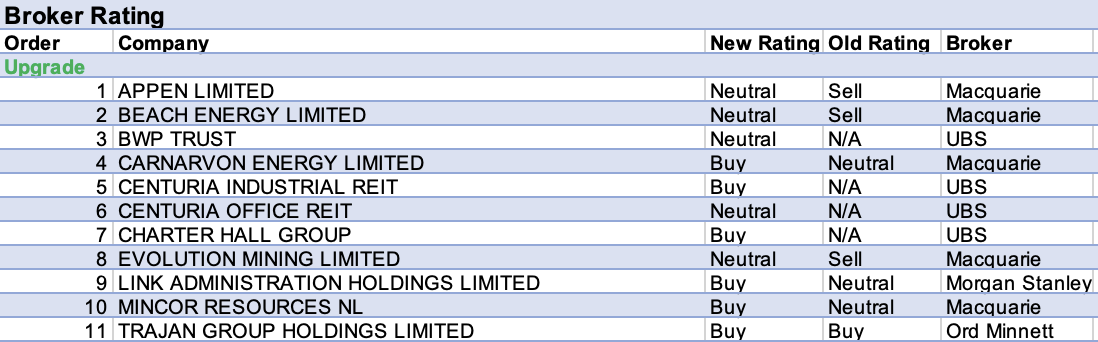

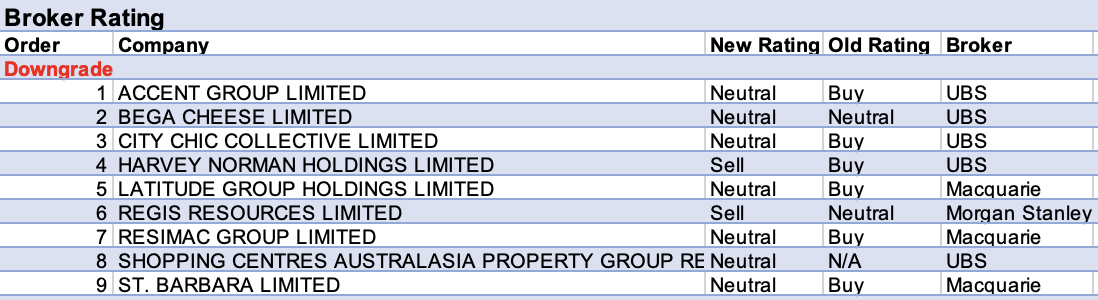

For the week ending Friday June 24 there were 11 upgrades and 9 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Due to challenging macroeconomic conditions both Morgan Stanley and UBS undertook reviews of consumer-exposed stocks and decided to lower FY23 earnings estimates for stocks under coverage by an average -37% and -23%, respectively.

UBS downgraded its rating for City Chic Collective to Neutral from Buy and slashed its target price to $2.00 from $4.50 after reducing the company’s sales forecasts across the Americas, EMEA and Australasia. While Morgan Stanley retained its Overweight rating, its target price fell to $3.00 from $4.40.

As a result, City Chic Collective received the largest percentage reduction in the average target price set by brokers last week. The second-largest reduction belonged to footwear retailer Accent Group after UBS lowered its target to $1.25 from $2.50 as gross margin forecasts were reduced on the expectation for increased discounting and a mix-shift back to lower-margin third-party brands. The broker’s rating was also downgraded to Neutral from Buy.

Also, as part of its review, UBS lowered its target price for Harvey Norman to $3.35 from $6.50 and its rating to Sell from Buy. The company’s sales mix is skewed to large items for which the purchasing decision can be delayed, and the broker feels market share and franchisee health are being prioritised over shareholder interests in the short term.

A decline in time spent listening to AM/FM radio, particularly by the youth audience, was cited by Morgan Stanley as just one example of structural (and cyclical) problems besetting the media and entertainment business HT&E.

Exposure to these problems has only increased, suggests the analyst after the company acquired regional radio business Grant Broadcasters last January. The Underweight rating was retained while the target price was reduced to $1.00 from $1.55.

The target price set for Centuria Capital was also materially reduced by UBS last week to $2.00 from $3.14. This was part of a wider REIT sector review due to a worsening macroeconomic backdrop that resulted in price targets falling by -15% on average across the broker’s REIT coverage.

