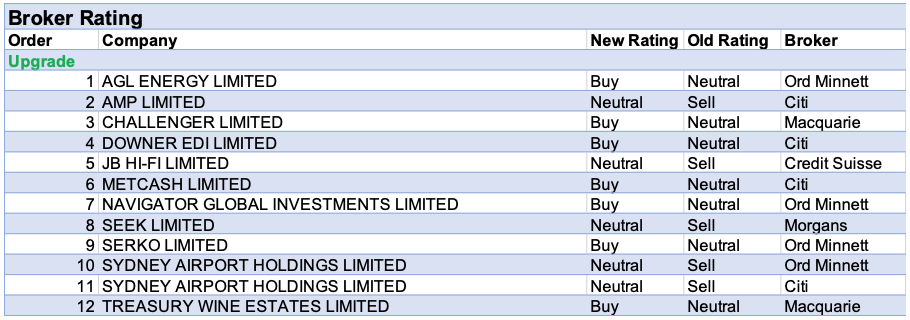

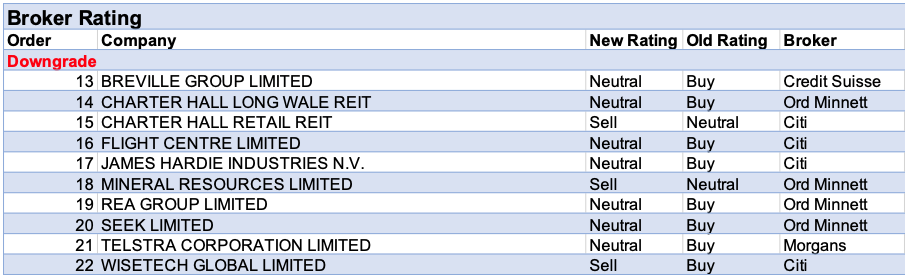

For the week ending Friday 14 August, the second week of the August reporting season, downgrades and upgrades were fairly evenly matched for stockbroking analysts’ company ratings on individual ASX-listed stocks. Of the 10 downgrades, three moved to a direct Sell including Charter Hall Retail REIT due to falling occupancy and softening leasing spreads, Wisetech Global from a combination of macroeconomic conditions and a slowing in acquisitions, and Mineral Resources, as the broker believes valuation has not kept up with the share price.

Twelve companies received upgrades and seven went to a Buy recommendation. The only company to receive two upgrades was Sydney Airport (to a Neutral from Sell), after launching a capital raise. Another travel-related upgrade was Serko (to a Buy from Neutral). Though it is too early to be adamant, these upgrades may point to a wider view by analysts across the travel sector that after making post-result negative earnings adjustments, some travel companies may be approaching a nadir.

