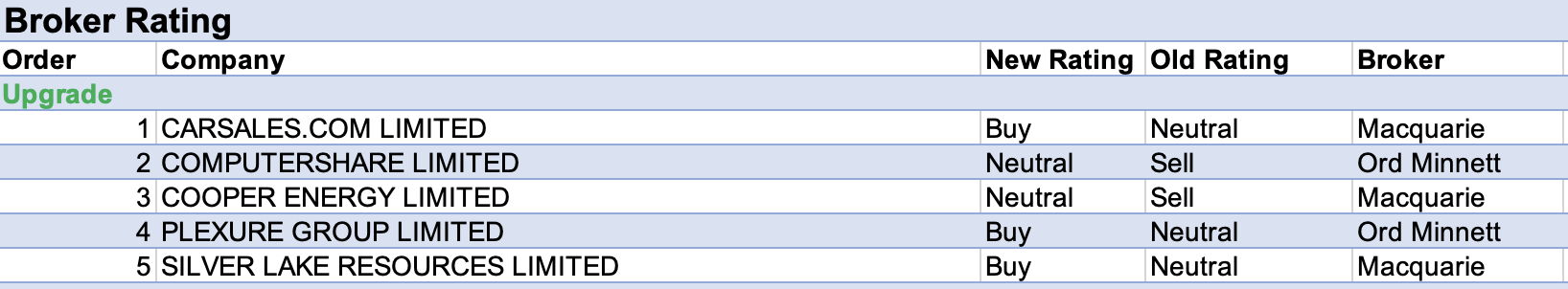

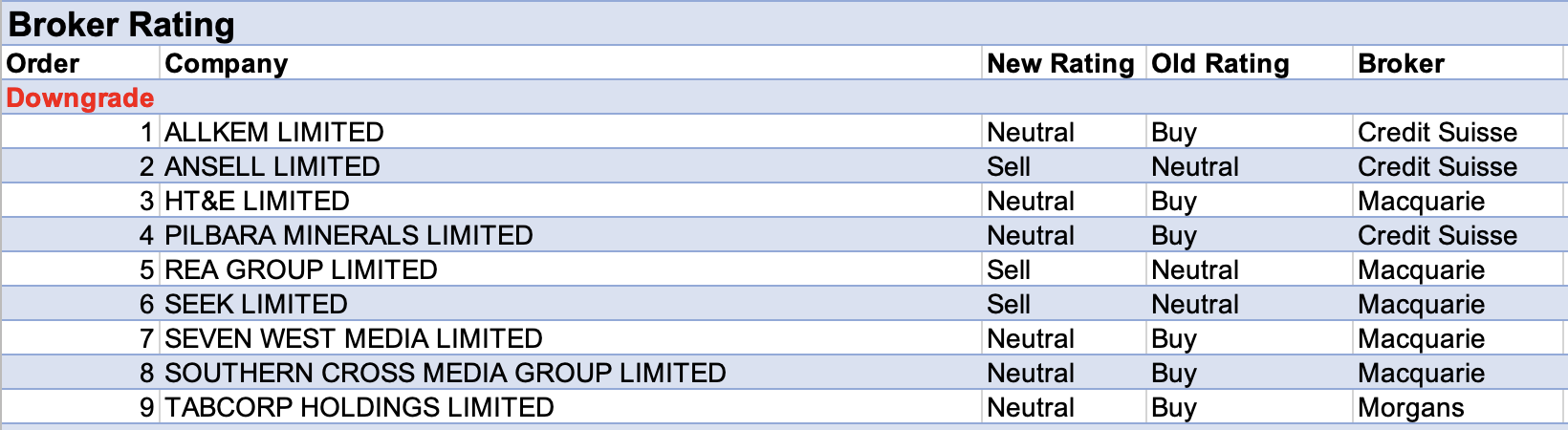

For the week ending Friday June 3 there were 5 upgrades and 9 downgrades to ASX-listed companies covered by brokers in the FNArena database.

As was the case in the prior week, Tabcorp headed the tables for the largest percentage reduction in target price, and the largest percentage fall in forecast earnings last week. Brokers continued to amend financial models to allow for the demerger of the company’s Lotteries & Keno business.

Morgans cautioned investors around impending licence renewals and the amount of competition weighing on the remaining Wagering & Media and Gaming Services businesses. The broker downgraded its rating to Hold from Add and reduced its target price to $0.95 from $6.12.

