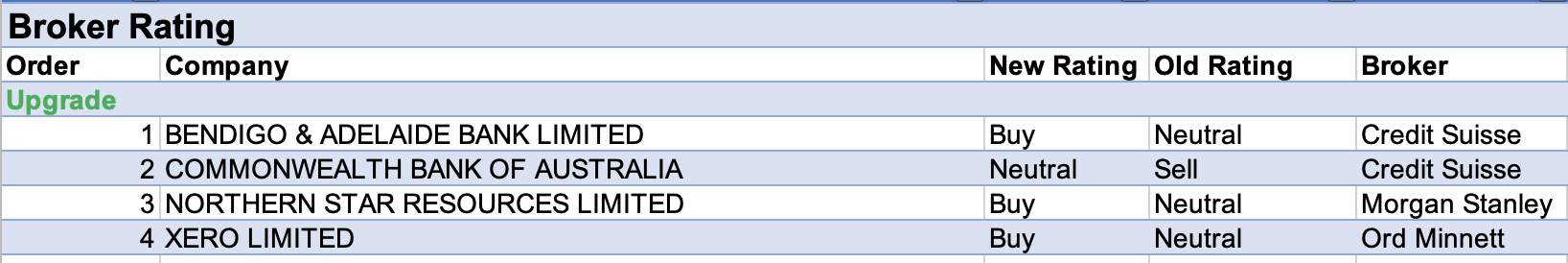

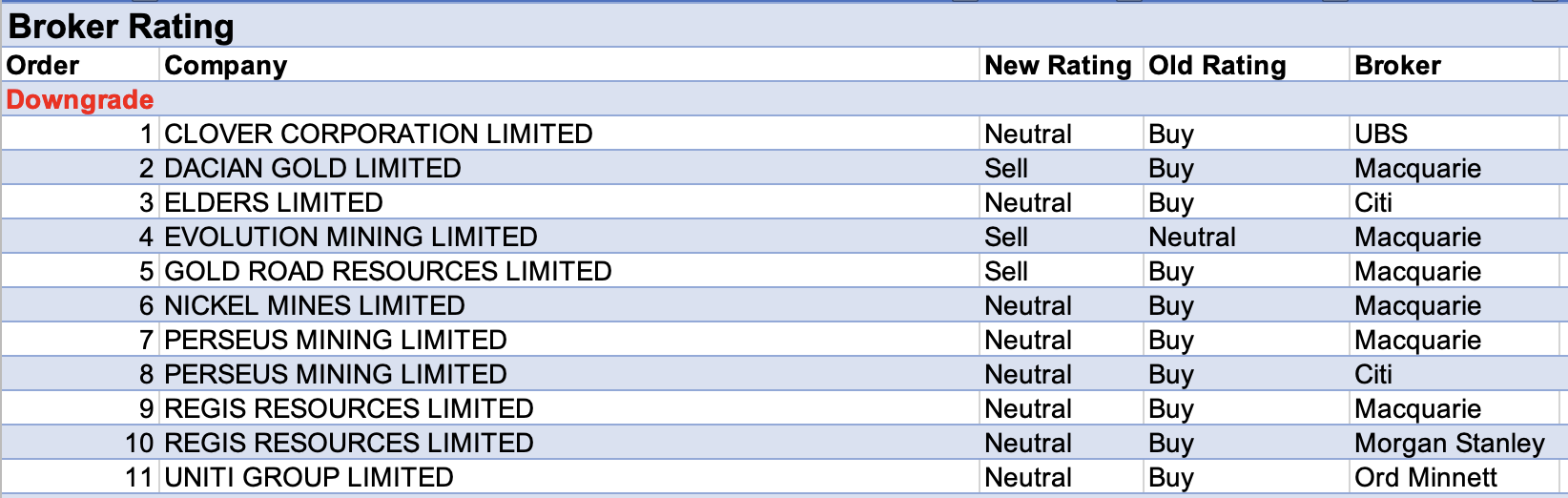

There have been no further upgrades and only one additional downgrade since our Buy, Hold, Sell report last Thursday. As such, for the week ending Friday March 18, there were four upgrades and eleven downgrades to ASX-listed companies covered by brokers in the FNArena database.

Both Perseus Mining and Regis Resources received downgrades from separate brokers.

The Macquarie commodities team last week upgraded its forecasts with base metals and coal proving the winners and precious metals also receiving a lift. While earnings forecasts rose sharply for its gold sector coverage, the broker lowered ratings for Perseus Mining and Regis Resources to Neutral from Outperform due to recent share price strength.

Over at Citi, the forecast gold price is now for US$1750/oz by 2023 versus the current US$1930/oz spot price. Alternatively, under the circumstances of a Russia/Ukraine-induced macroeconomic shock, gold prices are expected to exceed US$2,000/oz.

The broker lowered its rating for Perseus Mining to Neutral from Buy, given the share price has rallied 30% in the past month compared to increase of 8% for the gold price.

Apart from valuation, Morgan Stanley found further reasons to lower its rating for Regis Resources to Equal-weight from Overweight. These included the expensive recent Tropicana acquisition and production hiccups at the Duketon Gold project in Western Australia.

Brokers made no material percentage changes to price targets last week.

