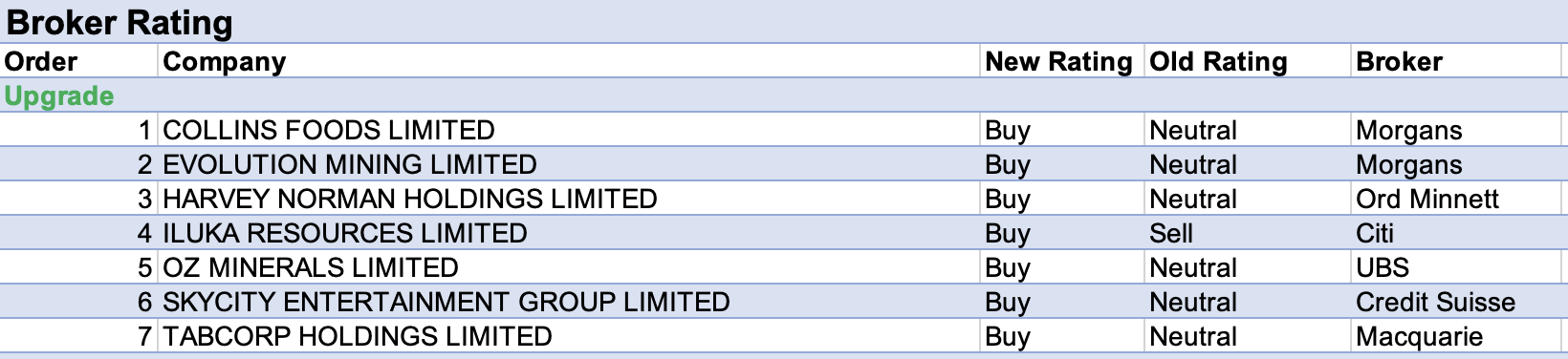

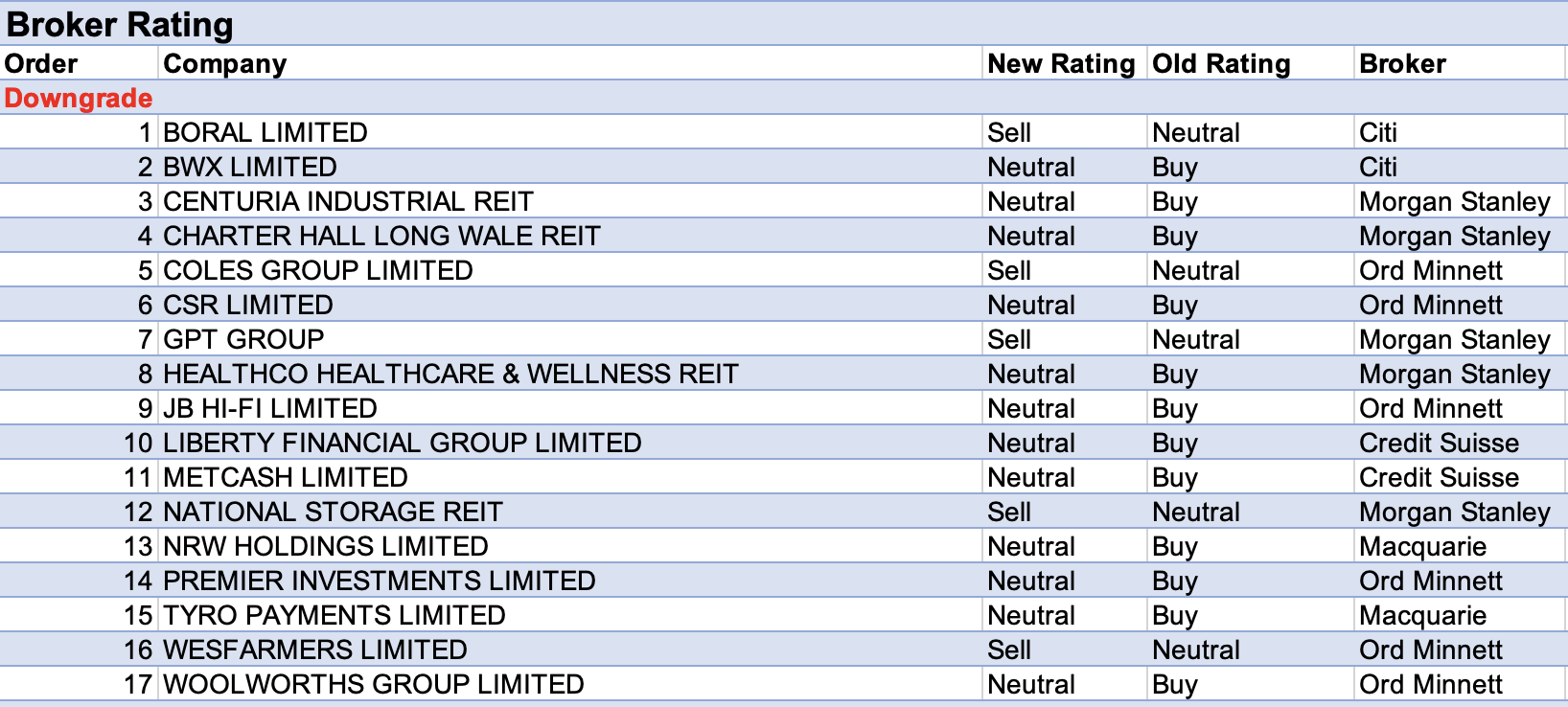

For the week ending Friday July 1 there were 7 upgrades and 17 downgrades to ASX-listed companies covered by brokers in the FNArena database.

As the tables below illustrate, broker target prices and earnings forecasts continue in a firm downtrend.

The largest percentage fall in price target set by brokers last week went to beauty and wellness business BWX, following a downgrade to full-year guidance and the announcement of a $23.2m capital raise to pay down debt.

UBS explained the downgrade was mainly due to a strategic decision to abandon the company’s practice of year-end investment buys. Underperformance in the Digital segment and delays to the US expansion of Mineral Fusion Wholefoods were also thought to contribute. The broker reduced its target price to $1.20 from $2.55.

Citi downgraded its rating for BWX to Neutral from Buy and slashed its target price to $0.75 from $2.76 after a change in valuation methodology. The analyst feels a turnaround will be difficult in the face of a weakening consumer environment and inflationary pressures. It’s also thought the put option for the Go-To founders is an ongoing overhang for the stock.

Macquarie also downgraded its rating to Neutral from Outperform (not shown in the table below due to a data glitch) and reduced its target to $0.70 from $2.20.

Liberty Financial Group received the second-largest percentage fall in price target after Credit Suisse lowered its target to $4.55 from $7.00, and reduced its rating to Neutral from Outperform, following an overall review of the non-bank financial sector.

The review noted funding costs are set to hit net interest margins and loan impairments are expected to rise. It’s felt the funding environment has deteriorated faster than expected and loan growth forecasts are weakening as higher interest rates and lower property prices come to bear.

As a result, Credit Suisse downgraded FY22-24 EPS forecasts for Liberty Financial by -4%, -28% and -29%, respectively, though the analyst suggested value remains and risks are already well priced in to the current share price.

