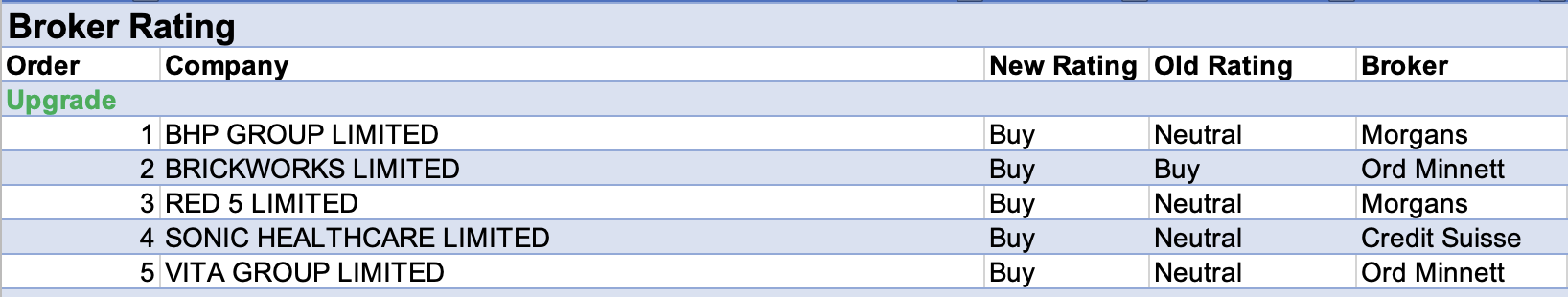

For the week ending Friday March 25 BHP Group received an upgrade while ResMed and Seek found themselves in the not-so-good books of ASX-listed companies covered by brokers in the FNArena database.

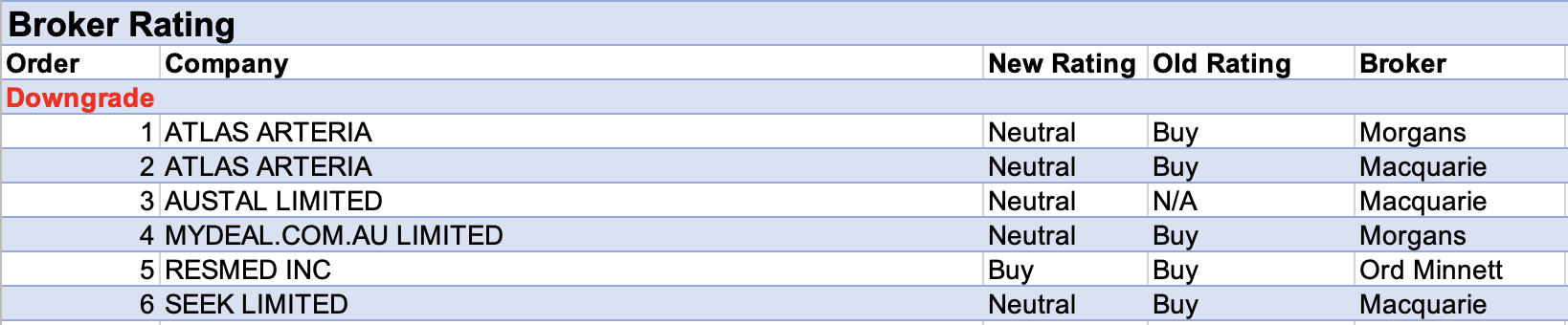

Atlas Arteria received two downgrades from two separate brokers. In lowering its rating to Neutral from Outperform, Macquarie considered rising French fuel prices (car trips are partly discretionary on its French toll road), soft traffic data so far this year and an unfavourable exchange rate.

Morgans also lowered its rating to Hold from Add due to concerns around exchange rate impacts as well as rising sovereign bond yields. The broker found it hard to reconcile these movements with the recent strength in the company’s share price.

Brokers made no material percentage changes to price targets last week.

