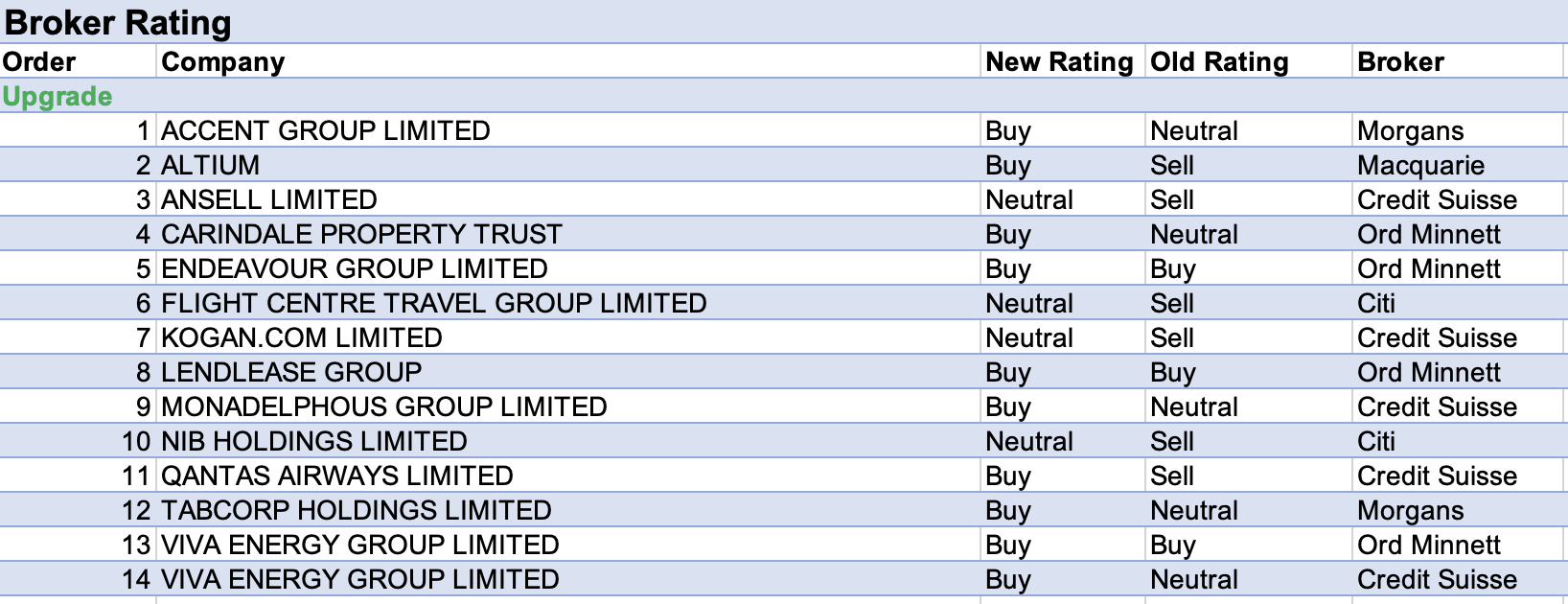

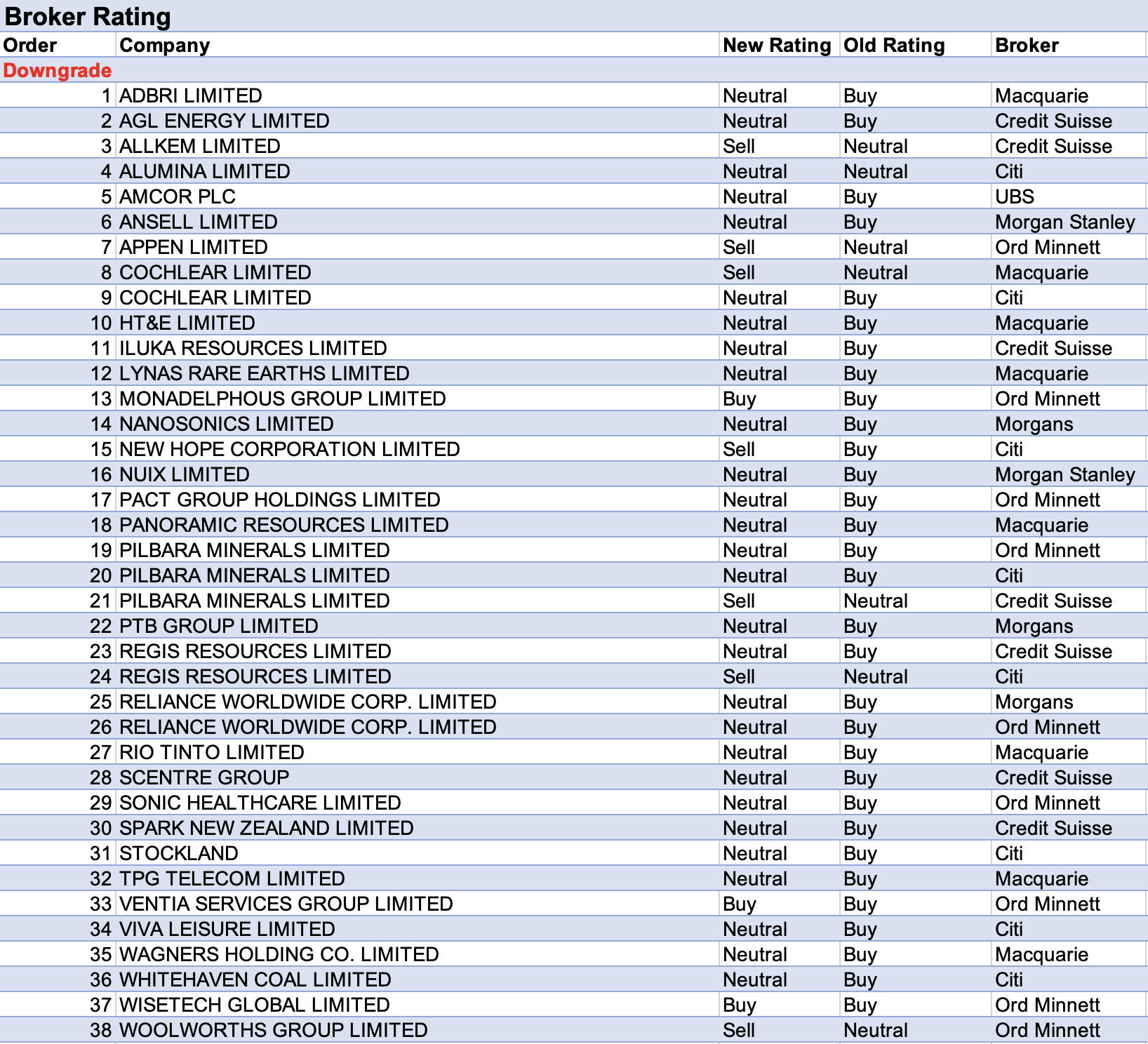

Rating downgrades were to the fore in another busy period of the August reporting season. For the week ending Friday August 26 there were 14 upgrades and 38 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Pilbara Minerals received ratings downgrades from three separate brokers after FY22 earnings and FY23 cost guidance missed consensus expectations. Credit Suisse downgraded to Underperform, while Ord Minnett and Citi downgraded to Hold on valuation. All three brokers remain positive about the long-term prospects for lithium.

Accent Group received the largest percentage increase in target price last week. Following in-line FY22 results, the focus was on a bright start to FY23 trading.

Morgans lifted its target to $2.00 from $1.40 and upgraded its rating to Add from Hold. The broker noted a renewed focus on selling at full price, which should support a recovery in the gross profit margin in FY23. Management guided growth in higher margin products, fewer promotions, and improved vertical brand penetration.

Wisetech Global was next after in-line FY22 results and FY23 guidance in advance of expectations. Overweight-rated Morgan Stanley raised its target to $62 from $50 after assessing the financial and strategic value of the core CargoWise software platform is rising sharply as customers navigate an increasingly complex global supply chain.

Ord Minnett raised its target to $64 from $52, despite lowering its rating to Accumulate on valuation, while Macquarie (Underperform) increased its target to $46 from $42. The analyst felt news of the signing of UPS as a global rollout customer was a “solid win”.