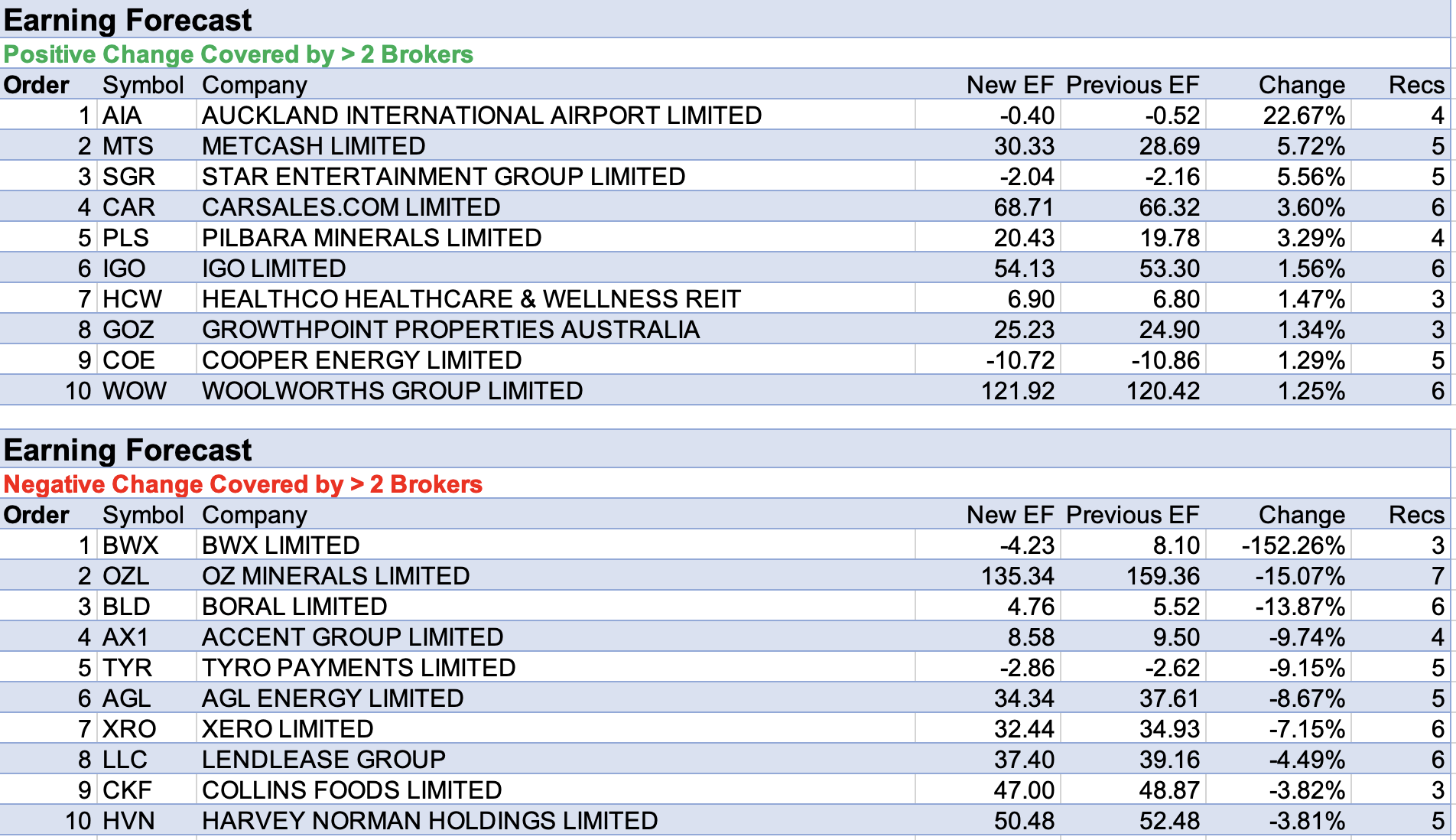

Auckland International Airport received the largest (and only material) percentage upgrade to forecast earnings. Macquarie suggested near-term earnings will reflect the ongoing international passenger recovery, as airlines increase capacity and travel restrictions are rolled back. It’s thought international passengers will match pre-covid levels by late FY24.

The broker pointed out the airport could lift aeronautical pricing by 40% in FY24, while the likely commissioning of a new domestic jet terminal should also support a material lift in pricing. The Outperform rating was retained and the target price increased to NZ$8.57 from NZ$7.95.

