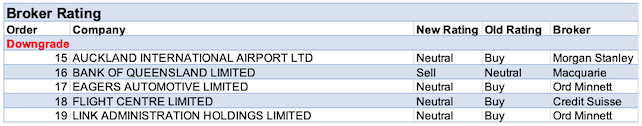

Another positive week (ending Friday October 16) for ASX-listed stocks, resulted in 14 upgrades and 5 downgrades by FNArena database stockbroking analysts.

Bank of Queensland received two upgrades and one downgrade to ratings. This may be explained in terms of two brokers having the same positive outlook and one being diametrically opposed. On most occasions, when a stock is simultaneously upgraded and downgraded it is explained by the relative starting position of the target prices in relation to the current share price.

On this occasion, all three broker’s started with identical target prices or estimated valuations in 12 months’ time. On the one hand, the bank was described as conservatively provisioned with limited downside, while on the other hand, it was overvalued with a price earnings (PE) premium 25% above its five-year average relative to peers. It’s sometimes all in the eye of the beholder and happily this creates a marketplace of buyers and sellers.

In a similar vein, Link Administration received one upgrade and one downgrade in rating. However, the waters are more muddied in this case due to an approach by a consortium to acquire 100% of the company’s shares. The upgrade was on the basis of the strategic interest in the company, while the downgrade was prompted by a strong uplift in the share price following interest from the consortium.

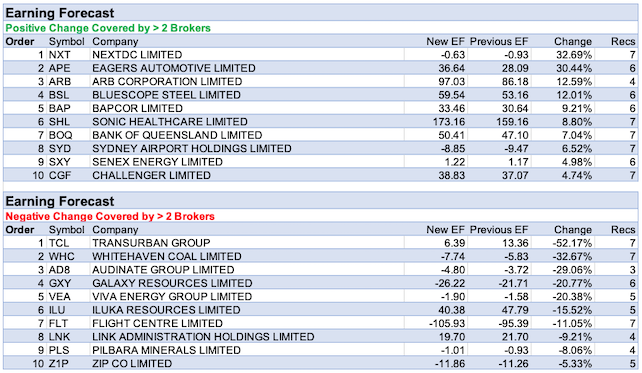

The largest percentage increase in earnings was reserved for NextDC, after a renegotiation of debt facilities. According to some brokers, this not only significantly reduces interest costs but also de-risks the company’s data centre roll-out strategy. Eagers Automotive had the second largest percentage increase, and next in order was ARB Corp after reporting strong sales figures. The company is benefiting from multiple drivers including higher consumer spending and domestic tourism. Bluescope Steel also received a significant boost to earnings forecasts from US steel spreads, which have effectively doubled since their July lows. There is an expectation that the company’s free cash flow yield will improve materially in coming years.

As highlighted last week, Transurban Group also suffered a large percentage decline in earnings forecasts after a first quarter traffic update. In addition, there was a rating downgrade by one broker last week that noted covid-19 continues to ravage Citylink traffic volume by -59% and declines of between -30% to 50% for the US.

Opinions varied for six brokers casting an eye over the third quarter operational performance of Whitehaven Coal. On balance, strong production and sales were overwhelmed by weaker pricing for coking and thermal coal. As a result, the company received a large percentage downgrade to earnings estimates for the week.

Despite favourable target price moves for Audinate, EPS estimates moderated for the company. Not far behind in the percentage earnings downgrades table were both Galaxy Resources and Viva Energy Group. Lower production and weakness in the lithium market amid elevated inventory and mothballed capacity is not a happy recipe for Galaxy Resources. Neither is lower than expected retail and commercial volumes and a worse than anticipated loss in refining for Viva Energy Group.

Brokers were generally disappointed with Iluka Resources’ production and sales of zircon and rutile in the September quarter. The immediate issue/catalyst for the stock is the demerger of Deterra, which (assuming shareholder approval) will be listed on October 23.

Total Neutral/Hold recommendations take up 51.29% of the total, versus 38.36% on Neutral/Hold, while Sell ratings account for the remaining 10.34%.

In the good books

ANSELL LIMITED (ANN) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 3/3/1

Ansell is a clear beneficiary of the coronavirus pandemic to date, observes Ord Minnett. The broker also thinks this will continue given the increased demand for hygiene and personal protective equipment (PPE) products is likely to endure well into the future. The broker highlights higher input costs have been fully passed on to customers, unlike in the past. Earnings estimates have been raised and the broker now thinks Ansell is undervalued. Recommendation upgraded to Accumulate from Hold with the target price increasing to $44.00 from $36.20.

