For the week ending Friday October 30, there were 15 upgrades and 7 downgrades to ASX-listed stocks in the FNArena database. Of the fifteen upgrades, four companies received twin upgrades from separate brokers. They were CSR, Hub24, Regis Resources and Shopping Centres Australasia. Meanwhile, Coca-Cola Amatil received three ratings downgrades.

Shopping Centres Australasia was a beneficiary after Ord Minnett adopted a more positive stance on the Australian REIT sector overall. However, there were both winners and losers from the broker’s review, as evidenced by the tables for weekly upgrades and downgrades. They show two REIT’s were upgraded and three downgraded during the week. Ord Minnett describes the shape of the recovery for the sector will best be described by the letter K. This is because some asset classes have strong capital growth prospects whereas others are in decline, and the chasm is widening.

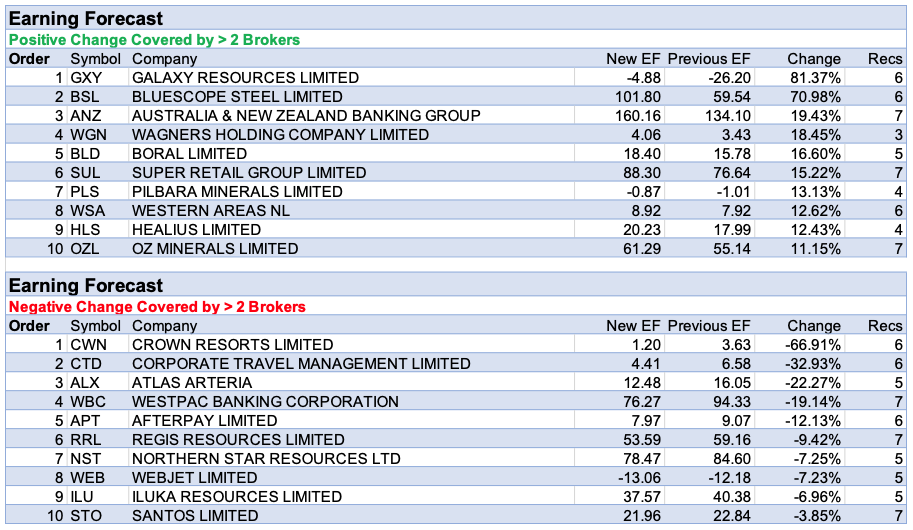

The largest fall in earnings forecasts was recorded by Crown Resorts as the regulatory focus has increased since AUSTRAC commenced a formal enforcement investigation. As mentioned last week, while this is currently centred on the Melbourne VIP business, it’s considered the broader company may come under scrutiny as well. The fact that Melbourne has only recently opened, and a Sydney launch is up in the air is not helping the cause.

Atlas Arteria continued a pattern of earnings downgrades. Last week brokers identified some concerning trends regarding the Atlantia’s Abertis (French) toll road network. This week Macquarie conceded the virus does hurt earnings and should in turn impact dividends in 2021. Fortunately, the company has plenty of surplus cash and the broker sees no financial threat.

Also featuring in the table for prominent percentage declines in earnings forecasts was Westpac. The bank announced second half cash earnings will be affected by -$1.22bn in “notable items”, which was greater than the consensus amount previously estimated by the broking community.

Some excitement surrounded Galaxy Resources during the week after a quarterly update revealed increasing lithium production and inventory levels to help satisfy December quarter demand for shipments. The second largest percentage increase in forecast earnings went to Bluescope Steel after a trading update showed a much improved first half. A stronger-than-expected performance in Australian Steel Products was supported by resilient volumes. Building products in Asia and North America also rebounded strongly.

Earnings forecasts by brokers for ANZ Bank also increased after there were positive signs on both costs and asset quality, with impairment charges lower than generally expected. The majority of the seven brokers on the FNArena database agreed the bank’s FY20 result either exceeded or met expectations.

Finally, one broker considered Wagners well-positioned to benefit from infrastructure and housing stimulus, while another broker continues to see clear, company specific drivers to support the company’s earnings recovery in FY21. The net result was a material boost to average earnings forecasts for the week.

