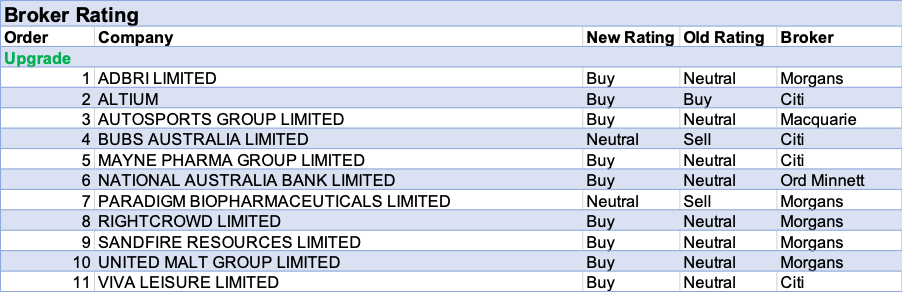

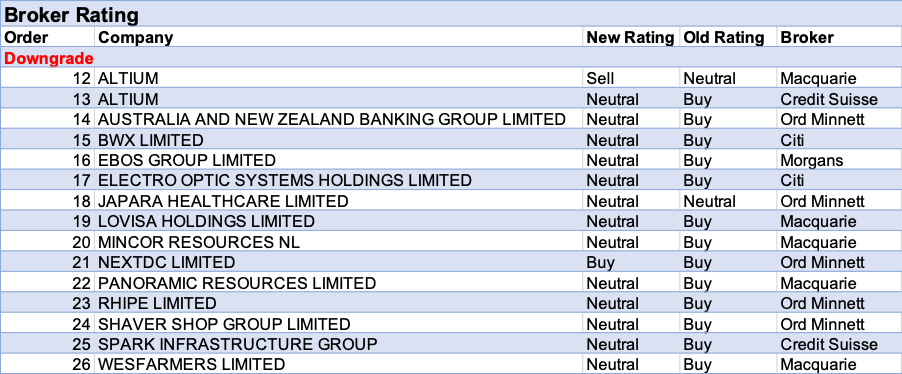

For the week ending Friday 3 September, there were 11 upgrades and 15 downgrades to ASX-listed companies covered by brokers in the FNArena database. Only Altium received multiple rating changes from separate brokers. Citi upgraded to Buy from Neutral, while Macquarie downgraded to Underperform from Neutral and Credit Suisse downgraded to Neutral from Outperform.

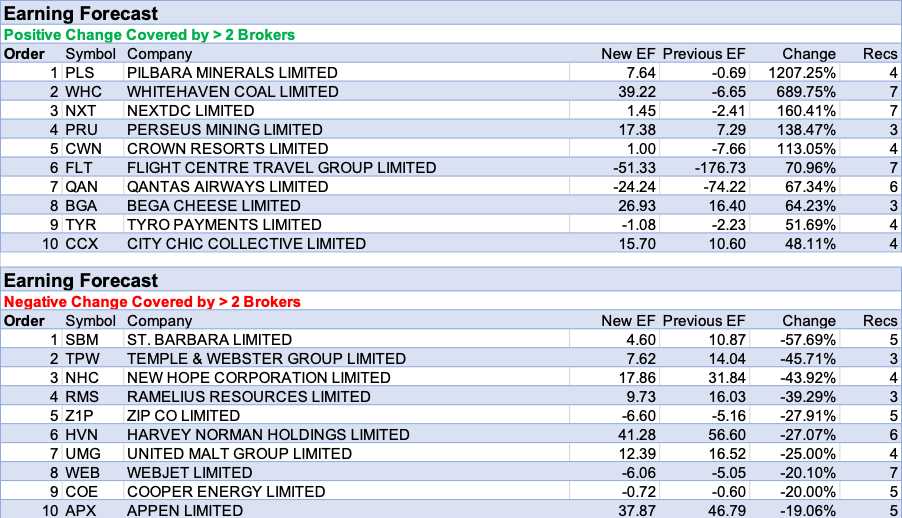

Pilbara Minerals had the largest percentage increase in forecast price target and forecast earnings for the week. In the wake of broadly in-line FY21 results, Citi notes recent strong online spot sales further highlight the tightness in lithium feedstock markets at present. The acquisition of Altura Mining’s assets and restart of the processing plant have increased capacity by around 60%, in what the analyst considers a transformational year.

