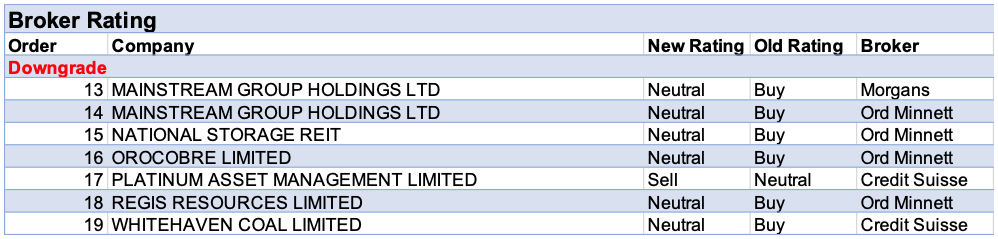

For the week ending Friday 16 April, there were 12 upgrades and 7 downgrades to ASX-listed companies by brokers in the FNArena database.

Mainstream Group received two downgrades from separate brokers. Both Ord Minnett and Morgans downgraded the company to a Hold rating in the belief the $2 bid for the company by SS&C Technologies was both fully valued and likely to be final. This has proven to be correct as the deadline of Friday 16 April has passed without a matching offer or more favourable terms from prior bidder Vistra.

The adjectives hefty and expensive were applied by two brokers to the price paid by Regis Resources for a 30% stake in the Tropicana gold mine. Nonetheless, the term transformational was also applied to the transaction and an increase in both scale and diversity were seen as positive attributes for the ‘new’ company.

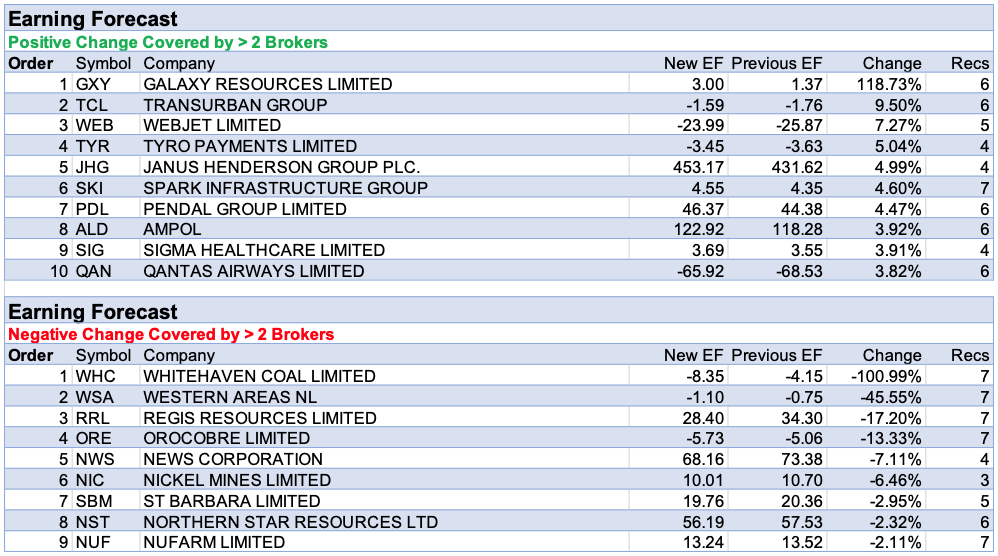

Galaxy Resources had the largest percentage increase in forecast earnings by brokers in the FNArena database last week.

The effective clubhouse leader was Whitehaven Coal after universal disappointment from the five brokers in the FNArena database that updated earnings forecasts last week. Production and sales were weaker than expected in the third quarter, impacted by floods in NSW, port damage and geological issues at the Narrabri mine.

In the good books

ABACUS PROPERTY GROUP (ABP) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 3/1/0

The acquisition of ezStorage by Public Storage in the US highlights for Ord Minnett the material difference in implied capitalisation rates between large US and UK listed self storage entities and Australia’s Abacus Property and National Storage (NSR). Both the Australian companies remain industry consolidators and the broker believes Australian self storage assets are undervalued. Abacus Property is upgraded to Accumulate from Hold. Target is steady at $3.10.

BANK OF QUEENSLAND LIMITED (BOQ) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 4/2/0

Bank of Queensland’s first-half net profit of $165m was broadly in line with Ord Minnett’s forecast of $166m. An interim dividend of 17c was declared, in line with the broker’s forecast. The result was pre-guided with hardly any surprises. Ord Minnett observes the bank delivered strong pre-provision profit growth of 3% half-on-half with support from funding cost tailwinds and improved execution in its mortgage business. The broker argues the bank is the best turnaround prospect in the sector, with potential upside from improvements in deposit mix and the delivery of revenue synergies at ME Bank. Ord Minnett upgrades to Accumulate from Hold with the target rising to $9.50 from $9.30.

WESFARMERS LIMITED (WES) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 1/5/1

Having reviewed the financial performance of the Wesfarmers retail businesses, Ord Minnett acknowledges its previous Lighten recommendation was the wrong call as the company has allocated capital in a firm manner and benefited from the pandemic. The broker finds Bunnings is well-positioned in most trading environments and increased home investment is a positive aspect that will allow it to cycle tough comparables. Catch Group is also proving to be a prescient acquisition with strong growth expected in coming years although operating earnings are likely to remain modest. Hence, Ord Minnett upgrades to Hold and raises the target to $53 from $50.

In the not-so-good books

NATIONAL STORAGE REIT (NSR) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 0/3/1

The acquisition of ezStorage by Public Storage in the US highlights for Ord Minnett the material difference in implied capitalisation rates between large US and UK listed self storage entities and Australia’s Abacus Property (ABP) and National Storage. Both the Australian companies remain industry consolidators and the broker believes Australian self storage assets are undervalued. Yet Ord Minnett downgrades National Storage to Hold from Accumulate based on valuation. Target is $2.05.

REGIS RESOURCES LIMITED (RRL) was downgraded to Hold from Buy by Ord Minnett B/H/S: 4/3/0

Regis Resources will buy a 30% stake in the Tropicana gold mine from IGO Ltd, to be funded with debt and equity. Ord Minnett observes the deal is dilutive on most valuation metrics and was disappointed there was no updated guidance for the asset. Still, the acquisition should improve asset quality and increase the mine life for the company. Rating is downgraded to Hold from Buy. Target is reduced to $3.40 from $4.20.

WHITEHAVEN COAL LIMITED (WHC) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 5/2/0

Whitehaven Coal’s March quarter performance disappointed Credit Suisse with solid output at the open-cut mines undone by problems at Narrabri mine that led to outages for four weeks in the half. The miner has cut its FY21 production and sales estimates yet again by -0.6-0.8mt for Narrabri. Also, the issues there eliminated cash generation in the quarter with no reduction in the net debt to date. The broker expected net debt to halve by the end of FY22 but sees that delayed by over two years now. Credit Suisse downgrades to Neutral from Outperform with the target price dropping to $1.55 from $1.95.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.