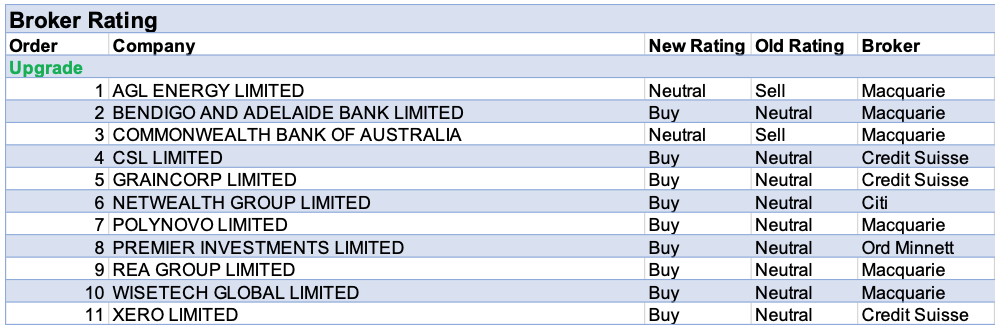

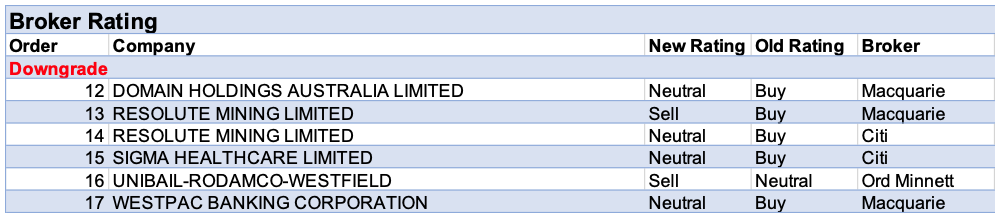

For the week ending Friday 26 March there were eleven upgrades and six downgrades to ASX-listed companies by brokers in the FNArena database.

Macquarie downgraded Resolute Mining to Sell from Buy while Citi downgraded to Neutral from Buy after the company was advised to cease all activities after Ghana’s Minerals Commission advised its lease on the Bibani gold mine had been terminated. The impact on the slated US$105m Bibiani divestment to Chifeng at this stage is unknown. The termination of the lease is unexpected and the company is seeking legal advice.

Despite releasing pre-announced first half results, Citi downgraded the rating for Sigma Healthcare to Neutral from Buy on valuation concerns and lowered its target price. Macquarie sees medium-term risks from a reliance on sales to Chemist Warehouse.

Also in defiance of a first half earnings beat, Credit Suisse downgraded Domain Holdings to Neutral from Outperform on management guidance for FY21 total costs that will be significantly higher than expected. Costs are also expected to step up in FY22 on account of the reversal of the JobKeeper/Zipline benefit.

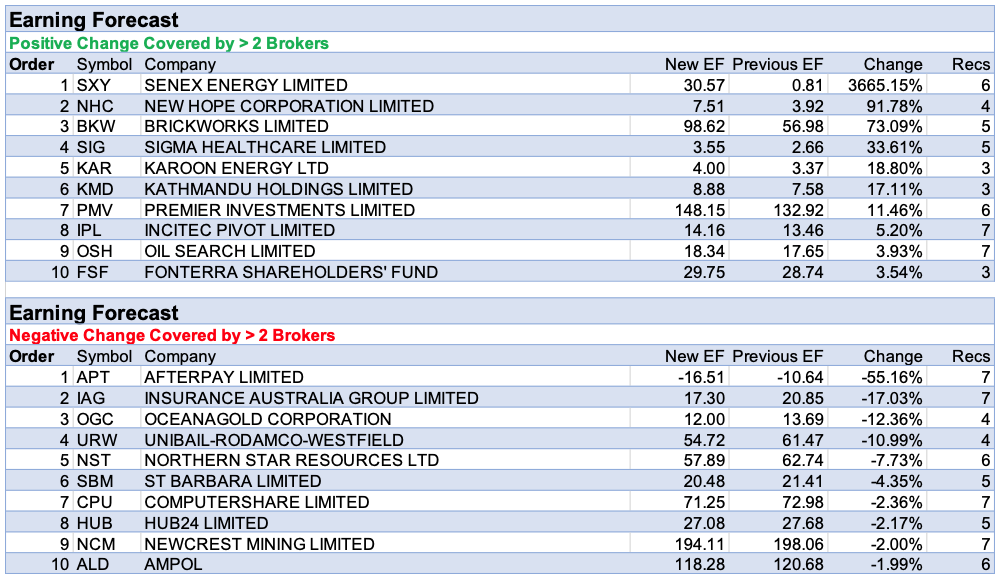

Afterpay headed the list last week for the largest percentage fall in earnings forecasts by brokers in the FNArena database. Macquarie lowered the terminal growth rate forecast to 3% from 4.5% and cut the target to $120 from $140. No cause for panic over a potential period of industry consolidation though, as the broker expects a better longer-term outlook afterwards.