The analyst estimates FY23 asset under management (AUM) for Centuria Capital will be flat with negative revaluations offset by some organic AUM growth. While greater growth is expected in FY24, forecasts for performance/transaction fees are significantly reduced and the market multiple applied to these fees is much lower.

The average target price set by brokers for Metcash also fell last week as estimates were made for FY22 results out today. The focus will be on leverage to grocery inflation and the demand environment, suggests Ord Minnett, as well as the outlook for trade hardware, given a slowing housing market. Based on industry feedback, Citi expects the outlook for the second half of FY22 and FY23 will be positive for supermarkets.

The commodities teams at Macquarie and Morgan Stanley last week generally reduced commodity price forecasts.

While a lower gold price forecast by Macquarie had some impact on the broker’s decision to downgrade its rating for St Barbara to Neutral from Outperform other factors were also at play. These included a delay in the Final Investment Decision for the Simberi project in Papua New Guinea, along with a delay in pit development timelines at the Atlantic operations in Canada.

After Citi also pointed to ongoing operational issues at Gwalia, St Barbara appeared atop the list for the largest percentage downgrade to forecast earnings by brokers in the FNArena database last week.

The next two list positions were filled by Regis Resources and Alumina Ltd because of the aforementioned commodity price downgrades by Macquarie and Morgan Stanley. The latter downgraded its rating for Regis Resources to Underweight from Equal-weight on recent production issues and sees the least upside for the company among its gold coverage.

Meanwhile, Macquarie lowered its target price for Alumina Ltd by -11% to $1.60 on forecast cost increases though noted alumina prices are a key risk to its forecasts. Morgan Stanley retained its Overweight rating and likes the attractive 2022 dividend yield. The broker’s target fell to $1.85 from $2.20 on negative impacts from updates to the broker’s alumina and aluminium price forecasts for 2022.

