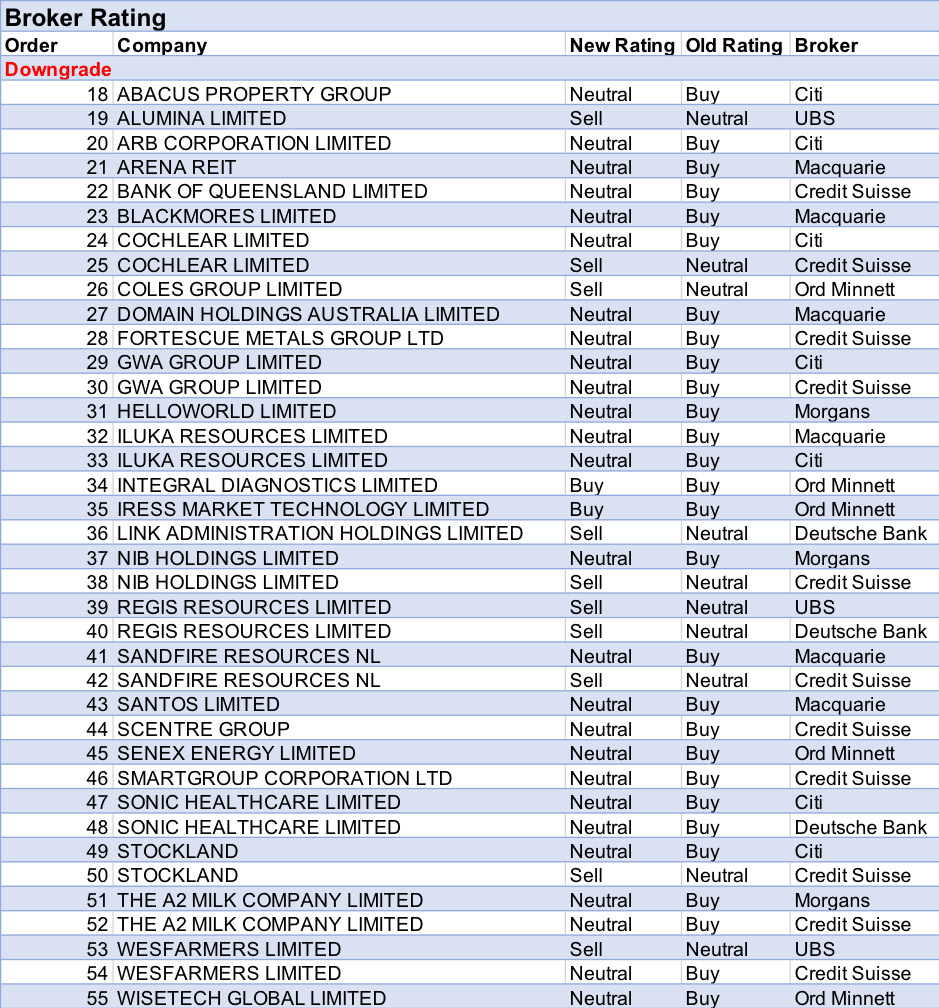

Week three of the domestic February corporate reporting season saw the deluge in recommendation downgrades continue. For the week ending Friday, 22nd February 2019, FNArena counted no less than 38 downgrades for individual ASX-listed entitties, against 17only upgrades.

Total Neutral/Hold ratings held by the eight stockbrokers monitored daily is rapidly closing in on total Buy ratings; 42.29% versus 43.28%, which can serve as an indication of where most downgrades lead to. The fact that share market indices have remained inside a strong upward channel provides an easy explanation as to why.

Only two brokers out of the eight are carrying more Buy ratings than Neutral/Holds; retail stockbrokerages Morgans and Ord Minnett.

Three companies received multiple upgrades during the week, with each of Pact Group, APA Group and AP Eagers receiving two upgrades post market updates. AP Eagers was the only one receiving two upgrades to Buy.

On the flipside, each of Cochlear, GWA Group, Iluka Resources, nib Holdings, Regis Resources, Sandfire Resources, Sonic Healthcare, Stockland, a2 Milk, and Wesfarmers seeing two downgrades post financial results.

