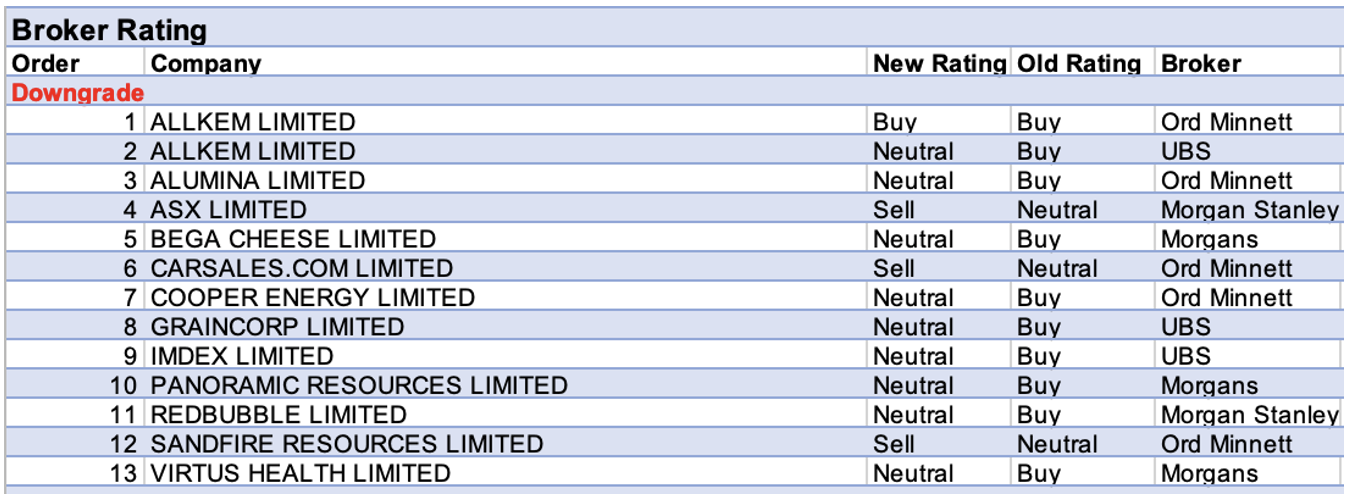

For the week ending Friday January 21, there were 21 upgrades and 13 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Allkem received both one upgrade and two downgrades to its rating by three separate brokers.

Morgans anticipates tight supply for lithium throughout 2022 (futures are in contango) and new spot price highs. The broker points to a 68% quarter-on-quarter increase in revenue at Olaroz in the December quarter, and a 7% 2021 beat of production guidance at Mt Cattlin, with large increases in realised prices at both projects. The company is Morgans’ preferred lithium exposure.

Both Ord Minnett and UBS have downgraded on valuation grounds. While UBS lifts its valuation by around 4% in reaction to the quarterly result, investors are reminded the stock has rallied circa 69% since the start of November 2021.

All of Macquarie, Morgan Stanley and Ord Minnett last week concluded the economic backdrop in Australia remains supportive of the Australian banking sector. Morgan Stanley expects credit quality will prove resilient, while the outlook for margins is positive and loan growth expectations are “reasonable”.

ANZ Bank’s rating was a beneficiary, rising to Overweight from Equal-weight (Morgan Stanley), and to Accumulate from Hold at Ord Minnett.

A market update from Hub24 was the catalyst for a lift in rating by Ord Minnett (Buy from Accumulate) and by Macquarie (Outperform from Neutral). In the context of the recent share price slide, Ord Minnett is attracted by a combination of organic growth and increased market share. Meanwhile, Macquarie expects flow momentum will likely continue, and the company is well placed to benefit from a flattening of the yield curve (positive leverage to higher cash rates).

