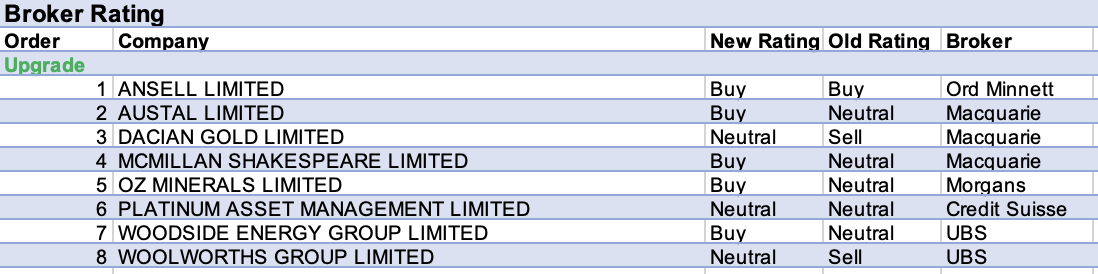

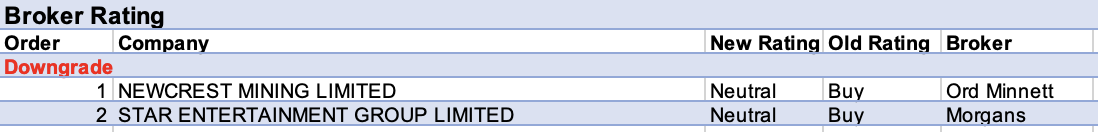

For the week ending Friday July 8 there were 8 upgrades and 2 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Austal headed up the table for the largest percentage increase in target price after announcing a contract worth up to US$3.3bn for detailed design and construction of up to eleven offshore patrol cutters for the US Coast Guard.

Macquarie felt the contract de-risked the company’s outlook and raised its rating to Outperform from Neutral and its 12-month target price to $2.65 from $1.91. The contract will cover shipyard overheads, which will allow more room to bid on future projects, according to Citi.

Citi also highlighted the Mobile division is more sophisticated and diversified than a few years ago and raised its target to $2.91 from $2.35. Hold-rated Ord Minnett was more cautious and noted the valuation impact of the contract win is difficult to assess given uncertainty around the expected margin.

On the flipside, Newcrest Mining received the largest percentage fall in target price. Across Ord Minnett’s commodities coverage, average net present values were reduced by -15% and its rating for Newcrest was lowered to Hold from Buy, while its target was slashed to $23 from $29.

From the same starting point of $29, Citi also reduced its target to $22 due to rising cost concerns and a lower consensus copper price expectation. The target was also impacted by a marking-to-market of commodity prices, partially offset by a lower Australian dollar. Lower commodity price forecasts at UBS also resulted in a $22.40 target, down from $26.20.

