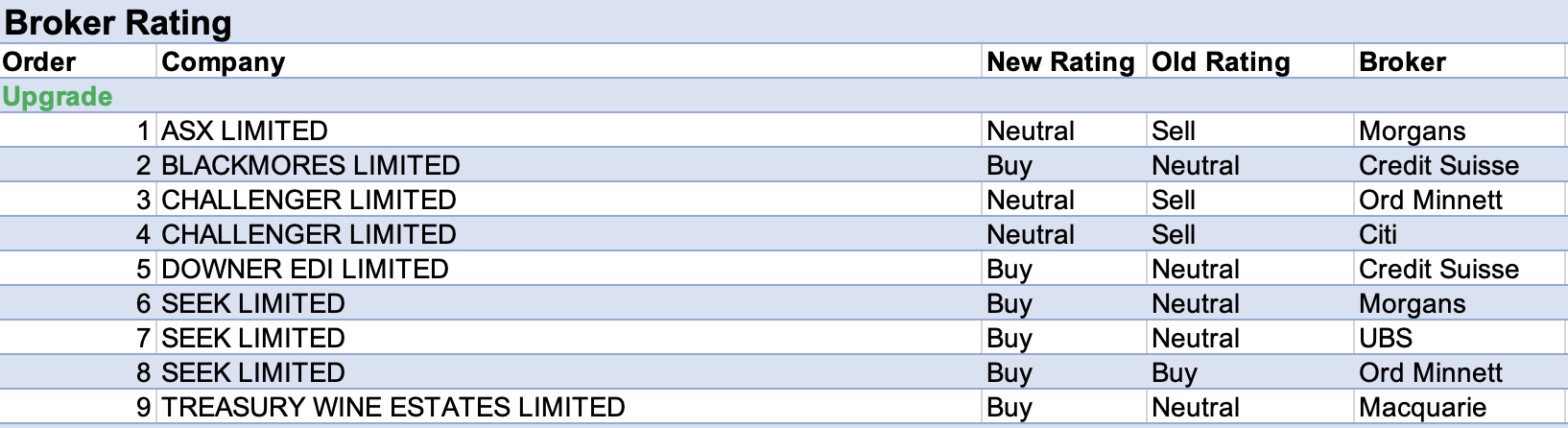

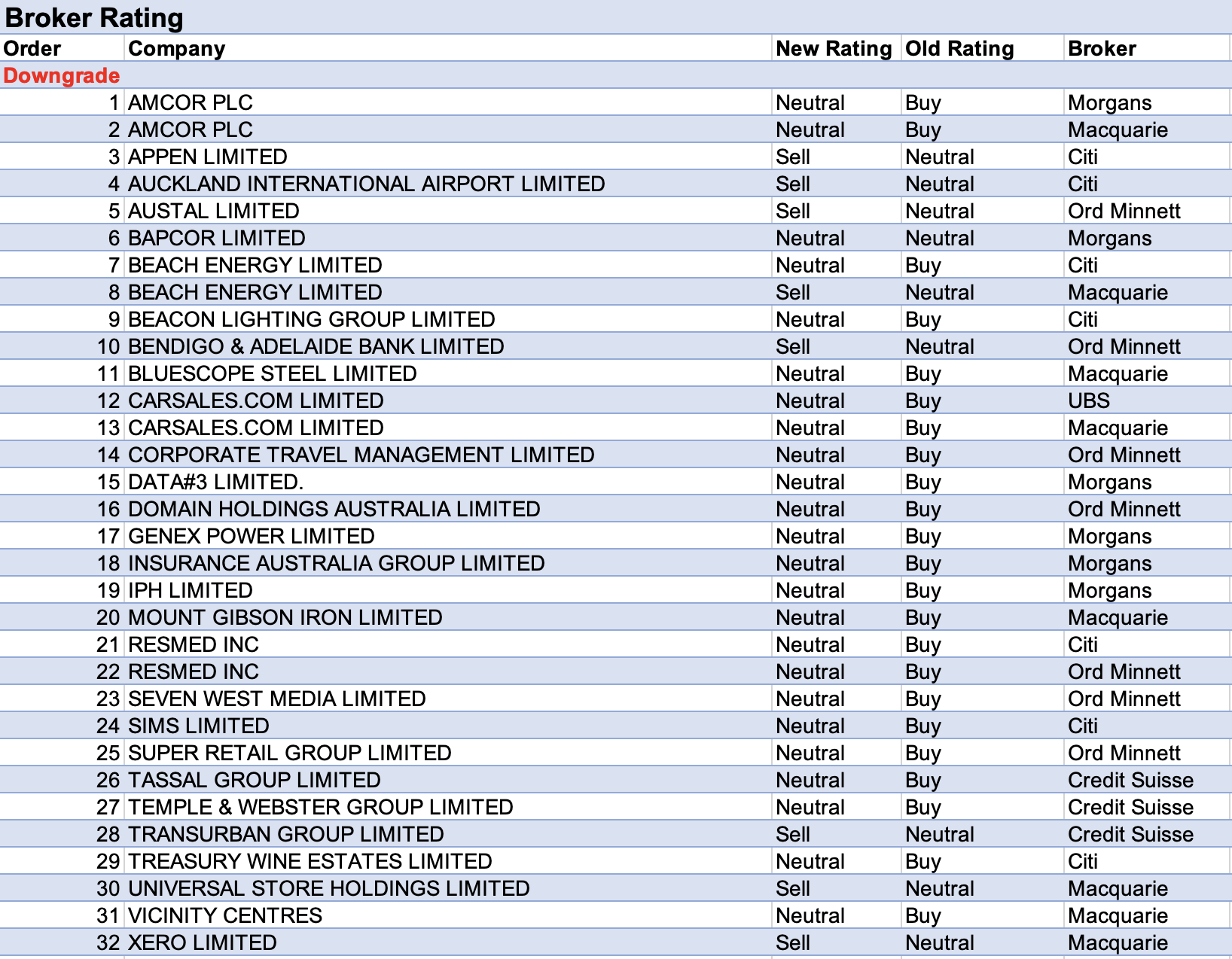

The busiest week of the August reporting season so far revealed a predominance of downgrades. For the week ending Friday August 19 there were 9 upgrades and 32 downgrades to ASX-listed companies covered by brokers in the FNArena database.

While there were rating downgrades by two separate brokers for each of Amcor, ResMed and Carsales, results were in line with analysts’ expectations for the former two and FY22 results for Carsales actually exceeded broker forecasts.

In each case, the brokers’ 12-month price targets did not justify the prior rating, when compared to current valuations.

Unfortunately for Beach Energy, dual broker rating downgrades are related to operational issues. Higher costs, including higher tax and restoration expenses, resulted in an -8% earnings miss compared to Citi’s forecasts. The broker downgraded its rating to Neutral from Buy and lowered its target to $1.85 from $2.10.

Macquarie also downgraded its rating to Underperform from Neutral and lowered its target to $1.55 from $1.85. FY23 production guidance was a -7% miss versus the broker’s forecast, while capital expenditure guidance was 16% higher than expected.

On the flip side, Seek’s FY22 results were an overall beat and resulted in three separate brokers upgrading ratings to Buy (or equivalent). While Seek’s FY22 result was in line on a net basis, FY23 guidance was much higher than anticipated.

Morgans pointed to Seek’s ability to raise prices if necessary and UBS estimated shares are trading at a -12% discount to historical earnings. Ord Minnett also raised its rating for several reasons including prior management execution, which has resulted in a doubling of Australian revenue in five years.