Insurance Australia Group experienced the second largest decline in broker earnings forecasts. Of the four brokers’ updates, two felt claims relating to the recent NSW floods were manageable, one felt they could lead to a catastrophe event and add to reinsurance pricing pressure while Credit Suisse resumed coverage with an Outperform rating.

Senex Energy was the leader in terms of positive revision to broker earnings forecasts for the week. However, this should be ignored as brokers adjusted their financial models for a company share consolidation.

The real ‘leader’ was New Hope Corporation after first half earnings and a four cent dividend exceeded broker forecasts. This was driven by higher than expected realised prices and a cost reduction at Bengalla. Thermal coal prices have increased around 100% since the lows of mid- 2020.

Brickworks would have been an interested observer of New Hope’s result, given a 39.4% interest in Washington H. Soul Pattison, which in turn owns 61.1 % of the coal company. Brokers upgraded earnings forecasts after first half results for Brickworks showed stronger contributions from the Investments and Property segments though building products North America was weaker than expected.

Readers will recall from above that Sigma Healthcare was downgraded by Credit Suisse to Neutral from Buy on valuation grounds. The company also experienced a reduction in the average target price by brokers in the FNArena database. This, of course, does not preclude a simultaneous lift in average earnings forecasts by those same brokers.

In the good books

GRAINCORP LIMITED (GNC) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/0/0

Credit Suisse has increased medium-term forecasts to align with the company’s new guidance for through-the-cycle earnings. The broker also upgrades FY22 amid expectations of another above-average east coast crop. The broker has frequently argued that the market has underrated cost reductions over recent years while noting the addition of capacity to the east coast grain industry peaked several years ago. This has created a stable competitive environment. Credit Suisse upgrades to Outperform from Neutral and raises the target to $5.59 from $5.06.

NETWEALTH GROUP LIMITED (NWL) was upgraded to Buy from Neutral by Citi B/H/S: 1/4/0

While uncertainty remains on what cash margins Netwealth and Hub24 will be able to earn in the future, the broker believes further downside risk is limited and the reduction in cash margins is to more sustainable levels. The broker expects both platforms will deliver strong earnings growth. Netwealth offers less execution risk, the broker notes, as Hub24 has to bed down acquisitions, but Hub offers greater earnings leverage. Netwealth upgraded to Buy from Neutral. The depression in cash margins takes the target down to $16.10 from $16.95.

PREMIER INVESTMENTS LIMITED (PMV) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/4/0

Premier Investments reported a first-half FY21 net profit of $188.2m, above Ord Minnett’s forecast of $176m. Premier Retail operating earnings at $237.8m came in above the broker’s $230.4m estimate and guidance of $221–233m. An interim dividend of 34c was declared which was below Ord Minnett’s 44c expectation. In the broker’s view, Premier Retail operating income margin expansion and Smiggle providing leverage to reopening following covid will position Premier Investments well to manage a difficult comparable period in some brands especially Peter Alexander from 2020. Ord Minnett upgrades its rating to Accumulate from Hold with the target price rising to $27 from $24.

POLYNOVO LIMITED (PNV) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/0/0

Macquarie continues to believe Polynovo is well-positioned to increase its share within existing indications. Moreover, entry into new indications with sizeable markets, such as chronic wounds and hernia, should support growth over the medium to longer term. There is a degree of short-term uncertainty related to the pandemic, the broker acknowledges. Rating is upgraded to Outperform from Neutral. Target is raised to $3.20 from $2.75.

In the not-so-good books

RESOLUTE MINING LIMITED (RSG) was downgraded to Underperform from Outperform by Macquarie and to Neutral from Buy by Citi B/H/S: 0/1/1

Resolute Mining has received notice from Ghana’s minerals commission advising that its lease on the Bibiani gold mine has been terminated. The company has been advised to cease all activities. Resolute Mining was in the process of selling Bibiani to Chifeng Jilong and close the deal this month. The termination of the lease is unexpected and the company is seeking clarification. Macquarie suspects it is unlikely the sale will go ahead, at least in its current form. The sale is removed from the broker’s estimates and the rating is downgraded to Underperform from Outperform. Target is reduced to $0.55 from $1.00.

Citi cuts the rating to Neutral (high risk) from Buy (high risk) and reduces the target to $0.75 from $0.90 after news of the termination of the mining lease for Bibiani. The impact on the slated US$105m Bibiani divestment to Chifeng at this stage is unknown. Activities at Bibiani (Ghana) are to cease after the termination. The analyst is disappointed, to say the least, especially when this news is coupled with recent industrial action at Syama and the contested circa US$66m in VAT and other tax balances in Mali. The company is seeking legal advice regarding validity, appeal rights and any recourse. Citi still expects the company can meet its debt repayment obligations either way without the need for capital though the outlook could change on gold weakness or further geopolitical events.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.