Brokers combined to raise the average target price for Whitehaven Coal after in-line FY22 results. Morgans noted shares provide an option over ongoing energy market dislocation and can continue upwards on windfall earnings and dividends. While the final dividend disappointed, Morgan Stanley forecast larger returns in FY23.

Citi downgraded its rating for the company to Neutral from Buy on the expectation thermal coal prices will moderate at the same time as costs are rising and management increases its Capex budget.

On the flip side, Wagners Holding Co had the largest percentage fall in average target price last week, after FY22 results missed expectations. Construction Material Services margins were weaker than Macquarie expected, as price improvement proved too slow to counter a sharp increase in costs.

Morgans lowered its target to $1.10 from $1.45 due to the application of lower multiples, an increased debt forecast and a reduced value for Earth Friendly Concrete. More positively, Credit Suisse maintained its Outperform rating and felt the business will gain a share in the south-east Queensland construction materials market, though reduced its target to $1.60 from $2.00.

Brokers lowered their target prices for Adbri after disappointing first-half results. Macquarie also downgraded its rating to Neutral from Outperform and suggested cost pressures will linger and materially reduce the broker’s margin assumptions and offset any price traction.

Citi attributed the weak result to a lack of pricing power in the face of rising costs, even though the company beat on sales. A strong pick-up in construction materials volumes was evident to Ord Minnett, though leverage to an improved outlook was still missing.

Target prices were also reduced for Appen following a miss for first-half results compared to broker expectations.

After noting no material improvement in second-half trading, Ord Minnett felt revenue and orders of up to US$360m may be at risk, as management has signalled much lower conversion levels. The broker downgraded its rating to Sell from Hold and reduced its target to $3.00 from $4.00.

Citi (Sell) noted the growth of Appen’s work-in-hand has slowed, while Underperform-rated Macquarie was disappointed by weaker than expected guidance and lowered its target price to $3.30 from $3.60. The company also featured third on the table for the largest percentage fall in forecast earnings last week.