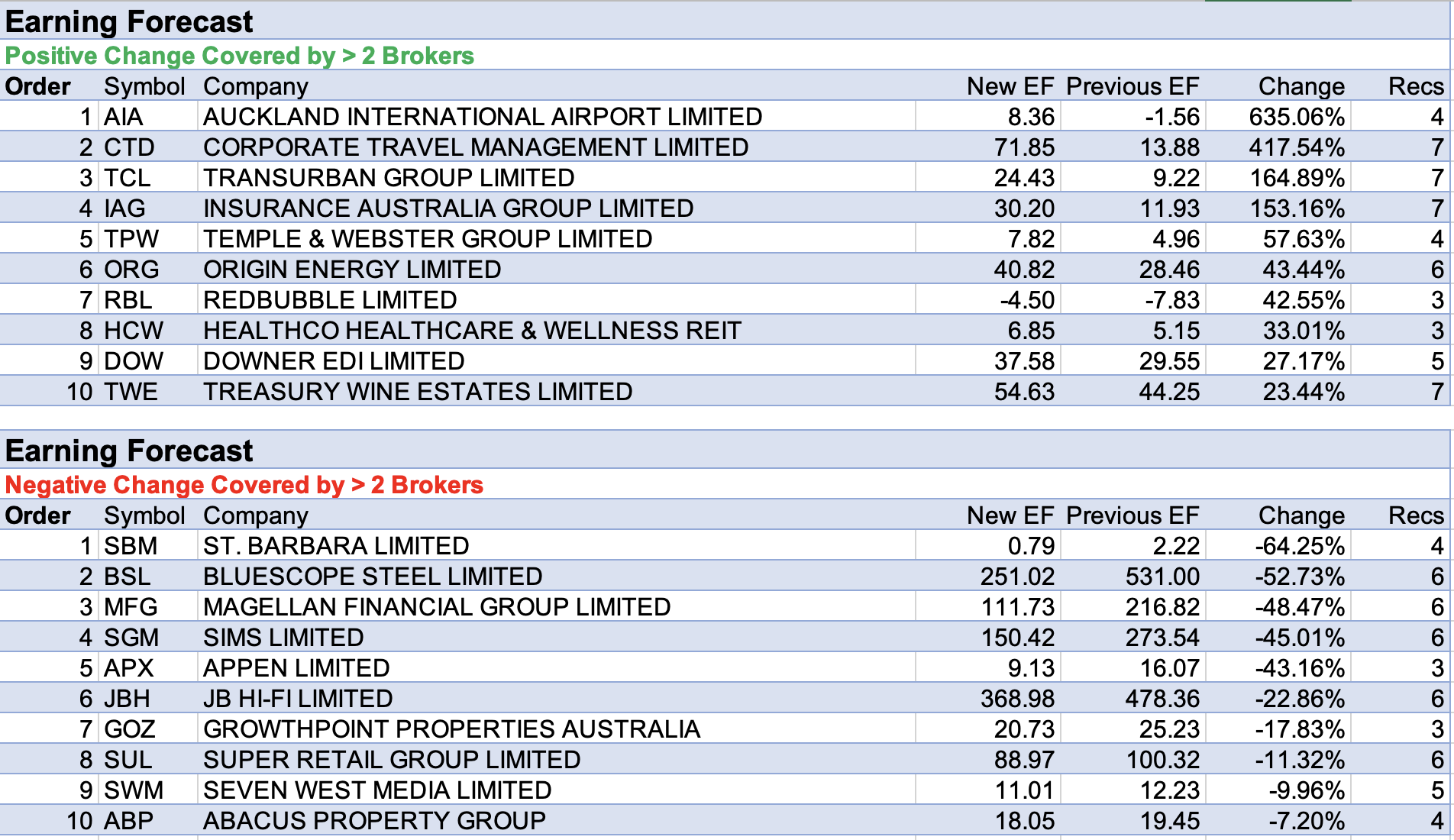

The top three percentage upgrades to forecast earnings by brokers last week were Auckland International Airport, Corporate Travel Management and Transurban.

All three companies operate within industries uniquely impacted by the pandemic and analysts’ forecasts for FY22 were accordingly low. Once these forecasts rolled off financial models and were replaced by sunnier recovery outlooks for FY23 and onwards, overall forecasts received a boost.

This boost occurred even if those sunnier forecasts were downgraded as a consequence of the reporting season results/outlooks. By way of example, FY23 guidance for Auckland International Airport missed the consensus forecast by brokers.

Citi even downgraded its rating to Sell from Neutral on the expectation of rising operational costs and interest rates, despite an FY22 result that beat the broker’s forecast.

Transurban FY22 result generally met broker forecasts though first-time FY23 DPS guidance of 53cps missed the 60cps expected by consensus. Morgans suggested management is understandably conservative at this point of the recovery, though Credit Suisse was less forgiving and downgraded its rating to Underperform from Neutral and lowered its target price to $13.00 from $13.60.

Corporate Travel Management achieved an overall earnings beat versus the consensus forecast. Revenues are recovering to pre-covid levels across the board with a full recovery forecast by FY24, UBS is enthused, and although labour problems remain, management will target productivity gains as an offset.

