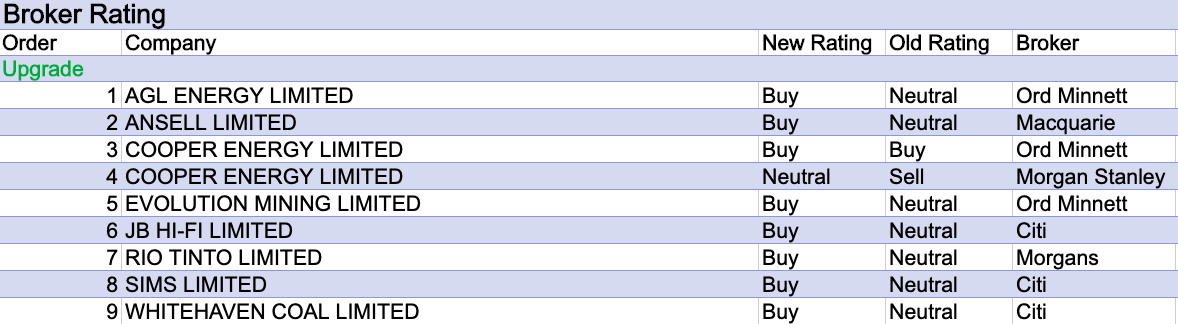

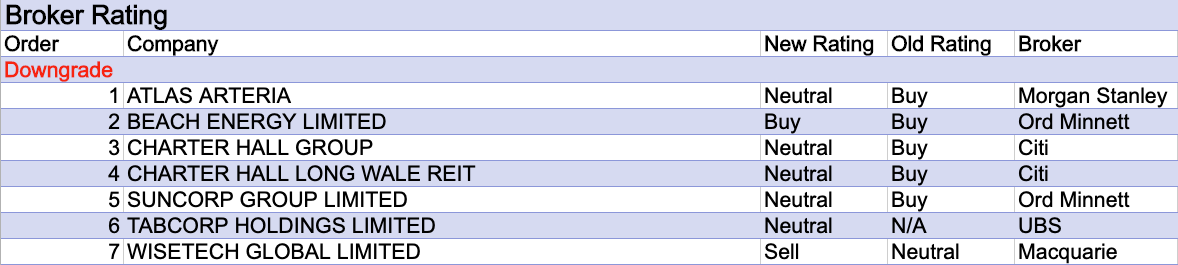

For the week ending Friday July 22 there were nine upgrades and seven downgrades to ASX-listed companies covered by brokers in the FNArena database.

Whitehaven Coal had the highest percentage increase in target price. This followed the release of unaudited FY22 earnings that were a 16% beat versus the consensus forecast. Morgans noted far higher than expected pricing offset volume and cost headwinds, and referred to “staggering” cash accumulation, with $1.4bn generated in the June quarter. The broker raised its target price to $6.70 from $5.25.

Citi raised its thermal coal price estimates for FY22 and FY23 by 60% and 100%, respectively, to US$350/t and US$210/t, and FY22 and FY23 earnings forecasts for Whitehaven Coal by 50% and 350%, respectively. As a result, the broker upgraded its rating to Buy from Neutral and increased its target to $7.85 from $4.90.

On the flipside, Charter Hall Group had the largest percentage fall in average target price after both Citi and Macquarie undertook REIT sector reviews last week.

Citi lowered its target to $12.60 from $24.80, and its rating to Neutral from Buy. Rising interest rates are expected to result in higher debt costs across all of Charter Hall Group’s funds, and increased acquisition costs could reduce the number of potential acquisitions.

While Outperform-rated Macquarie also lowered its target to $15.33 from $16.33, it was more upbeat than Citi. It’s thought the addition of a fund manager like Charter Hall would supplement more defensive REIT holdings, should bond yields show signs of stabilising.

Auckland International Airport received the largest percentage fall in forecast earnings last week, after Morgan Stanley lowered its FY22-24 EPS estimates to reflect June 2022 traffic data, and cost pressures resulting from inflation and disrupted supply chains.

