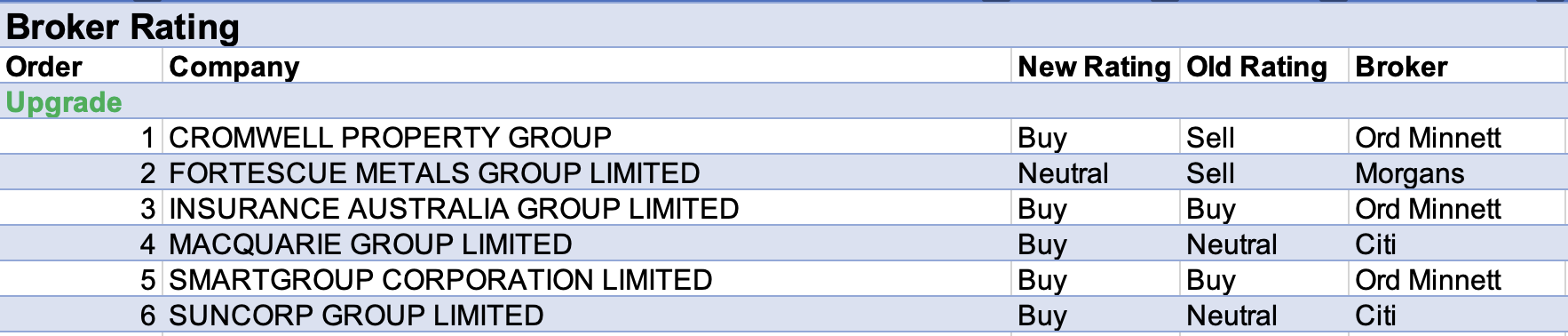

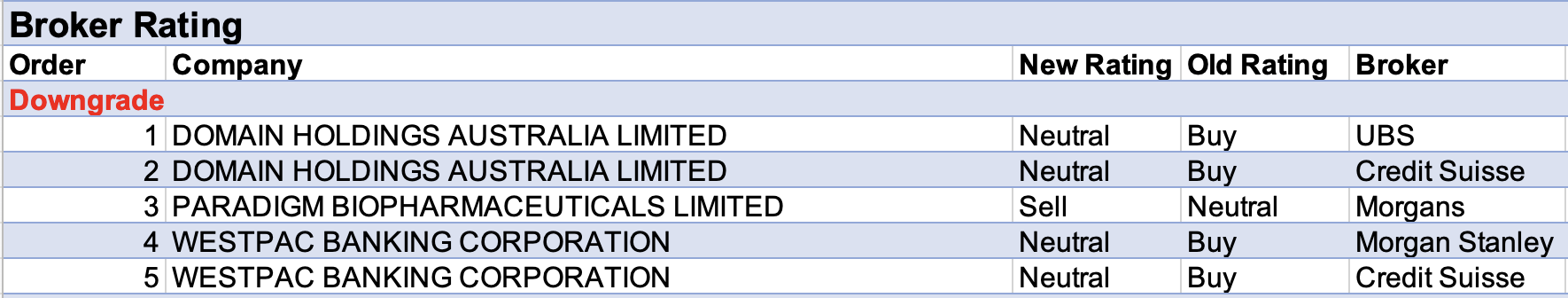

For the week ending Friday November 5, there were 6 upgrades and 5 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Despite a positive quarterly update by Domain Holdings, valuation concerns alone induced two ratings downgrades by separate brokers. UBS (downgrade to Neutral from Buy) is positive on the outlook and assumes listing volumes will return to around 2018 levels in FY23, though stamp duty reform has the potential to materially lift housing turnover structurally in the longer term.

Meanwhile, Credit Suisse (downgrade to Neutral from Outperform) was impressed by the growth in controllable yield, given listing volume declines in the core Sydney market.

In the case of Westpac, broker dissatisfaction was responsible for two downgrades by separate brokers. Morgan Stanley (downgrade to Equal-weight from Overweight) assessed a poor second half result and worse-than-expected outlook on FY22 margins and expenses. Also, Credit Suisse damningly suggests the bank continues to re-position its mortgage portfolio wherein lies most of the downside risks. The broker downgraded to Neutral from Outperform.

There were no material changes to forecast target prices last week.