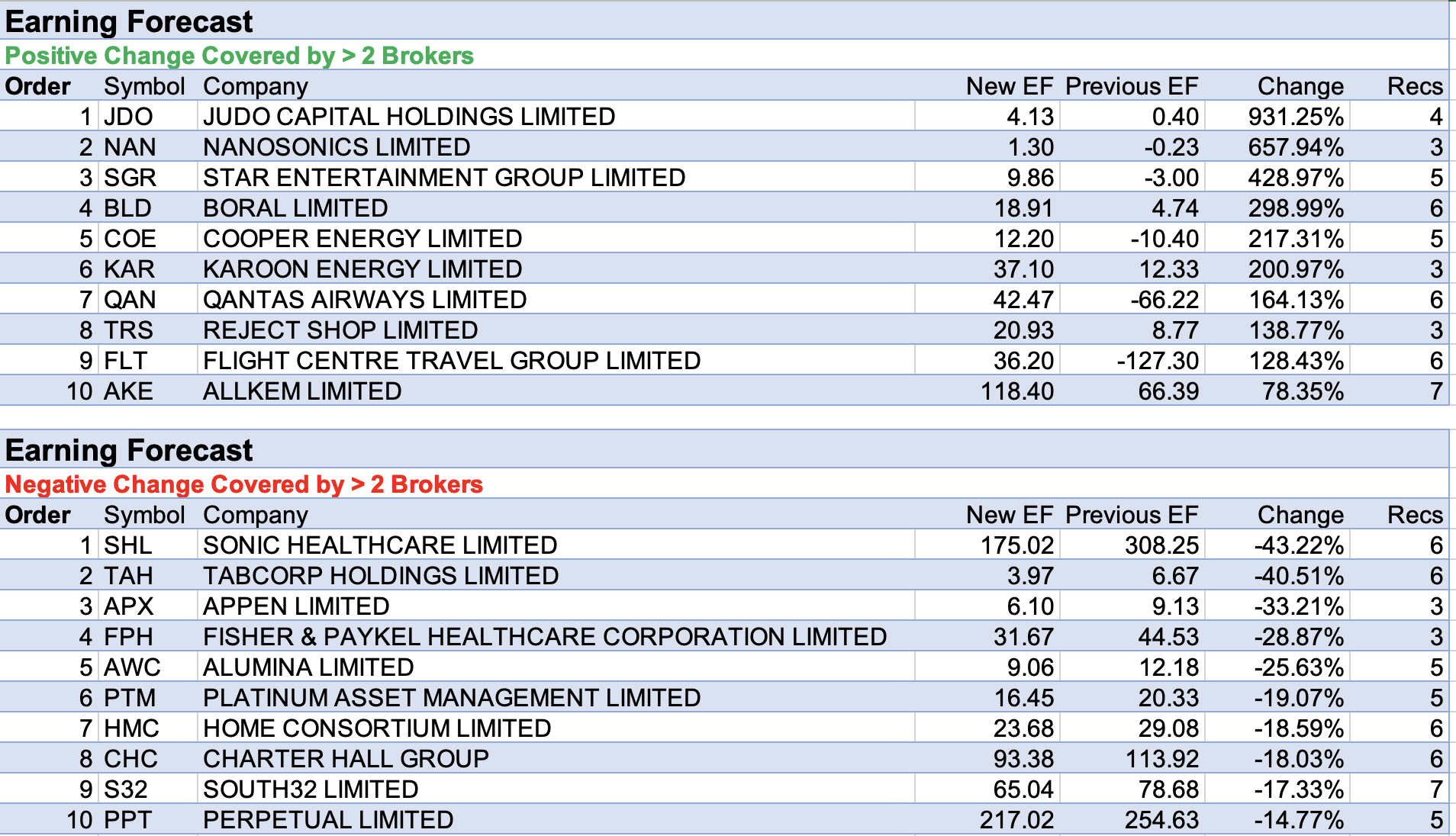

Coming first was Sonic Healthcare, despite producing FY22 results in advance of consensus expectations. Management failed to provide FY23 guidance though noted long-term covid volumes will be -10-20% off peak levels.

Ord Minnett downgraded its rating for the company to Hold from Accumulate and expected group earnings to more than halve on lower covid testing volumes which are already declining across all major markets, signalling the end of a period of super profits.

On the other hand, Overweight-rated Morgan Stanley noted the absence of cost inflation for Sonic Healthcare, while the base business accelerated more than expected.

Tabcorp was next after a slight miss versus broker expectations for FY22 results. Ord Minnett failed to see upside from current market share without promotional bonuses or benefits being significantly increased to simply defend existing market share and maintained its Lighten rating.

Alternatively, Morgans upgraded its rating to Add from Hold on the potential for the digital strategy (with enhancements) and sustainable cost efficiencies. With a new app coming and better marketing, the analyst forecast improved market share. The dividend yield and a relatively low multiple were also considered an attraction.

Brokers lowered earnings forecasts for Fisher & Paykel Healthcare after a profit warning accompanied an FY23 trading update. Macquarie lowered FY23-24 Hospital revenue forecasts on higher destocking and a slower clinical adoption ramp-up and reduced its rating to Neutral from Outperform on valuation.

Citi reduced its earnings forecasts by -31% and -19% for FY23 and FY24 and noted significant uncertainty around forecasting earnings due to ongoing covid impacts.

Judo Capital received the largest percentage increase in forecast earnings. FY22 results were ahead of prospectus, and Credit Suisse noted FY23 guidance is strong, particularly for interest margins and loan growth.

Ord Minnett repeated its view the company will continue to take share in the SME lending market and Macquarie noted higher interest rates are set to assist earnings in the coming year.

As explained in last week’s report, many FY22 broker forecasts for a range of companies were severely depressed by pandemic-related factors. With the advent of a new financial year, overall forecasts for those companies have received a boost as FY22 forecasts rolled off broker financial models.

This boost occurred even if existing (sunnier) forecasts for FY23 and beyond were downgraded due to changed reporting season results/outlooks, as was the case for Nanosonics, Star Entertainment Group and Boral, which all featured in the table for forecasts earnings upgrades by brokers last week.

While FY22 underlying net profit for Nanosonics beat Ord Minnett’s forecast, the broker lowered its EPS forecasts by -50% (on small numbers), largely due to lower-than-expected FY23 revenue guidance and retained its Lighten rating.

Morgans downgraded its rating to Hold as its price target for Nanosonics had been reached and noted the launch of the new CORIS product could take a couple of years. Citi observed the transition to a direct distribution model was largely complete though required significant investments and retained its Sell rating.