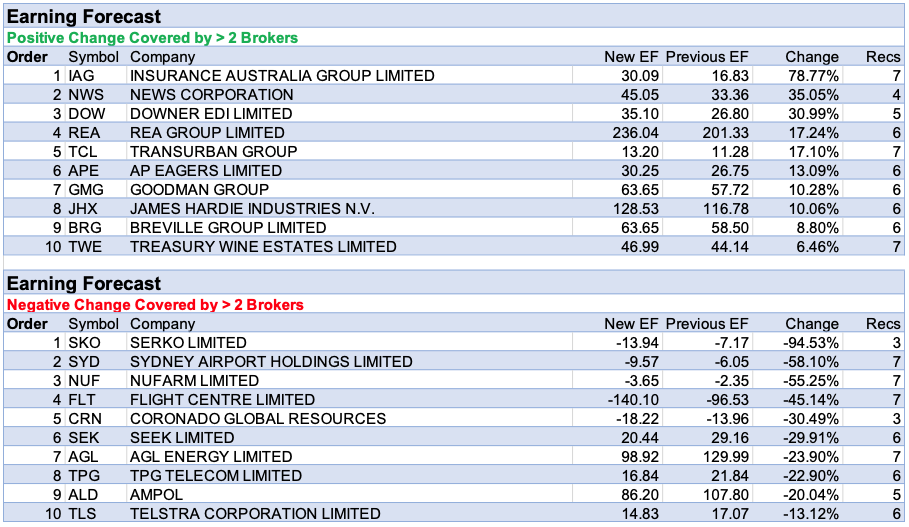

Those adjustments are clearly highlighted in the table showing negative updates to earnings estimates, in which three of the top four percentage downgrades were Serko, Sydney Airport and Flight Centre. Understandably, the official line from analysts is that many uncertainties remain. The top three positive updates to earnings estimates were Insurance Australia Group, News Corp and Downer EDI. Of the three, only News Corp had a slight beat to earnings, while analysts are attempting to discern the effect of Downer EDI allocating capital toward more profitable segments of the business.

Total Neutral/Hold recommendations take up 48.48% of the total, versus 40.03% on Neutral/Hold, while Sell ratings account for the remaining 11.49%.

In the good books

AGL ENERGY LIMITED (AGL) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 1/3/3

Underlying net profit in FY20 was below Ord Minnett’s forecasts. The result was affected by weaker commodity prices and driven by lower wholesale electricity prices. Net profit guidance for FY21 of $560-660m implies earnings are likely to decline further. Despite management’s warnings that market headwinds are intensifying, Ord Minnett believes there are now reasons to own the stock predicated on the unsustainable nature of current commodity prices and a recovery in wholesale electricity as a positive catalyst. The broker estimates FY21 dividends could result in yields up to 6-7%. Rating is upgraded to Accumulate from Hold and the target is reduced to $17.30 from $18.40.

AMP LIMITED (AMP) was upgraded to Neutral from Sell by Citi B/H/S: 1/5/1

While the proposed capital return of $544m will likely be welcomed, Citi points out up to $200m of this is in the form of a buyback over 12 months and, therefore, not necessarily a done deal. The broker makes compositional changes to forecasts to allow for a higher second half compared with the first half and the buy-out of the minority stake in AMP Capital. Although the short-term outlook is challenging, because of the special dividend, Citi lifts its rating to Neutral/High Risk from Sell/High Risk. Target is steady at $1.45.

DOWNER EDI LIMITED (DOW) was upgraded to Buy from Neutral by Citi B/H/S: 2/3/0

Citi suggests Downer EDI should re-rate with an outlook for stronger and more resilient earnings and a stronger balance sheet after the recent capital raising. Resilient second half revenues were a standout feature of the FY20 result for the broker. The analyst upgrades FY21 profit (NPATA) estimates by 29%, revenue by 10% and EBITA margins by around 40 basis points. The rating is upgraded to Buy from Neutral. The target price is increased to $5.32 from $4.65.

JB HI-FI LIMITED (JBH) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/7/0

Government support measures, particularly superannuation withdrawals, have led to a near term bubble in household goods spending, suggest the analysts, leading Credit Suisse to upgrade its forecasts for JB Hi-Fi till the first half FY21. The broker expects JB Hi-Fi’s net profit for FY20 to be $325m. The company will report its FY20 results on August 17. Credit Suisse upgrades its rating to Neutral from Underperform with the target price increasing to $42.71 from $34.52.

METCASH LIMITED (MTS) was upgraded to Buy from Neutral by Citi B/H/S: 4/2/0

Trading conditions for the grocery businesses in general remain buoyant and the analysts have penciled in higher than usual growth numbers for the six months ahead. Apart from elevated sales growth, Citi cites rational market conditions and earnings/dividend stability which all justify an overweight portfolio position towards the main industry stalwarts in Australia. Metcash has been upgraded to Buy from Neutral, with a price target of $3.50.

NAVIGATOR GLOBAL INVESTMENTS LIMITED (NGI) was upgraded to Buy from Hold by Ord Minnett B/H/S: 2/0/0

Ord Minnett upgrades to Buy from Hold as, while FY20 results were slightly below expectations, the company’s new partnership with Dyal Capital offers a compelling economic and strategic opportunity. The broker considers the stock cheap, noting an FY21 cash/PE ratio of 10x and dividend yield of around 7.2%, and this is ahead of the contribution from the new partnership. Target is raised to $2.30 from $1.40.

