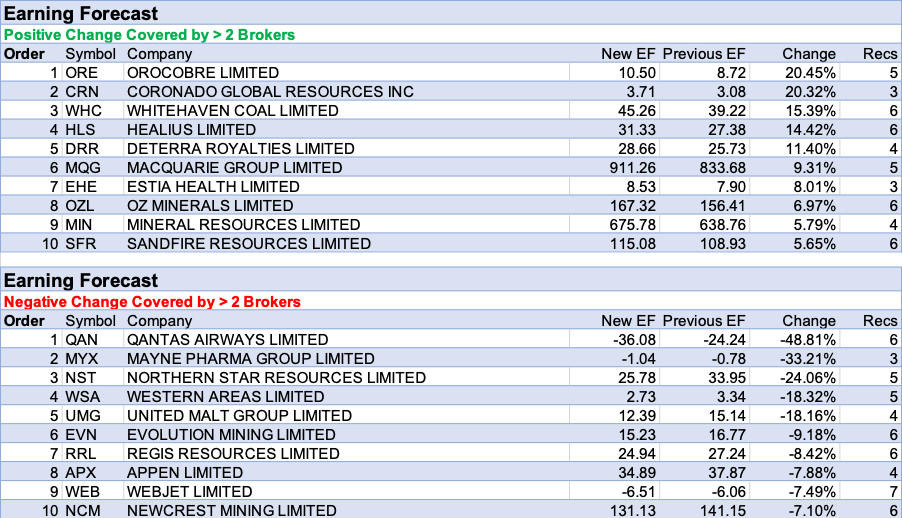

Orocobre had the largest percentage rise in forecast earnings in the FNArena database last week as brokers react to a beat for FY21 results. After combining the Orocobre and Galaxy Resources accounts, Citi generates a lift in forecast earnings for Orocobre in FY22 and FY23 of 139% and 55%, respectively.

The next largest rises in forecast earnings went to Coronado Global Resources and Whitehaven Coal. This comes as Macquarie strategists consider the outlook for coal continues to be positive, even after thermal and met-coal prices have more than doubled in 2021. The broker notes equities have lagged the increase in coal prices and predicts material upside, with greater leverage to metallurgical coal prices favoured via Coronado.

Despite Qantas having the largest percentage decrease in earnings forecasts by brokers in the FNArena database last week, UBS believes the company will return as a stronger airline post pandemic. Nevertheless, the recovery is sensitive to higher vaccination rates, cooperation on borders and increased traffic from pent-up demand.

Coming next was Mayne Pharma, following a miss in broker expectations for FY21 earnings. Macquarie highlights falling gross margins from increased competition. However, Citi believes the company is transitioning to branded products from generic drugs as the largest segment. The analyst lifted the rating to Buy from Neutral soon after the initial downward share price reaction to the FY21 result.

Finally, Northern Star Resources also appears on the list for the largest percentage fall in forecast earnings last week. Despite this, Citi retains its Buy rating and expects Kalgoorlie District Milling synergies.

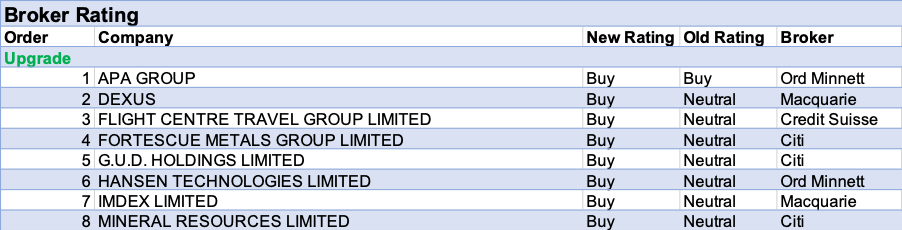

In the good books

FORTESCUE METALS GROUP LIMITED (FMG) was upgraded to Buy from Neutral by Citi B/H/S: 3/2/2

Citi upgrades Fortescue Metals to Buy from Neutral and reduces the target to $18.50 from $19.50. The broker suspects iron ore could hold at levels over US$100/t for longer than the market is currently factoring. Longer-dated market concerns regarding large-scale iron ore exports from Guinea now look much less certain. Moreover, China’s leading indicators are stabilising and have headed higher from recent lows.

IMDEX LIMITED (IMD) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/0/0

Macquarie considers the earnings outlook is positive given the latest data that show a continuation of favourable industry inputs. Rating is upgraded to Outperform from Neutral. The main risks to the rating include a material downturn in gold and copper prices or disruptions caused by the pandemic to operations in Australia and North America. Target is raised to $2.65 from $2.56.

In the not-so-good books

JUPITER MINES LIMITED (JMS) was downgraded to Underperform from Neutral by Macquarie B/H/S: 0/0/1

Jupiter Mine’s 49.9%-owned Tshipi manganese mine in South Africa has announced a dividend well below Macquarie’s expectation. The lower distribution is due to Tshipi being cautious on depressed lower-grade manganese prices and higher shipping and transport costs, while also maintaining cash to fund FY22 capital expenditure, the broker notes. While this leads to only a -2% downgrade to the broker’s FY22 earnings forecast, increased risk has the broker increasing its weighted cost of capital assumption and lowering its forecast enterprise multiple. Target falls to 22c from 30c, Downgrade to Underperform from Neutral.

MACQUARIE GROUP LIMITED (MQG) was downgraded to Hold from Add by Morgans B/H/S: 2/2/1

Morgans upgrades FY22 and FY23 estimates for earnings per share by 8% and 3%, respectively, to reflect Macquarie Group’s more positive outlook. Macquarie Group expects first half net profit to be only slightly lower compared with the prior half’s strong performance. The business is exposed to structural growth areas and capitalising well on the current environment, with the broker noting some value accretive acquisitions. Yet, with the stock running hard and now trading on 20x FY22 PE it is close to fair value and the broker downgrades to Hold from Add. Target is raised to $181.10 from $172.30.

NOVONIX LIMITED (NVX) was downgraded to Hold from Add by Morgans B/H/S: 0/1/0

It is Morgans’ view that while the company looks promising, much of its future success is already reflected in the share price and the rating is therefore downgraded until further detail on the Samsung quality audit and gross margin expectations are confirmed. The rating is downgraded to Hold from Speculative Buy and the target price increases to $5.68 from $4.49.

QUBE HOLDINGS LIMITED (QUB) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/3/0

Qube Holdings has announced the acquisition of the Newcastle Agri Terminal for -$90m. Credit Suisse notes that although this is a small deal for the company, it allows Qube to provide grain export services through the Port of Newcastle. The broker also notes that Qube is set to receive $1.3bn in initial proceeds from the Moorebank sale, which is likely to generate $200-300m in tax payments and $600m in capital management. Accounting for the acquisition, Credit Suisse upgrades earnings per share forecasts by 0.5% and 2.0% for FY22 and FY23, respectively. The rating is downgraded to Neutral from Outperform and the target price increases to $3.55 from $3.30.

TECHNOLOGY ONE LIMITED (TNE) was downgraded to Neutral from Buy by UBS B/H/S: 1/3/0

UBS resumes coverage with a downgrade to Neutral from Buy and $11.70 price target, transferring coverage to another analyst. The broker forecasts 14% growth in pre-tax profit in FY21-26 and half of this growth is likely to be driven by the migration of the majority of existing customers to the SaaS platform. The broker is more cautious on the remaining uplift, which is likely to be driven by product/mix and UK expansion. While the recent acquisition of Scientia should assist the UK expansion, UBS does not believe it will provide substantial upside.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.