It was no surprise to see BWX had the largest percentage reduction in its earnings forecast. Coming second on the table was OZ Minerals, following a 2022 guidance downgrade by management.

While some caution is warranted around the short-term outlook for copper, UBS noted OZ Minerals shares are now trading at a discount to the broker’s amended target price of $23.65, down from $26.50. As a result, UBS upgraded its rating to Buy from Neutral.

Considering worsening economic conditions, last week Citi reviewed its assumptions regarding the widely touted infrastructure boom. The analyst felt socially important projects like water security and energy will be prioritised at the expense of metro road projects, which have had questionable track records in the past.

As NSW transport projects, in particular, are expected to disappoint, the broker reduced its earnings forecasts for Boral and downgraded its rating to Sell from Neutral. Citi’s target price was also reduced to $2.57 from $3.45.

Total Buy recommendations take up 59.06% of the total, versus 33.95% on Neutral/Hold, while Sell ratings account for the remaining 6.99%.

In the good books

OZ MINERALS LIMITED (OZL) was upgraded to Buy from Neutral by UBS, B/H/S: 2/4/0

While UBS lowers its price target to $23.65 from $26.50 for OZ Minerals on lower earnings forecasts after a 2022 guidance downgrade, the rating rises to Buy from Neutral.

Some caution is warranted on the short-term outlook for copper though the company’s shares are now trading at a discount to the amended target price, explains the analyst.

The company lowered 2022 copper guidance by -8% due to covid absenteeism and weather impacts, as well as labour and inflationary pressures.

TABCORP HOLDINGS LIMITED (TAH) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/3/0

Macquarie expects the launch of Tabcorp Holdings’ new wagering app, as well as regulatory reforms, should see the company be more competitive moving forward.

The broker notes Tabcorp Holdings hopes to launch its app ahead of the September Spring Carnival, with a focus on a simpler and faster interface.

Macquarie expects Tabcorp Holdings to show more discipline around capital, suggesting the company may look to service markets like Victoria or Western Australia with a digital product.

The rating is upgraded to Outperform from Neutral and the target price increases to $1.20 from $1.05.

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Sell from Neutral by Citi, B/H/S: 1/2/3

Citi analysts have reviewed their assumptions regarding the widely touted infrastructure boom in light of changing macro conditions.

Their conclusion is metro projects are most likely at risk, also given questionable track records in the past.

In direct response, the rating for Boral has been downgraded to Sell from Neutral. Target price shifts to $2.57 from $3.60 on reduced forecasts.

CSR LIMITED (CSR) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 3/3/0

Ord Minnett notes that housing is at a global inflection point as rates rise and early signs of a slowdown are emerging.

The broker expects earnings are peaking for CSR. Target price falls to $4.65 from $6.30. Rating is downgraded to Hold from Accumulate.

The broker retains a Hold rating for Boral (BLD) and Adbri (ABC). Boral’s target price falls to $3.15 from $3.25 and Adbri’s target price falls to $2.75 from $3.30.

James Hardie Industries (JHX) remains Ord Minnett’s sector pick and retains its Buy rating. Target price slips to $52 from $53.10.

TYRO PAYMENTS LIMITED (TYR) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 4/1/0

Tyro Payments looks to achieve a full-year total transaction value of $34.4bn, a miss on Macquarie’s expected $35.2bn but the broker notes the discrepancy is not indicative of an economic slowdown.

Macquarie notes weekly total transaction values have held up, as merchant growth and price inflation offset the cost of living pressures. The broker has reduced its expected total transaction value per terminal for three halves from the second half of FY23 to account for a period of subdued economic activity.

The rating is downgraded to Neutral from Outperform and the target price decreases to $0.75 from $2.15. The broker notes an increasingly competitive environment will make it hard for Tyro Payments to re-rate in the near term.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.