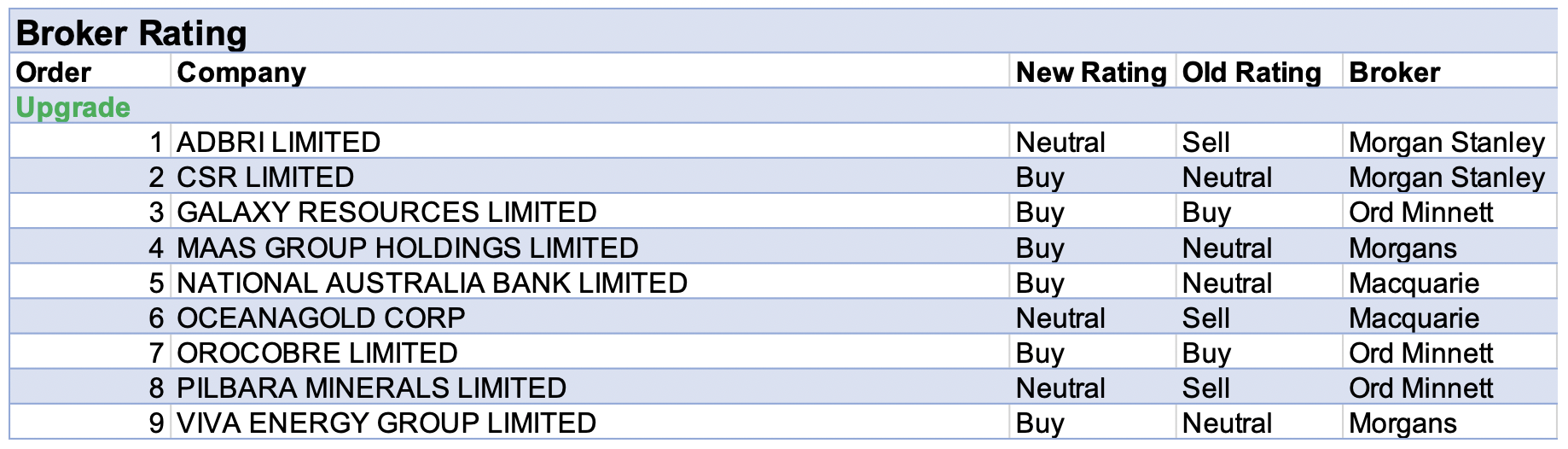

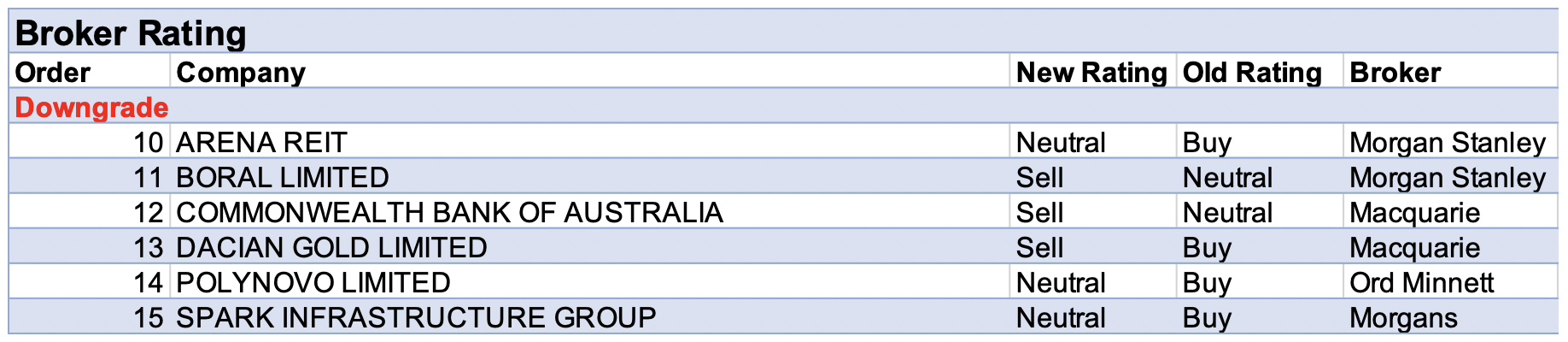

For the week ending Friday 16 July, there were 9 upgrades and 6 downgrades to ASX-listed companies by brokers in the FNArena database.