Coming fourth on the table for the largest percentage increase in forecast earnings was Insurance Australia Group after in-line FY22 results. Despite a rise in inflation, management expects to sufficiently raise rates to meet its FY23 margin target of 14%-16%.

Ord Minnett suggested reserves now appear reasonable assuming inflation retreats, and Credit Suisse now expects a further margin boost in the new financial year. This comes after underlying investment returns and lower expense ratios delivered an 80bps improvement to underlying margins in the second half of FY22.

Speaking of margins, Temple & Webster delivered a clear earnings beat versus consensus expectations on improving margins, which demonstrated to Morgan Stanley flexibility and a strong market position.

The broker raised its FY23 earnings forecasts and noted an attractive valuation for a leader in a structurally growing market, with revenue on track to reach $1bn in five years.

Origin Energy also received earnings upgrades. While FY22 results were generally in line with expectations, Morgans is increasingly confident the company is through the worst of its exposure to volatile electricity prices and raised its target to $5.68 from $5.39.

Buybacks were discussed by management though Outperform-rated Macquarie expects special dividends are more likely. The broker raised its target price to $7.42 from $6.87.

Redbubble also appeared in the table for material forecast earnings upgrades by brokers in the FNArena database following both in-line FY22 results and the benefit of forecasts for FY22 rolling-off broker financial models.

UBS adjusted its earnings forecasts for higher gross margins in FY23 and FY24, while Morgan Stanley noted a June quarter revenue growth rate of 1% compared to -7%, -11% and -28%, respectively, in the prior three quarters.

On the negative side of the ledger, St Barbara headed up the table for the largest forecast earnings downgrades by brokers, after a site trip by Ord Minnett reinforced the structural challenges at Gwalia. The orebody is deep and has a declining grade profile, explains the analyst.

The Hold-rated broker’s FY23/24 earnings forecasts were lowered on higher costs and capital requirements. While the valuation is considered attractive, and the target was raised to $1.10 from $0.90, risks across the portfolio remain.

Next on the table was BlueScope Steel after FY22 results exceeded consensus expectations, but first-half guidance disappointed. Macquarie downgraded its rating to Neutral from Outperform and lowered its earnings per share forecasts by -32%, -19% and -17%, respectively through to FY25.

While the buyback was extended and the dividend was in line, the broker pointed out that Capex guidance was again lifted to account for acquisitions and further investment in the US.

Magellan Financial Group also received lower earnings forecasts from brokers last week after FY22 earnings missed the consensus estimate. The second half dividend also missed Morgan Stanley’s forecast by -10% on lower performance fees, and the broker sees lumpy downside risks on flows and little offsetting flexibility for costs.

Broker earnings forecasts for Sims declined last week, despite an in-line FY22 result and a dividend that surprised to the upside. While the company benefited from higher scrap prices in FY22, management pointed to a fall in non-ferrous prices to US$320-US$400/t at the start of FY23 from around US$700/t in March.

Citi also lowered its earnings forecasts for Appen in reaction to the previous week’s half-year result and trading update. Global Services segment revenue is expected to decline by -10% year-on-year in the second half.

However, with the company’s largest customers, Google, and Facebook, both indicating slowing headcount growth and investment, the broker noted further downside risk and downgraded its rating to Sell from Neutral.

Finally, Data#3 received the only material change to price targets set by brokers in the FNArena database last week, following pre-guided and in-line FY22 results.

Morgan Stanley noted a significant acceleration in services in the second half and raised its target to $6.90 from $6.30, while Morgans found another record result in the face of supply chain pressures hard to fault and raised its target to $6.42 from $6.27.

Total Buy recommendations take up 57.28% of the total, versus 35.15% on Neutral/Hold, while Sell ratings account for the remaining 7.57%.

In the good books

ASX LIMITED (ASX) was upgraded to Hold from Reduce by Morgans, B/H/S: 1/4/1

Morgans upgrades its rating for ASX to Hold from Reduce after a recent share price retracement and FY22 results showing top-line growth across all business units. The target is increased to $76.90 from $74.05 on the result and less conservatism for forecast revenue.