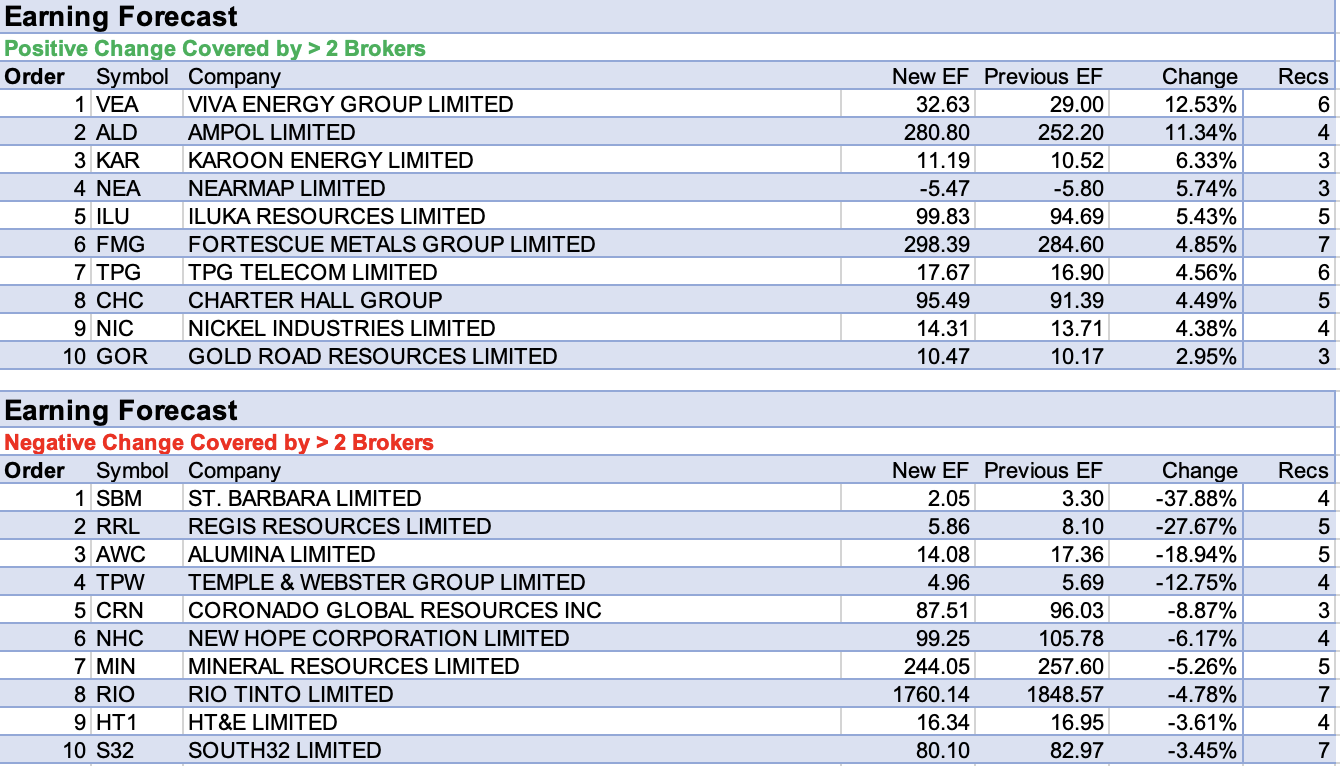

As displayed in the tables below, earnings forecasts (and target prices) continue in a firm downtrend. The rare industry exception was provided by Ampol and Viva Energy after Morgan Stanley suggested both companies could generate around $500-600m of extra cash flow from refining over the next 18 months.

The broker estimated there will be $850m of debt capacity for Ampol to fund an off-market buyback by the end of 2022. Meanwhile, the performance of Viva Energy is expected to depend on whether refining margins keep rising and how the Geelong Energy hub develops. An Overweight rating is retained for both companies and Viva Energy’s target price was raised to $3.30 from $2.70.

Total Buy recommendations take up 59.26% of the total, versus 33.95% on Neutral/Hold, while Sell ratings account for the remaining 6.79%.

In the good books

APPEN LIMITED (APX) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 0/3/0

Macquarie considers Appen’s strategy to diversify its customer base is sound but will take time. Growth will be driven by China and the Appin Ontology Studio.

Consensus expectations still need to be achieved to regain market confidence, the broker observes, as the stock is trading below its historical average on earnings multiples.

Macquarie upgrades to Neutral from Underperform and retains a $5.70 target.

BEACH ENERGY LIMITED (BPT) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 5/1/1

A recent decline in Beach Energy’s share price, down -16% over the last fortnight, has seen Macquarie lift its rating on the company given an improved risk-reward outlook. Further, the broker has lifted its base case oil price deck, further supporting Beach Energy’s valuation.

Looking ahead, Macquarie highlights the company is investing in a sizable growth program to lift production. The company is targeting 28m barrels equivalent with its investment program, which the broker finds achievable.

The rating is upgraded to Neutral from Underperform and the target price increases to $1.65 from $1.51.

EVOLUTION MINING LIMITED (EVN) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 1/5/1

Macquarie’s commodity team lowers its 2022 gold price forecast by -1%, with no changes thereafter, while forecasts for the Australian dollar have also been revised down.

The net effect is a broad EPS forecast improvement from FY23/2023 to FY26/2026 for gold miners that report in the local currency, explains the broker. The currency is expected to remain at or below 70c in the medium to long term, and as low as 66c during FY23.

Macquarie upgrades its rating for Evolution Mining to Neutral from Underperform, while the target falls by -10% to $3.60 on a multiple de-rating and after Macquarie incorporates a higher weighted average cost of capital.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 3/2/0

Morgan Stanley upgrades its rating for Link Administration to Overweight from Equal-weight on valuation support.

The broker believes the company’s assets are strategically attractive at current valuation levels, as indicated by the current $5.50 Dye & Durham offer and several other previous offers for parts of the business.

The target price falls to $4.40 from $5.50 on a sum-of-the-parts calculation, while FY23 earnings (EBITDA) estimate falls by -4%. Industry view: Attractive.

MINCOR RESOURCES NL (MCR) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/0/0

Incorporating changes to commodity prices and exchange rates has meant a material impact on Macquarie’s earnings forecasts. The broker highlights the volatility in nickel equities, with spot LME nickel up 23% in 2022 while the share prices of the nickel sector are all down -10-20%.

Earnings estimates for Mincor Resources are reduced by -2% for FY22, -17% for FY23 and -9% for FY24 amid increases in nickel price forecasts and a lower Australian dollar which have offset increases to cash costs forecasts that reflect higher energy prices.