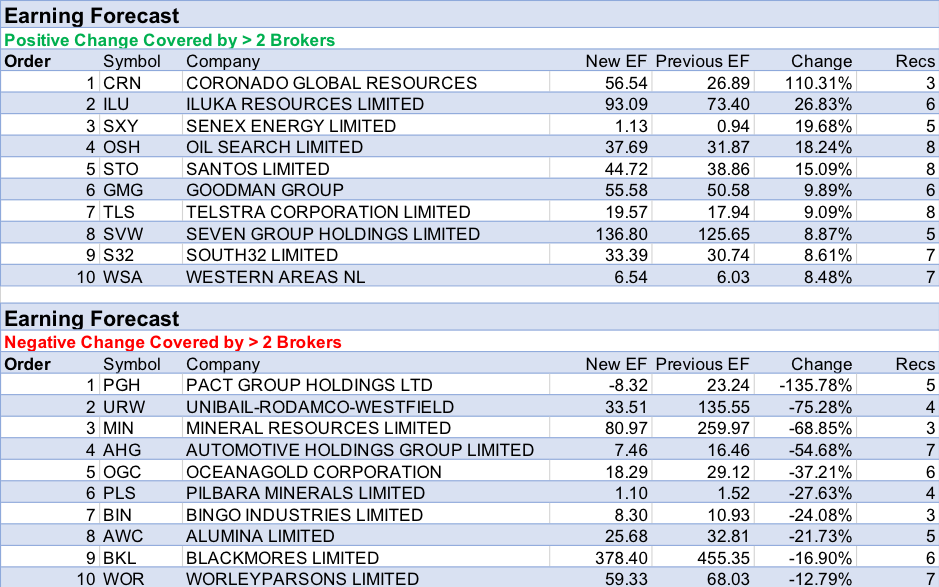

As is normal practice during reporting season, positive adjustments to earnings estimates are nothing short of enormous, and last week commodities producers (more miners than oil & gas) commanded pole position. The negative side shows more diversity, and equally ginormous adjustments, with plenty of corporate disappointers featuring prominently.

The largest downward adjustment goes to Pact Group (-135%), followed by Unibail-Rodamco-Westfield, Mineral Resources, Automotive Holdings, and OceanaGold.

Reporting season continues this week but at a gradually slowing pace from last week’s tsunami of corporate releases. The epicentre of domestic reports is well and truly behind us. Ex-dividends start populating the calendar from here onwards.

In the good books

- APA GROUP (APA) was upgraded to Neutral from Underperform by Credit Suisse and to Buy from Hold by Deutsche Bank B/H/S: 1/7/0

First half earnings were ahead of Credit Suisse forecasts. The broker asserts arbitration rules are proving ineffective, and the upcoming elections and the outcome of the review in August signal the risk has not entirely diminished. Growth projects are largely on track. The broker believes there is upside to consensus FY20 forecasts. Rating is upgraded to Neutral from Underperform, to reflect the upside. Target is raised to $8.75 from $7.65.

Deutsche Bank believes the interim report was “solid”. It was clearly better-than-expected by the broker beforehand. As management continues to deliver solid, consistent and predictable distributions, the recommendation is upgraded to Buy from Hold. Target $9.90.

- AP EAGERS LIMITED (APE) was upgraded to Add from Hold by Morgans and to Accumulate from Hold by Ord MinnettB/H/S: 2/2/0

AP Eagers 2018 result met the broker, defying industry weakness thanks to years of cost control, risk-based pricing and business restructuring. The company improved volumes, market penetration and margin retention and the company remains confident on these fronts. Broker notes the stock is well-positioned for acquisitions, although this would pose downside risk to the share price and dividend. Target price inches up to $8.03 from $8. Broker upgrades to Add from Hold.

The 2018 result was in line with the guidance provided in mid-January. Ord Minnett observes the economics of dealerships have changed and will continue to evolve. The company reported margin expansion in the second half in both operating divisions, providing a level of comfort in what is expected to be a weak new vehicle sales environment. That said, the company is ideally positioned to participate in industry consolidation. Rating is upgraded to Accumulate from Hold and the target raised to $7.50 from $7.00.

