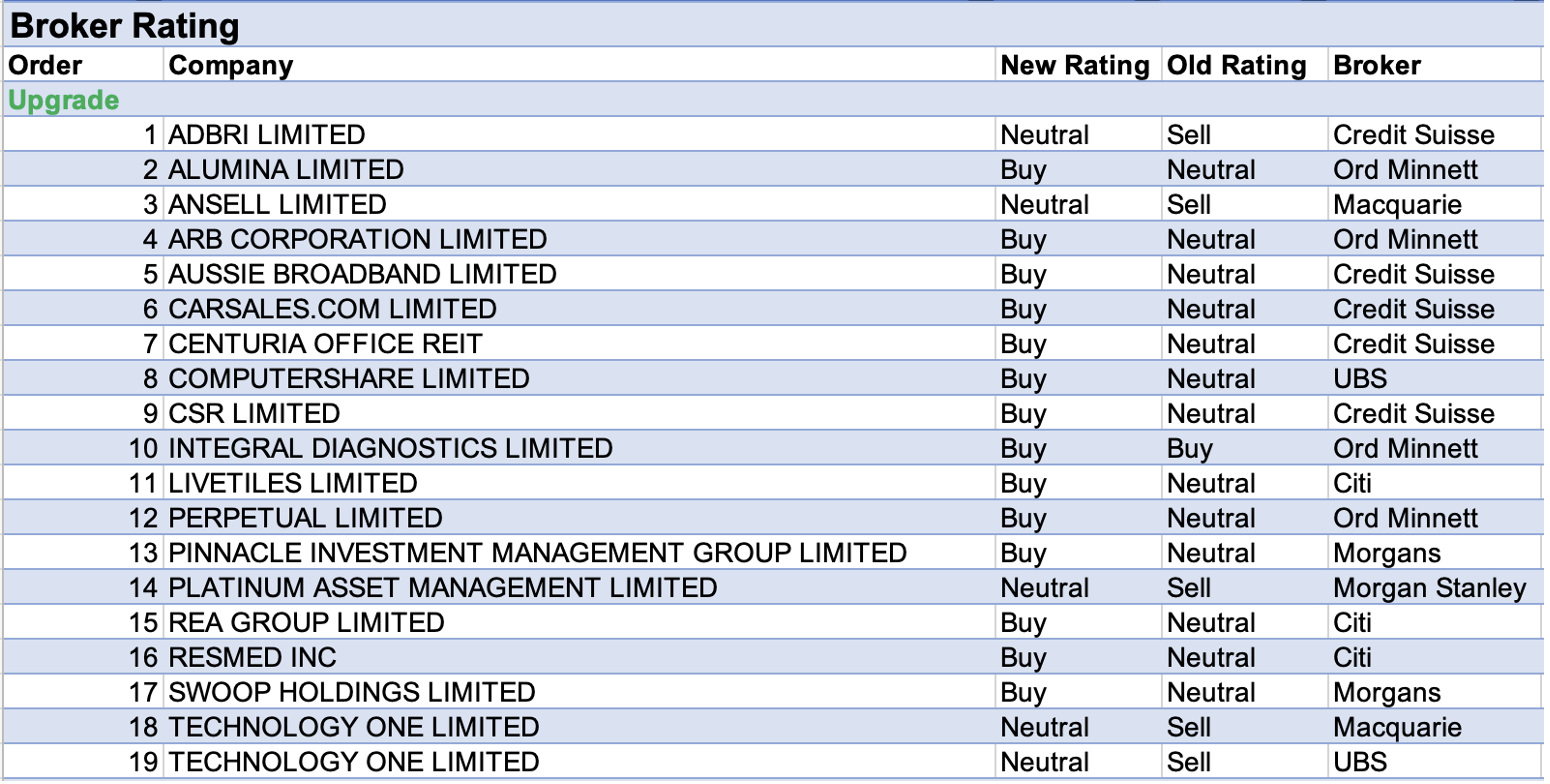

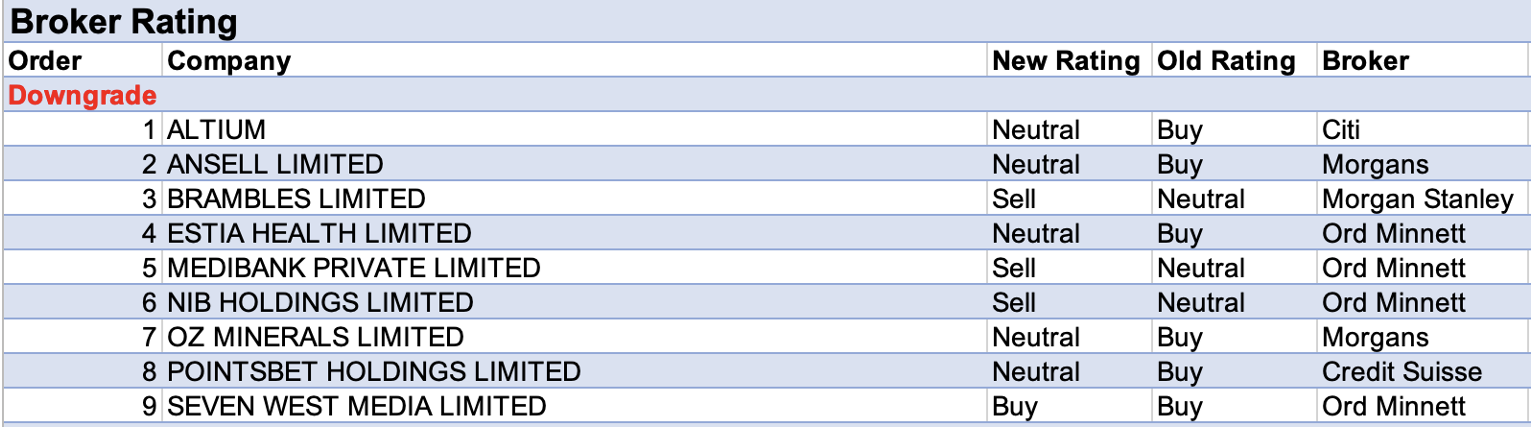

For the week ending Friday February 4, there were 19 upgrades and 9 downgrades to ASX-listed companies covered by brokers in the FNArena database.

TechnologyOne received an upgrade from both UBS (Neutral from Sell) and Macquarie (Neutral from Underperform) after recent share price weakness.

Cash generation is increasingly important in a rising interest rate environment, according to UBS, and with $112m net cash on hand the company has options for inorganic growth. Macquarie likes TechnologyOne’s balance sheet, quality customer base and sticky long-term contracts and notes the government and education sectors account for more than 75% of revenue.

After three different brokers in the FNArena database performed a sector review, the average target price set for Platinum Asset Management decreased materially last week. Ord Minnett identified key risks for the asset manager, including weak ongoing fund performances and increased competition from passive instruments.

However, the broker notes the company might see a return of investor favour on the back of a revival of the Value trade. Also, Morgan Stanley considers Australian asset managers are no longer expensive versus global peers and upgrades its rating to Equal-weight from Underweight after recent share price weakness. Additionally, the analyst likes the relatively defensive channel mix that includes mostly retail clients, which reduces the risk of large mandate losses.