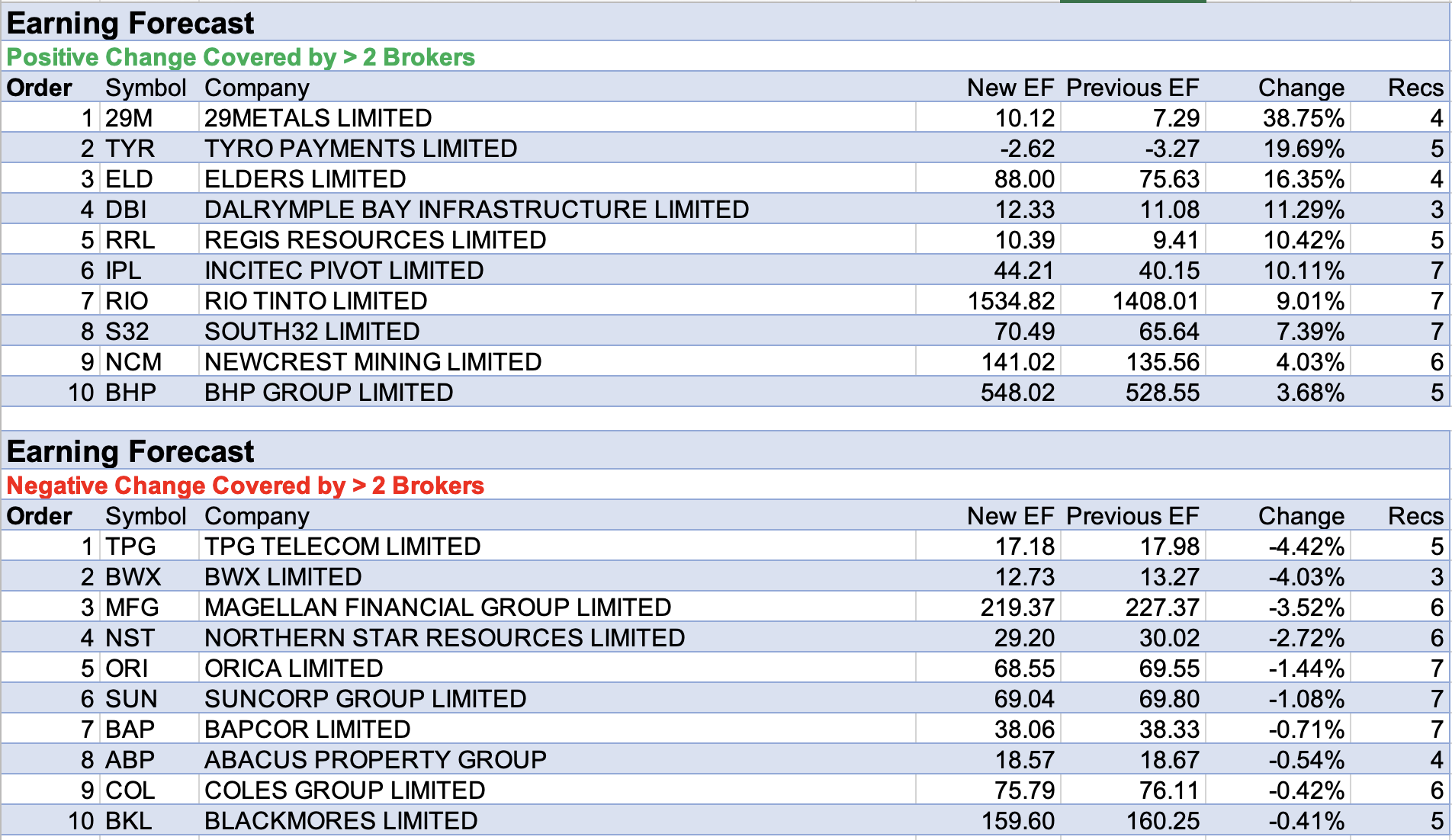

Meanwhile, the only material changes made by brokers to forecast earnings were positive.

29Metals headed the table of these forecast changes after Macquarie noted earnings could exceed the broker’s base case by 73% at current spot prices. While the company’s resource and reserve update held few surprises, it excluded six recent drill results from the Cervantes deposit at the Golden Grove mine which could offer resource upside, according to the analyst.

Next on the table was Tyro Payments after UBS initiated coverage with a Buy rating and earnings forecasts that lifted the average earnings forecast of the (now) five brokers that cover the stock in the FNArena database. The broker likes the company’s broader payments ecosystem compared to competitors and forecasts a group transaction value compound annual growth rate of 15% over the next five years.

Broker earnings forecasts for Elders also rose last week after the company announced a strong five month start to its financial year and raised FY22 guidance 15% above what Macquarie had expected.

While brokers raised target prices for the company, some felt les favourable seasonal conditions and lower commodity and livestock prices over time may cause earnings to normalise. Citi, for example, lowered its rating to Neutral from Buy and noted shares are currently trading near fair value.

Regis Resources also appeared on the list for the largest percentage increase in forecast earnings. This came despite the negative ratings changes mentioned above.

Finally, Incitec Pivot received positive upgrades to earnings forecasts last week. Morgan Stanley sees significant capacity for the company to arbitrage low gas input costs and high global ammonia prices and raised its target price to $2.70 from $2.60, while maintaining an Overweight rating.

Meanwhile, despite the strong agricultural pricing environment, Citi adopted a more cautious tone and Neutral rating, especially after the recent shares price rally.

Total Buy recommendations take up 58.72%of the total, versus 35.10% on Neutral/Hold, while Sell ratings account for the remaining 6.17%.

In the good books

In the not-so-good books

CLOVER CORPORATION LIMITED (CLV) was downgraded to Neutral from Buy by UBS, B/H/S: 1/1/0

Clover has reported 1H results with revenues a -5% miss versus the UBS forecast while profit was a -30% miss, driven by softer than forecast gross margins.

Margins suffered from significant raw material and freight cost inflation, explains the analyst, partially offset by margin benefits from a move into the Melody Dairies facility for some production.

The broker downgrades its rating to Neutral from Buy and believes some patience is required, with an eye on long-term growth opportunities. The target falls by -24% to $1.40.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.