The analyst cautions about elevated risks in the near-term surrounding current large-scale technology projects. Guidance was for double-digit expense growth in FY23 and a circa 14% increase in Capex.

BLACKMORES LIMITED (BKL) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 1/3/1

Blackmores’ result missed Credit Suisse on out-of-stocks in Australia, China lockdowns, restoration of incentive payments and difficult to measure inflationary pressure.

But the broker upgrades to Outperform on the basis that upside risk is greater than downside, suggesting that through price

increases and cost savings, Blackmores has the chance to pull growth forward.

One key challenge in FY23 is the company will be cycling tough covid comparables for immunity products, particularly in Indonesia in the September quarter. Target unchanged at $90.

DOWNER EDI LIMITED (DOW) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/1/0

Downer EDI’s FY22 result outpaced consensus and Credit Suisse’s forecasts, which, combined with decent cash conversion satisfied the broker given challenging operating conditions.

But FY23 guidance disappointed, falling well shy of consensus and the broker, and EPS forecasts are downgraded accordingly

Nonetheless, the broker upgrades to Outperform from Neutral, reflecting its appreciation of management, lower risk profile in comparison to peers, and light capital model, discarding concerns about consensus downgrades and too high an entry price (after the share price retreat in the June half).

Target price rises to $5.75 from $5.32.

SEEK LIMITED (SEK) was upgraded to Buy from Neutral by UBS, B/H/S: 5/0/1

UBS points to the market’s disappointment regarding “potentially bullish” guidance for Seek’s FY23 earnings outlook.

The company reported 11% growth in listings over FY22 with the uptake of Premium ads and higher pricing for Classic ads, estimated at 5%, ex-discounts for volume.

The analyst views Applications per Ad which reached a historical low will reverse as labour supply pressures ease.

The broker’s earnings forecasts are reduced by -21.9% and -21.3% for FY23 and FY24, respectively, and account for a -5% and -12% decline in listings volumes over the next two financial years.

On the positive side, UBS is forecasting EBITDA margins to grow 190bs between FY23 and FY26, due to the strong operating leverage in the business and despite ongoing investment in the platform.

UBS upgrades Seek to Buy from Neutral and sees the stock trading at a -12% discount to historical earnings. The price target falls to $27.80 from $32.

TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 5/2/0

Treasury Wine Estates reported a “solid” result according to Macquarie with a consensus beat on after-tax earnings and EPS, while revenues were in line with expectations.

Of note, the broker highlights the ongoing “premiumisation” trend for the business with the Luxury and Premium categories now contributing 83% of revenues, up 6bp on the year.

Macquarie raises earnings forecasts by 0.8% for FY23 and 0.5%% for FY24 and moves to a more confident stance on the company after the successful transition away from China alongside good growth opportunities in Asia.

The rating is upgraded to Outperform from Neutral and the price target is raised to $15.00 from $12.55.

See downgrade below

In the not-so-good books

AUCKLAND INTERNATIONAL AIRPORT LIMITED (AIA) was downgraded to Sell from Neutral by Citi, B/H/S: 3/0/1

While Auckland International Airport delivered a beat with its full-year results, the company’s FY23 net profit guidance has disappointed Citi’s expectations -32%, and consensus forecasts -47%, underpinned by what the broker finds conservative passenger assumptions.

While better passenger recovery could allow some upside to guidance, the broker notes rising operational costs, higher interest and lower retail costs all look likely to drag on earnings and predicts downgrades to forecasts across the market.

The rating is downgraded to Sell from Neutral and the target price decreases to NZ$7.24 from NZ$7.55.

AMCOR PLC (AMC) was downgraded to Neutral from Outperform by Macquarie and Hold from Add by Morgans, B/H/S: 2/5/0

Further to the results, Macquarie downgrades to Neutral from Outperform as the stock is now trading close to its target, steady at $19. Amcor is guiding for 3-8% growth in earnings per share in FY23 and is trading at a 16% PE premium to global peers.

The outlook remains positive, the broker adds, and defensive growth characteristics continue to be attractive.

Following FY22 results for Amcor, Morgans upgrades its FY23 underlying EPS forecast by 1% and raises its target to $18.75 from $18.60. The rating falls to Hold from Add, due to a 5% forecast for the 12-month total shareholder return.