Despite broadly in-line FY22 results, management at Star Entertainment Group flagged increased costs from tight labour markets, supply chain issues and rising inflation.

Morgans retained its Hold rating on concerns about ongoing regulatory investigations and potential delays for the sale and leaseback of The Star Sydney buildings, while Outperform-rated Macquarie highlighted resilient revenue streams and felt there is a re-rating opportunity ahead.

While Boral recorded in-line FY22 results, Citi retained its Sell rating due to a challenging outlook. Macquarie assessed a weaker operational outcome than guided and remained concerned over the unhedged energy portfolio. While price increases are helping, the analysts noted costs and weather impacts remain hard to forecast.

Total Buy recommendations take up 55.75% of the total, versus 35.49% on Neutral/Hold, while Sell ratings account for the remaining 7.76%.

In the good books

FLIGHT CENTRE TRAVEL GROUP LIMITED (FLT) was upgraded to Neutral from Sell by Citi, B/H/S: 0/4/2

Following FY22 results, Citi upgrades its rating for Flight Centre Travel to Neutral from Sell after a material share price fall, and now that revenue margin issues are factored-in to consensus expectations. The target rises to $16.60 from $15.55.

Yesterday, the broker noted the underlying operating earnings loss was pre-reported in July, and there were no surprises in the FY22 result. Citi asserts revenue margins of around -25% below pre-pandemic levels are unsustainable and need to normalise before there is proper recovery.

Moreover, capacity revisions are heading down instead of up. Hence, the broker calculates, that for Flight Centre Travel to hit FY23 consensus revenue estimates at existing take rates implies 11% more than the total transaction value the market is expecting.

QANTAS AIRWAYS LIMITED (QAN) was upgraded to Outperform from Underperform by Credit Suisse, B/H/S: 5/0/1

The FY22 loss of -$1.86m was slightly more than Credit Suisse expected. Net debt was better than forecast. Qantas Airways expects a record fuel bill in FY23 of $5bn but has announced a -10% cut to domestic capacity and anticipates unit revenue growth of 10% compared to FY19 levels will fully offset higher fuel costs.

Credit Suisse highlights the airline’s pricing power in the domestic market, with a market share close to 70%, but remains surprised by the idea that higher fuel costs can be fully offset with capacity reductions and unit revenue increases.

It seems Qantas is assuming competitors are either unwilling or unable to fill a capacity gap. Rating is upgraded to Outperform from Underperform, and the target lifted to $5.65 from $4.35.

TABCORP HOLDINGS LIMITED (TAH) was upgraded to Add from Hold by Morgans, B/H/S: 3/2/0

After Tabcorp Holdings reported in-line FY22 results, Morgans upgrades its rating to Add from Hold on the potential for the digital strategy (with enhancements) and sustainable cost efficiencies. The target price increases to $1.20 from $1.15.

With a new app coming and better marketing, the analyst expects the company’s 24.9% digital revenue market share to improve. The dividend yield and a relatively low multiple are also considered an attraction.

VIVA ENERGY GROUP LIMITED (VEA) was upgraded to Outperform from Neutral by Credit Suisse and Buy from Accumulate by Ord Minnett, B/H/S: 5/1/0

Viva Energy’s first-half result impressed Credit Suisse. Refining margins are expected to strengthen into the second half while the outperformance of the commercial business should continue.

The refining dividend has been pulled forward, given the strong cash position. Credit Suisse expects the company to retain net cash at the end of 2022 and believes further capital management is an increasing possibility.

Earnings upgrades are largely commercial as refining costs are a partial offset. Rating is upgraded to Outperform from Neutral and the target lifted to $3.14 from $2.77.

FY22 results were very strong with record operating earnings albeit in line with forecasts. Ord Minnett found the post-covid recovery clear and positive trends are expected to continue.

Retail margins are now set to expand, and commercial sales volumes are elevated. The stock offers good exposure to a recovery and Ord Minnett upgrades to Buy from Accumulate. Target is lowered to $3.35 from $3.40.

In the not-so-good books

ALLKEM LIMITED (AKE) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 5/1/1

FY22 EBITDA missed forecasts. Production at Mount Cattlin for FY23 has been downgraded -12% to 140-150,000t while costs are up 14%. Credit Suisse notes possible upside from operating improvements with two improvement projects underway for Olaroz.

