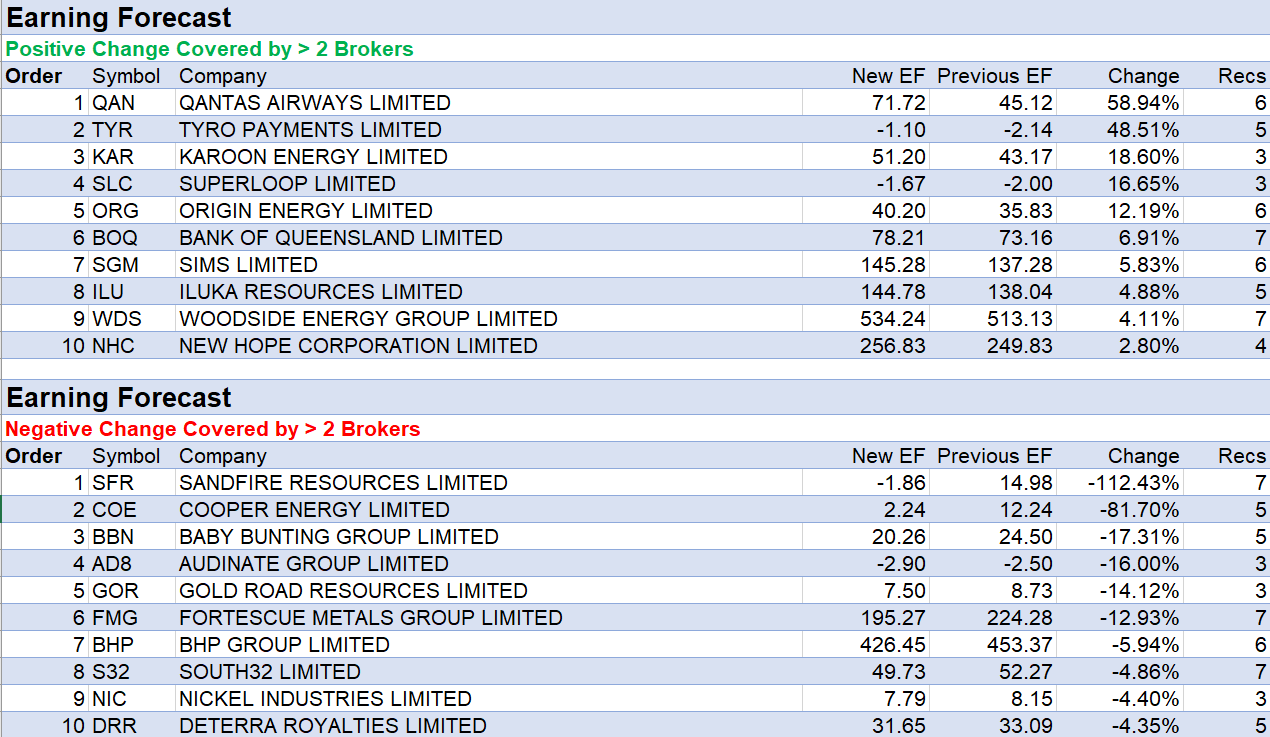

Following a first quarter trading update, Qantas Airways received an upgrade in rating to Neutral from Sell by Citi, and had the largest percentage upgrade to the average earnings forecasts of brokers in the database.

Strong demand coupled with capacity constraints supported higher ticket pricing, noted Credit Suisse, with management suggesting current demand is twice that of pre-covid. Moreover, guidance for profit before tax of $1.2-1.3bn was more than double the broker’s previous assumption.

Next on the table for earnings upgrades is Tyro Payments. Morgans liked the tone set by new CEO Jon Davey, following a first quarter update that detailed a new cost-out plan. FY23 earnings guidance was also raised by around 19%.

Morgan Stanley kept its Equal-weight rating and $1.40 target price given some M&A premium remains in the Tyro share price, after the recently rejected bid from private equity. Industry consolidation remains an integral part of the broker’s investment thesis and $2.50 bull case target price.

Morgans increased its earnings forecast for Karoon Energy last week, upon learning the national petroleum regulator in Brazil had offered a discount on royalties for the company’s Bauna project. The broker raised its target to $3.95 from $3.60.

Macquarie agreed with Morgans the discount shows strong ongoing support for the energy industry in Brazil and increased its target to $3.00 from $2.90.

Superloop also received increased earnings forecasts from brokers last week after revealing 14,637 net new subscribers in the consumer business in the first quarter, not far off the 17,621 subscribers added through the whole of FY22.

New FY23 earnings guidance also beat the consensus forecast by 19%. Morgans partly attributed these strong outcomes to organic NBN subscriber growth and the Acurus and VostroNet acquisitions. A network partnership deal with Uniti Group, announced a day earlier, will also be immediately earnings accretive, explained the analyst.

On the flipside, Sandfire Resources received the largest percentage reduction in forecast earnings last week. This was partly due to an updated macroeconomic view from Citi anticipating short-term headwinds for metals demand from a sluggish China and higher interest rates from the Federal Reserve in the US.

The broker maintained its High-risk Buy rating for Sandfire though lowered its target to $5.50 from $6.00. More positively, the broker still expects a rebound for metal prices during the second half of 2023 from an easing in China and a pivot in Fed policy from the second quarter of 2023.

While Morgans also lowered its earnings forecasts for Sandfire and reduced its target to $5.20 from $7.50, several catalysts were noted that should support a positive share price re-rating for assertive investors.

Earnings forecasts also fell for Baby Bunting last week. Citi was surprised by the extent of the -230 basis point gross margin contraction in the first quarter, and downgraded its rating to Neutral from Buy.

Ord Minnett attributed the margin decline to loyalty program investment, unrecovered cost increases and heightened price competition.

Morgan Stanley adopted a more positive view and noted gross margins declined by -1% in FY18 only to rebound to record highs in FY19. The broker felt subsequent price rises will render pressures on the gross margin transitory.

Total Buy recommendations comprise 56.01% of the total, versus 36.50% on Neutral/Hold, while Sell ratings account for the remaining 7.49%.

In the good books

QANTAS AIRWAYS LIMITED (QAN) was upgraded to Neutral from Sell by Citi, B/H/S: 5/1/0

It was only a month ago, Citi analysts point out, Qantas guided to a profit before tax result of $1.3bn for FY23. Yesterday, the expectation shifted in that this number will be achieved over the first six months of the financial year. Citi assumes yields were the driver of the circa 100% upgrade in guidance. Clearly, concludes the broker, travellers had no qualms with picking up the bill. Citi has lifted core EBIT forecasts by 89%/16% for FY23/24 respectively and raised its target price to $5.78 from $4.72. Upgrade to Neutral from Sell.

In the not-so-good books

REGIS RESOURCES LIMITED (RRL) Initiation of coverage with Neutral by UBS, B/H/S: 2/2/2

UBS initiates coverage of Regis Resources with a Neutral rating and provides commentary on the West Australian-based projects Duketon and Tropicana. A 12-month target price of $1.80 is set. The broker’ current valuation of Tropicana suggests a slight overpayment for the company’s -$903m purchase (30% interest), though it remains a quality cornerstone asset. It’s thought mine life extension, most likely from the underground operations, will provide upside. Also, underground extensions will help Duketon maintain rates of 350kozpa for longer and 500kozpa for the company, forecasts the broker.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings-per-share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.