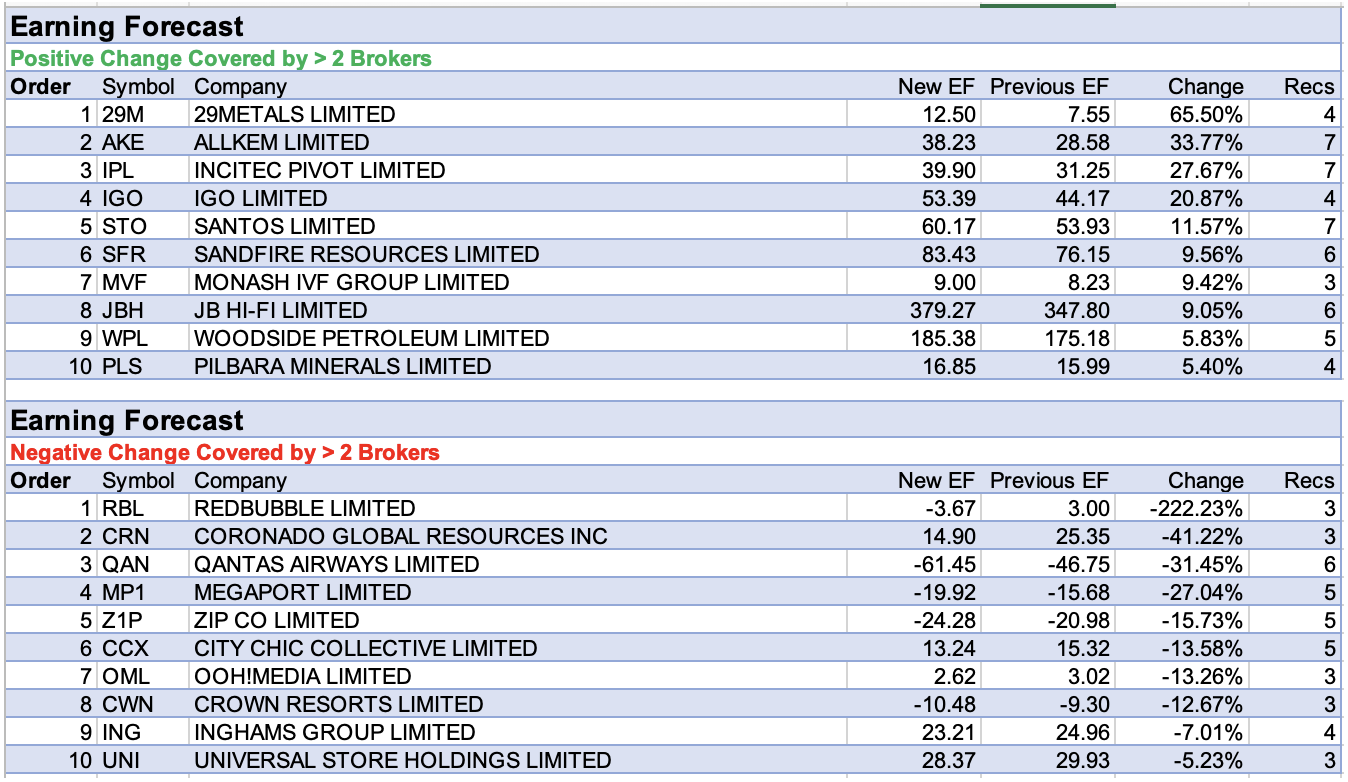

There were two material changes to target prices in the FNArena database for the week, one positive (Pilbara Minerals) and one negative (Redbubble).

Pilbara Minerals enjoyed a material rise in target price ($3.95 from $2.05) when Credit Suisse upgraded its spot lithium forecasts. However, the broker is wary of the gap between the company’s share price and anticipated electric vehicle momentum, and prefers both Allkem and IGO.

Redbubble suffered a material fall in target price after a profit warning triggered a downgrade of rating by Morgan Stanley to Equal-weight from Overweight and a fall in the broker’s target price to $2.65 from $6.50. Higher competition and rising costs are seen as the main causes and are expected to persist. Revised FY22 guidance was well below the consensus estimate and Morgans’ forecasts, and the broker lowered its target price to $3.59 from $4.84.

29Metals had the largest percentage upgrade to earnings forecasts after Credit Suisse raised forecast copper prices and retained its Outperform rating.

