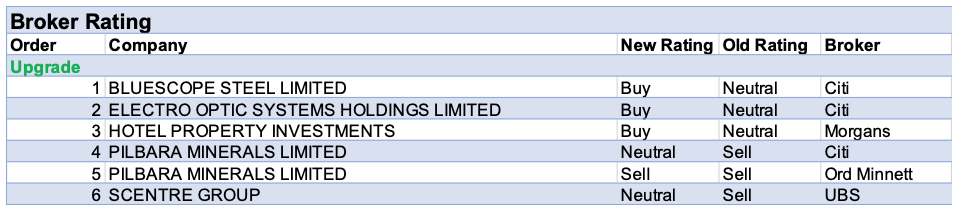

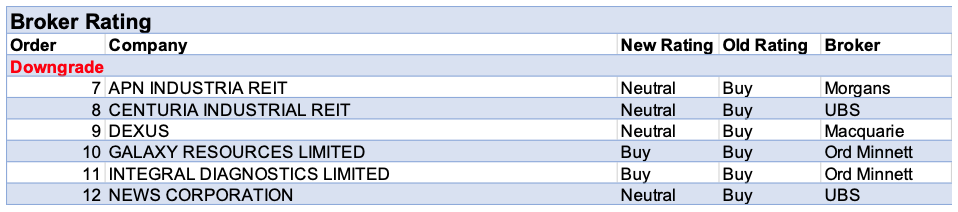

For the week ending Friday 4 June, there were 6 upgrades and 6 downgrades to ASX-listed companies by brokers in the FNArena database.

Both Citi and Ord Minnett raised their Pilbara Minerals’ Sell recommendations, to Neutral and Lighten from Sell respectively. As the only pure spodumene producer, Ord Minnett feels the company is the most leveraged to the broker’s recently-upgraded price forecasts from the lithium stocks under coverage. Meanwhile, Citi believes strong demand for lithium is uncovering latent supply and forecasts many a producer will be operating plants at full throttle.

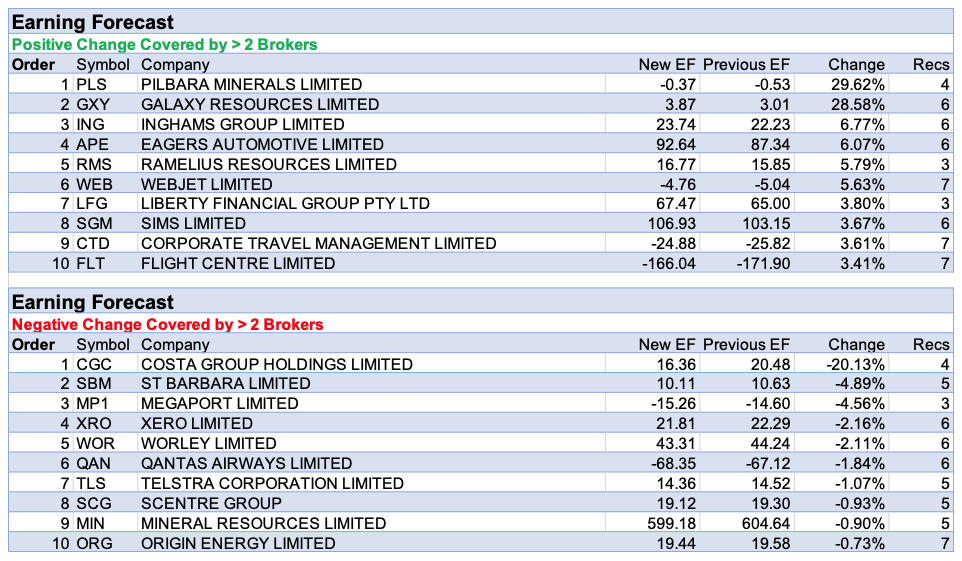

Pilbara Minerals headed up the table for largest percentage gain in earnings. Second up for forecast earnings changes by brokers was another lithium producer in Galaxy Resources, after raising FY21 spodumene production guidance for Mt Cattlin. In addition, management expects third quarter spodumene prices to be above US$750/t, including the cost of insurance and freight, which was higher than Macquarie expected.

Ord Minnett feels higher prices reflect spodumene catching up to the improving chemical prices, continued tightness along the lithium supply chain and the lack of any significant supply response.

Costa Group experienced the only material percentage downgrade to forecast earnings by brokers last week. As mentioned in this article for the week ending 28 May, more limited visibility for the earnings potential of the domestic Produce business prompted Morgans to lower the rating to Hold from Add. Additionally, there’s considered uncertainty remaining over the extent of the second half earnings recovery.

