Stockbroking analysts may have been slow to jump into action in the first weeks of the new calendar year, there is no disputing they’ve become busy now that the February reporting season is upon us.

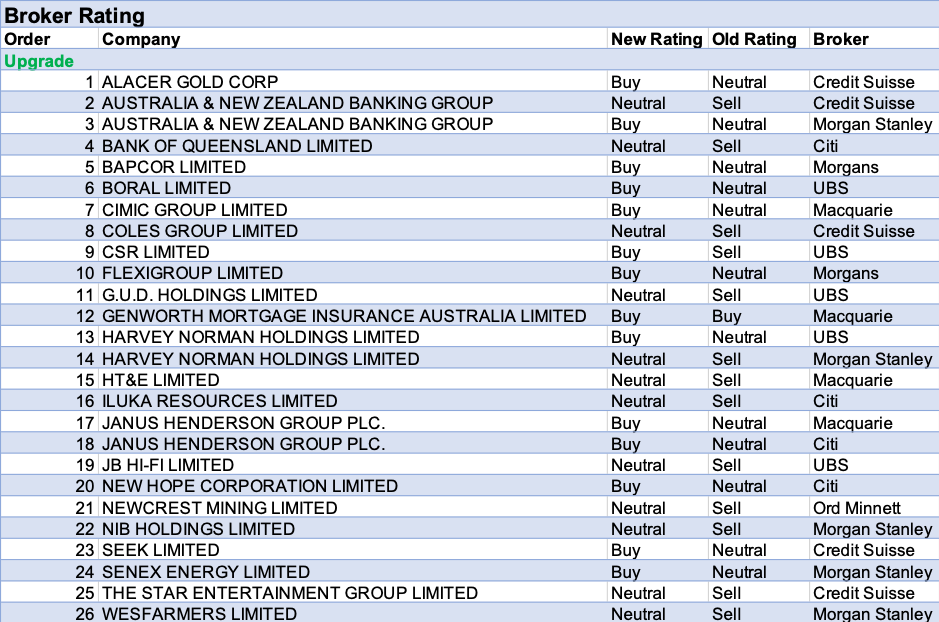

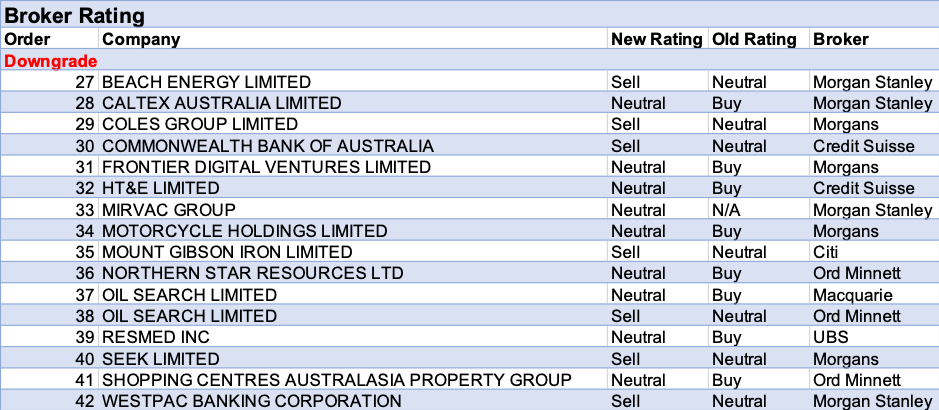

For the week ending on Friday 7 February 2020, FNArena counted no less than 26 upgrades in ratings for individual ASX-listed stocks against 16 downgrades.

The real story might be found in changes to earnings estimates and valuations/price targets. While adjustments to forecasts carry a bias to the downside, valuations and price targets are most likely to be revised upwards. As such, analysts are justifying the strong start for the local share market in January.

ANZ Bank, Harvey Norman and Janus Henderson all received two upgrades during the week as 14 of the 26 upgrades provided investors with fresh Buy ratings. Oil Search was the week’s sole receiver of two downgrades on the back of political stasis in PNG. Seven downgrades resulted in new Sell ratings.

