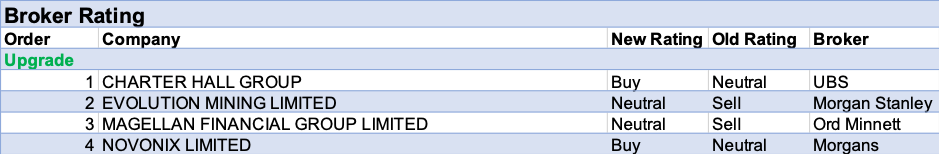

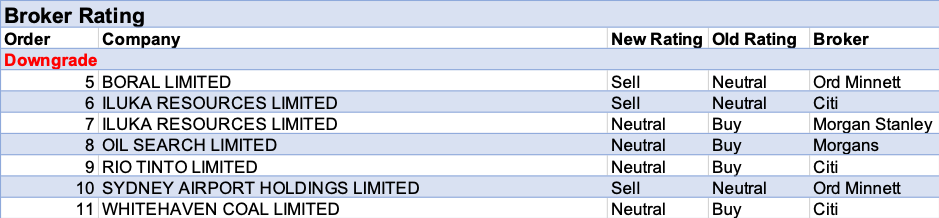

As corporate activity begins to wind down for 2019, the week ending Friday the Thirteenth of December brought four upgrades and seven downgrades from FNArena database brokers. Of the upgrades, two went to Buy and two to Hold, while three downgrades went to Sell and four to Hold.

Evolution Mining and Magellan Financial were both upgraded to Hold on valuation, while Iluka Resources, Rio Tinto and Sydney Airport were all downgraded to Hold on valuation.

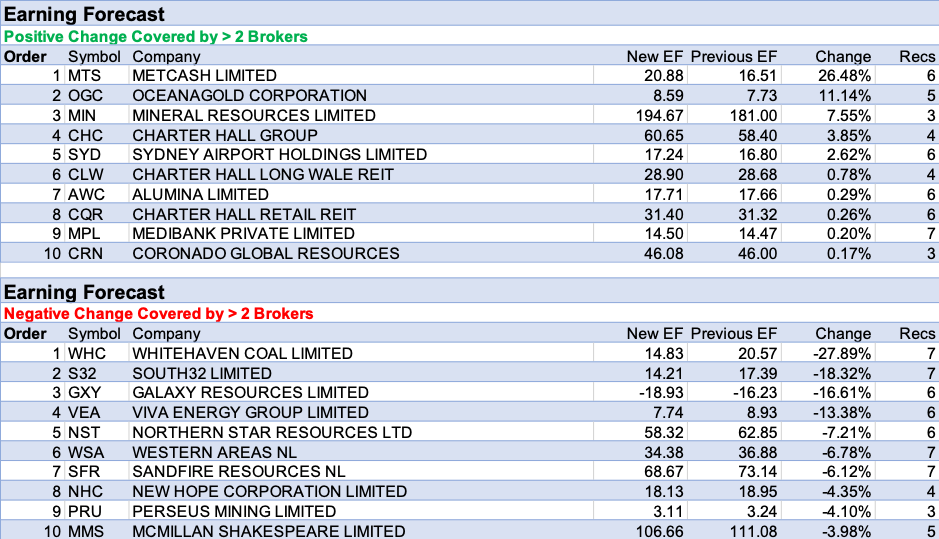

Metcash managed to top the earnings increase table with 26.5% after delivering an earnings result that was not as bad as feared in the underlying business. OceanaGold (OGC) followed with 11.1%.

Whitehaven’s downgraded guidance resulted in a -27.9% forecast cut, while a run of broker resets of commodity price forecasts netted to an -18.3% cut for South32 (S32). Same story for Galaxy Resources (GXY), down -16.6%, while downgraded guidance hit Viva Energy (VEA) forecasts by -13.4%.

In the good books

CHARTER HALL GROUP (CHC) was upgraded to Buy from Neutral by UBS B/H/S: 3/1/0

UBS is increasingly convinced of Charter Hall’s ability to continue raising and deploying third-party equity/debt. The broker upgrades earnings estimates by 7-8% to reflect growth in assets under management and co-investments. UBS also believes concerns regarding peak performance fees in FY20 and Sydney/Melbourne office fundamentals are unjustified. The broker upgrades to Buy from Neutral and raises the target to $12.50 from $12.10.

EVOLUTION MINING LIMITED (EVN) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 2/4/1

Evolution Mining has fallen -28% from its August peak and is now near Morgan Stanley’s valuation, prompting an upgrade to Equal-weight from Underweight. The broker sees costs and the relatively short lives of some of the company’s mines as well priced versus the potential for operational and mine-life improvements. Target falls to $3.80 from $4.00. Industry view: In-Line.

In the not-so-good books

ILUKA RESOURCES LIMITED (ILU) was downgraded to Sell from Neutral by Citi and Downgrade to Equal-weight from Overweight by Morgan Stanley B/H/S: 0/5/1

Citi downgrades Iluka to Sell from Neutral because of recent share price strength. Target is steady at $9. Citi estimates global growth will be modestly higher in 2020, which is bullish for commodities. An improvement in market conditions for commodities is expected to attract investor flows. Most of the improvement is expected to come from emerging markets. Nevertheless, the two largest economies, the US and China, still have the greatest potential to influence demand through policy decisions, in light of the US election holding promise for a breakthrough with China on trade. Monetary and fiscal policies in both countries have potential for higher GDP, the broker notes as well. After a 40% rally from its trough in August, Iluka Resources is now close to Morgan Stanley’s valuation, hence a downgrade to Equal-weight from Overweight. A demerger of the MAC royalty would add upside but given the complexities the broker does not see this happening. If the Sembuhan project is deemed commercial, this would provide for incremental upside. Target falls to $10.45 from $11.15 on a commodity price forecast review. Industry view: In-Line.

OIL SEARCH LIMITED (OSH) was downgraded to Hold from Add by Morgans B/H/S: 2/4/1

Morgans downgrades to Hold from Add, concerned about the new risks associated with PNG growth. The broker recognises the new government may require a settling in period and may seek a higher share of value from P’nyang, which in turn could jeopardise the entire three-train development. The broker is now less convinced about assumptions that an agreement on fiscal terms will be easily reached. Target is reduced to $7.82 from $8.68.

RIO TINTO LIMITED (RIO) was downgraded to Neutral from Buy by Citi B/H/S: 2/4/1

Citi estimates global growth will be modestly higher in 2020, which is bullish for commodities. The broker is positive about hard coking coal in the first quarter of 2020, expecting the price to average US$170/t over the year. The alumina market is expected to move to a modest deficit in 2020. The broker remains cautious on iron ore and expects sizeable oversupply over the next two years will bring down benchmark prices to US$60/t by 2022. Rio Tinto’s rating is downgraded to Neutral from Buy, to reflect the outperformance in the stock over the past 12 months, and the target is reduced to $100 from $105.

WHITEHAVEN COAL LIMITED (WHC) was downgraded to Neutral from Buy by Citi B/H/S: 4/2/0

Citi estimates global growth will be modestly higher in 2020, which is bullish for commodities. The broker is positive about hard coking coal in the first quarter of 2020, expecting the price to average US$170/t over the year. Yet the broker downgrades Whitehaven Coal to Neutral from Buy because of the cuts to near-term earnings and the risk of ongoing weather-related constraints at Maules Creek. Target is reduced to $2.90 from $3.70.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.