- Data#3 Limited (DTL) was upgraded to Add from Hold by MorgansB/H/S: 1/0/0

Data#3’s first-half result outpaced the broker by 4%, the dividend doubling off a low figure in the previous corresponding period. Product outpaced Services and the company outstripped peers thanks to its diversified customer base. On the downside, the gross profit margin fell below 13% for the first time in a decade due to weakness in Services. The Federal election could also create a drag in the second half. EPS forecasts rise 3% in FY19 and 11% in FY20. Target price rises to $1.85 from $1.67 and rating upgraded to Add from Hold.

- MOELIS AUSTRALIA LIMITED (MOE) was upgraded to Buy from Accumulate by Ord MinnettB/H/S: 1/0/0

2018 operating earnings (EBITDA) were ahead of Ord Minnett estimates. Asset management underpins the strong performance, with total segment revenue up 95%. The broker believes corporate advisory is largely a distraction to the base business. The broker upgrades to Buy from Accumulate and reduces the target to $6.63 from $6.67.

- PACT GROUP HOLDINGS LTD (PGH) was upgraded to Hold from Reduce by Morgans and to Outperform from Neutral by Credit SuisseB/H/S: 2/2/1

Pact Group’s first-half result met the broker and last week’s trading update. The company has won an RPC pooling contract to serve ALDI growers, but the balance sheet was stretched (gearing increased to 3.3x and interest cover fell to 6.5x) and no dividend was forthcoming. The company is backing off acquisitions and will be consolidating and rationalising. Target price falls to $2.62 from $3.01. Morgans upgrades to Hold from Reduce to reflect the recent share price retreat and the price-earnings multiple of 10.8x and an expected 2% rise in total shareholder return.

When management stated it was considering capital options and did not declare a dividend Credit Suisse suspects this led investors to believe a capital raising was imminent, driving the share price down a further -17%. The broker does not believe a capital raising is in the offing because the company has some time yet to determine whether earnings will meet its guidance range and support debt levels. The broker upgrades to Outperform from Neutral and upgrades estimates for earnings per share by 2-4%, amid improved confidence in cost savings and the price versus raw material cost spreads. Target is steady at $3.85.

- SONIC HEALTHCARE LIMITED (SHL) was upgraded to Accumulate from Hold by Ord MinnettB/H/S: 3/5/0

First half net profit was better than Ord Minnett expected while, at the operating level, results were in line. The broker is encouraged by the strong lift in US revenues, given this was delivered despite funding cuts. Domestic collection costs are stable and the broker envisages few funding risks for the near term. Rating is upgraded to Accumulate from Hold and the target to $27.40 from $24.10. See downgrade below.

In the not-so-good books

- THE A2 MILK COMPANY LIMITED (A2M) was downgraded to Neutral from Outperform by Credit Suisse and to Hold from Add by MorgansB/H/S: 2/4/1

First half results were ahead of Credit Suisse estimates. Importantly, revenue grew 41% and featured another step-up from Chinese labelled infant formula. The company anticipates second half revenue growth at a similar level. Credit Suisse upgrades FY19-21 estimates for earnings per share by 7-8%. Following the outperformance of the share price the broker lowers the rating to Neutral from Outperform. Target is raised to NZ$13.60 from NZ$12.25.

The a2 Milk Company’s first-half result outpaced the broker by 11.7%, infant formula the star of the show. Guidance was upgraded. Margins seriously surprised Morgans to the upside, the balance sheet was strong and costs rose due to marketing expenditure and administration – in part to reflect its very promising China expansion. Earnings-per-share forecasts rise 8.3% and 3.4% for FY19 and FY20. Target price rises to roughly in line with the share price at $13.66 from $12.35. Broker downgrades to Hold from Add after the strong rally in the share price.

- ARB CORPORATION LIMITED (ARB) was downgraded to Neutral from Buy by CitiB/H/S: 1/3/0

ARB Corp’s first-half result disappointed, the broker citing weak passenger vehicle sales and potential headwinds from the Hayne Royal Commission. Earnings-per-share forecasts fall -5% to -6% across FY20-FY21 and target price eases -2% to $18.38 from $18.66. Citi downgrades to Neutral from Buy.

- ALUMINA LIMITED (AWC) was downgraded to Sell from Neutral by UBSB/H/S: 3/1/1

Alumina’s result met expectations, driven by a 33% increase in alumina prices offset by only a 14% increase in costs. AWAC earnings nevertheless fell short of UBS’ estimate on higher costs. Ahead are a number of significant costs for site closures and Point Comfort holding costs that will continue for the next few years, the broker notes, reducing earnings and cash flow. On a premium to net present value, UBS downgrades to Sell from Neutral while retaining a $2.20 target.