The Equal-weighted Morgan Stanley also ‘initiated’ coverage on the ’new’ Tabcorp and arrived at the same target price of $0.95. While the retail wagering licences in Australia are a monopoly, the analyst cautioned investors over online competition from corporate bookmakers, who have a lower cost structure, and in some cases, global scale.

Seven West Media was second on the table for the largest percentage reduction in target price. Morgan Stanley, after a long hiatus, resumed coverage of the company last week and set a $0.50 target, which had the effect of lowering the average 12-month target price of (now) five brokers in the FNArena database to $0.75. An Underweight rating was set, due to the company’s ongoing cyclical and structural challenges from reliance on television advertising, which is in decline over the medium-to-long-term.

Meanwhile, Macquarie lowered its target price to $0.66 from $0.95 and downgraded its rating to Neutral from Outperform. This followed an overall downgrade by the broker’s macro strategy team to its Media sector outlook, due to a 60% probability of a mild recession in Australia. It’s felt Media multiples tend to be the canary in the earnings coalmine, and right now they are pointing to a -20% reduction in sector earnings.

Speaking of lower forecast earnings, Macquarie lowered its estimates for Block Inc last week. This left the company effectively second on the table for forecast earnings downgrades after a data glitch was responsible for Beach Energy’s initial second placing.

Despite the earnings downgrades following attendance at Block’s investor day, the broker highlighted some hidden alpha that comes with owning the company’s shares. This included decentralised identity, which is considered one of the bigger opportunities as the company increasingly owns consumer relationships and credit information around SME lending and BNPL.

The analyst also highlighted the key opportunity for international expansion and untapped value via future market launches and new products/innovations. Management noted that markets outside the US currently only comprised 9% of gross profit in 2021.

Total Buy recommendations take up 59.96% of the total, versus 33.45% on Neutral/Hold, while Sell ratings account for the remaining 6.59%.

In the good books

COOPER ENERGY LIMITED (COE) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 1/3/1

Macquarie notes Cooper Energy has materially underperformed peers recently, even as Orbost processing rates have improved. Orbost is almost at nameplate capacity, increasing exposure to current elevated spot prices.

With the stock now trading in line with net asset valuation, the broker upgrades to Neutral from Underperform but warns establishing balance sheet capacity for pending commitments remains key.

Target rises to 28c from 26c.

COMPUTERSHARE LIMITED (CPU) was upgraded to Hold from Lighten by Ord Minnett, B/H/S: 4/2/1

Ord Minnett increases its earnings forecasts for Computershare in recognition of the company’s leverage to sharp rises in cash interest rates over the last two months.

The broker raises its rating to Hold from Lighten and lifts its target price to $25.00 from $23.67.

SILVER LAKE RESOURCES LIMITED (SLR) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/0/0

Macquarie incorporates Silver Lake Resources’ Sugar Zone mine into its base case after the latter’s strong and steady turnaround.

EPS forecasts rise 2% in FY23; 4% in FY24, 14% in FY25 and 19% in FY26. Rating upgraded to Outperform from Neutral. Target price rises to $2.10 from $2.

In the not-so-good books

ALLKEM LIMITED (AKE) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 5/2/0

Suppliers have responded faster than anticipated to spiking lithium prices, and in opposition to previous deficit forecasts, Credit Suisse now expects lithium supply will meet demand in a balanced market in 2023-24 before supply exceeds demand creating a surplus in 2025.

With macro conditions, including inflation, war and lockdowns, slowing the demand outlook, the broker notes lithium prices may peak in coming months and has downgraded its FY23 spot lithium carbonate forecasts -12%.

Credit Suisse notes while upside may be limited for Allkem if elevated lithium pricing cannot be sustained, it prefers Allkem to Pilbara Minerals (PLS), with the company less exposed to margin compression from downstream risk.

The rating is downgraded to Neutral from Outperform and the target price decreases to $14.70 from $16.40.

ANSELL LIMITED (ANN) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 3/2/1

With little protection from material price increases, Credit Suisse anticipates raw material costs to become a headwind for Ansell. With raw materials accounting for around 55% of Ansell’s cost of goods sold, the broker lowers earnings -5% through to FY24.

The rating is downgraded to Underperform from Neutral and the target price decreases to $24.00 from $25.00.

PILBARA MINERALS LIMITED (PLS) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/1/0

Within its coverage, Credit Suisse notes Pilbara Minerals is most exposed to macro weakness, and limited vertical integration leaves the company at greater risk of margin compression.

The rating is downgraded to Neutral from Outperform and the target price decreases to $3.00 from $3.70.