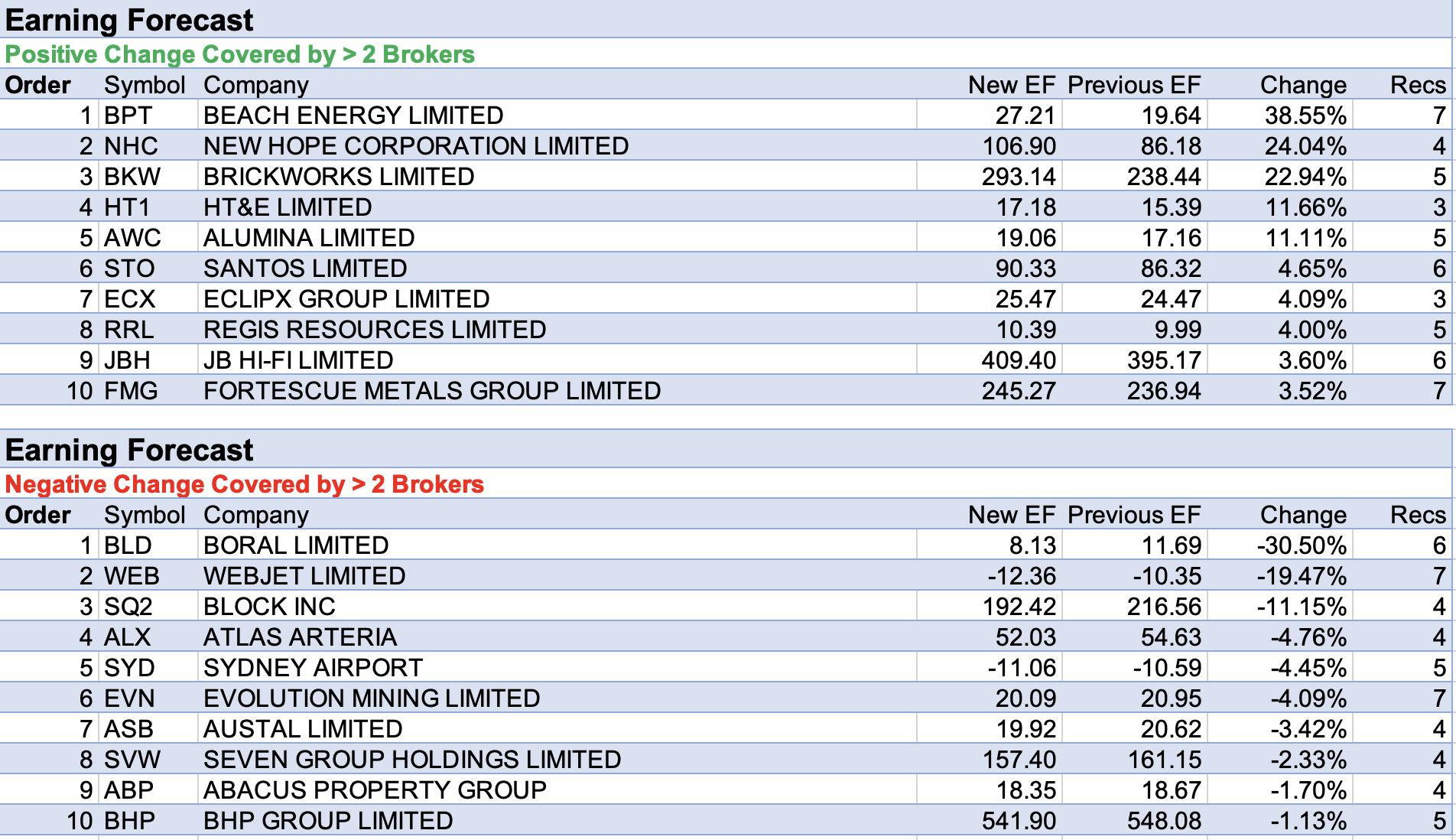

Meanwhile, Beach Energy had the largest percentage increase in forecast earnings after Citi’s commodities team adjusted its forecasts for the sector.

The Brent oil price forecast lifted by US$20 a barrel to average US$91 a barrel in 2022, while the broker’s gas price forecast increased US$10 per million thermal units to an average of US$22pmtu. Beach Energy remains the broker’s top pick and its only Buy-rated stock in the sector.

While first-half results for New Hope Corp were largely pre-announced, brokers upgraded earnings forecasts. The combined 17cps ordinary dividend and surprise 13cps special dividend were largely due to higher-than-expected first-half cash flows and a very strong second half cashflow outlook, according to Morgans.

Credit Suisse also noted continuing tightness in the coal industry, which may see New Hope command a premium price above US$200 per tonne for several years and increased its pricing forecast for the company to US$230 per tonne in the second half.

Brickworks also released first-half results last week and brokers generally raised earnings forecasts. Ord Minnett raised its rating to Buy from Accumulate on potential within the Property division for further development opportunities and rental income growth.

Meanwhile, UBS retained its Neutral rating in the belief that Property division upside is adequately reflected in the current share price, and noted uncertainties surrounding the new operating land trust, and for US property.