Coming second for earnings forecast upgrades was Allkem for reasons advanced earlier in this article.

Next follows Incitec Pivot after brokers lifted fertiliser price forecasts in the wake of the company’s December quarter trading update. Morgan Stanley points out that plants are operating well and leverage to strong fertiliser markets is materialising. However, Citi cautions that lower fertiliser prices are anticipated in the near term and retains its Neutral rating.

Redbubble headed the table for the largest percentage downgrade to earnings forecasts for the reasons as explained above.

It may be best to ignore Coronado Global Resources’ second position on the table due to a data glitch, as brokers were uniformly upbeat following fourth quarter results that revealed higher-than-expected coal pricing.

Next up was Qantas Airways, as the omicron variant has negatively impacted the domestic recovery. Last week the company lowered third quarter guidance for domestic travel capacity to 70% of pre-covid levels, down from 102%.

Finally, Megaport’s share price slumped last week. Macquarie believes switching to channel sales impacted upon margin improvement in the second quarter results. However, brokers were generally positive on the outlook as revenue expectations were largely met.

Total Buy recommendations take up 57.65% of the total, versus 35.71% on Neutral/Hold, while Sell ratings account for the remaining 6.64%.

In the good books

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ANZ) was upgraded to Overweight from Equal-weight by Morgan Stanley and Accumulate from Hold by Ord Minnett, B/H/S: 4/2/0

Morgan Stanley has issued a 72 pager on Australian banks, expressing the view the banks, as a group, might well outperform the broader share market in 2022 “against a backdrop of higher rates”.

In support of its thesis, the broker notes credit quality should prove resilient, while the outlook for margins is positive and loan growth expectations are “reasonable”.

ANZ Bank has been upgraded to Overweight from Equal-weight with a price target of $31 (up from $28) while the industry view has been lifted to Attractive.

This report was released on January 20 (yesterday).

Ord Minnett has drawn the conclusion that the economic backdrop in Australia remains supportive of the Australian banking sector, and has thus upgraded ANZ Bank to Accumulate from Hold.

The price target has lifted to $31.50 from $30.

The broker’s sector ranking, in order of preference, is NAB on top, followed by ANZ Bank, Macquarie Group, Bank of Queensland, Westpac, Bendalaide Bank and CommBank least preferred.

BORAL LIMITED (BLD) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 1/4/0

Morgan Stanley upgrades Boral to Equal Weight from Underweight as part of a review of Industrials. Target price is steady at $6.10. Industry view: In-Line.

CARNARVON ENERGY LIMITED (CVN) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 1/1/0

Energy analysts at JP Morgan believe higher hurdles for financing growth projects in traditional oil and gas industries has created a platform for higher energy prices.

Late last year those analysts raised their long-term price forecast for Brent to US$80/bbl.

Ord Minnett, a bit slow off the mark in early 2022, has now incorporated this change into its own modeling for oil and gas stocks under coverage on the ASX.

Carnarvon Petroleum has been upgraded to Buy from Accumulate. Price target moves to 47c from 38c.

DEXUS INDUSTRIA REIT (DXI) was upgraded to Add from Hold by Morgans, B/H/S: 1/1/0

Dexus Industria REIT announced revaluations as at December 2021 with the portfolio increasing by 8.4% on a like-for-like basis. Morgans lifts its rating to Add from Hold and raises its target price to $3.63 from $3.56.

The analyst forecasts a total shareholder return in excess of 10% over the next 12 months and expects the next trading update with the 1H22 result on February 9.

HUB24 LIMITED (HUB) was upgraded to Outperform from Neutral by Macquarie and Buy from Accumulate by Ord Minnett, B/H/S: 4/0/0

Macquarie upgrades its rating for Hub24 to Outperform from Neutral after net inflows for the 2Q were ahead of estimates.

The broker expects flow momentum will likely continue, and the company is well placed to benefit from a flattening of the yield curve (positive leverage to higher rates).

The target price rises to $32.40 from $30.60 after forecast earnings (EBITDA) upgrades and the roll forward of the valuation model.