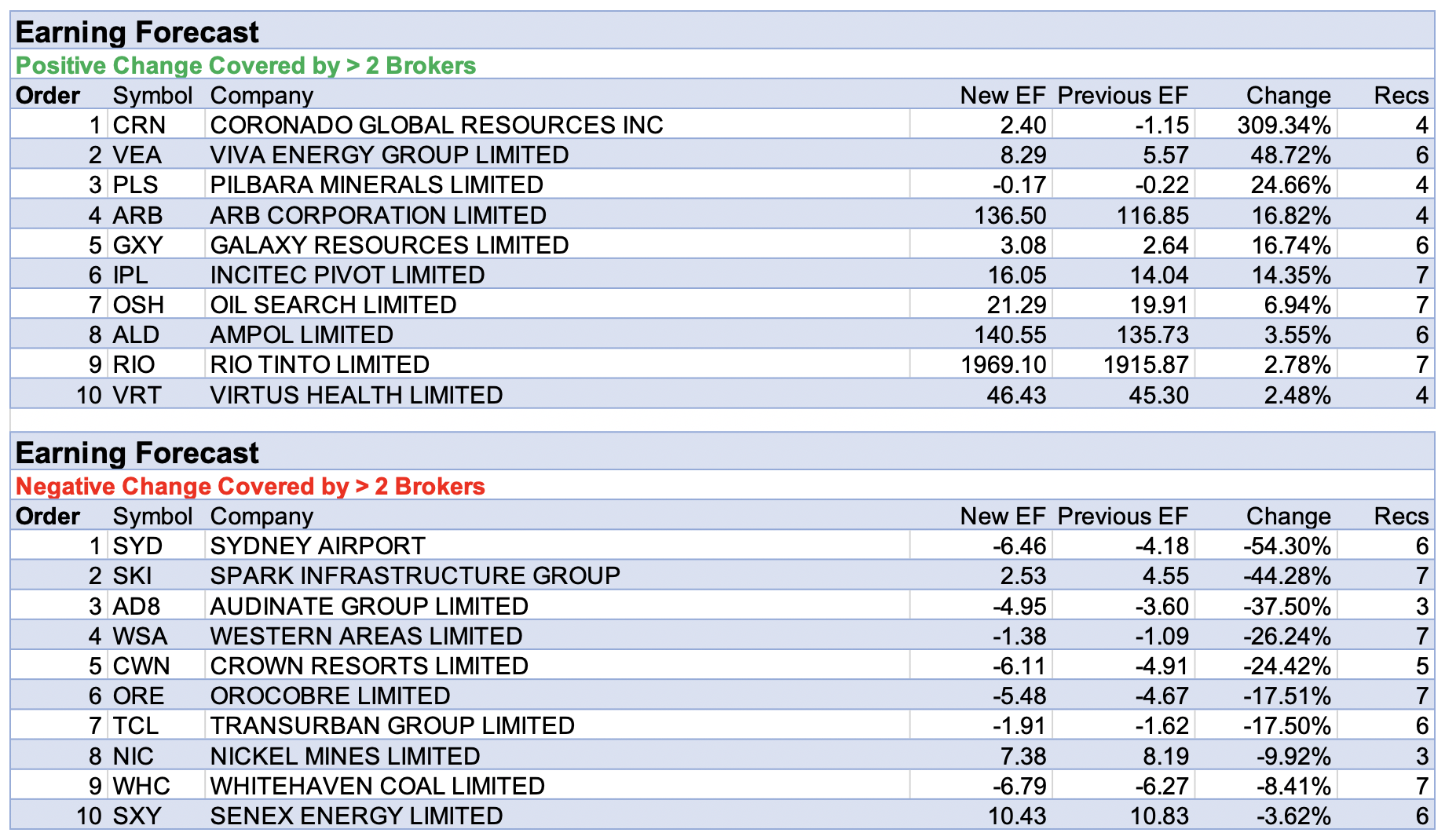

Coronado Global Resources had the largest percentage increase in forecast earnings. Morgans upgraded its rating to Add from Hold, and estimates leverage to sharply higher coking coal prices will offset any dilution after the company recently raised capital.

