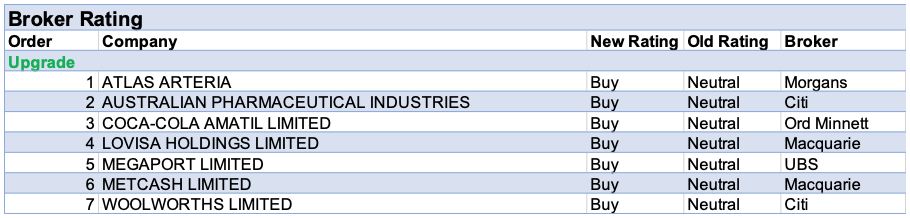

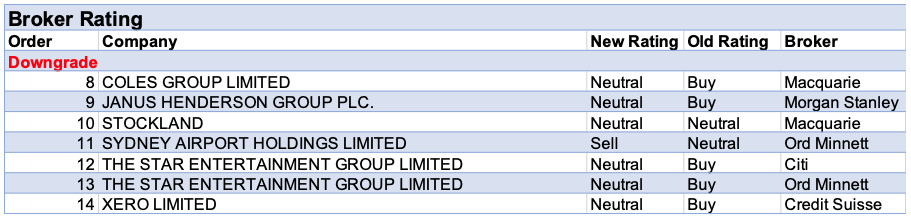

For the week ending Friday October 23, there were 7 upgrades and 7 downgrades for individual ASX-listed stocks. All 7 upgrades by brokers in the FNArena database went to a Buy rating. Of the 7 downgrades, two related to Star Entertainment Group.

The downgrades for Star arose from concerns the positive catalysts from the reopening of state borders are likely to be offset by increased competition and the regulatory focus shifting to the broader VIP market.

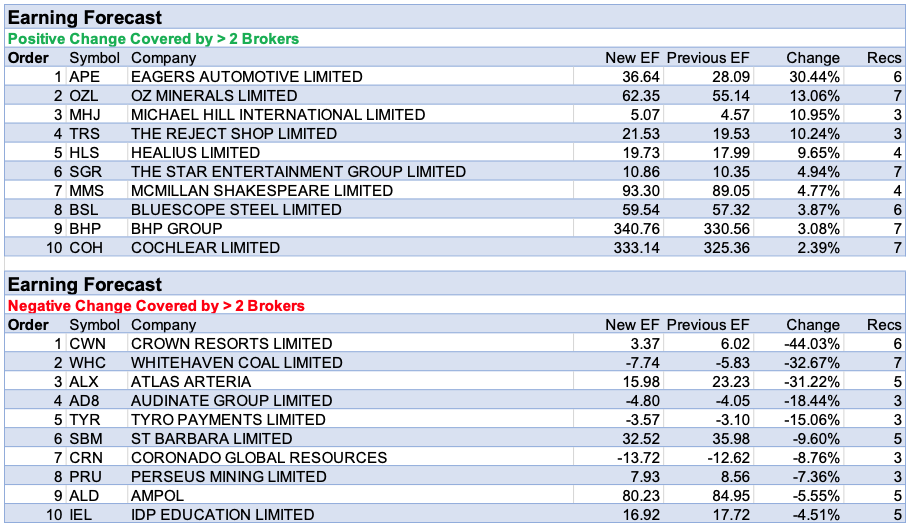

Eagers Automotive topped the table for the largest percentage increase in earnings for the week, as sales were up strongly in a quarterly update and the company’s margins are benefiting from an ongoing cost-out program. Next was Oz Minerals as strong gold and copper prices are expected to drive earnings momentum over 2021-22. September quarter gold production beat some brokers’ forecasts, thereby leading the miner to reduce its gold cost guidance and increase its gold production guidance. The backdrop for copper is also considered promising.