Hub24’s market update proved a positive surprise, including new business from the IOOF Holdings ((IFL)) private label product, comment analysts at Ord Minnett.

They note the company continues to combine strong organic growth with increased market share. In light of the recent sell-off, they have decided it’s time to upgrade to Buy from Accumulate.

Target price moves $1 higher to $34. The broker’s positive view is supported by a generally positive view on the outlook for independent wealth platforms in Australia.

MEGAPORT LIMITED (MP1) was upgraded to Hold from Sell by Ord Minnett, B/H/S: 3/2/0

Megaport’s second quarter update was largely in line with Ord Minnett’s expectations. Looking ahead, the broker expects Megaport to benefit from top-line growth in the second half following first half investment and indirect sales channel growth.

The company reported 123 customer adds and 439 port adds over the second quarter, and Ord Minnett expects utilisation ramp up in the third and fourth quarters to drive monthly recurring revenue growth.

The rating is upgraded to Hold from Sell and the target price increases to $15.50 from $15.00.

In the not-so-good books

ASX LIMITED (ASX) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 1/2/4

After a review of ASX Ltd versus global peers and some local negatives, Morgan Stanley lowers its rating to Underweight from Equal-weight and reduces its target price to $72.50 from $79.50. Industry view In-Line.

The local negatives include the persistently lower interest rate environment and a delay in new revenue options, along with risks concerning cost growth and execution, explains the analyst.

Morgan Stanley feels the company is susceptible to technology-industry wage inflation in handling its key project with the CHESS replacement plus work required after regulatory scrutiny on system stability.

ALUMINA LIMITED (AWC) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 2/3/0

AWAC-partner Alcoa has released a stronger-than-expected Q4 production update and in response Ord Minnett has raised its price target for Alumina Ltd to $2.20 from $2.10.

However, in response to the strong share price, the broker has downgraded its rating to Hold from Accumulate.

To put things in perspective: Alcoa’s December result was the strongest quarterly for several years, observes Ord Minnett, with the company forecasting an aluminium market deficit of -1.4m this year.

COOPER ENERGY LIMITED (COE) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 1/3/1

Energy analysts at JP Morgan believe higher hurdles for financing growth projects in traditional oil and gas industries has created a platform for higher energy prices.

Late last year those analysts raised their long-term price forecast for Brent to US$80/bbl.

Ord Minnett, a bit slow off the mark in early 2022, has now incorporated this change into its own modeling for oil and gas stocks under coverage on the ASX.

Cooper Energy has been downgraded to Hold from Accumulate. Price target loses -1c to 32c.

GRAINCORP LIMITED (GNC) was downgraded to Neutral from Buy by UBS, B/H/S: 2/2/0

UBS raises GrainCorp’s EPS estimates 9% and 4% for FY22 and FY23, after the company’s recent harvest updates, believing operating conditions remain very favourable.

The broker considers the company cheap at a 5x multiple, although it expects FY22 will most likely represent peak-cycle earnings, and believes any share-price rise from here would most likely come from consensus upgrades in FY23 forecasts pending Abares’ FY23 crop estimate in June.

Target price rises 6% to $8 to reflect earnings revisions, but UBS downgrades to Neutral from Buy given recent share-price moves.

SANDFIRE RESOURCES LIMITED (SFR) was downgraded to Sell from Hold by Ord Minnett, B/H/S: 4/1/1

It appears while production volumes for Q4 were higher-than-anticipated, Sandfire Resources’ market update did disappoint through higher-than-expected costs.

Nevertheless, Ord Minnett’s price target lifts to $5.60 from $5.50. But the rating is downgraded to Sell from Hold on the back of a rallying share price.

VIRTUS HEALTH LIMITED (VRT) was downgraded to Hold from Add by Morgans, B/H/S: 1/1/1

Virtus Health is in receipt of a non-binding bid from CapVest to acquire 100% of the company by way of a scheme of arrangement for $7.60/share.

Morgans sets the target price at the bid price, up from $7.13, lowers its rating to Hold from Add and provides little in the way of commentary.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.