Coming next was Whitehaven Coal, with the second largest percentage increase in forecast price target and forecast earnings for the week. Macquarie strategists consider the outlook for coal continues to be positive, even after thermal and met coal prices have more than doubled in 2021. Meanwhile, Ord Minnett feels the share price remains a laggard due to an ESG overhang and ongoing operational issues at Narrabri/NCIG.

On the flipside, St Barbara was the recipient of the largest percentage rise in forecast earnings. FY21 underlying earnings of $300m were in-line with consensus, while a 2 cent final dividend was slightly below, according to Credit Suisse. FY22 production guidance is roughly flat on FY21 with all-in costs expected to increase to $1,710-1,860/oz from $1,616/oz.

Finally, Temple & Webster Group came second for the largest percentage rise in forecast earnings. A trading update has shown further acceleration in sales growth in August and Credit Suisse upgrades its near-term forecasts, under the assumption that lockdowns persist through September. Morgan Stanley also expects near-term trading to continue to benefit from lockdowns.

Total Buy recommendations take up 52.82% of the total, versus 39.5% on Neutral/Hold, while Sell ratings account for the remaining 7.68%.

In the good books

RIGHTCROWD LIMITED (RCW) was upgraded to Add from Hold by Morgans B/H/S: 1/0/0

Given a recent quarterly update, Morgans didn’t find much new in the FY21 results. The highlight was considered the doubling of annualised recurring revenue to $8.1m. No specific FY22 guidance was given. The broker upgrades its rating to Speculative Buy from Hold on recent share price weakness. The target price falls to $0.37 from $0.39.

UNITED MALT GROUP LIMITED (UMG) was upgraded to Add from Hold by Morgans B/H/S: 3/1/0

FY21 guidance was weaker than Morgans expected albeit a large part of the miss is due to a new accounting standard. Trading conditions indicate the recovery in North America and UK is being partially offset by covid restrictions in Australia and Asia, explains the analyst. While the broker expects solid earnings growth in FY22, it is still likely to be impacted by covid in Asia and increased supply chain costs. After material share price weakness, the rating is upgraded to Add from Hold and the target price of $4.79 is retained. Management reiterated the $30m in earnings (EBITDA) benefits targeted by FY24 under its transformation initiatives.

VIVA LEISURE LIMITED (VVA) was upgraded to Buy from Neutral by Citi B/H/S: 2/0/0

With Viva Leisure’s recent $12m equity raising having potentially resolved issues surrounding its balance sheet following recent lockdowns, Citi has upgraded the company to Buy from Neutral and increases the price target to $1.90 from $1.75. Citi expects the strengthened balance sheet, plus the company’s focus on preserving cash to provide sufficient liquidity to trade through FY22, providing the company ceases paying rent. While Citi continues to forecast 22 greenfield clubs and 14 acquisitions in FY22, the broker suspects the improved balance sheet could result in Viva Leisure undertaking further acquisitions should the opportunity arise.

In the not-so-good books

EBOS GROUP LIMITED (EBO) was downgraded to Hold from Add by Morgans B/H/S: 2/3/0

Morgans sees potential for further sales growth and margin expansion after the acquisition announcement of Sentry Medical, a designer, marketer and distributor of medical consumables. The target rises to $34.50 from $31.68, despite no changes to near-term forecasts. Due to recent share price strength, the analyst pulls back the rating to Hold from Add and awaits a better entry point.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.