BANK OF QUEENSLAND LIMITED (BOQ) was upgraded to Outperform from Neutral by Credit Suisse and Upgrade to Add from Hold by Morgans B/H/S: 3/3/1

Following the FY20 result Credit Suisse upgrades cash earnings estimates by 3-4% for FY21 and FY22. The broker now envisages the downside is limited, amid a conservatively set provision for the pandemic and good execution of the bank’s strategy, which is delivering underlying profit growth. Nevertheless, the broker acknowledges Bank of Queensland is still likely to struggle to achieve double-digit returns on equity in the near term. Target increases to $7.60 from $5.50 and given the limited downside risk the rating is upgraded to Outperform from Neutral.

Bank of Queensland has reported FY20 cash earnings of $225m, which is 4% better than Morgans expected. The beat is largely the result of net interest income being stronger than the broker expected. The bank will pay a 12cps fully franked dividend. Despite Morgans forecasts being above consensus, they are starting to look conservative in light of this new data, explains the broker. Morgans adjusts EPS forecasts up by 3.5% for FY21 and reduces FY22 by -1.25%. The rating is increased to Add from Hold and the target price is increased to $7.20 from $5.50.

See downgrade below.

G.U.D. HOLDINGS LIMITED (GUD) was upgraded to Buy from Neutral by Citi B/H/S: 1/4/0

Citi upgrades GUD Holdings to Buy from Neutral with the target price rising to $14.30 from $12.75. GUD Holdings’ medium-term outlook appears better placed than previously expected due to changes in consumer mobility behaviour. The company is trading at a -21% discount to Bapcor (BAP), considered excessive by Citi given the strong demand for aftermarket auto parts is likely to offset a risk of customers pursuing private label strategies. Earnings estimates upgrade for FY21-22 due to better than expected first-quarter sales in Auto and Davey.

MEDIBANK PRIVATE LIMITED (MPL) was upgraded to Overweight from Equal-weight by Morgan Stanley B/H/S: 2/5/0

Medibank Private’s policy-holders grew 0.6% in FY20 amid the pandemic. Morgan Stanley considers this a good performance and believes the insurer’s target for 1% growth in FY21 is achievable. FY21 guidance expects claims to be broadly in line with FY20’s circa 2.9% growth. Morgan Stanley lowers its claims growth forecast by -0.5-2.4% leading to upgrades in earning growth forecasts in FY21-22. Morgan Stanley upgrades its rating to Overweight from Equal-weight with the target price increasing to $3.10 from $2.70. Industry view: In-line.

NORTHERN STAR RESOURCES LTD (NST) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 1/4/0

Ord Minnett now assesses the merger with Saracen Mineral Holdings makes for a compelling gold option for large domestic and global investors. The portfolio offers a rare combination of well-run mines, production growth, cash flow and lower sovereign risk exposure. As a result the broker upgrades Northern Star to Hold from Lighten and raises the target to $13.90 from $11.50.

In the not-so-good books

EAGERS AUTOMOTIVE LIMITED (APE) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/3/0

Eagers Automotive’s third-quarter trading update was strong, notes Ord Minnett, with the company delivering a profit of $56.3m versus $40.3m in the first half. Ord Minnett is positive on the medium-term prospects for Eagers, especially considering the strong order bank and the government’s recent decision on responsible lending that could further help the new vehicle sales market. Looking at the recent uplift in the share price, Ord Minnett downgrades its rating to Hold from Accumulate. The target price rises to $12 from $9.50.

BANK OF QUEENSLAND LIMITED (BOQ) was downgraded to Underperform from Neutral by Macquarie B/H/S: 3/3/1

BANK OF QUEENSLAND LIMITED (BOQ) was downgraded to Underperform from Neutral by Macquarie B/H/S: 3/3/1

Bank of Queensland delivered an “adequate” result, Macquarie suggests, thanks to positive margin trends, although volume growth required to meet guidance appears unlikely to be achieved. Revenue growth will remain subdued given the ongoing impact of low interest rates. The bank’s recent re-rating has taken its PE premium to 25% above its five-year average relative to peers. Target rises to $6.00 from $5.50 but the broker downgrades to Underperform from Neutral on valuation.

See upgrades above.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.