Following a FY22 guidance downgrade, Boral received the largest percentage downgrade to earnings forecasts by brokers last week. Management cited not only recent rain and flood disruptions, but also negative coal and fuel impacts.

The broker also noted diesel hedging expires in April 2022 and coal costs are unhedged, which implies ongoing risks should prices remain high.

Finally, Webjet received the second-largest earnings forecast downgrade though Ord Minnett advocates investors buy into weakness, given ongoing volatility. While the upcoming FY22 result (March year-end) will be weaker than initially expected, strong demand for 2023 Northern Hemisphere summer holiday travel is forecast. Additionally, the analyst estimates the business-to-business and business-to-consumer divisions should win material market share.

Total Buy recommendations take up 58.86% of the total, versus 35.16% on Neutral/Hold, while Sell ratings account for the remaining 5.98%.

In the good books

BHP GROUP LIMITED (BHP) was upgraded to Add from Hold by Morgans, B/H/S: 2/3/0

While Morgans expects growth in iron ore pricing growth to slow the broker anticipates supply tightness will continue to support continuing strong earnings in the sector, maintaining the market remains strong with benchmark pricing of US$140-150 per tonne.

While pressure is likely to be felt from surging fuel costs and labour and supply constraints, the broker doubts these will have significant impact on pricing.

BHP Group remains Morgans’ top sector pick given superior diversification and ability to mitigate cost and labour pressures. Key to the company’s outlook, according to the broker, is growth in China and internationally.

The rating is upgraded to Add from Hold and the target price increases to $51.80 from $48.70.

BRICKWORKS LIMITED (BKW) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 2/3/0

Ord Minnett raises its rating for Brickworks to Buy from Accumulate following 1H results that indicated further upside potential from the Property division. Its estimated upside will derive from further development opportunities and rental income growth.

First-half profit of $330m exceeded the broker’s $258m forecast, while the 22cps dividend was in-line.

Along with upside from Property operations, the analyst notes a strong pipeline of work from housing activity in Australia and improving

non-residential construction in the US. The target price is lowered to $26 from $26.20.

In the not-so-good books

ATLAS ARTERIA (ALX) was downgraded to Hold from Add by Morgans and Neutral from Outperform by Macquarie, B/H/S: 2/2/0

Morgans has been surprised by the recent strength of Atlas Arteria’s share price given momentum in sovereign bond yields and surges in exchange rates.

The broker notes strength in the Australian dollar, and the Australian to US dollar exchange rate has impacted negatively on distributions received by Macquarie Fund Advisors, driving dividend per share forecast downgrades from the broker of -5% in FY22 and -8-9% in FY23 and FY24.

The rating is downgraded to Hold from Add and the target price decreases to $6.41 from $6.69.

Macquarie downgrades its rating for Atlas Arteria to Neutral from Outperform and its target price falls to $6.66 from $7.09 after an unfavourable exchange rate is taken into account.

In addition, with French fuel prices having risen by 60% from 2019 levels, the analyst points out car trips are partly discretionary and expects trips to be cut by -6-7%. Traffic data so far in 2022 has been soft, notes Macquarie.

AUSTAL LIMITED (ASB) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/2/0

Due to lower visibility of the medium-term outlook for Austal, Macquarie downgrades its rating to Neutral from Outperform. This comes as the company was notified it will not be awarded the contract to construct offshore patrol vessels for the Philippines Navy.

The broker notes the company will now focus on winning orders for commercial ferries for its Philippines shipyard. For FY23 and FY24, EPS forecasts are downgraded by -10% and -21% and the target price is lowered by -24% to $1.91.

RESMED INC (RMD) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 5/1/0

Based on commentary from management, Ord Minnett notes ResMed has not been able to meaningfully increase device supply in the March quarter as constrained availability of chips continues but reiterates an anticipated supply boost in the June quarter.

The broker expects this will be insufficient to meet the company’s US$300-350m incremental revenue guidance, but notes the miss is largely a timing issue. Further, Ord Minnett notes supply issues are consistent with other providers.

The rating is downgraded to Accumulate from Buy and the target price decreases to $37.00 from $38.00.

SEEK LIMITED (SEK) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 3/3/0

Macquarie lowers its rating for Seek to Neutral from Outperform on downside risk for earnings and limited valuation support. The target price of $32 is unchanged.

As the labour market normalises, the broker anticipates formerly strong depth revenue growth will subside. Depth is not considered to be the structural growth driver that the market is assuming.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.