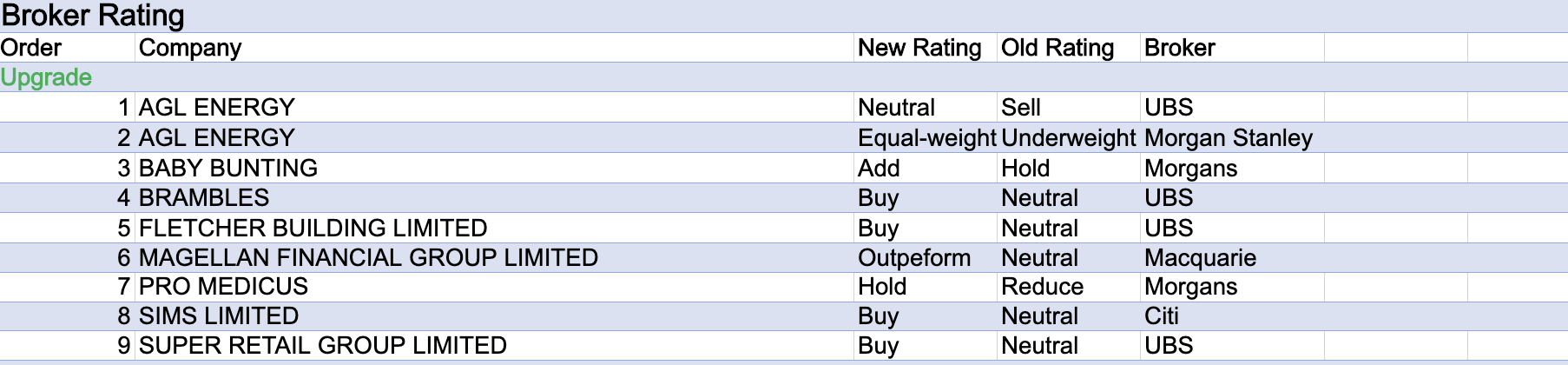

For the week ending Friday, October 8, there were nine upgrades and one downgrade to ASX-listed companies covered by brokers in the FNArena database.

AGL Energy was the only company to receive a rating upgrade from two separate brokers last week. Both Morgan Stanley (to Equal-weight from Underweight) and UBS (to Neutral from Sell) reacted to an undemanding valuation, given the -51% year-to-date share price decline.

However, the upgrades came with some misgivings as Morgan Stanley cautioned over ESG and demerger uncertainty, while UBS sees limited upside from rising electricity prices, which are hedged out until FY23.

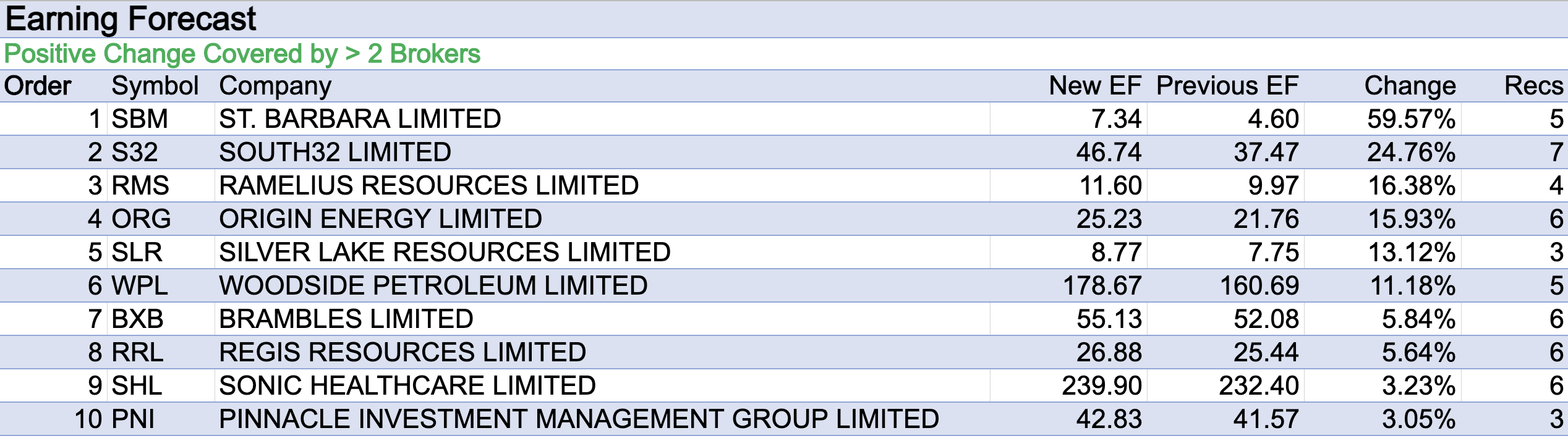

There were, however, upgrades to forecast earnings, with St Barbara heading the list last week. Ord Minnett sees renewed investor interest in the gold sector on rising inflation risks and recently initiated coverage on St Barbara with a Hold rating and a $1.50 12-month target price. The broker likes the company’s mine plan, which is backed by healthy reserves.

Finally, South32 was second on the table for percentage change to forecast earnings by brokers, after UBS took a liking to its defensive characteristics despite a slowdown in Chinese growth.