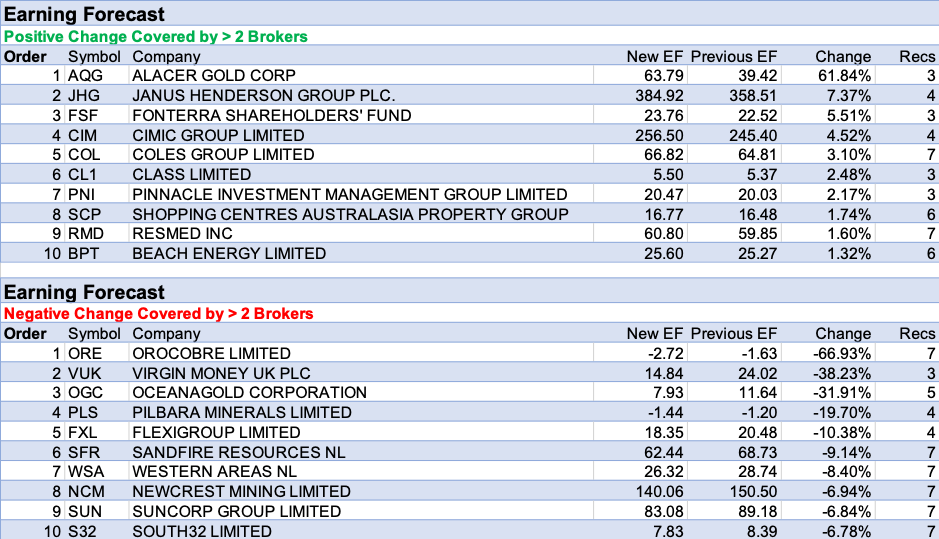

A lot more action can be found in both tables for amendments to earnings forecasts. Alacer Gold takes the week’s top spot for positive changes to forecasts, well ahead of Janus Henderson, Fonterra, Cimic Group, and Coles Group. Negative adjustments are much larger in size, with Orocobre’s forecasts taking the largest hit, followed by Virgin Money UK, OceanaGold, Pilbara Minerals, and FlexiGroup.

The local reporting season steps it up one notch in the week ahead.

In the good books

ALACER GOLD CORP (AQG) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/0/0

2019 net profit materially exceeded Credit Suisse forecasts as an additional tax credit was realised, partly offset by unrealised non-cash FX losses. No dividend was declared, as expected, with the focus remaining on debt repayment. The company is intent on growing oxide reserves and production and advancing its geological understanding of Cakmaktepe and Ardich as well as increasing the sustainable Copler production. Credit Suisse upgrades to Outperform from Neutral. Target is steady at $7.20.

BORAL LIMITED (BLD) was upgraded to Buy from Neutral by UBS B/H/S: 1/3/0

UBS observes Boral is trading at a steep discount to the market and suspects this reflects expectations that the 2019 underperformance will continue into 2020. While the previous year was difficult, FY20 guidance assumes a catch up is possible in the second half. The broker suspects investors are increasingly worried that the diverse operating footprint will stretch management. However, downside risks are considered limited and UBS upgrades to Buy from Neutral. Target is raised to $6.00 from $4.90.

BANK OF QUEENSLAND LIMITED (BOQ) was upgraded to Neutral from Sell by Citi B/H/S: 0/4/3

Citi believes the majority of the near-term downside for Bank of Queensland has played out. The dilution from funding the restructuring plan has been quantified and CET1 will be at the upper end of the target range. A reduction to the final dividend is considered priced in and the broker upgrades to Neutral from Sell. Target is $7.75.

COLES GROUP LIMITED (COL) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/3/3

Credit Suisse remains constructive about the company’s strategies to date. The second quarter sales growth accelerated to 3.6% and beat expectations. The broker also believes the ability of Coles to catch up to Woolworths (WOW) in terms of performance is not difficult. Rating is upgraded to Neutral from Underperform. Target is raised to $16.00 from $13.17.

See downgrade below.

CSR LIMITED (CSR) was upgraded to Buy from Sell by UBS B/H/S: 2/1/2

UBS adopts a more bullish approach to property valuation and upgrades CSR to Buy from Sell. The broker would not be surprised if more land sales were used to prop up earnings and therefore assesses a negative catalyst is absent. Aluminium’s negative aspects remain a drag but the broker believes this is factored into the price. Targets raised to $5.24 from $3.60.

