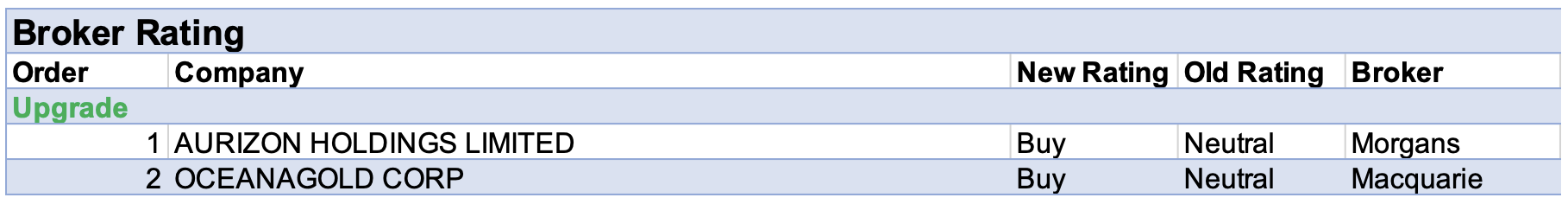

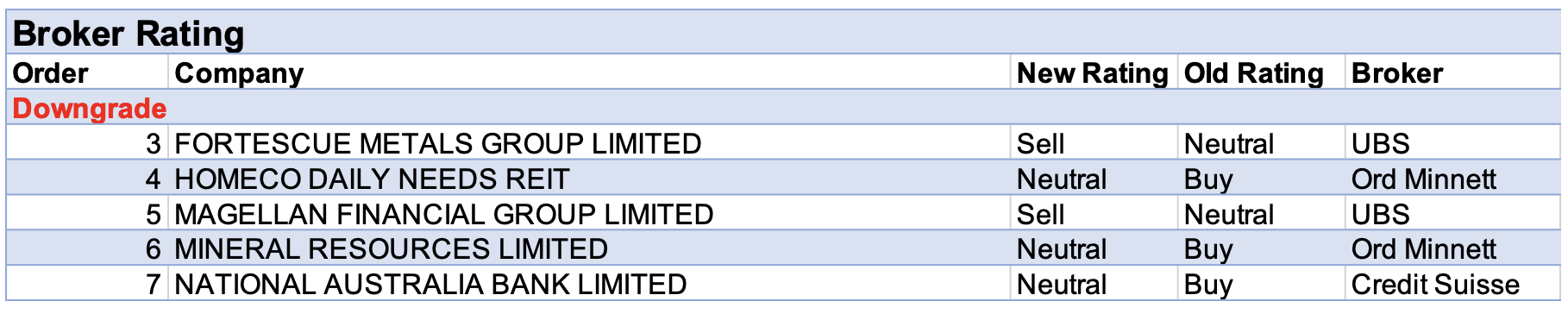

For the week ending Friday 17 September, there were 2 upgrades and 5 downgrades to ASX-listed companies covered by brokers in the FNArena database.