Credit Suisse notes the Curragh operations are generally subject to a three-month pricing lag, and expects the met coal pricing rally from May to take effect in the June half, with significant free cash flow growth likely to be reflected beyond the December half.

Next was Viva Energy Group. A first half trading update and a lift in FY21 guidance was lauded by all five brokers who cover the stock on the FNArena database. Macquarie was impressed by an ability to capture market share in both retail and commercial. The dividend is expected to be reinstated and a return of up to $100m in capital from the sale of the property portfolio could follow at the August result.

Meanwhile, UBS pointed out total fuel volumes (ex-jet) are now above pre-covid levels and diesel demand in regional Australia, particularly from agriculture and resource industries, has offset weakness in lockdown-affected metro fuel sales.

Both Pilbara Minerals and Galaxy Resources featured in the top percentage gainers to forecast earnings by brokers, after Ord Minnett lifted lithium forecasts. An estimated 10% market deficit out to 2024 supports higher near-term prices and the broker sees risk attached to an aggressive demand increase.

The broker’s rating for Pilbara Minerals was upgraded to Hold from Lighten and its target price increased to $1.50 from $1.05. Based on the assumption that the proposed merger with Orocobre will go ahead, the broker’s rating for Galaxy Resources was also upgraded to Buy from Accumulate, and its target price increased to $4.80 from $4.20.

A trading update and increased FY21 guidance from ARB Corp resulted in forecast earnings upgrades by brokers in the FNArena database last week. The main drivers included a marked uplift in new vehicle sales in Australia, strong export sales growth and higher operating margins.

While Ord Minnett expects demand will stay strong in the short term and future sales are likely to be driven by continued growth in demand in 4WD and SUV markets, Credit Suisse feels visibility beyond the first half FY22 remains low, and sees some risk to end-demand as international travel resumes.

Sydney Airport had the largest negative percentage change in forecast earnings. Commentary centred on management’s rejection of a $8.25 takeover offer from an infrastructure consortium. Morgans believes it is a signal of optimism for the future by the board and suspects this is not the last takeover approach, while the share price languishes due to covid. Citi expects the consortium, or another potential bidder, will eventually acquire the company, albeit at a slightly higher price.

Another consortium made a takeover approach for Spark Infrastructure Group. Ord Minnett feels management may come under pressure to engage though it doesn’t recommend investors buy the stock in anticipation of a higher bid price. The broker estimates there’s circa -14% potential downside to consensus valuation and the offer price appears fair.

Next was Audinate Group, and while FY21 guidance was a 2.5% beat on Morgan Stanley’s revenue estimates, there remains some impact from chip headwinds. With a record order backlog, the analyst highlights a head start in FY22. However, the Live segment is still likely depressed.

Finally, Western Areas appeared in the list of material forecast earnings downgrades. Macquarie lowered its rating to Neutral from Outperform last week after a mixed June quarter production report, with nickel production 7% higher than forecast, but shipments -5% lower. Given Flying Fox continues to underperform expectations, the ability to deliver a replacement source is now a key catalyst. The broker now expects the miner to report a small loss at its FY21 result release.

In the good books

ADBRI LIMITED (ABC) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 0/6/1

Morgan Stanley makes revisions to the ratings and preferences for building materials companies. While challenges remain in the short term, it’s felt Adbri will be well positioned to benefit, once encouraging infrastructure lead indicators translate to materials demand. The broker upgrades the rating to Equal-weight from Underweight and retains the $3.30 target. Industry view: Cautious. The analyst’s prior Underweight stance was more predicated on being the least preferred sector exposure rather than any meaningful issue with the valuation or demand drivers.