The analyst highlights price/mix was favourable in the Flexibles and Rigid Plastics divisions, due to a stronger focus on higher-value segments.

FY23 guidance is for constant currency underlying EPS growth of 1-6%, compared to the broker’s 4% forecast. Guidance includes a -4% impact from higher interest costs and a -2% drag from the decision to exit operations in Russia.

Management announced a US$400m share buyback (US$600m in FY22).

APPEN LIMITED (APX) was downgraded to Sell from Neutral by Citi, B/H/S: 0/1/2

While Citi was not surprised by Appen’s ad-related revenue declining by 8% year-on-year in the first half, the broker noted a -7% decline in non-ad-related revenue and a -52% decline in Global Product revenue both less expected.

The broker is predicting Appen’s Global Services segment revenue to decline by 10% year-on-year in the second half, but with the company’s largest customers, Google and Facebook, both indicating slowing headcount growth and investment, notes downside risk.

Citi finds Appen’s step up in technology platform and go-to-market strategy investment as the right move to reduce exposure to Big Tech. The broker expects no dividend to be paid in the second half and reduces the dividend ratio to 15%.

The rating is downgraded to Sell from Neutral and the target price decreases to $4.40 from $6.60.

AUSTAL LIMITED (ASB) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 3/0/0

Austal expects earnings (EBIT) to be $120.7m in FY22, which would be ahead of Ord Minnett’s forecasts and prior guidance. The substantial uplift is driven by changed assumptions around costs and labour utilisation.

The broker envisages downside risk to market expectations regarding future margins for the business as Austal transitions from highly profitable LCS vessels to a new steel-based OPC program.

Rating is downgraded to Lighten from Hold and the target is lifted to $2.40 from $2.30.

BAPCOR LIMITED (BAP) was downgraded to Hold from Add by Morgans, B/H/S: 5/2/0

Following FY22 results for Bapcor, Morgans expects a solid near-term outlook though assesses a fair valuation and downgrades its rating to Hold from Add. The target rises to $7.36 from $7.08.

The results met guidance, with a 2H earnings (EBITDA) improvement of 12.5% half-on-half coming from the Trade and Specialist Wholesale divisions, which increased by 21% and 17%, respectively.

Management noted a “good start” to FY23, and the focus in the coming year will be on operational efficiency.

BEACON LIGHTING GROUP LIMITED (BLX) was downgraded to Neutral from Buy by Citi, B/H/S: 1/1/0

While Beacon Lighting continues to execute on its emerging trade business, Citi is concerned about the company’s ability to offset a likely slowdown in its larger retail business over the second half of FY23.

The broker predicts the impacts of rising rates on the housing cycle will be felt more in the second half of FY23 and will challenge Beacon Lighting in the medium term.

Having reported flat margin growth in the second half of FY22, Citi is predicting Beacon Lighting will suffer a -40-basis point decline in the coming year, driven by a declining Australian dollar, higher freight costs and growth in the lower margin trade segment.

The rating is downgraded to Neutral from Buy and the target price decreases to $2.53 from $3.00.

CORPORATE TRAVEL MANAGEMENT LIMITED (CTD) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 4/3/0

Corporate Travel Management’s FY22 net profit was in line with Ord Minnett’s expectations. The broker was impressed with the fourth quarter net profit, which more than offset an aggregate loss for the first three quarters.

The turnaround was driven by the northern hemisphere while the Australian division reported a materially lower revenue margin because of limited international travel.

The main challenge is the historical evidence which points to a significant contraction in business travel expenditure in times of economic downturn. Ord Minnett revises assumptions to reflect this prospect and downgrades to Hold from Accumulate. Target is reduced to $20.76 from $25.86.

DOMAIN HOLDINGS AUSTRALIA LIMITED (DHG) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 2/4/0

Ord Minnett asserts Domain Holdings Australia must absorb incremental costs from recent acquisitions and offset the prospect for the listings environment to deteriorate.

The broker factors in a -5% decline in listings for FY23 across the business, although notes the first quarter will be a strong period because of the lockdown on the east coast in the prior comparable quarter.

Amid changing circumstances and increased costs, the broker assesses the risk/reward is balanced at current levels and downgrades to Hold from Buy. Target is reduced to $4.00 from $4.40.