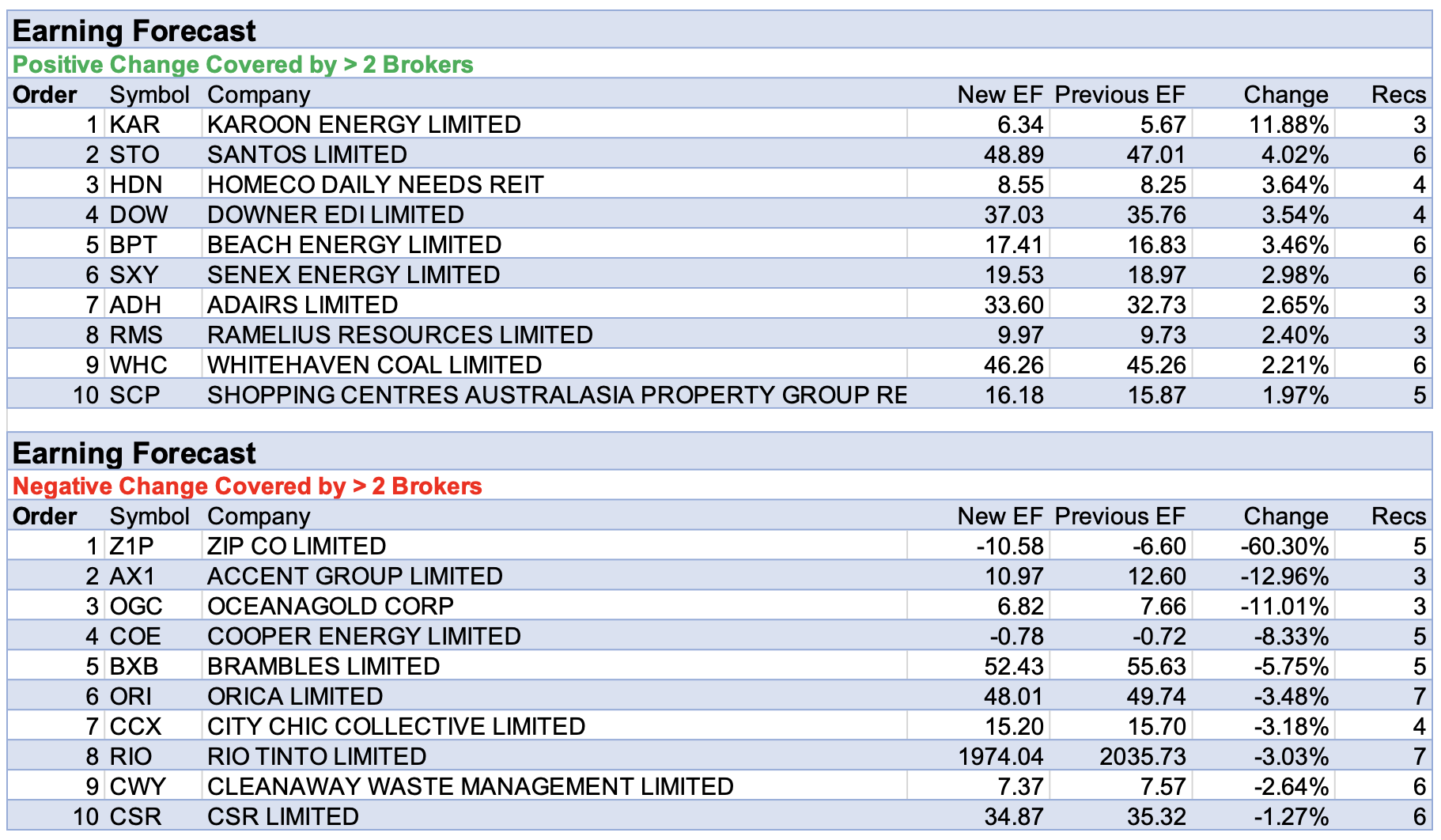

Zip Co had the largest percentage fall in forecast earnings last week after Macquarie noted an increased risk appetite is driving elevated bad debt write-offs. These accounted for around 1.8% of total transaction value in the second half of FY21 for QuadPay. Additionally, reduced customer growth and subdued web traffic has the broker cautious about the outlook.

In a relatively quiet week on the bourse for adjustments to forecast earnings, there were no other material changes.

In the good books

In the not-so-good books

FORTESCUE METALS GROUP LIMITED (FMG) was downgraded to Sell from Neutral by UBS B/H/S: 3/1/3

Iron ore fundamentals have deteriorated faster than UBS expected. The broker now expects that having already more than halved, the iron ore price will drop further to US$70-80/t. Fortescue Metals’ share price has fallen -34%. At current spot the miner is still generating a free cash flow yield of 11% but this falls to 5.4%, the broker estimates, at US$90/t. Downgrade to Sell from Neutral, target falls to $15 from $18.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.