Conversely, Credit Suisse upgraded to Outperform from Neutral while lowering the target price dropping to $4.15 from $4.70. While management guidance was below market expectations it resulted from factors the broker considers are seasonal and not structural. Meanwhile, the company expects the June half performance to be marginally ahead of the last year.

In the good books

BLUESCOPE STEEL LIMITED (BSL) was upgraded to Buy from Neutral by Citi B/H/S: 2/4/0

On the observation that prices for both steel and scrap remain in an uptrend, Citi analysts have lifted their EPS estimates for BlueScope Steel and Sims “materially”. For BlueScope Steel specifically, the analysts suggest volume expansion at North Star, while cash is building fast, can offset price weakness later on. Citi predicts the company will announce large scale capital management within the next 24 months. Rating is upgraded to Buy from Neutral. Price target moves to $25 from $22.

ELECTRO OPTIC SYSTEMS HOLDINGS LIMITED (EOS) was upgraded to Buy from Neutral by Citi B/H/S: 1/0/0

Citi increases the rating for Electro Optic Systems Holdings to Buy (High Risk) from Neutral (High Risk), following the -19% share price decline since 29 April 21. The target price is lowered to $5.15 from $5.28. The broker highlights cash collection from a key customer has resumed and revenue is being progressively diversified. Additionally, it’s believed the current share price appears to be factoring in limited upside from new defence opportunities. The analyst’s FY21 earnings (EBIT) estimate reduces to $5.5m (excluding FX losses and interest income) in-line with the mid-point of the company’s guidance range, driven by higher-than-expected costs. Earnings estimates for FY22-3 are also cut by -$11m on higher costs.

HOTEL PROPERTY INVESTMENTS (HPI) was upgraded to Add from Hold by Morgans B/H/S: 2/0/0

Morgans lifts the rating of Hotel Property Investments to Add from Hold after the purchase of six pubs for $32.7m. All properties are leased to Australian Venue Co and have an initial term of 20 years. Potential catalysts include accretive acquisitions and asset revaluations. The target price is increased to $3.52 from $3.31.

PILBARA MINERALS LIMITED (PLS) was upgraded to Neutral from Sell by Citi and to Lighten from Sell by Ord Minnett B/H/S: 1/2/0

Strong demand for lithium is unravelling latent supply, report analysts at Citi. It is their forecast the market will likely remain in surplus for quite some time, with many a producer operating their plants at full throttle. Citi thinks the price of lithium is likely to remain range-bound over the next 18 months. Pilbara Minerals’ price target has lifted to $1.30 from $1.10. Upgrade to Neutral/High Risk from Sell/High Risk.

As the only pure spodumene producer, Ord Minnett notes Pilbara Minerals is most leveraged to the broker’s recently upgraded price forecasts of 10–25% over the next five years. The broker notes, at the latest closing price of $1.30 the company is imputing a flat US$760/t spodumene price with other commodities at spot. Ord Minnett’s updated model sees the company’s production ramping up from 290,000t in FY21 to 1.3Mtpa spodumene, or 155,000t lithium carbonate equivalent at all-in sustaining costs of US$400/t by FY27. Ord Minnett’s rating is upgraded to Lighten from Sell and target price increases to $1.05 from $0.80.

In the not-so-good books

APN INDUSTRIA REIT (ADI) was downgraded to Hold from Add by Morgans B/H/S: 0/2/0

Morgans downgrades APN Industria REIT’s rating to a Hold from Add on recent share price strength. The price target is increased to $3.28 from $3.17. Draft valuations have increased for 17 of 23 properties by 11.9% and the average cap rate has tightened by 51bps to 5.83%. The REIT’s portfolio is valued at $1.05bn across 37 assets (circa 60% industrial assets/40% business park assets). Occupancy at December was 97% with the industrial assets 100% occupied and business park assets at 80%.

GALAXY RESOURCES LIMITED (GXY) was downgraded to Accumulate from Buy by Ord Minnett B/H/S: 3/2/1

Galaxy Resources expects third quarter 2021 spodumene prices to be above US$750/t including cost of insurance and freight. Ord Minnett notes, the price upgrade cycle has been confirmed by all players, including China-based Ganfeng Lithium, which holds less than one month’s inventory of both carbonate and hydroxide. The broker has increased 2024 spodumene price by 25% to US$1,000/t, rivaling the previous cycle high. Ord Minnett believes higher prices reflect spodumene catching up to the improving chemical prices, continued tightness along the lithium supply chain and the lack of any significant supply response. With strong demand, low inventories and sidelined mines, Ord Minnett believes this looks set to continue. The Buy rating is downgraded to Accumulate, and price target increases to $4.20 from $4.10.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.