GENWORTH MORTGAGE INSURANCE AUSTRALIA LIMITED (GMA) was upgraded to Outperform from Neutral by Macquarie B/H/S: 1/0/0

Macquarie suggests Genworth Mortgage Insurance has signalled the end of the “run off” thesis with its 2019 result and the beginning of a growth thesis. Gross written premium grew 32.8% in the fourth quarter compared to 24.4% in the third. The broker has increased its net earned premium forecast to above the guidance range. Macquarie sees the opportunity for multi-year improvements to loss ratios and upgrades to Outperform. Target rises to $4.30 from $4.10.

JANUS HENDERSON GROUP PLC. (JHG) was upgraded to Outperform from Neutral by Macquarie B/H/S: 3/0/1

Janus Henderson beat earnings forecasts in the December quarter but the underlying result was weak, Macquarie suggests, given a strong market performance and currency movements offset ongoing outflows while increased performance fees were offset by higher employee expenses. Institutional flow pressures remain but the broker is encouraged by improving retail momentum. To that end, and with the stock trading at a -22% discount to its five-year average PE, Macquarie upgrades to Outperform and sector preferred status. Target rises to $42.80 from $34.50.

SEEK LIMITED (SEK) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/2/1

The week macro environment creates a risk for near-term guidance, in Credit Suisse’s view. FY20 is expected to be affected by weak domestic volumes, the direct impact of coronavirus on the Chinese labour market and any knock-on impact on Asia. Estimates are lowered as a result. Longer-term, the dynamics are intact. Given the upside from current trading levels, Credit Suisse upgrades to Outperform from Neutral. Target is raised to $23.80 from $19.60.

SENEX ENERGY LIMITED (SXY) was upgraded to Overweight from Equal-weight by Morgan Stanley B/H/S: 3/3/0

Morgan Stanley upgrades to Overweight from Equal -weighted and raises the target to $0.45 from $0.41. The broker believes the stock has underperformed for a number of years but 2020 should bring strong progress on the gas assets. The stock is expected to slowly re-rate as investors see the production and cash flow build. Industry view: In-Line.

In the not-so-good books

BEACH ENERGY LIMITED (BPT) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 0/4/2

Morgan Stanley downgrades to Underweight from Equal-weight. The broker observes the company is moving to a more difficult execution phase and has outperformed significantly. The stock is now implying significant growth in reserves in the Cooper Basin and large value for the Waitsia project. Target is $2.00. Industry view: In Line.

COLES GROUP LIMITED (COL) was downgraded to Reduce from Hold by Morgans B/H/S: 0/3/3

The first half sales update was better than Morgans expected, as all divisions delivered solid growth. The company has advised first half earnings are likely to be between $710-730m. While at the headline level the update appears well and good, adjusting for favourable movements in non-operating earnings means a weaker outcome than the broker anticipated. Finding it hard to justify the stretched valuation, Morgans downgrades to Reduce from Hold. The company will report its first half result on February 18. Target is raised to $14.29 from $14.01.

See upgrade above.

CALTEX AUSTRALIA LIMITED (CTX) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 0/5/0

Morgan Stanley downgrades to Equal-weight from Overweight as the stock has traded up to the price target and risks are building to the downside should takeover discussions stall. Target is $34. Industry view is In-Line.

HT&E LIMITED (HT1) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 0/3/1

With the metro radio market down -9.4% in the December half, Credit Suisse observes the company faces difficult trading conditions. Still, the broker continues to expect the Australian Radio Network will outperform the market as it has had a solid ratings performance. Rating is downgraded to Neutral from Outperform, given limited upside from current trading levels. Target is reduced to $1.65 from $1.90. See also HT1 upgrade.

MIRVAC GROUP (MGR) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 2/4/0

First half results were slightly below forecasts. Full year guidance for earnings per share of 17.6-17.8c has been maintained. Morgan Stanley remains cautious about the company’s ability to outperform in the near term along with a perceived earnings hole in FY21. While office comparable net operating income growth was 5.6%, incentives have crept up to 20% for leases signed. The broker downgrades to Equal-weight from Overweight. Target is reduced to $3.40 from $3.45. Industry view is In-Line.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.