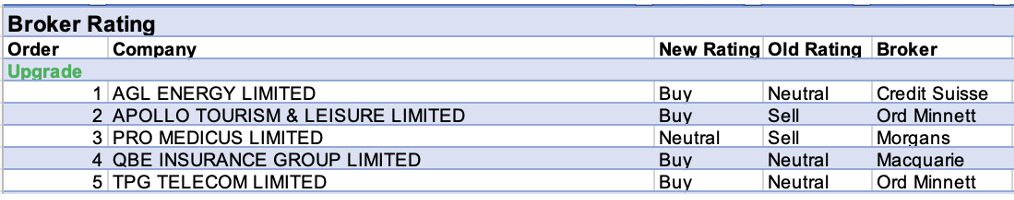

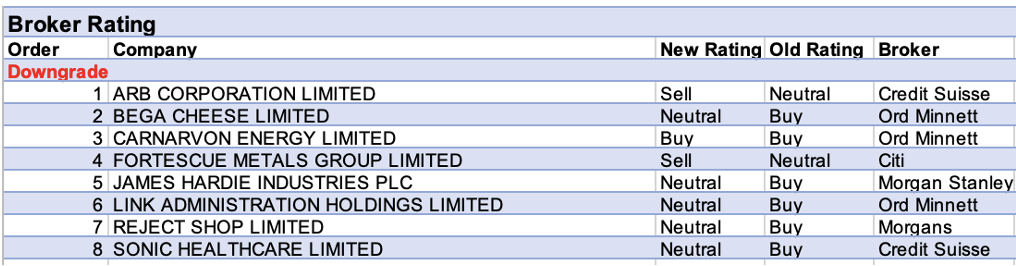

The local stockbroking community hasn’t genuinely awoken yet from the end-of-year celebrations and hibernation, but last week, ending Friday 14th January 2022, nevertheless generated eight downgrades in ratings for individual companies and only five upgrades.

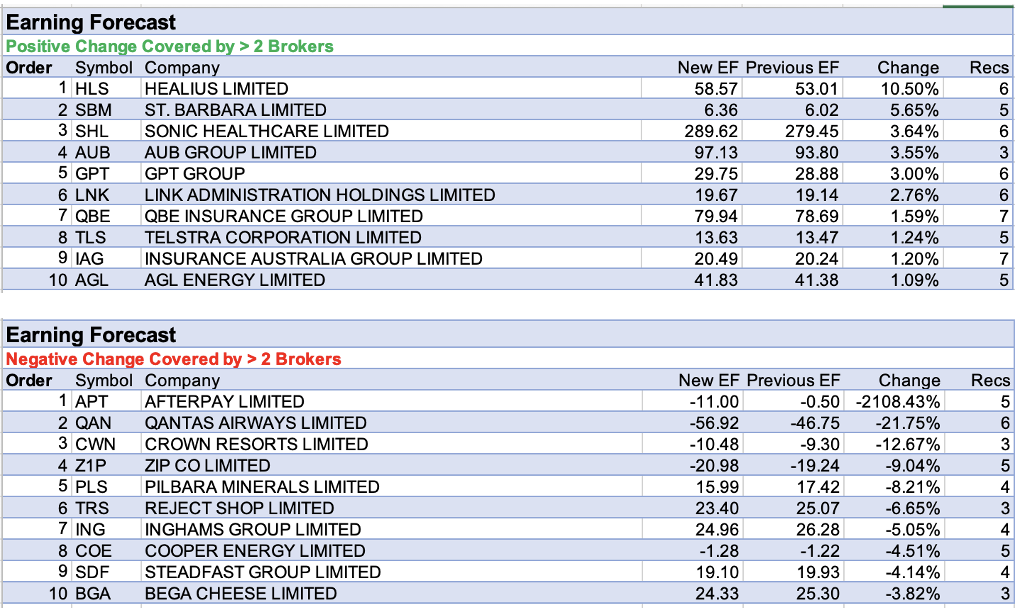

This suggests January weakness coincides with analysts, on balance, adopting a negative bias. Such a conclusion is supported by last week’s table of positive and negative revisions for earnings forecasts which carries a decisive emphasis on quite heavy-looking reductions, led by soon-to-depart Afterpay.