Allkem’s recent share price improvement no longer appears to factor in the risk of a downturn emerging in the lithium market from the June half, the broker observes.

Believing this is a sector-wide issue the rating is downgraded to Underperform from Neutral as a result. Target is reduced to $10.30 from $10.40.

APPEN LIMITED (APX) was downgraded to Sell from Hold by Ord Minnett, B/H/S: 0/0/3

The first half net loss of -US$3.8m was in line with Ord Minnett’s forecast. There has been no material improvement in trading to date in the second half and the broker believes revenue and orders of US$360m may be at risk, as management has signalled much lower conversion levels.

The seasonal skew to the second half is also expected to be weaker. Challenges are stemming from decreased investment expenditure from Appen’s largest customers, and the broker envisages limited opportunity for this to turn around in the near term.

Rating is downgraded to Sell from Hold and the target lowered to $3 from $4.

ILUKA RESOURCES LIMITED (ILU) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 2/3/0

Credit Suisse found the first half mixed, with net profit ahead of estimates and underlying EBITDA in line. The interim dividend was substantially below expectations.

Iluka Resources has dismissed the prospect of softening demand, instead focusing on the supply chain and customer desire for supply security.

The broker disagrees with this and forecasts price weakness as the global economy stumbles in 2023. Rating is downgraded to Neutral from Outperform. Target is lowered to $10.00 from $10.48.

PANORAMIC RESOURCES LIMITED (PAN) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/1/0

Having fully examined Panoramic Resources’ FY22 result, Macquarie downgrades to Neutral from Outperform and cuts the target price to 24c from 25c.

Macquarie is surprised by the drawing down of the revolving credit facility, which stems from the delay of a fifth shipment and was secured in April 2021 as part of the US$45m financing package with Trafigura. The facility is now fully drawn.

As a result, Macquarie expects the company’s net debt is expected rise to $45m at the end of the September quarter, increasing balance-sheet risk. Should the facility be repaid in the quarter, the company’s cash balance would fall to $13.4m.

The company has signalled a previously planned August shipment has been delayed because of ongoing tightness in international sea freight markets, with 11,000t of nickel-copper-cobalt concentrate now stockpiled at Wyndham.

Macquarie now expects there will be only one shipment during the first quarter of FY23. On the positive side, Panoramic Resources has arranged the revolving credit facility for use in these situations and this will not affect the ramp-up at Savannah in FY23.

EPS forecasts fall -11% in FY23; -15% in FY24; -9% in FY25; and -23% in FY26. IGO (IGO) is a major shareholder of the company.

PILBARA MINERALS LIMITED (PLS) was downgraded to Neutral from Buy by Citi, B/H/S: 1/2/1

Following an around 40% rally in share price over the last month, Citi reviews the relative valuation of Pilbara Minerals against peers and decides to lower its rating to Neutral from Buy.

No changes are made to the broker’s forecasts.

REGIS RESOURCES LIMITED (RRL) was downgraded to Sell from Neutral by Citi and Downgrade to Neutral from Outperform by Credit Suisse, B/H/S: 2/1/2

Citi’s downgrade to Sell from Neutral is not directly linked to Regis Resources’ FY22 performance, which proved ever so slightly better-than-forecast, both by Citi and market consensus.

But then…

The valuation is seen as full with the market ostensibly already awarding upside to the, as yet not approved, McPhillamys project, the broker suggests.

Citi doesn’t see a lot of momentum for the gold price on the horizon. Even so, the broker sees better opportunities in the sector elsewhere.

There are several other negatives, with the broker highlighting “permitting an open pit project in NSW requires patience would be an understatement”.

Target drops to $1.60 from $1.70.

The FY22 EBITDA of $336m missed Credit Suisse estimates, because of a non-cash stockpile write-down. Management has indicated stockpiles are attractive from a cash perspective and remain in the mine plan but are not likely to be positive for earnings given the sunk costs.

Regis Resources has also re-started dividend payments, with a final dividend of 2c. While Credit Suisse forecasts a 3c annual pay-out over the next few years it is becoming cautious about the balance sheet, should the company go ahead with McPhillamys.

Amid the continued risks, the broker downgrades to Neutral from Outperform. Target is reduced to $1.60 from $1.80.