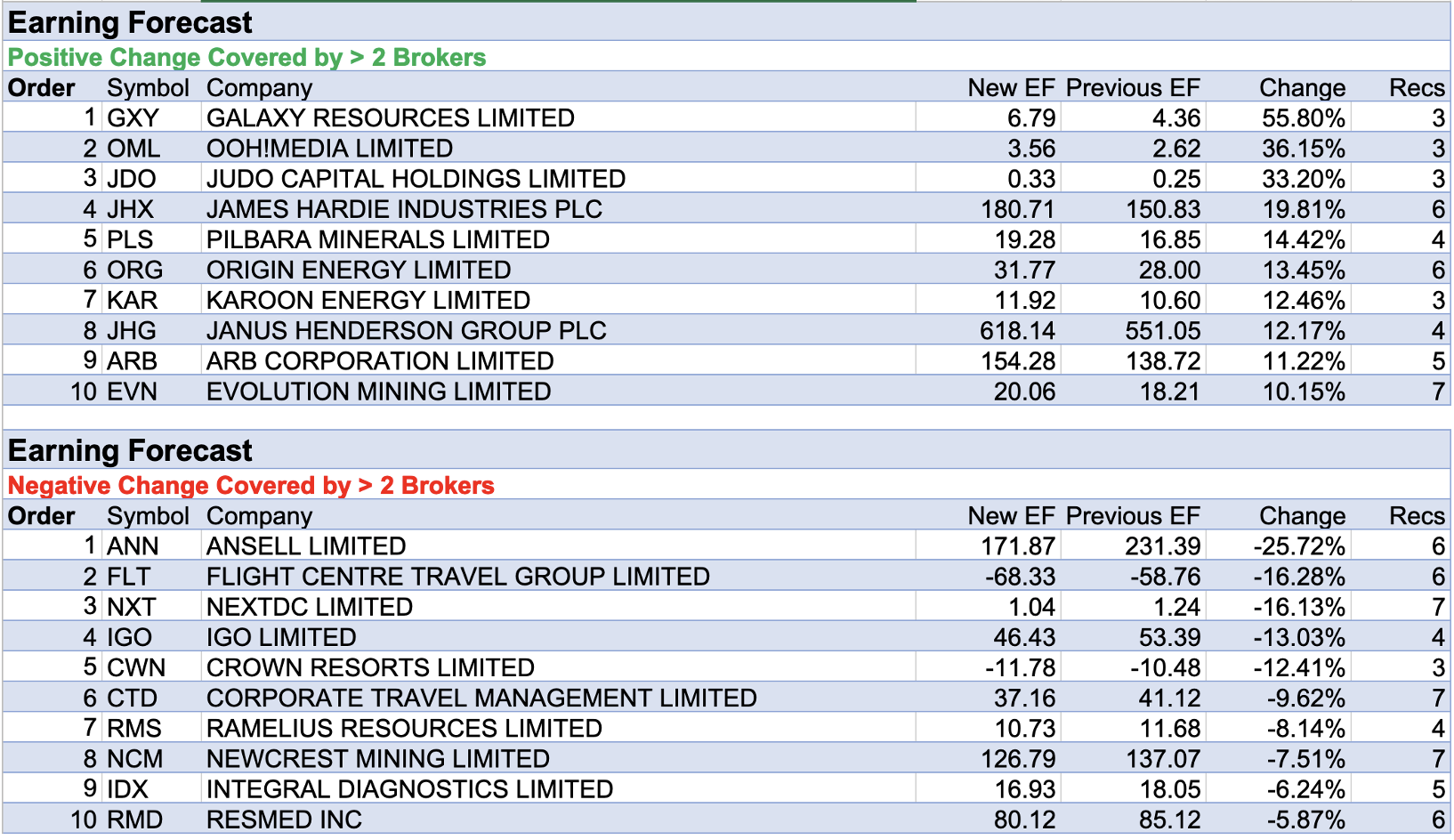

oOh!media was near the top of the table in earnings upgrades, This came after the Outdoor Media Association reported industry revenue for the 12 months ending December 2021 which was 24% higher than Macquarie had expected. No split by medium was provided by the out-of-home (OOH) industry group though the analyst suspects better-than-expected performances from street furniture and public transport (Commute). Macquarie estimates a reversion of OOH advertising back to pre-covid levels would lift forecast earnings/valuation for oOh!media by greater than 80%.

Both Macquarie and Credit Suisse point to short-term headwinds from the omicron variant though overall Macquarie feels the negative structural impacts from covid have already been factored-in by the market.

There were two brokers in the FNArena database already researching Judo Capital until last week when Macquarie initiated coverage (Neutral rating, $2 target price). An additional forecast for earnings in the database had the effect of raising the company’s average forecast earnings by all brokers. Macquarie feels Judo is well placed to grow loans materially ahead of system over the next three years, having built a $5bn loan book in only two and a half years.

In a preview of the reporting season last week for the Building Materials sector, UBS expressed a preference for James Hardie, and raised its earnings forecast. The broker equally likes Reliance Worldwide. It’s believed pent-up demand, supported by structural covid tailwinds, will ensure positive housing and remodelling volumes.

On the flipside, Ansell received the largest percentage decrease in forecast earnings by brokers last week, after a preliminary first half result and updated FY22 guidance, which were weaker than broker expectations.

The company faced greater cost and production challenges in the December quarter than Ord Minnett had assumed. Nonetheless, Citi retains the faith and its Buy rating after explaining a key factor responsible for a hefty guidance downgrade is a faster-than-expected drop in demand/prices for exam gloves. This led to inventory, purchased at a high price, being sold at a lower price, an occurrence that is expected to normalise over time.