To reflect tight supply, the broker upgraded its metallurgical coal, alumina and aluminium price forecasts. Moreover, the acquisition of up to 25% of the Mozal aluminium smelter in Mozambique is considered to be financially attractive, as is a potential re-start of Alumar aluminium smelter in Brazil.

Total Buy recommendations take up 54.85% of the total, versus 37.89% on Neutral/Hold, while Sell ratings account for the remaining 7.26%.

In the good books

FLETCHER BUILDING LIMITED (FBU) was upgraded to Buy from Neutral by UBS, B/H/S: 4/1/0

Following recent share price weakness, and with a looming re-opening opportunity, UBS raises its target price for Fletcher Building to NZ$8 from NZ$7.85 and increases its rating to Buy from Neutral. There’s also considered to be an attractive dividend yield.

Despite current lockdowns, the analyst’s forecasts point to further earnings momentum, reflecting higher construction activity and stronger building products pricing.

MAGELLAN FINANCIAL GROUP LIMITED (MFG) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/2/2

In a further review of the quarterly funds’ performance, Macquarie assesses that increased earnings volatility and a poor investment performance have resulted in material de-rating.

Flows are likely to remain under pressure for much of FY22 but the broker finds too much valuation support, given the 7% dividend yield. The stock is also trading at 13.7x one-year forward PE compare with a five-year average of 19.2x.

Thus the rating is upgraded to Outperform from Neutral. Target is reduced to $38.00 from $46.75.

SIMS LIMITED (SGM) was upgraded to Buy from Neutral by Citi, B/H/S: 3/3/0

Citi expects Sims will be a key beneficiary of steel decarbonisation strategies and the stock is now “sufficiently” cheap” for an upgrade to Buy from Neutral even in a moderating scrap pricing cycle.

The company is also expected to benefit from scrap demand growth in China as EAF steel production rises over time.

The broker suspects the second half earnings per tonne in FY21 of US$76/t was the peak for the current cycle and expects this will retrace to a through cycle level of US$23/t in FY24, which is in line with historical levels. Target is reduced to $18 from $19.

SUPER RETAIL GROUP LIMITED (SUL) was upgraded to Buy from Neutral by UBS, B/H/S: 4/2/0

A number of economic indicators suggest to UBS a stronger consumer with intentions to spend on retail. The broker expects Super Retail Group will enjoy a strong post lockdown recovery, and after upgrading EPS forecasts lifts its rating to Buy from Neutral.

Moreover, the share price has slipped -11% since the FY21 result, and the broker lifts its target price to $13.50 from $13.20.

In the not-so-good books

HOME CONSORTIUM (HMC) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 1/1/1

While Home Consortium is exposed to favourable classes and has a supportive base, Ord Minnett assesses the strong share price performance means the stock is trading on very high multiples.

The business is well-placed to grow, yet the broker downgrades to Lighten from Hold on valuation grounds. Ord Minnett believes the stock is priced two years ahead of execution. Target is raised to $6.40 from $4.40.

![]()

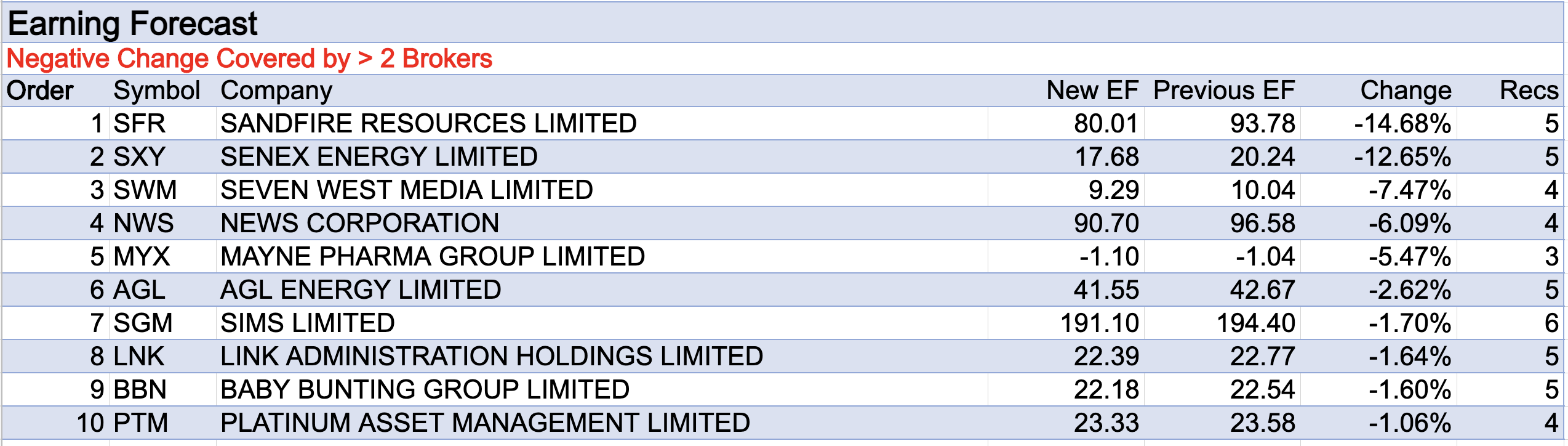

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.