- FORTESCUE METALS GROUP LTD (FMG) was downgraded to Neutral from Outperform by Credit SuisseB/H/S: 1/4/3

Underlying operating earnings (EBITDA) were 8% ahead of Credit Suisse expectations, supported by lower shipping costs and lower operating expenditure. The stock has rallied 60% so far in 2019 and moved well ahead of the broker’s valuation. Hence the rating is downgraded to Neutral from Outperform. Credit Suisse now assesses the valuation and investment case is too stretched for fresh money. Target is raised to $6.00 from $5.10.

- INTEGRAL DIAGNOSTICS LIMITED (IDX) was downgraded to Accumulate from Buy by Ord MinnettB/H/S: 2/1/0

First half operating earnings (EBITDA) were below Ord Minnett estimates, despite revenue being slightly ahead. Earnings were undermined by an unexpected lift in costs. This is expected to constrain margin expansion over the short term. While envisaging multiple avenues for growth, Ord Minnett recognises a shifting environment and downgrades to Accumulate from Buy. Target is reduced to $2.99 from $3.00.

- ILUKA RESOURCES LIMITED (ILU) was downgraded to Neutral from Outperform by Macquarie and to Neutral from Buy by CitiB/H/S: 4/2/0

As reported yesterday already, Iluka’s update missed Macquarie’s projections. Because the share price has performed well to date, and management has guided towards lower production volumes for 2019, Macquarie has downgraded to Neutral from Outperform. Medium term, the analysts see upside risk from rutile prices. The broker has increased rutile prices forecast to US$1250/t from 2HCY20 onwards. Target price $9.10. Estimates reduced for 2019, but lifted for 2020. DPS forecasts have gone up.

Iluka management has guided to weaker production in 2019. 2018 results were largely in line. Citi envisages downside risks to production forecasts, downgrading 2019 earnings estimates by -4% to reflect lower JA rutile production and increasing 2020 earnings estimates by 2% to reflect a higher iron ore price (BHP royalties). Target price falls to $10.40 from $12.40. Rating is downgraded to Neutral from Buy.

- IRESS MARKET TECHNOLOGY LIMITED (IRE) was downgraded to Accumulate from Buy by Ord MinnettB/H/S: 2/3/0

While the company’s growth story is complex, Ord Minnett was pleased that both top-line growth and margin expansion occurred in 2018. The result beat guidance, with the UK demonstrating a robust result. The broker looks forward to further operating leverage over coming years but, given the target now indicates a 6% total shareholder return, lowers the rating to Accumulate from Buy. Target is raised to $13.09 from $11.73.

- REGIS RESOURCES LIMITED (RRL) was downgraded to Sell from Hold by Deutsche Bank and to Sell from Neutral by UBS B/H/S: 0/3/4

Interim performance missed Deutsche Bank’s expectations, despite tail winds from an accounting adjustment. Target rises to $4.50 from $4.30 but with the share price trading well above this level, the rating is downgraded to Sell from Hold.

Regis Resources posted a small beat of UBS’ forecast on lower costs. Net cash and bullion means the miner is well funded to develop Rosemont underground and McPhillamy’s, although the broker suspects the McPhillamy’s feasibility study will show an increase on previously assumed capex given mining cost inflation. The stock has rallied hard on the rising A$ gold price but the broker now believes too far. The gold price may continue to rise but the broker sees better value in Evolution Mining (EVN) and Northern Star (NST). Downgrade to Sell from Neutral. Target unchanged at $5.00.

- SCENTRE GROUP (SCG) was downgraded to Neutral from Outperform by Credit SuisseB/H/S: 1/4/1

2018 results were in line with expectations. 2019 guidance is lower than Credit Suisse expected, with the company signalling funds from operations growth of around 3%. Although the broker assesses value in the stock, moderating comparable income growth and a prolonged stabilisation period for developments suggest the outlook is challenging. Rating is downgraded to Neutral from Outperform and the target reduced to $4.20 from $4.70.

