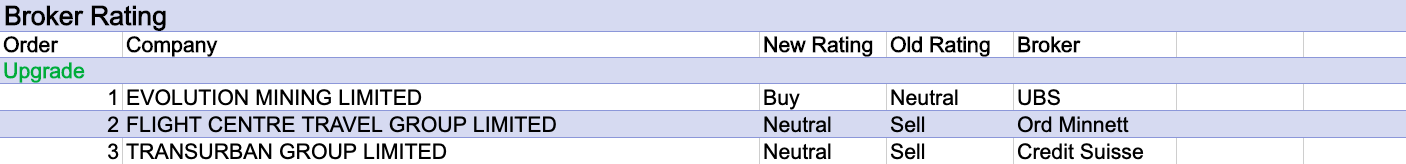

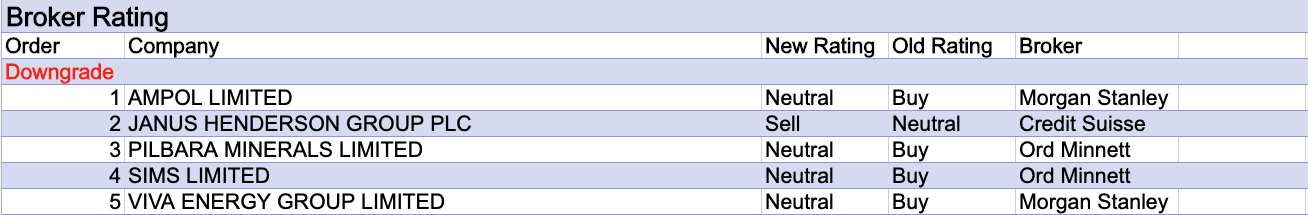

For the week ending Friday October 7 there were three upgrades and five downgrades to ASX-listed companies covered by brokers in the FNArena database.

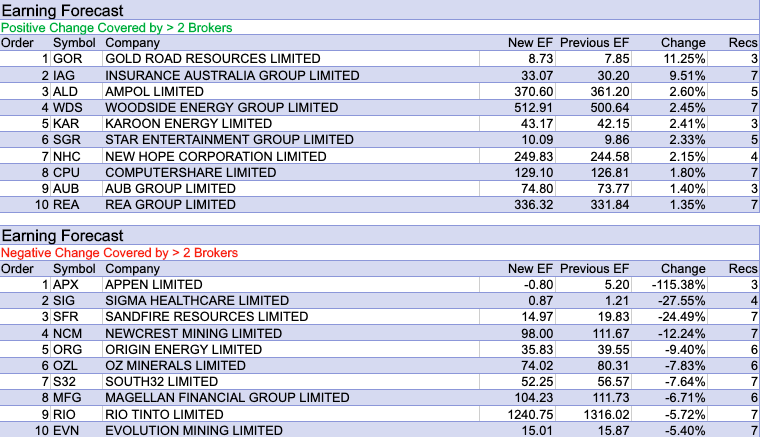

The horror run continued for Appen as the company headed up the table below for the largest percentage downgrade to forecast earnings. This followed yet another negative trading update, this time due to lower customer spending and higher product and technology costs.

Following a peak above $43 in August 2020, shares in Appen have consistently trended down to finish last week at $2.87.

Sell-rated Ord Minnett suggested management has limited visibility on earnings and little confidence in a recovery, and lowered its 12-month target price to $2.60 from $3.00. There’s considered to be looming balance sheet risk, with a potential need to raise funds for working capital.

Sigma Healthcare was next as pharmacy distribution revenue for the six months to July 31 contracted by around -7%.

Morgan Stanley suggested the first half benefit of covid testing masked underlying challenges, which included an ongoing loss of market share. The Underweight-rated broker cuts its FY23 and FY24 EPS forecasts by -70% and -25%, respectively, and the target price fell to $0.43 from $0.48.

Following twin announcements by Sandfire Resources, Morgan Stanley and Macquarie left target prices unchanged at the beginning of last week. Management updated on first quarter production guidance and the company’s CEO transition.

Later in the week, Ord Minnett and UBS lowered earnings forecasts for Sandfire after updating Mining sector commodity price forecasts.

Ord Minnett concluded risks for mining stocks are skewed to the downside, given the odds of a global recession continue to increase, while UBS pointed out prices for most commodities are still above cost support levels and do not yet fully price in a recession.

Specific to Sandfire Resources, UBS (Buy) noted copper remains stuck between the worsening economic backdrop and potential supply growth, as evidenced by BHP Group’s bid for OZ Minerals, which highlights copper’s scarcity. The broker ultimately decided to lower its price target to $5.90 from $6.10.

Ord Minnett also lowered its target target for Sandfire to $3.30 from $3.80 and preferred to await a lower share price before changing its current Hold rating.

Newcrest Mining was also caught up in both brokers’ Mining sector review. Neutral-rated UBS remained positive on the Gold sector following recent underperformance though lowered the company’s price target to $18.40 from $19.50.

Ord Minnett also lowered its target to $19 from $21 and noted Newcrest’s spot free cash flow yields are negative. For the sector as a whole, higher nominal interest rate expectations are dampening gold prices and a strong US dollar continues to weigh, explained the broker.

While the earnings forecast for Newcrest fell last week, Gold Road Resources headed up the table for the largest percentage increase in forecast earnings.

As noted above, UBS remained positive on the Gold sector and noted in many cases more conservative guidance now includes lower production and higher costs. The target for Gold Road Resources was raised to $1.81 from $1.80.

There were no material percentage changes to price targets set by brokers last week.

Total Buy recommendations comprise 55.80% of the total, versus 36.72% on Neutral/Hold, while Sell ratings account for the remaining 7.49

In the good books

In the not-so-good books

JANUS HENDERSON GROUP PLC (JHG) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 0/1/2

Credit Suisse marks to market asset managers for the September quarter and downgrades earnings estimates accordingly.

EPS forecast fall an average of -5% to -6% across the sector over FY23 to FY25.

The analyst considers the sector’s -30% trading discount to the market to be justified given negative flows and market uncertainty.

The broker also downgrades Janus Henderson to Underperform from Neutral and cuts the target price to $29 from $31.50.

EPS forecasts fall -3% in FY23; -8% in FY24; and -9% in FY25.

Credit Suisse’s earnings forecasts sit -20% below consensus forecasts for FY23 and FY24, believing the asset manager faces a strong strategic investment bill going forward, not to mention margin compression as markets continue to weaken on top of a likely continuation of outflows.

Earnings Forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.