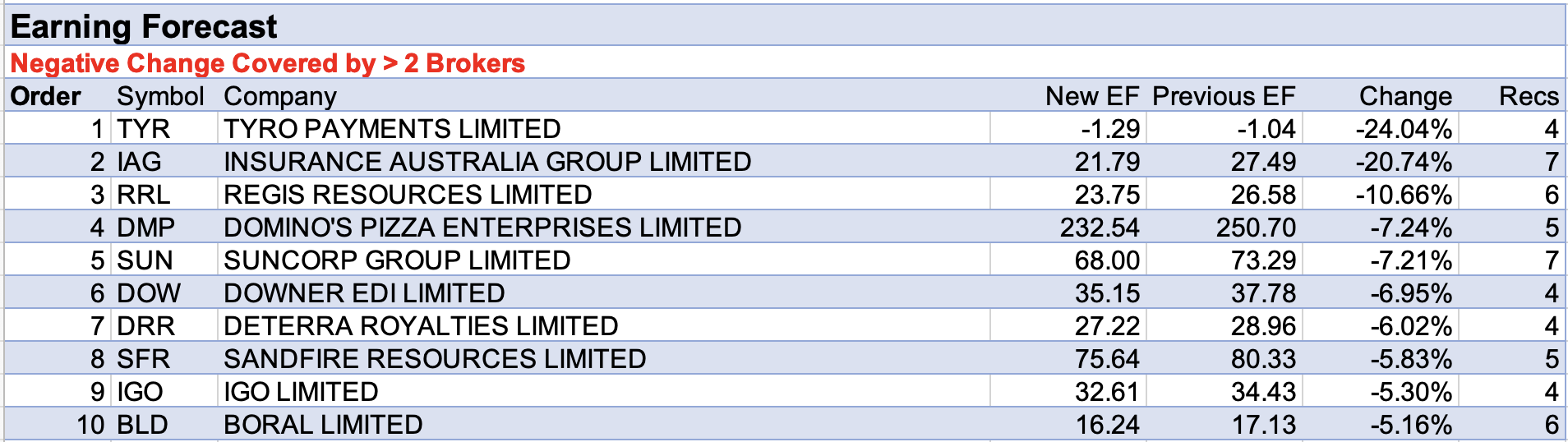

Superloop received the greatest percentage upgrade to earnings forecasts last week. As mentioned in last week’s article, Morgans felt the trading update engenders greater confidence in accelerating organic growth.

On the other hand, Tyro Payments received the greatest percentage downgrade to earnings forecasts last week, after a trading update. Morgans is concerned full-year guidance is now less likely, despite an ability to ramp up activity once restrictions ease. The broker lowered FY22 and FY23 EPS forecasts by more than -10%.

However, Ord Minnett was more optimistic and points out an average of 1,259 new merchant applications per month for the first four months of FY22 is a solid result, given covid disruptions.

Finally, investors in Insurance Australia Group must approach the nightly weather report with some trepidation, after more fallout from storms around Australia. The company downgraded FY22 guidance as catastrophe costs are now expected to exceed the original budget for $765m by $280m.

With La Nina expected this summer, and the peak risk period still coming, Morgan Stanley sees a risk of further earnings downgrades for Australian insurers.

Total Buy recommendations take up 55.15 % of the total, versus 38.31% on Neutral/Hold, while Sell ratings account for the remaining 6.49%.

In the good books

CROMWELL PROPERTY GROUP (CMW) was upgraded to Buy from Lighten by Ord Minnett, B/H/S: 1/1/0

Ord Minnett upgrades its rating for Cromwell Property Group to Buy from Lighten and raises its target price to $0.95 from $0.80. The analyst believes the market is applying a -20% discount to the group’s net tangible assets (NTA).

The broker is backing a refreshed board and new management to address elevated gearing, prove up external funds under management (FUM) growth and simplify the business.

SMARTGROUP CORPORATION LIMITED (SIQ) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/2/0

In the wake of the disbanded takeover of SmartGroup Corp, Ord Minnett upgrades its rating to Buy from Accumulate and lowers its target price to $8.80 from $9.85. The broker remains attracted to the pure exposure to salary packaging and novated leasing.

The analyst was also pleased by management commentary that included “the company is currently on track to deliver 2021 financial performance in-line with consensus expectations”.

SUNCORP GROUP LIMITED (SUN) was upgraded to Buy from Neutral by Citi, B/H/S: 4/3/0

Suncorp has been increasing its hazard allowances in significant fashion in recent years but yesterday the insurer had to concede it still wasn’t enough for the running financial year.

The profit warning represents a circa -10% reduction of Citi’s EPS forecast, explains the analyst. Citi continues to view Suncorp as a medium-term opportunity with margins likely to improve in H2.

Share price weakness has created a reasonable entry point, suggests the analyst. Upgrade to Buy from Neutral. Price target $12.80 (unchanged).

In the not-so-good books

DOMAIN HOLDINGS AUSTRALIA LIMITED (DHG) was downgraded to Neutral from Outperform by Credit Suisse and downgraded to Neutral from Buy by UBS, B/H/S: 1/5/0

Domain Holdings’ quarterly update revealed trends consistent with Credit Suisse’s estimates. Digital revenues were up 18% year on year and total revenues up 20%, thanks to the return of Print after being non-existent a year ago.

Cost growth guidance for the main business has been lowered but acquisition costs stemming from Insight Data Solutions will balance that out, the broker notes. Growth in yield was impressive given listing volume declines in the core Sydney market.

Target rises to $5.70 from $5.40 but the broker sees limited upside from here, and pulls back to Neutral from Outperform.

UBS downgrades its rating to Neutral from Buy for Domain Holdings Australia, with the share price now trading in-line with the broker’s revised $5.80 price target, up from $5.70. The broker assesses the 1Q trading update shows the business tracking in-line with expectations.

The analyst’s forecasts assume listing volumes return to around 2018 levels in FY23, though stamp duty reform has the potential to materially lift housing turnover structurally in the longer term.

PARADIGM BIOPHARMACEUTICALS LIMITED (PAR) was downgraded to Reduce from Hold by Morgans, B/H/S: 0/0/1

Paradigm Biopharmaceuticals has announced US FDA clearance for its knee osteoarthritis major trial, Morgans noting 65 trial sites have been identified across the US and Australia. Patient screening has started in Australia, and will start in the US by year-end.

The broker sees downside risk to the now narrower marketability given likely trial protocol changes to gain FDA acceptance. Additionally, trial patient screening could be a lengthier process, and the broker awaits updates on trial timelines and costs in the near term.

Morgans downgrades to Reduce from Hold given recent share-price strength. Target price of $1.68 is retained.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

he above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.