SEEK LIMITED (SEK) was upgraded to Hold from Reduce by Morgans B/H/S: 3/3/0

Seek has reported results in-line with guidance given in late June. However, the indicative earnings potential (not outlook) was below market expectations, according to Morgans. The broker shows that the second half bore the full force of covid-19 lockdowns, but since April/May there has been a steady improvement in volumes and the company continues to invest regardless. The large end markets that the company is attempting to dominate appeal to Morgans, but the broker awaits more concrete evidence on the return profile on these investments and acceleration of core business earnings. The rating is upgraded to Hold from Reduce. The target price is increased to $17.90 from $15.55.

See downgrade below.

TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/4/0

Treasury Wine Estates released FY20 results in-line with its pre-announcement, but flagged cost outs and signs of improving volumes in China, leading Macquarie to upgrade its rating to Outperform. The new strategic agenda outlines plans for a further -$50m of cost savings on top of the -35m cost out program already announced, notes the broker. The analyst materially lifts the target price on an improved medium-term growth outlook and lowered risk premium on Chinese business as volumes recover. The rating is upgraded to Outperform from Neutral. The target price is increased to $14.90 from $11.50.

In the not-so-good books

CHARTER HALL RETAIL REIT (CQR) was downgraded to Sell from Neutral by Citi B/H/S: 3/1/2

FY20 earnings beat estimates and Citi highlights the accounting approach to the impact of the pandemic is less conservative compared with peers. The broker notes falling occupancy and softening leasing spreads signal landlords will increasingly have to reduce rents to maintain occupancy at high levels. The broker estimates A-REIT earnings will settle -15-20% below FY20 levels, given the uncertainty. Rating is downgraded to Sell from Neutral as the broker believes the results have left investors more focused on downside risks and questioning the underlying earnings outlook. Target is reduced to $2.86 from $2.99.

FLIGHT CENTRE LIMITED (FLT) was downgraded to Neutral from Buy by Citi B/H/S: 4/2/0

Flight Centre anticipates a FY20 pre-tax loss in a range of -$475-525m. Citi downgrades to Neutral from Buy, raising the target to $13.50 from $12.50, given the uncertainty surrounding the resumption of global and domestic travel and the lack of catalysts outside of a successful vaccine. Liquidity has improved and the monthly cash burn has reduced, although revenue is at just 7% of historical levels. Still, this likely rules out a second equity raising until early 2021, in the broker’s view.

SEEK LIMITED (SEK) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/3/0

Seek’s FY20 operating income was $414.9m versus $455m in FY19. Management expects the net profit in FY21 to be $20m, or $330m in EBITDA. This has led to Ord Minnett lowering its operating income estimate by -25.8% for FY21. While management has an impressive track record of high returns on investment, the broker prefers to wait for a clearer picture of the impact of lockdowns on the employment market. The broker is upbeat on China from FY22 onwards and believes the company’s recovery will be led by its Zhaopin division. Operating income forecasts reduced for FY21-22. On account of lower estimates, Ord Minnett downgrades its recommendation to Hold from Accumulate with the target price decreasing to $20.15 from $24.

See upgrade above.

TELSTRA CORPORATION LIMITED (TLS) was downgraded to Hold from Add by Morgans B/H/S: 4/1/1

Morgans states the FY20 result for Telstra was in-line with guidance, but the FY21 guidance was below the broker’s and consensus forecasts and was negatively impacted by the ongoing challenges of covid-19. This was due to reduced international travel and some short-term timing delays in relation to cost saving, notes the analyst. The company declared a final dividend of 8 cents, bringing the FY20 total to 16 cents, however, the analyst explains after FY23 the NBN one-offs effectively disappear and there will no longer be support from special dividends. The company reduced its FY23 return on capital target to greater than 7% from 10%, which has implications for both EPS and DPS sustainability, warns the broker. Morgans materially reduces forecasts for EPS and DPS and expects the company to declare a 12 cent fully franked dividend in FY21 and beyond. The rating has declined to Hold from Add. The target price is decreased to $3.21 from $3.73.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.