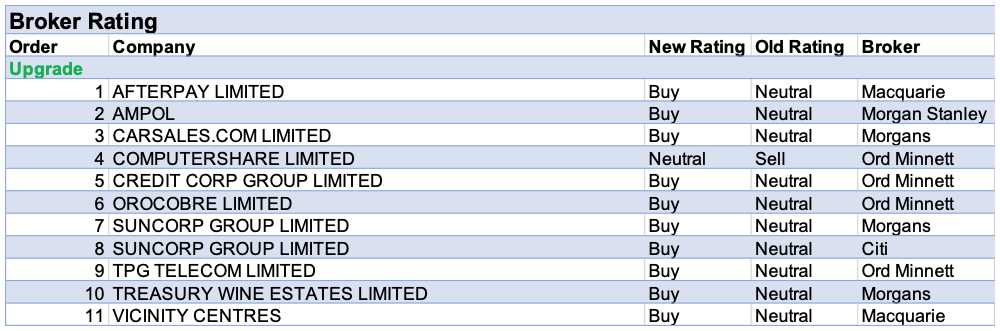

For the week ending Friday 21 May, there were 11 upgrades and 9 downgrades to ASX-listed companies by brokers in the FNArena database. The recent fall in the Suncorp Group share price enticed both Citi and Morgans to upgrade the company rating last week. As part of a general insurance forum, the bankinsurer confirmed that momentum in the banking franchise broadly continued as expected in the third quarter. Citi sees attractive medium-term upside potential as long as the group can deliver on at least some of its FY23 targets, about which the market remains sceptical.

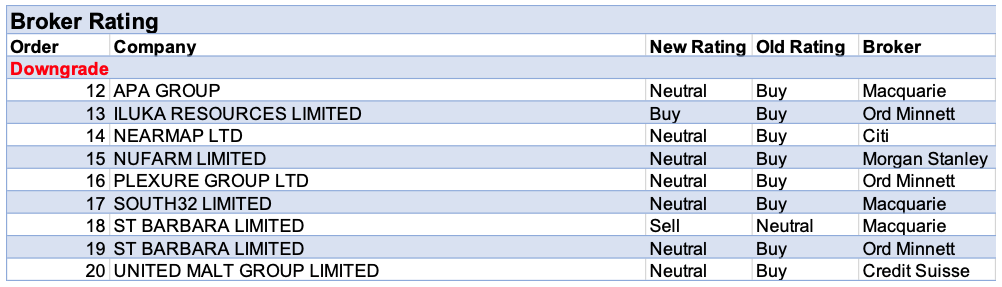

After another production downgrade, Ord Minnett feels it may take some time to regain confidence in St Barbara and the potential growth story. The broker lowered the company rating to Hold from Buy and reduced earnings estimates by -40% in FY21 and -30% in FY22. While Macquarie downgraded to Underperform from Neutral, the broker highlighted a number of meaningful upcoming catalysts that could be key to re-setting the production profile.

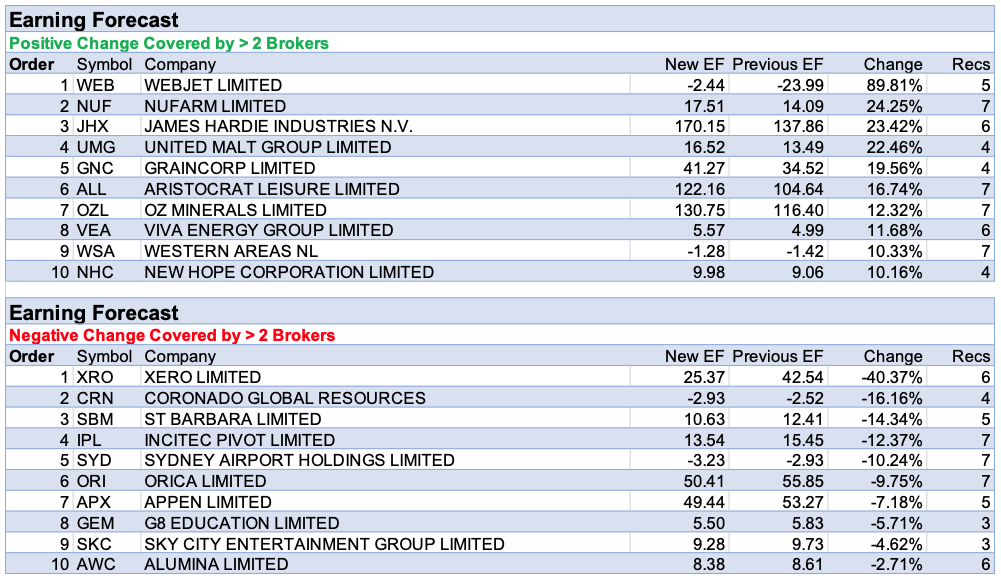

The largest percentage decline in forecast earnings by brokers in the FNArena database went to Xero, after the company lowered expectations for earnings margins in the previous week. This initially resulted in a hefty share price decline, which was largely recovered by the end of last week. Maybe investors began to agree with Morgan Stanley that continual reinvestment in product is necessary to sustain a leadership position. The broker remains Overweight.

Next was Coronado Global Resources. As mentioned last week, Credit Suisse downgraded met coal forecast for the June quarter and December half, which had the effect of reducing the broker’s net profit forecast by circa -67%.

Conversely, Webjet had the largest percentage rise in forecast earnings by brokers last week though many were pushing a recovery out to FY23 and beyond. The company posted a roughly in-line earnings result on stronger revenues offset by higher costs. The signs are looking more positive, UBS suggests, given potential re-openings for the northern summer, and pent-up demand shown by improving bookings.

