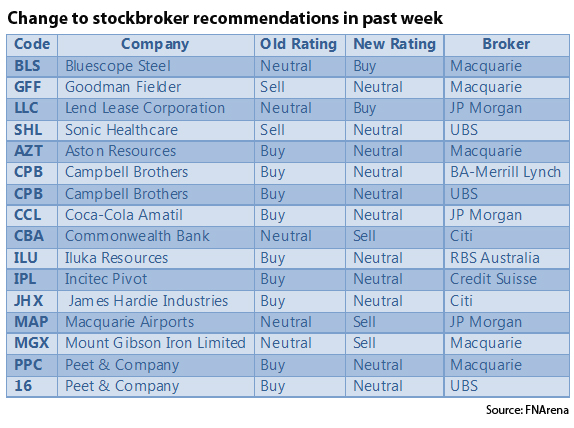

Downgrades have dominated yet another week, with brokers in the FNArena database lowering ratings on 12 stocks while upgrading just four. This brings total Buy ratings to just a touch under last week’s 57.7%.

Downgrades have dominated yet another week, with brokers in the FNArena database lowering ratings on 12 stocks while upgrading just four. This brings total Buy ratings to just a touch under last week’s 57.7%.

Among the upgrades was BlueScope Steel (BSL), Macquarie moving to an Outperform rating from Neutral on expectations the ‘new’ BlueScope will be a closer play on the domestic economic cycle as a result of a reduction in some loss-making export operations as part of an operational restructuring.

Macquarie expects the market’s confidence in BlueScope to lift as earnings improve, which should be enough to drive a re-rating of the stock in time.

A strategic review by Goodman Fielder (GFF) has also prompted an upgrade to Neutral from Underperform by Macquarie, the broker taking a slightly more optimistic approach to new management’s proposed cost estimates. Improved valuation also supports the upgrade in rating, as do increases to earnings estimates.

J.P. Morgan meanwhile has upgraded Lend Lease (LLC) to Overweight from Neutral driven by what it sees as a solid medium-term earnings growth outlook and an attractive valuation at current levels. The broker has also identified some positive near-term catalysts, such as new work for Valemus and good mixed-use and residential development pipelines.

Sonic Healthcare (SHL) enjoyed an upgrade to Neutral from Sell by UBS, the broker now adopting a more positive stance on opportunities in the UK pathology sector as outsourcing momentum increases.

On the downgrade side, Aston Resources (AZT) has been downgraded to Neutral from Outperform by Macquarie to reflect uncertainty from board changes arising from a difference of opinion in relation to corporate strategy.

While the Maules Creek project continues to offer promise, the board issues have seen Macquarie remove a previous takeover premium, which also means a cut in price target. A similar boardroom issue at Mount Gibson (MGX) has also seen Macquarie downgrade it to an Underperform from Neutral.

Both UBS and BA Merrill Lynch downgraded Campbell Brothers (CPB) during the week on valuation grounds to reflect recent share price gains. In both cases the brokers moved to Neutral ratings from Buy recommendations previously, though BA-ML did lift its price target slightly.

Recent outperformance was also enough for JP Morgan to downgrade Coca-Cola Amatil (CCL) to Neutral from Overweight, while earnings estimates have been trimmed in anticipation of another wet summer impacting demand.

Citi’s downgrade on Commonwealth Bank (CBA) to Sell from Neutral is based on the view a new CEO will be looking for growth avenues, so potentially putting some downward pressure on the share price. As well, Citi’s view is the recent trading update by the bank implies a slow start to the new fiscal year.

A strategy day was enough to prompt RBS Australia into making minor changes to its model for Iluka (ILU), with earnings and price target both adjusted. While the stock now offers an attractive yield there is potentially less growth on offer, which supports the broker’s move to a Hold rating.

While Incitec Pivot’s (IPL) full-year earnings broadly met expectations, Credit Suisse downgraded it to a Neutral from Outperform to reflect a tempering of expectations in coming years. The price target was unchanged, so the downgrade was a valuation call by the broker.

Valuation also explains Citi’s downgrade of James Hardie (JHX), as the company delivered a solid second quarter update with some signs of volume and margin improvement.

For MAp Group (MAP), valuation is also an issue in the view of JP Morgan, who has downgraded it to Underweight from Neutral given the share price is now in line with its estimate of value. Also supportive of the downgrade is that the stock is trading at a premium to the market despite the possibility of softer passenger numbers in coming months.

Peet (PPC) delivered a weak update and a lowering of earnings guidance for the full year causing UBS and Macquarie to downgrade it to Neutral from Outperform as weak operating conditions and capital levels suggest outperformance is unlikely in the short term.

Note: FNArena monitors eight leading stockbrokers on a daily basis. These are: BA-Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, JP Morgan, Macquarie, RBS and UBS.

Note: FNArena monitors eight leading stockbrokers on a daily basis. These are: BA-Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, JP Morgan, Macquarie, RBS and UBS.

For more news and analysis, visit FNArena.com.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: A big market move might be ahead

- Vas Kolesnikoff: Shareholders get what they pay for

- Alistair Bailey: How to invest in artwork

- Tony Negline: Planning your retirement for the self-employed