Varying opinions on Ansell were reflected in Morgans’ rating downgrade to Hold from Add, while Macquarie lifted its rating to Neutral from Underperform on the recent share price tumble. Morgan Stanley (Overweight) and Citi (Buy) have retained their respective ratings.

Finally, Macquarie lowered its FY22-24 earnings estimates for Flight Centre as the omicron outbreak continues to drag on domestic and international airline activity. While the analyst expects the company’s targeted return to monthly profitability will be impacted in FY22, a strong recovery should ensue from FY23.

Total Buy recommendations take up 58.23% of the total, versus 35.09% on Neutral/Hold, while Sell ratings account for the remaining 6.67%.

In the good books

CENTURIA OFFICE REIT (COF) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/1/1

While Centuria Office REIT has reported a -13% funds from operation half-on-half decline, Credit Suisse notes this accounts for a large surrender payment received in the prior half and the company largely performed better than expected in the first half.

While the company received $2m in lease surrender payments in the half this will largely be offset by second half vacancies, with new tenancies to drive FY23 normalisation. Portfolio occupancy was up to 94.3% from 93.1% in the previous half, full year guidance retained.

The rating is upgraded to Outperform from Neutral and the target price decreases to $2.42 from $2.48.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED (PNI) was upgraded to Add from Hold by Morgans, B/H/S: 3/0/0

Morgans upgrades its rating for Pinnacle Investment Management Group to Add from Hold . It’s thought there’s structural growth within the affiliate base (maturing of performing funds), and from the business model (new managers, offshore expansion).

The group’s 1H headline result beat the broker’s forecast by around 5% and the underlying result by circa 9%. Better-than-expected operating leverage was achieved at both the group and affiliate level.

While volatility from the equity market has the potential to disrupt flows momentum, notes the analyst, non-equity funds are experiencing solid retail inflows. The target price falls to $14.45 from $15.80.

PERPETUAL LIMITED (PPT) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 5/2/0

In a broad sector update, Ord Minnett sums up various supportive factors and risks for ASX-listed funds managers. Weak fund performances are among the key risks identified, as they lead to fund outflows.

Increased competition, also from passive instruments, is considered a potential stumbling block too.

Perpetual has been upgraded to Accumulate from Hold. New price target of $36.60 compares with $39.50 previously.

TECHNOLOGY ONE LIMITED (TNE) was upgraded to Neutral from Underperform by Macquarie and Upgrade to Neutral from Sell by UBS, B/H/S: 1/3/0

Despite widespread equity weakness in the software sector from rising interest rates, Macquarie upgrades its rating for Technology One to Neutral from Underperform, with an $11.00 target.

The company’s quality should lend support and the share price is now at levels that equates to the analyst’s valuation. The broker likes the company’s balance sheet, quality customer base and sticky long-term contracts.

Government and Education sectors account for more than 75% of revenue, points out Macquarie.

UBS upgrades its rating for TechologyOne to Neutral from Sell on recent share price weakness. Despite a rising interest rate environment, the analyst has comfort around near-term earnings.

Cash generation is increasingly important in such an environment, and with $112m net cash on hand the broker also sees options for inorganic growth.

The Neutral rating is unchanged. For UBS to become more positive a material acceleration in net revenue retention (NRR) is required. Given lower sector multiples, the target price falls to $10.60 from $11.90.

In the not-so-good books

OZ MINERALS LIMITED (OZL) was downgraded to Hold from Add by Morgans, B/H/S: 1/4/1

Covid challenges and industry cost pressures dominated OZ Minerals’ quarterly update and Morgans sees rising execution risks. The broker has nevertheless kept a small premium in its valuation calculation, because of the company’s quality.

Morgans has downgraded to Hold from Add on valuation but suspects macro-inspired selling might provide a buying opportunity in the shares.

Price target has increased to $25.80 from $24.45.

SEVEN WEST MEDIA LIMITED (SWM) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 4/0/0

Resilience in the free-to-air advertising market and an ability to capture continuing growth in digital platforms offers benefit to the free-to-air media segment according to Ord Minnett.

Although the broker has noted a preference for Nine Entertainment ((NEC)) over Seven West Media, it does like that the recent acquisition of PRT Company ((PRT)) offers greater reach for its 7plus on-demand service.

The rating is downgraded to Accumulate from Buy and the target price of $0.70 is retained.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.