The notion of an extremely bifurcated share market is in particular expressed through the balance of broker ratings. 57% of total ratings now consists of a Buy or equivalent rating while major indices are not that far off their all-time high. If ever there was an indicator to illustrate extreme polarisation, we are staring at it right here, right now.

Five of the regular seven stockbrokers have their largest allocation in Buy ratings, with Citi and Credit Suisse the two exceptions.

Not much is happening with valuations and price targets, not so far. This might change as more and more previews ahead of the February reporting season are released. Two more weeks and February will be upon us.

Though in Australia, reporting season doesn’t genuinely start until mid-month. So there’s plenty of time, still. Too early to get nervous just yet.

In the good books

AGL ENERGY LIMITED (AGL) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/3/0

AGL Energy was recently upgraded to Outperform from Neutral with an increased price target of $8.30 (from $7.30).

Credit Suisse last upgraded its rating to Neutral from Underperform in mid-August last year, while at that time raising its target price to $7.30 from $6.70.

EPS and DPS forecasts have been noticeably increased.

APOLLO TOURISM & LEISURE LIMITED (ATL) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 2/0/0

It is Ord Minnett’s opinion that Apollo Tourism and Leisure’s proposed merger with Tourism Holdings ((THL)) offers benefit to all shareholders and give Apollo Tourism and Leisure shareholders an opportunity to hold a stake in a larger business.

Despite this, the broker notes Tourism Holdings’ current share price suggests the market has concerns that the merger will not go ahead or won’t gain approval but sees no reason why the deal would not receive ACCC approval.

The rating is upgraded to Buy from Hold and the target price increases to $0.77 from $0.31.

This report was published on December 22, 2021.

QBE INSURANCE GROUP LIMITED (QBE) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 7/0/0

Given strengthening in the global premium rate environment, Macquarie has improved its forecasts for QBE Insurance Group’s FY22 growth to 6.1% from 3.3%. The broker also updates earnings per share forecasts 3.3%, -0.4% and 1.9% for FY22-FY24.

Macquarie noted that QBE Insurance Group is trading at a 12% discount to international peers, and expects this discount to peers to reduce long-term as underperforming portfolios are addressed.

The rating is upgraded to Outperform from Neutral and the target price increases to $13.90 from $12.10.

In the not-so-good books

CARNARVON ENERGY LIMITED (CVN) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 1/1/0

Ord Minnett revisits resources stocks after updating its commodity price forecasts and also increases earnings estimates across its energy and utilities coverage by roughly 21% for 2023/FY23, with the largest beneficiaries being AGL Energy and Origin Energy.

The broker downgrades Carnarvon Petroleum to Accumulate from Buy, given the recent sharp run in the share price.

The in-house Brent oil price forecast (thanks JPMorgan) is now for an average price of US$78 per barrel for 2022 (+7%), US$75 for 2023 (+7%) and US$71 for CY24 (+2%).

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 3/3/0

Link Administration Holdings has entered into a scheme of arrangement deed with Dye&Durham, a software and technology solutions provider offering services. Ord Minnett notes Dye&Durham will acquire 100% of Link Administration shares at $5.50 per share.

The broker notes a 3 cent per share dividend will be paid by Link Administration prior to the payout of shares, with upside potential for a higher interim dividend payment based on banking and credit management.

Given little synergy between the companies’ core business, the broker suggests Dye&Durham’s interest is driven by Link Administration’s PEXA stake.

The rating is downgraded to Hold from Accumulate and the target price increases to $5.60 from $5.30.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.