The broker upgrades to Outperform from Neutral with the stock now a key preference in pure-play nickel exposure. Target is reduced to $2.20 from $2.40.

In the not-so-good books

ACCENT GROUP LIMITED (AX1) was downgraded to Neutral from Buy by UBS, B/H/S: 1/3/0

UBS believes a more bearish view of the consumer discretionary sector is required. Higher interest rates, food inflation, soaring fuel and energy costs are all combining along with more sober house prices. The broker reduces earnings estimates for the sector in FY23 by -23% on average.

UBS revises estimates to reflect the deteriorating environment. Gross margins have been reduced on the expectation of the mix shift back to lower-margin third-party brands and increased discounting. Rating is downgraded to Neutral from Buy and the target is lowered to $1.25 from $2.50.

CITY CHIC COLLECTIVE LIMITED (CCX) was downgraded to Neutral from Buy by UBS, B/H/S: 4/1/0

UBS believes a more bearish view of the consumer discretionary sector is required (see Accent above).

UBS revises estimates to reflect the deteriorating environment, reducing sales forecast across the Americas, EMEA and Australasia. The broker assumes that, while sales reduce, there is only modest margin compression. Rating is downgraded to Neutral from Buy and the target lowered to $2.00 from $4.50.

HARVEY NORMAN HOLDINGS LIMITED (HVN) was downgraded to Sell from Buy by UBS, B/H/S: 2/2/1

UBS believes a more bearish view of the consumer discretionary sector is required (see Accent above).

UBS revises estimates for Harvey Norman earnings to reflect the deteriorating macro environment. The sales mix is skewed to large items that can be deferred such as furniture and bedding, white and brown goods.

The broker also notes the company adopts an approach that prioritises market share and franchisee health over shareholders in the short term.

Rating is downgraded to Sell from Buy and the target reduced to $3.35 from $6.50.

RESIMAC GROUP LIMITED (RMC) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/0

Macquarie observes funding costs have increased more quickly than previously expected. Book growth for Resimac Group is still expected, supported by ongoing variable rate settlement activity and the refinancing of fixed-rate loans as these mature.

Still, the broker expects cash rates need to stabilise for investors to be more confident in the outlook. Rating is downgraded to Neutral from Outperform. Target is lowered to $1.30 from $1.91.

REGIS RESOURCES LIMITED (RRL) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 2/2/1

Morgan Stanley generally lowers its price targets for stocks in its Resources sector coverage after cutting 2022 forecasts for most key commodities. This comes as China lockdowns impact and global growth is considered an ongoing concern.

However, there is an average upside of 21% to those lowered price targets and the broker suggests concerns have been more than factored into current share prices.

Morgan Stanley sees the least upside for Regis Resources among its gold coverage and notes recent production issues. The rating falls to Underweight from Equal-weight and the target declines to $1.75 from $2.30. Industry view: Attractive.

BARBARA LIMITED (SBM) was downgraded to Neutral from Outperform by Macquarie,B/H/S: 0/4/0

Two separate departments of Macquarie updated today on St. Barbara, and this summary note combines the two, resulting in a rating downgrade to Neutral from Underperform and a new target price of $1, down from $1.70.

Firstly, Macquarie’s commodity team lowers its 2022 gold price forecast by -1%, with no changes thereafter, while forecasts for the Australian dollar have also been revised down.

The net effect is a broad EPS forecast improvement from FY23/2023 to FY26/2026 for gold miners that report in the local currency, explains the broker. The currency is expected to remain at or below 70c in the medium to long term, and as low as 66c during FY23.

The target price for St. Barbara is reduced to $1.50 from $1.70 on a multiple de-rating and after Macquarie incorporates a higher weighted average cost of capital. The Outperform rating is unchanged.

Secondly, St. Barbara has announced it will delay the Final Investment Decision for its Simberi project as it undergoes a strategic review.

Macquarie notes the company has suggested its front-end engineering design report indicated a significant increase in required capital expenditure. The company is facing a potential production hiatus at its Atlantic project given delays to its tails solution permitting.

The broker incorporates a four-week hiatus into forecasts, driving a -3% decline to earnings per share expectations in FY23, but delays to the project’s pit development drive further -11% and -21% forecast declines in FY25 and FY26.

The rating is downgraded to Neutral from Outperform and the target price decreases to $1.00.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.