- STOCKLAND (SGP) was downgraded to Neutral from Buy by Citi and to Underperform from Neutral by Credit Suisse B/H/S: 2/2/2

Stockland’s first-half result missed the broker – primarily because of an unexpected residential skew to the second half. The broker notes operating conditions are deteriorating faster than expected and management lowered guidance despite weaker debt costs. Funds from operations estimates ease -1% to -2% to account for lower residential volumes. Target price falls to $3.88 from $4. Citi downgrades to Neutral from Buy.

First half results missed Credit Suisse estimates and reflected lower-than-expected income across all divisions. Guidance is reduced to the lower end of the previous guidance range for growth of 5-7%. Credit Suisse finds it difficult to envisage a silver lining amid ongoing pressure on retail asset valuations and further price declines in residential land. Rating is downgraded to Underperform from Neutral. Target is reduced to $3.17 from $3.76.

- SONIC HEALTHCARE LIMITED (SHL) was downgraded to Hold from Buy by Deutsche Bank and to Neutral from Buy by Citi B/H/S: 3/5/0

Sonic Healthcare’s interim result was “broadly in line” (read: slightly disappointing) with Deutsche Bank. Margins disappointed a little, but the broker expects this will be rectified in H2. Downgrade to Hold from Buy. Target declines slightly to $24.70 from $24.85.

Sonic Healthcare’s first-half result was in line with Citi forecasts. Guidance was revised up by 6%-8%. Interest guidance also fell to reflect a $328m placement (compared with an expect $100m), which results in a -2% share dilution in FY20 and beyond. This has resulted in a dilution to the discounted cash-flow based target price to $24.75 (a price-earnings multiple of 20x) from $25.25. The broker downgrades to Neutral from Buy, noting the recent sharp rally in the share price. See upgrade above.

- SANTOS LIMITED (STO) was downgraded to Neutral from Outperform by MacquarieB/H/S: 4/4/0

2018 results beat Macquarie’s forecasts. Despite the strong headline result, Macquarie believes the upside going forward is less apparent. Following the share price appreciation since the December lows, and because catalysts around reserves and expenditure are largely played out, the broker downgrades to Neutral from Outperform. Versus its peers, Santos has fewer near-term drivers and Macquarie prefers Oil Search ((OSH)). Target is raised to $7.20 from $6.80.

- SENEX ENERGY LIMITED (SXY) was downgraded to Hold from Buy by Ord MinnettB/H/S: 3/2/0

While exposure to domestic gas prices and strong production growth are positives, Ord Minnett is concerned about well performance relative to other Queensland gas assets. As the stock is now trading within 6% of valuation the broker downgrades to Hold from Buy. The $0.40 target is unchanged. The broker believes the company will require high prices to ensure an appropriate rate of return on its Queensland assets.

- WESFARMERS LIMITED (WES) was downgraded to Neutral from Outperform by Credit Suisse and to Sell from Neutral by UBSB/H/S: 2/2/3

The company has emerged from the first half result in a strong position, Credit Suisse believes, with most businesses performing solidly. While market conditions in retail moderated over the first half, management does not appear to be implying further deterioration in the second half. Credit Suisse believes investors should take comfort in the consistency of the company’s strategies at Kmart and Bunnings. The broker downgrades to Neutral from Outperform because of the strong share price reaction. Target is reduced to $33.12 from $34.98.

Wesfarmers’ result was not as strong as it appeared on the headline, given various one-offs, and underlying earnings only exceeded UBS’ forecast slightly. Bunnings missed the mark and Kmart and industrials earnings declined. Cash conversion was the bright spot, the broker notes, providing for a special dividend, and Officeworks outperformed. UBS has made little change to forecasts but suggests a 20x FY20 earnings multiple is too rich in the face of slowing consumer spending, the impact of a weak housing market on Bunnings, and a competitive environment. Downgrade to Sell from Neutral. Target rises to $32.60 from $30.75.

- WISETECH GLOBAL LIMITED (WTC) was downgraded to Hold from Buy by Ord MinnettB/H/S: 1/3/0

The first half result was better than Ord Minnett expected. The only issue the broker has is with guidance, which was revised slightly higher and potentially implies softer second half organic growth. Ord Minnett lowers the rating to Hold from Buy as some risk is creeping into FY20. Target is raised to $18.12 from $17.87.

Earnings Forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.