The broker predicted an international passenger recovery to 60% of 2019 levels by the end of 2022, and the resumption of a dividend in the second half of FY23.

Last week Citi downgraded its metals deck to account for weaker demand, and sharply downgraded its earnings forecasts for 29Metals, expecting cash burn to emerge in the second half. At the same time, the company’s June-quarter production report outpaced the broker’s forecasts and management retained 2022 guidance.

Underperform-rated Credit Suisse also lowered FY22 earnings forecasts for 29Metals on weaker June and September quarter revenues.

As part of its general review of REITs prior to the reporting season, Macquarie lowered earnings forecasts for Outperform-rated HealthCo Healthcare & Wellness REIT. Increased market scrutiny over capital management was noted, given the dividend is unlikely to be covered until FY25.

Earnings forecasts for Alumina Ltd were also revised lower by brokers following June quarter results for the AWAC joint venture with Alcoa. Morgan Stanley revised its estimate for Alumina Ltd’s 40% share of AWAC’s first half dividend to US$4.1cps compared to the US$5.7cps previously expected.

Incorporating the AWAC result and lower forecasts for the San Ciprian refinery triggered a -16% cut to Macquarie’s earnings forecasts. Credit Suisse noted the refinery accounts for around 12% of AWAC production, and according to Alcoa is losing circa -US$75m per quarter at current gas and power prices in Spain. Gas prices have increased five-fold from 2021 levels.

Iluka’s June quarter production of both zircon and synthetic rutile came in above consensus forecasts, according to Credit Suisse, and a sell-off in inventories for zircon, rutile and synthetic rutile resulted in a 20% beat for sales versus consensus.

Outperform-rated Macquarie noted the company is set to benefit from rising zircon, rutile and rare earth prices in the short and medium term, while Buy-rated Citi pointed to strong US demand due to supply chain constraints on paints, coating and plastics, and raised 2022 earnings forecasts by 38%.

Ampol also received higher earnings forecasts from brokers. Macquarie returned from a period of research restriction on the company with an Outperform rating, noting the Z Energy acquisition is more than 20% accretive and should accelerate debt reduction.

Second quarter refining margins confirmed Buy-rated UBS’s suspicions that the Lytton refinery will continue to benefit from strong margins, given 97% of its fuel is transport related. Meanwhile, Morgan Stanley noted recent share price weakness and sniffed a buying opportunity.

Total Buy recommendations take up 59.53% of the total, versus 33.57% on Neutral/Hold, while Sell ratings account for the remaining 6.90%.

In the good books

COOPER ENERGY LIMITED (COE) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 2/3/0

As Cooper Energy’s share price continues to underperform, Morgan Stanley’s rating is lifted to Equal-weight from Underweight. It’s felt the Orbost Gas Processing Plant transaction last month puts the company in control of its own destiny. Morgan Stanley feels Sole is showing signs of improvement after a disappointing couple of years. In a 4Q update, the company reported higher annual production, sales volume and revenue for FY22. The analyst estimates the removal of the Orbost Gas Processing Plant tariff will save the company around $50m per year, partly offset by a -$25m increase in opex related to the plant. The target price rises to $0.25 from $0.23. Industry view: Attractive.

EVOLUTION MINING LIMITED (EVN) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 3/4/0

Evolution Mining’s June quarter numbers proved broadly in-line with Ord Minnett pointing out management at the gold producer had already lowered expectations in late June, so no flowers this time around (we made up the latter). Now that expectations have been re-based, and so has the share price, Ord Minnett sees an opportunity to jump on board of a lower cost producer with a quality management team at an attractive price. Hence, the rating has been upgraded to Accumulate from Hold. Target price has lost another -10c to $2.90.