SONIC HEALTHCARE LIMITED (SHL) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 2/3/1

FY22 underlying net profit was broadly in line with Ord Minnett’s forecast largely underpinned by stronger higher-margin coronavirus testing.

Sonic Healthcare has emerged from the pandemic with a refreshed balance sheet but will face a tougher cost environment and a health system with funding and staffing challenges, the broker asserts.

Even with acquisitions supporting growth, group earnings are expected to more than halve as coronavirus testing volumes slow. Volumes are now declining across all major markets, signalling the end of a period of super profits.

Ord Minnett downgrades to Hold from Accumulate and lowers the target to $36.00 from $37.50.

SPARK NEW ZEALAND LIMITED (SPK) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 0/2/0

Spark New Zealand’s FY22 results were in line with estimates. Guidance for FY23 is better than Credit Suisse expected, with the midpoint of EBITDA of NZ$1.185-1.225bn implying 5% growth.

Capital management, foreshadowed after the TowerCo sale, is in the form of a NZ$350m buyback. Despite the strong guidance, the upside is limited and the broker downgrades to Neutral from Outperform. Target is raised to $5.00 from $4.90.

VENTIA SERVICES GROUP LIMITED (VNT) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 2/0/0

First-half Pro-forma net profit was below Ord Minnett’s forecasts although Ventia Services is considered on track to achieve 2022 prospectus forecasts.

Infrastructure services were the main drag on earnings in a challenging operating environment. Still, management has highlighted favourable contracting structures and the essential nature of much of the work at hand.

Ord Minnett downgrades to Accumulate from Buy on valuation while the target is raised to $2.80 from $2.70.

WAGNERS HOLDING CO. LIMITED (WGN) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/2/0

Wagners reported below Macquarie’s forecast. Construction Material Services margins were weaker than expected, as the company was unable to secure sufficient price improvement fast enough to counter sharp cost growth.

New Generation Building Materials sales were better than expected, with Composite Fibre Technologies revenues rising 32%, and Macquarie notes that increased production capacity in A&NZ and a new facility in Texas set this division up for growth ahead.

While the stock is trading at the low end of the historical valuation, the broker sees little chance of a re-rating. Outlook commentary is opaque, and cost pressures are unlikely to abate in the near term.

Downgrade to Neutral from Outperform. Target falls to 85c from $1.30.

WHITEHAVEN COAL LIMITED (WHC) was downgraded to Neutral from Buy by Citi, B/H/S: 5/1/0

Citi’s downgrade to Neutral from Buy is linked to the fact the broker sees thermal coal prices moderating at the same time as costs are rising and Whitehaven Coal intends to fire up Capex.

Target price falls to $7.40 from $7.85.

Yesterday, the broker highlighted Whitehaven Coal’s FY22 result outpaced consensus by 10% while the dividend sharply disappointed at 48c, compared with Citi’s forecast of 71c, given management is considering a buyback.

Estimates have been reduced. Interestingly, Citi’s DCF valuation has only declined to $9 from $10.30 but for specific coal uncertainty, a discount has been applied.

WOOLWORTHS GROUP LIMITED (WOW) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 1/3/1

Woolworths Group’s FY22 only slightly missed Ord Minnett’s numbers, with the broker acknowledging it was a strong performance overall.

The downgrade to Lighten from Hold occurs because the broker sees cost inflation as a problem, with the company believed to rely on margin expansion to keep its growth story going.

Yet another downgrade for the New Zealand operations is seen as a negative too. Forecasts for the years ahead have been reduced.

Ord Minnett argues Woolworths needs to become “leaner” and less reliant on suppliers facilitating gross margin expansion. Target drops to $34 from $35.40.

WISETECH GLOBAL LIMITED (WTC) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 2/1/1

WiseTech Global reported FY22 underlying net profit of $181.8m, ahead of Ord Minnett’s forecast. The final dividend was also ahead of expectations.

FY23 guidance is well ahead of forecasts and driven by the global roll-out over the second half as well as price rises and cost control.

FY23 guidance is for 21% revenue growth and 25% EBITDA growth and reflects continued margin expansion. While expecting potential upside, Ord Minnett downgrades to Accumulate from Buy based on valuation. Target is raised to $64 from $52.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.