Favourable retail conditions have led to a sizeable percentage earnings upgrade by brokers for Michael Hill International. This occurred as first quarter gross margins improved by 100 basis points. Consequently, Citi forecasts the first half retail gross margin to increase to 60.6%. Not far behind in terms of an earnings upgrade was The Reject Shop, with catalysts including opportunities from a stay-at-home Christmas, a better staples offer and rental cost efficiency. Healius also posted a 151% increase in earnings in the September quarter on a 16.5% increase in margins. While pathology was helped by covid-19 testing one broker (of the seven covering the stock in the FNArena database) highlighted non-covid revenues were ahead of what they were last year.

Crown Resorts led the negative percentage earnings changes for the week. The regulatory focus has stepped up as AUSTRAC commences a formal enforcement investigation. While this is currently centred on the Melbourne VIP business, it’s considered the broader company may come under scrutiny as well. The fact that Melbourne is closed, and a Sydney launch is up in the air is not assisting matters.

As mentioned last week, the opinions of six brokers varied when casting an eye over the third quarter operational performance of Whitehaven Coal. On balance, strong production and sales were overwhelmed by weaker pricing for coking and thermal coal. As a result, the company received a large percentage downgrade to earnings estimates for the week.

Atlas Arteria received an upgrade in rating by Morgans as third quarter traffic and revenue were ahead of the broker’s forecast. However, the analyst also alluded to some concerning trends regarding the Atlantia’s Abertis (French) toll road network. Overall, once the view of Macquarie is taken into account, the average percentage earnings outlook took a tumble.

Despite Tyro Payments’ acquisition of the Bendigo and Adelaide Bank portfolio of merchant acquirer customers, the earnings outlook was reigned in. This was due to caution surrounding the risk of elevated churn rates over coming months and concerns over what will happen to revenue growth rates post the pandemic.

In the good books

ATLAS ARTERIA (ALX) was upgraded to Add from Hold by Morgans B/H/S: 3/2/0

Third quarter traffic and revenue declined -2.7% and -1.9%, respectively, which was 2% ahead of Morgans forecast. Traffic is considered to have benefited from the relaxation of covid-19 restrictions from May-July. Also the start of the summer holiday season assisted. However, signs for a continuing recovery into the fourth quarter are not good, according to the broker. Atlantia’s Abertis French toll road network, which releases weekly data that has correlated closely with the APRR’s performance (in Eastern France), has seen traffic deteriorate since peaking in August. Traffic was down around -10% in the first week of October and the analyst is concerned that daily new cases of covid-19 in France have been growing rapidly. Morgans base case assumes the APRR’s traffic returns to trend growth by FY22, despite downgrades to short-term expectations. At current prices, the broker estimates a 12-month potential total shareholder return of 19%. The rating is upgraded to Add from Hold and the target price is increased to $7.01 from $6.83.

AUSTRALIAN PHARMACEUTICAL INDUSTRIES (API) was upgraded to Buy from Neutral by Citi B/H/S: 1/1/1

Australian Pharmaceutical Industries’ FY20 result showed a net loss of -$8m. The company declared a dividend of 2c (which had been suspended at its first-half result) Citi notes the major highlight of Australian Pharmaceutical Industries’ FY20 result was an extraordinary reduction in its working capital and net debt. The company did not provide any FY21 guidance and the broker has lowered its operating income forecast by -5% Rating is upgraded to Buy from Neutral with the target price rising to $1.40 from $1.25.

LOVISA HOLDINGS LIMITED (LOV) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/1/1

Like-for-like sales in the first 16 weeks of the first half were down -10.2%. Macquarie interprets this implying flat sales across those stores that were opened in the most recent eight-week period. The broker assesses a recovery, ex Asia, does not require a reopening of borders but rather a return to fewer restrictions and normal behaviour within geographic zones. Macquarie is now more positive about the profile of recovery and expects store roll-outs to return to previous run rates in FY22. Rating is upgraded to Outperform from Neutral and the target raised to $9.57 from $7.50.