In the not-so-good books

ATLAS ARTERIA (ALX) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 1/3/0

Morgan Stanley lifts its target price for Atlas Arteria to $8.08 from $6.88 to incorporate the growth outlook and potential corporate activity. IFM Global Infrastructure Fund obtained a 15% shareholding in the company at $8.10/share in early June. The broker also lowers its rating to Equal-weight from Overweight on valuation. Industry view: Cautious. APPR 2Q traffic and revenue were lower than expected and the analyst now has less hope for a French traffic recovery for the rest of the year, due to weather, petrol prices and economic uncertainty.

BEACH ENERGY LIMITED (BPT) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 5/1/1

Upon further reflection, the broker has downgraded Beach Energy to Accumulate from Buy – we can blame the share price performance for that. Ord Minnett believes the company released a “reasonable quarterly activities report” which hereby gets rewarded with minor upgrades to forecasts. In response, the price target has climbed to $2 from $1.95.

CHARTER HALL GROUP (CHC) was downgraded to Neutral from Buy by Citi, B/H/S: 4/2/0

Citi reviews the Australian Real Estate sector and forecasts a -6% to -10% fall in asset values by 2024 in response to rising bond yields but expects a hard landing will be avoided. Add to that the near-term and medium-term earnings hit from higher rates, Citi favours asset classes with better demand supply dynamics such as industrial, or short-term leases such as Storage. Income favourably exposed to high inflation such as convenience and certain weighted asset lease expiries are also preferred. Citi expects rising interest rates will hit Charter Hall hard, resulting in higher debt costs across all funds, as well as increase acquisition costs, potentially reducing the number of forecast acquisitions. While valuation is starting to appeal, the broker spies no upside catalysts. Rating downgraded to Neutral from Buy. Target price slumps to $12.60 from $24.50.

CHARTER HALL LONG WALE REIT (CLW) was downgraded to Neutral from Buy by Citi, B/H/S: 1/4/0

Citi reviews the Australian Real Estate sector and forecasts a -6% to -10% fall in asset values by 2024 in response to rising bond yields but expects a hard landing will be avoided. Add to that the near-term and medium-term earnings hit from higher rates, Citi favours asset classes with better demand supply dynamics such as industrial, or short-term leases such as Storage. Income favourably exposed to high inflation such as convenience and certain weighted asset lease expiries are also preferred. Citi expects Charter Hall Long WALE REIT’s low hedging and high gearing will result in a hit to near-term and medium-term earnings.

TABCORP HOLDINGS LIMITED (TAH) was downgraded to Neutral by UBS, B/H/S: 2/4/0

Following a period of restriction on Tabcorp Holdings research, UBS reinstates coverage with a Neutral rating and $1.00 target price, down from $4.70 following the demerger of the Lotteries and Keno business. Despite a lack of growth options, it’s felt there’s little downside risk. For the remaining Wagering business, the analyst feels the company will need to improve its product and value perception to stabilise market share. While structural reform of key licences will be the most significant value driver, the broker cautions that such reform is uncertain and the timing difficult to forecast.

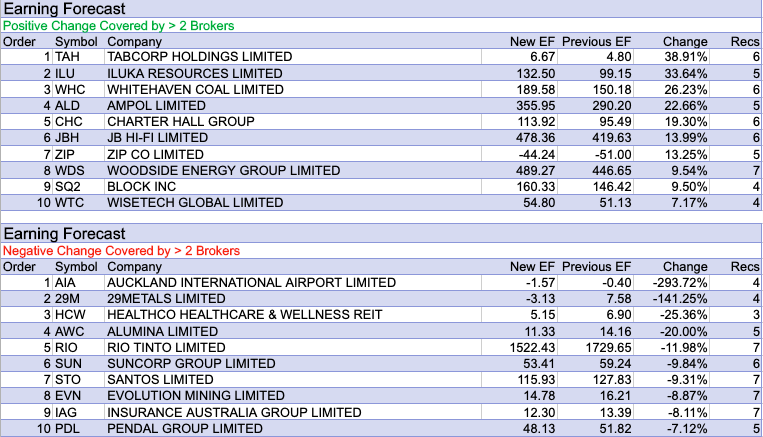

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.