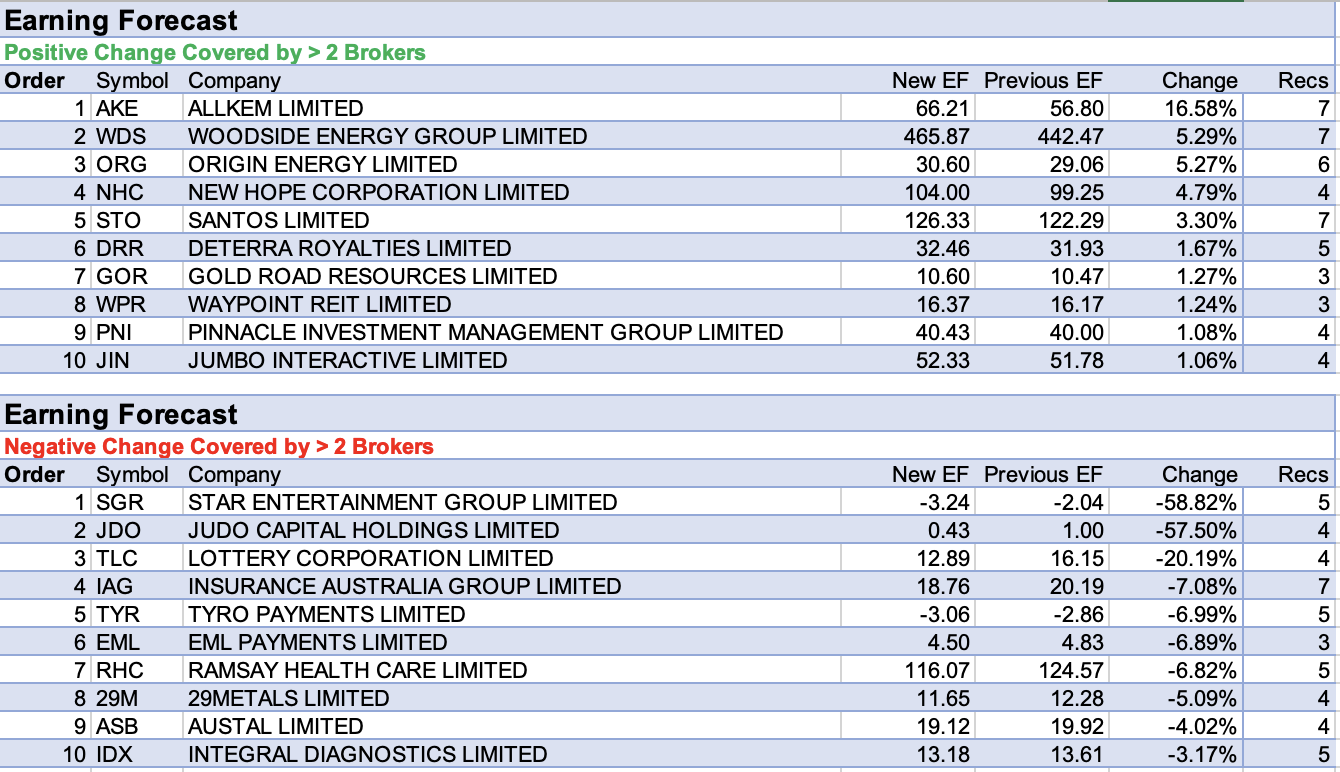

The only commodities exempt from lower price revisions by UBS were thermal coal, the broader Energy sector and lithium. The broker highlighted a constructive outlook for lithium prices and exceptional cashflows are expected to fund transformational growth for Allkem (and IGO and Mineral Resources), even as prices fall by up to two-thirds by the end of 2023.

This positive view was responsible for Allkem’s position atop the table for largest percentage increase in forecast earnings last week. On the other hand, Star Entertainment received the largest percentage decrease. Morgans downgraded its rating to Hold from Add while the findings of the Bell Review (due August 31) are awaited.

The broker lowered its FY22 earnings forecast (to align with consensus) by -28% to take account of higher operating costs and expressed a preference for gaming stocks like Jumbo Interactive and Lottery Corp, which are exposed to higher potential earnings growth from lotteries.

Judo Capital was next on the forecast earnings downgrade list. While an Outperform rating was retained, Macquarie is concerned about loan impairments as rates rise, a position not helped by the company’s sub-scale operation. Also, the loan book is skewed to SME’s and Judo Capital is thought to have easier underwriting standards than peers in that segment.

However, following an update on loan growth by management, Macquarie conceded prospectus targets continue to be met. Ord Minnett also noted ongoing market share gains in the SME lending market and retained its Buy rating.

Last week, Ord Minnett initiated coverage on Lottery Corp with an Accumulate rating, which increased the number of covering brokers in the FNArena database to five, though had the effect of lowering the company’s average forecast earnings within the database.

The broker noted Lottery Corp’s capacity to generate profits and deliver hefty returns to shareholders, though highlighted the consensus margin expansion forecast from digital penetration may be overdone. More positively, the broker noted a capital-light business model and defensive earnings that may come in handy should the economic backdrop worsen.

Total Buy recommendations take up 59.03% of the total, versus 33.98% on Neutral/Hold, while Sell ratings account for the remaining 7.00%.

In the good books

ANSELL LIMITED (ANN) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/2/1

Ord Minnett conducts its quarterly currency revisions for healthcare companies and finds a very modest benefit to companies reporting in Australian dollars.

Ansell is upgraded to Buy from Accumulate on valuation grounds. Target price is steady at $33.

MCMILLAN SHAKESPEARE LIMITED (MMS) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 3/1/0

Minister for Climate and Energy Chris Bowen confirmed at a National Press Club address the government could cut the 5% tariff on electric vehicles and abolish fringe benefits tax on affordable electric vehicles (EVs) priced up to $77,565 from July 22.

Macquarie says the policy offers a tax advantage for Novated Leases and expects it should boost the salary-package market share and conversion, compared with other distribution channels.

Macquarie considers the near-term earnings impact to be immaterial but considers the potential upside to medium-term earnings from the fringe-benefits tax policy should support the company’s multiple.

The broker notes that the lifetime cost of an EV is up to -50% less than an internal combustion vehicle and running costs are also cheaper.

Rating is upgraded to Outperform from Neutral. Target price falls to $11.20 from $12.59 to reflect the de-rating in Small Industrials price-earnings ratios.

WOODSIDE ENERGY GROUP LIMITED (WDS) was upgraded to Buy from Neutral by UBS, B/H/S: 5/2/0

With supply availability continuing to tighten the global oil market UBS has lifted its Brent oil forecast to US$104 a barrel in FY22, up from US$95 a barrel, and to US$95, US$85 and US$80 a barrel through to FY25, driving earnings per share increases across the sector ranging 8-25% to FY24.

While the broker sees better value with Santos (STO), it does note Woodside Energy should benefit from higher spot LNG prices, with UBS lifting its forecast for North Asian spot LNG by an average 40% through to 2026.

The Woodside Energy rating is upgraded to Buy from Neutral and the target price increases to $34.25 from $32.00.

In the not-so-good books

No new downgrades since last reported on Thursday July 7.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.