CSR LIMITED (CSR) was upgraded to Overweight from Equal-weight by Morgan Stanley B/H/S: 3/3/0

Morgan Stanley makes revisions to the ratings and preferences for building materials companies. The rating for CSR is lifted to Overweight from Equal Weight, due to underperformance versus the ASX200 by -18% since the FY21 results in May. This runs counter to the company’s position of having the greatest exposure of peers to the detached housing market, the strongest domestic end market, explains the broker. The target price of $6.30 is unchanged. The industry view is cautious. With a net cash position and strong cash generation, the analyst expects special dividends will be a regular feature and sees CSR trading on an attractive 6% fully franked yield for FY22.

MAAS GROUP HOLDINGS LIMITED (MGH) was upgraded to Add from Hold by Morgans B/H/S: 1/0/0

Morgans raises the rating to Add from Hold and maintains its $5.85 target price. It’s considered the $79m capital raising will further strengthen the balance sheet position, and the broker now forecasts FY22 net debt of just $54.7m. Along with total debt facilities, recently increased to $300m, the company is now free to pursue further M&A opportunities, believes the analyst. The broker makes modest EPS forecast downgrades, as the placement dilution is partially offset by lower net interest costs.

OCEANAGOLD CORP (OGC) was upgraded to Neutral from Underperform by Macquarie B/H/S: 1/2/0

OceanaGold has received renewed approval from the Philippines government for its Didipio mine, allowing it to restart. This removes a key obstacle to the resumption of operations and the company is now prioritising the retraining and hiring of its workforce. Meanwhile, news on Haile was less positive as re-handling and processing problems are weighing on costs and approval delays could affect the mine over the longer term. Didipio, in Macquarie’s view, remains the best asset and the rating is upgraded to Neutral from Underperform. Target is steady at $2.70.

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 1/3/1

Morgan Stanley makes revisions to the ratings and preferences for building materials companies. It’s felt downside risks prevail for the Boral share price in the short term, with a cessation of the takeover offer coinciding with the completion of the buyback. The broker expects the company’s index weighting to reduce, given Seven Group Holding’s increased stake and a reluctance from domestic investors, due to a lower free float and liquidity. Morgan Stanley downgrades the rating to Underweight from Equal-weight and reduces the target price to $6.80 from $7.60. Industry view is in-line.

DACIAN GOLD LIMITED (DCN) was downgraded to Underperform from Outperform by Macquarie B/H/S: 0/0/1

Macquarie assesses Dacian Gold had a softer end to FY21, with a modest guidance miss. A materially higher capex forecast at Mt Morgans in FY22 leads the broker to lower the rating to Underperform from Outperform. The target price also falls to $0.28 from $0.32. FY22 production estimates, however, were in-line with the analyst’s forecast. The company will release a new life-of-mine plan for Mt Morgans in the first quarter FY22.

POLYNOVO LIMITED (PNV) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 1/1/0

Polynovo has announced FY21 revenue of around $25.5m, signalling 34% growth over FY20. All geographies grew, although from a low base. Yet there is uncertainty regarding US hospitals re-engaging and a lack of formal guidance was a surprise to Ord Minnett, given robust commentary from US peers. Ord Minnett suspects FY22 will be lumpy and there is a wide range of potential outcomes. The broker resets base projections and awaits evidence of a more stable and predictable environment, downgrading to Hold from Accumulate. Target is reduced to $2.54 from $3.10.

SPARK INFRASTRUCTURE GROUP (SKI) was downgraded to Hold from Add by Morgans B/H/S: 2/5/0

Morgans downgrades its rating to Hold from Add, given the M&A-driven price spike, after Spark Infrastructure Group announced it had received a takeover approach. The broker’s target price of $2.80 is set in-line with the bid price. Given the group is a minority owner in the bidder’s companies, the analyst doesn’t foresee the FIRB having issues with the bid consortium. Also, as the group’s key electricity network assets are regulated, it’s felt there shouldn’t be issues with the ACCC’s review of the bid.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.