MEGAPORT LIMITED (MP1) was upgraded to Buy from Neutral by UBS B/H/S: 1/2/0

UBS observes new ports saw a strong rebound in the first quarter after the soft June quarter result. The broker takes this to mean the momentum trajectory is back on track. The structural shift to cloud remains intact, highlights the broker and waits for more potential developments around SD-WAN/MVE either in terms of the revenue model or new potential partners onto the platform. With port growth back on track, UBS upgrades its rating to Buy from Neutral. The target price rises to $16.45 from $16.

METCASH LIMITED (MTS) was upgraded to Outperform from Neutral by Macquarie B/H/S: 6/0/0

Macquarie rejigs its order of preference in the Australian supermarket sector. Third-party payment data suggest strong sales growth has continued into the first half. The themes of internet sales and shopping local favours Metcash and Woolworths (WOW) over Coles (COL). Macquarie now expects Metcash has gained share in food which will be sticky over FY21. Moreover, strong sales in hardware are likely because of increased renovation activity. Rating is upgraded to Outperform from Neutral and the target raised to $3.30 from $3.05.

In the not-so-good books

COLES GROUP LIMITED (COL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 3/4/0

Macquarie rejigs its order of preference in the Australian supermarket sector. Strong volumes have been maintained but internet sales and the shopping local theme both favour Woolworths (WOW) and Metcash (MTS) over Coles. The broker notes the Coles Little Treehouse Books campaign has not resonated strongly with customers compared with the more successful Ooshies campaign at Woolworths. Rating is downgraded to Neutral from Outperform and the target is reduced to $18.70 from $19.80.

JANUS HENDERSON GROUP PLC. (JHG) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 2/2/0

Janus Henderson Group’s recent share price rally (up 32%) with no adjusted earnings growth expected in FY21 and limited upside prompts Morgan Stanley to downgrade its rating to Equal-weight from Overweight. The target price rises to $40.10 from $38.50. The broker expects September quarter net outflows to be -US$3.8bn. Retail flows data suggest a slowdown in the momentum with outflows expected to be circa -US$0.5bn. Morgan Stanley suspects this will make it hard for the group to deliver sustainable inflows in the near term since retail flows make up circa 65% of its assets under management (AUM). The broker is of the view Janus needs to deliver consistent institutional inflows to give investors some confidence. The group would also do well to push more into dedicated ESG products where the broker notes the group is lagging its peers. Industry view is In-line.

THE STAR ENTERTAINMENT GROUP LIMITED (SGR) was downgraded to Hold from Accumulate by Ord Minnett and to Neutral from Buy by Citi B/H/S: 4/3/0

Ord Minnett downgrades its rating to Hold from Accumulate with the target price increasing to $3.50 from $3.25. Star Entertainment Group provided its first-half FY21 update. The broker is pleased to note deleveraging plans appear to be successfully addressing the debt overhang. The broker feels Sydney’s competitive environment may benefit Star more than expected. On the flip side, domestic revenue trends have softened to about 75% from 80% a year ago. Ord Minnett has increased its FY21 operating earnings forecasts by 10.7% due to stronger Queensland revenues and better margins.

Citi downgrades Star Entertainment Group to Neutral from Buy with the target price rising to $4 from $3.60. The downgrade comes ahead of competition ramping up with the opening of Crown Sydney (CWN) in the second half of FY21. Supporting catalysts have played out, believes the broker, prompting the downgrade. Star’s domestic gross gaming revenue declined by -25% year to date (till 15 October). Citi expects Sydney domestic’s gross gaming revenue to come down by circa -40-50% driven by restrictions. The broker continues to prefer Star Entertainment over Crown Resorts but believes positive catalysts from the reopening of state borders are likely to be offset by increased competition and the regulatory focus shifting to the broader VIP market.

XERO LIMITED (XRO) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/3/1

The share price has materially outperformed since late September, Credit Suisse notes. The broker now believes the current share price factors in the macro environment and the valuation relative to peers seems appropriate. While the macro environment remains supportive it is increasingly understood by the market. Target is raised to $111 from $88. Rating is downgraded to Neutral from Outperform as a result.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.