In the good books

COLES GROUP LIMITED (COL) was upgraded to Add from Hold by Morgans B/H/S: 4/3/0

The Coles Group reported first quarter sales growth slightly better than the forecast of Morgans. Like-for-like sales for the core Supermarkets business increased 9.7% (broadly in line with the broker’s forecast). Additionally, Liquor increased 17.8% and Express increased 10.2%. Both of these latter segments delivered stronger-than-expected growth, assesses the analyst. Management advised that for the first four weeks of the second quarter Supermarkets like-for-like sales were up 6.4% while Liquor like-for-like sales were 16.9% higher. The rating is upgraded to Add from Hold and the target price is increased to $19.40 from $18.90.

HUB24 LIMITED (HUB) was upgraded to Neutral from Underperform by Credit Suisse and to Add from Hold by Morgans B/H/S: 3/2/0

HUB24 has made several acquisitions for a total consideration of $90m and announced a $60m equity raising. The company will also sell Paragem to Easton for scrip. Credit Suisse assesses the acquisitions in total are financially accretive and also bring new revenue opportunities. The broker raises FY21-23 forecasts for earnings per share by 1-15% and increases the target to $21.50 from $18.70. As the company continues to capitalise on the opportunity in the wealth market and provides strong earnings growth, the rating is upgraded to Neutral from Underperform.

Morgans believe that Hub24 is acquiring scale and some capability, after the company announced three acquisitions and the divestment of Paragem. Net consideration will be around -$93m (including integration and transaction costs), to be funded primarily via additional capital raised (around $60m) and scrip (around $30m), details the broker. Acquisitions include Xplore Wealth (XPL) (around $60m), Ord Minnett PARS (around $10m) and an equity stake in Easton Investments (around $14m for up to an approximate 40% stake). Management expects the transactions to be circa 13% EPS accretive in FY22. Morgans continues to see the largest near-term earnings risk is the impact from lower rates (cash rate decline or cut to the margin achieved on cash). The rating is increased to Add from Hold and the target price is increased to $22.40 from $18.10.

JB HI-FI LIMITED (JBH) was upgraded to Neutral from Sell by Citi B/H/S: 1/6/0

JB Hi-Fi and Good Guys sales slowed in August-September as Citi expected given super withdrawals were made in July and then Melbourne went into lockdown. The December quarter should be incrementally slower again, but the broker increases earnings forecasts on the assumption of a longer duration of elevated sales as the housing outlook improves into the second half FY21 and FY22. Low interest rates are supporting investment in the home, driving demand for household goods and offsetting the pull-forward of sales in the September quarter, Citi suggests. Target rises to $49.30 from $44.80, upgrade to Neutral from Sell.

In the not-so-good books

Australian REIT sector analysis by Ord Minnett

Ord Minnett has undertaken an in-depth analysis of the Australian REIT sector, which suggests asset values will recover more strongly than the broker previously expected. The broker anticipates the shape of the recovery can be best described as the letter K, as some asset classes have strong capital growth prospects versus others that are in decline, and the chasm is widening. The analysts move to a more positive stance on the sector, which sees the REITs that Ord Minnett covers trading about -10% on average below the broker’s revised valuations. Ord Minnett forecast an average uplift in book values of 30% for industrial REITs, 25% for the long weighted average lease expiry (WALE) segment, and 15% for convenience retail and self-storage assets. The broker’s review of $7bn of sales suggests transaction markets are strong (excluding retail malls), high-quality assets are ‘well bid’ and return spreads are elevated, despite lower assumed long-term growth.

SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP (SCP) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 3/2/1

As a result of the review by Ord Minnett, the rating for Shopping Centres Australasia is increased to Accumulate from Hold and the target price is increased to $2.55 from $2.30.

VICINITY CENTRES (VCX) was upgraded to Buy from Hold by Ord Minnett B/H/S: 2/3/1

As a result of the review by Ord Minnett, the rating for Vicinity Centres is upgraded to Buy from Hold and the target price is increased to $1.70 from $1.60.

ABACUS PROPERTY GROUP (ABP) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 2/2/0

As a result of the review by Ord Minnett, the rating for Abacus Property Group is decreased to Hold from Accumulate and the target price is increased to $3.10 from $3.

BWP TRUST (BWP) was downgraded to Hold from Buy by Ord Minnett B/H/S: 0/2/1

As a result of the review by Ord Minnett, the rating for BWP Trust is decreased to Hold from Buy and the target price is increased to $4.40 from $4.30.

DEXUS PROPERTY GROUP (DXS) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 2/3/1

As a result of the review by Ord Minnett, the rating for Dexus Property Group is decreased to Hold from Accumulate and the target price is increased to $9.85 from $9.65.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.