DATA#3 LIMITED (DTL) was downgraded to Hold from Add by Morgans, B/H/S: 2/1/0

Following a rally in the Data#3 share price, Morgans moves to a Hold rating from Add, while the target rises to $6.27 from $5.89.

The broker expects few surprises when the company releases its FY22 result today.

GENEX POWER LIMITED (GNX) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Morgans lowers its rating for Genex Power to Hold from Add and reduces its target to $0.25 from $0.30 following an increased $0.25 non-binding offer for the company by Skip and Stonepeak.

The board will recommend the offer at the new price, which the analyst understands, given the premium to the previous share price trading range. However, it’s thought the fundamental value still exceeds the bid price.

IPH LIMITED (IPH) was downgraded to Hold from Add by Morgans, B/H/S: 1/1/0

While Morgans makes EPS forecast upgrades following FY22 results for IPH, the rating falls to Hold from Add after a strong positive share price reaction to an acquisition announcement. The target rises to $10.63 from $9.52.

The broker likes the highly strategic move into another large secondary market, with the acquisition of Canada’s leading IP firm, Smart & Biggar for about -$387m (scrip and debt).

Morgans awaits a share price pullback before suggesting another entry point for the shares.

SUPER RETAIL GROUP LIMITED (SUL) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 4/2/0

Super Retail’s strong FY22 result and trading update reflect buoyant trading, which Ord Minnett suspects is in its final stages.

The broker envisages downside risk to consensus expectations in the second half of FY23 and in FY24, as higher interest rates and pressures on the cost of living become more pronounced.

Rating is downgraded to Hold from Buy as the buffer in the share price to earnings downgrades has been eroded. Target rises to $11.00 from $10.50.

TRANSURBAN GROUP LIMITED (TCL) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 3/3/1

Transurban reported a weak FY22 result with earnings -5% below Credit Suisse’s forecast, mostly due to higher operating costs and

partly due to weaker traffic. FY23 dividend guidance is -14% below forecast.

The company has guided to higher cost growth in FY23 compared to FY22 due to underlying inflationary pressures, new asset costs and costs related to early-stage development projects.

While guidance may be conservative, Credit Suisse cuts its target to $13.00 from $13.60 and downgrades to Underperform from Neutral.

TREASURY WINE ESTATES LIMITED (TWE) was downgraded to Neutral from Buy by Citi, B/H/S: 5/2/0

It appears Citi analysts have been quite pleased with Treasury Wine Estates’ FY22 release; in particular the fact the company managed to grow volumes in Asia ex-China is seen as quite the positive surprise.

But then we get to the ‘valuation’, plus Citi is worried about ongoing inflationary pressures (potentially impacting consumer spending) which might translate into lower margins and a higher cost base.

Also, management has indicated supply chain savings will take a step back in FY23, to generate a better outcome by FY25. Total weight of premium and luxury products in sales continues to increase, Citi observes.

Downgrade to Neutral from Buy. Target price declines slightly to $13.50 from $13.78.

See upgrade above

VICINITY CENTRES (VCX) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/5/1

Vicinity Centres’ full-year funds from operations have beaten Macquarie’s forecast by 2.9%, despite some underlying softness attributed to second-half expenses skew.

The company has provided guidance for the coming year, including $30m in rental relief, largely for small and medium CBD retailers, significantly higher than Macquarie’s anticipated $12m and causing some drag on guidance.

Macquarie questioned whether rental assistance should be considered transitory or a permanent fixture to profit and loss reports. The rating is downgraded to Neutral from Outperform and the target price increases to $2.03 from $2.01.

XERO LIMITED (XRO) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 4/0/2

Xero revealed weaker than expected growth in net subscriber additions in the UK which is the company’s second-largest market after Australia, at 26% of estimated revenues for FY23, according to Macquarie.

The analyst views the market has yet to discount a potential slowdown in the outlook for the international markets, excluding the UK.

The broker’s earnings forecasts are adjusted by -33% in FY23 and -25% in FY24 and sit below consensus earnings with Macquarie emphasising the sensitivity of the business model to changes in revenue growth, with the company at very early stages of profitability.

The analyst estimates a -1% revenue miss equates to a -13% downgrade in EBIT.

Macquarie downgrades Xero to Underperform from Neutral and the target price is lowered to $70 from $80.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.