There is a new niggle on the horizon, however, with Qantas sharply reducing commissions for travel agents.

Next up was James Hardie Industries as March-quarter profit exceeded the consensus forecast by 7%, with a stronger APAC/Europe offsetting a weaker North America. The latter doesn’t concern Credit Suisse as reported growth has so far been in the high teens this quarter. Macquarie also notes the slightly softer-than-expected North American trading was partially explained by the shutting down of two Texas plants.

A stronger volume recovery than anticipated in March drove United Malt Group’s first half earnings higher. Crucially for Morgans, the second half outlook comments were more upbeat. Additionally, all four broker updates on the FNArena database referenced the better–than-expected benefits flowing from the group’s Business Transformation Program of $30m by FY24.

As mentioned last week, GrainCorp reported strong first half results and materially upgraded FY21 guidance. The initial outlook for the 2021/22 east coast winter crop is considered encouraging by Morgans. UBS went further and believes significant upside remains if FY22 produces a bumper crop and feels the solid balance sheet offers M&A or capital return potential.

Via a strong first half result, Nufarm elicited a material average upgrade to forecast earnings by six of a potential seven broker updates within the FNArena database. Better seasonal conditions, lower costs and improved execution were considered keys to the result, according to Morgan Stanley, who downgraded the company’s rating on valuation concerns.

Ord Minnett’s increased forecasts also imply a recovery in earnings in the years ahead. Similarly to United Malt Group above, it was considered equally important that progress is being made toward the Performance Improvement Program target of $35–40m by FY22, on a run-rate basis.

Finally, Aristocrat Leisure enjoyed a lift in earnings estimations by brokers last week. The company is recovering much faster than Citi expected, fuelled by a reopening and stimulated US economy. A profit update was released last week just ahead of first half results due out today.

In the good books

AFTERPAY LIMITED (APT) was upgraded to Outperform from Neutral by Macquarie B/H/S: 4/2/1

After conducting a Buy Now Pay Later (BNPL) survey in the US, Macquarie observes there is limited brand loyalty among BNPLs. It’s estimated around 70% of users would prefer to sign up with a different BNPL rather than switch stores. The broker believes this increases the importance of having a large two-sided network of merchants/users of which Afterpay ranks the highest amongst peers. The broker upgrades to Outperform from Neutral and retains the $120 target price. In-terms of brand perception, among the brands surveyed, PayPal, Affirm and Afterpay ranked in the top three, in that order.

In the not-so-good books

ILUKA RESOURCES LIMITED (ILU) was downgraded to Accumulate from Buy by Ord Minnett B/H/S: 1/3/1

The company has indicated its Sierra Rutile operations will be suspended in six months if it is unable to make the project more profitable or attract a new investor. The announcement has come as no surprise to Ord Minnett with the broker noting this has been a troubled asset for quite a while. Iluka has better growth options available closer to home, states the analyst. As forecast earnings have been reduced by -14%, the broker’s price target has retreated to $8 from $8.20. The Buy recommendation has been downgraded one notch to Accumulate.

NEARMAP LTD (NEA) was downgraded to Neutral from Buy by Citi B/H/S: 1/2/0

Nearmap remains confident about successfully defending itself against Eagleview’s allegations of patent infringement. In Citi’s view, Nearmap can still be successful in the US even if it were to lose the lawsuit. Even so, Citi downgrades to Neutral from Buy as the broker expects legal proceedings to have a negative impact on demand in the US, in turn weighing on the share price. The target drops to $2 from $3.15.

NUFARM LIMITED (NUF) was downgraded to Equal-weight from Overweight by Morgan Stanley .B/H/S: 4/3/0

Despite a much improved first half result, Morgan Stanley lowers the rating for Nufarm to Equal-weight from Overweight due to valuation concerns. Better seasonal conditions, lower costs and improved execution were considered keys to the result. Group earnings (EBITDA) margins of 14% exceeded the broker’s forecasts. Strong margins in Europe were considered due to an improved mix, delivery of cost-out and raw material prices easing. The analyst increases the FY21 earnings (EBITDA) forecast by 5%. Target price falls to $5.30 from $5.60. Industry view: In-Line.

PLEXURE GROUP LTD (PX1) was downgraded to Hold from Buy by Ord Minnett B/H/S: 0/1/0

Plexure Group’s fully audited FY21 release is labelled “a reasonable set of revenue and EBITDA numbers” by Ord Minnett. The numbers were largely in-line with the unaudited guidance provided earlier. Cash flow generated surprised on the upside. However, downward pressure on the gross profit margin is seen as a concern by the broker. Main customer McDonald’s is making the company pay for a higher rate of communications and infrastructure costs as app usage increases. Ord Minnett has reduced its forecasts, while acknowledging risks have risen, but also that a re-negotiation of the contract is probably overdue, without putting too much faith in this actually happening. Lower forecasts have pulled back Ord Minnett’s price target to $0.80 from $1.36. Given higher short-term execution risks, the rating has been downgraded to Hold from Buy.

UNITED MALT GROUP LIMITED (UMG) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/2/0

United Malt Group’s first half result was solidly ahead of guidance, observes Credit Suisse. The result was driven by a stronger volume recovery than anticipated in March. The result also absorbed -$7m in non-recurring costs. The broker is positive with respect to market recovery and opportunities for further expansion and sees low risk to demand recovery in North America and the United Kingdom. Lockdowns in Asia may impact exports ex Australia, adds Credit Suisse. Even with the strong result, Credit Suisse reduces its rating to Neutral from Outperform led by a strong rise in the group’s share price since the March lows. The target price rises to $4.58 from $4.21.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.