TABCORP HOLDINGS LIMITED (TAH) was downgraded to Hold from Add by Morgans, B/H/S: 1/4/0

Morgans lowers its rating for Tabcorp to Hold from Add. This comes after allowing for the demerger of the Lotteries and Keno business and cautioning investors around impending licence renewals and competition for the Wagering & Media and Gaming Services businesses.

As a result of these adjustments, the broker’s FY23 earnings (EBITDA) forecast falls by -64%, and the target price falls to $0.95 from $6.12. The removal of a source of largely predictable cash flows is expected to result in more volatile earnings.

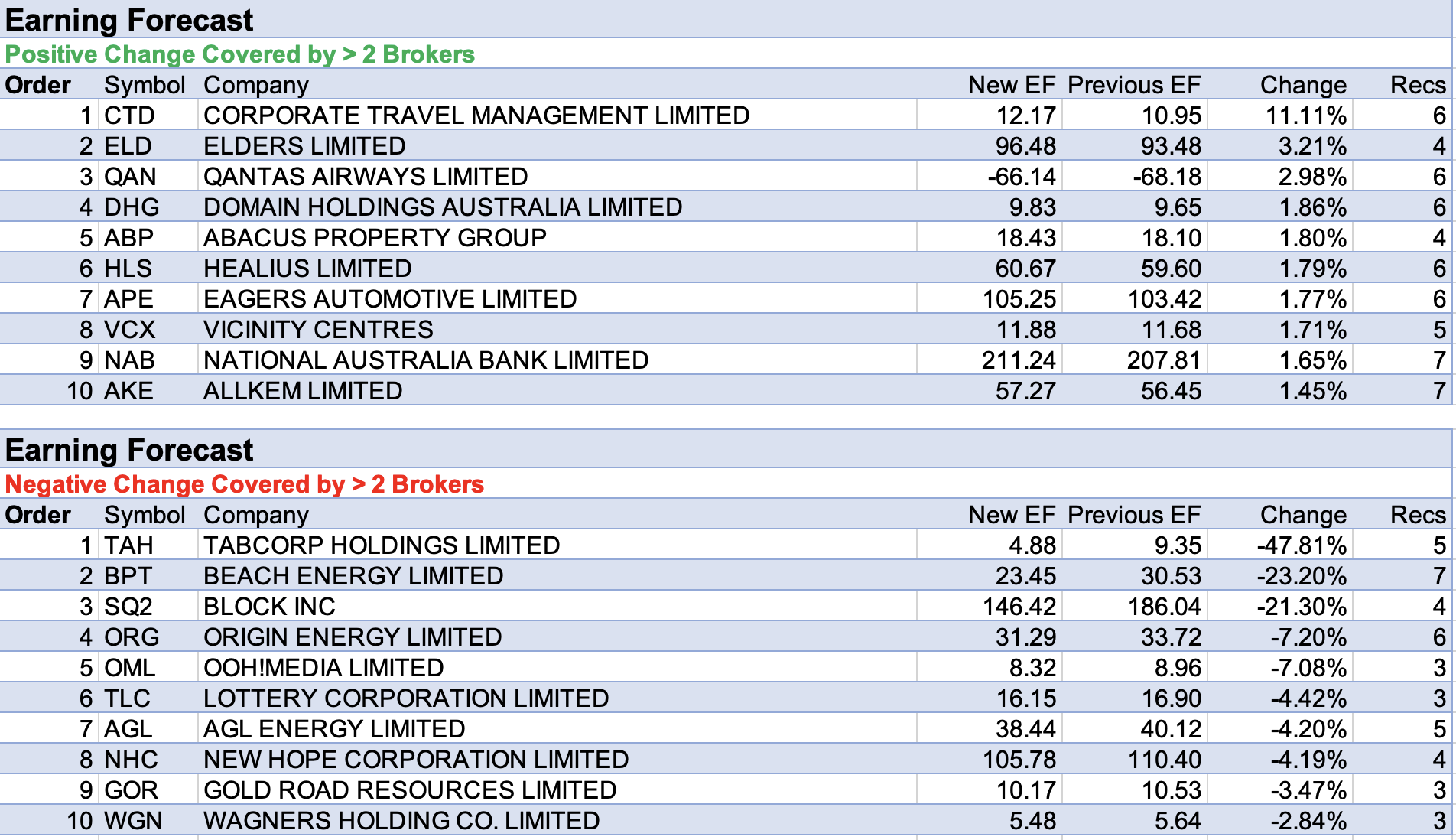

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.