An investor I know once commented on the folly of owning drive-in cinemas. Who would want to own an outdoor cinema when all the growth was in indoor movie theatres at the time?

That simplistic analysis overlooked two factors. Once the land was bought, drive-in cinemas had relatively low capital expenditure. And the land became far more valuable over time.

Sadly, the business model of drive-in cinemas was less viable. But some cinema owners made windfall gains when their property sold because of the land value.

I see parallels with holiday parks that provide budget accommodation. I’m not suggesting holiday parks have a flawed business model and are headed for near-extinction. Far from it. But they, too, have relatively light capital expenditure (on buildings) and lots of valuable land in good locations.

In the short term, holiday parks should benefit from the boom in driving holidays as Australians take domestic trips, thanks to shut international borders.

Business forecaster IBISWorld expects a strong recovery in the Caravan Parks, Holiday Houses and Other Accommodation sector in Australia. Annual revenue growth will be 10.1% over 2021-26, from -9.85% annual growth over 2016-21.

That’s a good result considering international borders with Australia are mostly expected to stay shut this year and possibly next – not to mention travel chaos from occasional domestic border closures. International tourists who visit Australia and have driving holidays are an important source of demand for holiday parks.

Longer term, the holiday-parks industry should benefit from Australia’s ageing population. An increase in older travellers – the so-called “grey nomads” – will support demand for holiday parks and bed-and-breakfast-style accommodation that suits budget holidaymakers.

Also, as Australia’s population grows and more people relocate to coastal areas, it’s a no-brainer that land values should increase for well-positioned holiday parks. Imagine owning large caravan parks or holiday parks (with simple accommodation) in prime coastal areas in Southeast Queensland or Northern New South Wales.

Downsizing is another favourable trend. As “empty-nesters” seek smaller accommodation after their children leave home, demand for lifestyle communities should keep rising. Some property operators own a mix of holiday parks and lifestyle property developments.

Taken together, these trends should mean rising Net Tangible Asset (NTA) value for Australian Real Estate Investment Trusts (A-REITs) that own holiday parks and lifestyle communities. These include Lifestyle Communities, Ingenia Communities Group and Aspen Group.

Here is a snapshot of their prospects:

1. Lifestyle Communities (LIC)

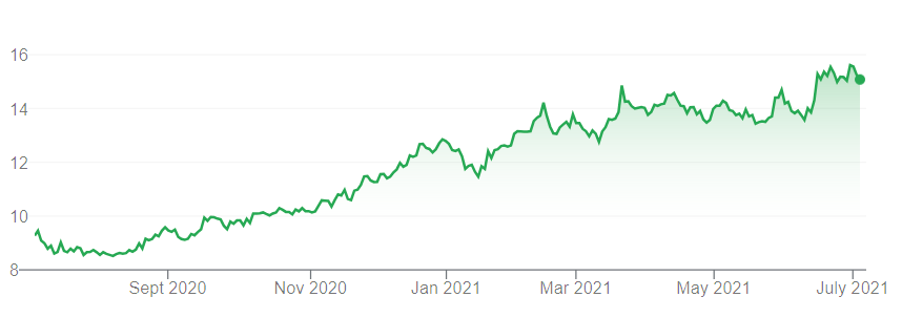

I wrote favourably in this Report in early May about the Victorian provider of affordable land-lease communities for older Australians. Lifestyle Communities has risen from $13.75 at the time of that column to $15.10, having tracked as high as $15.80.

I wrote in May: “Any price weakness would be a buying opportunity for one of the market’s best-run small-caps, which is superbly leveraged to downsizing trends.”

My interest in Lifestyle Communities was based on its lower-risk business model of building communities and selling homes in Melbourne and Geelong’s growth corridors. I described its strategy as “boring”, “cookie cutter” and highly effective.

There’s nothing wrong with that. Lifestyle Communities has growing annuity income from new-home settlements, rental increases and re-sales of existing homes. The company benefits as retirees in its communities downsize and move into aged care.

Better still, Lifestyle Communities is replicating a highly effective strategy in a market it knows well – Victoria – and minimising investment risks. Compared to small-cap companies that expand rapidly in new markets here and overseas, Lifestyle Communities is a safer bet.

Share-price gains might be slower from there, but there’s a lot to like about Lifestyle Communities’ long-term prospects. It’s one of the market’s better-run, under-researched small-cap companies. The stock still looks reasonably valued, despite recent share-price gains.

Chart 1: Lifestyle Communities (LIC)

Source: ASX

2. Ingenia Communities Group (INA)

I also outlined a positive view on Ingenia Communities Group in my May 2021 column for this Report.

I wrote: “From a charting view, Ingenia has broken through points of key resistance, suggesting a new upleg in its price trend could be forming.” Ingenia has rallied from $5.44 at the time of that column to $6.15, having gone as high as $6.44 in past 52 weeks.

To recap, Ingenia (formerly known as ING Real Estate Community Living) owns, manages and develops retirement and holiday communities across Australia.

The company’s $1.3-billion property portfolio includes 42 lifestyle and holiday communities and 26 Ingenia Garden Communities. Most of its communities are in New South Wales and Ingenia has an expanding presence in Southeast Queensland.

Ingenia has a different risk profile to Lifestyle Communities. It owns a number of holidays parks that have budget cabins and camping sites that appeal to families. Ingenia is much more of a play on a Covid recovery as demand for domestic driving holidays increases.

In its latest investor presentation in May, Ingenia said it has acquired $170 million of assets (year-to-date) and has a strong pipeline of acquisition opportunities in greenfield land and residential communities. Ingenia is well placed to consolidate a fragmented industry that consists of many small, independent holiday-park operators.

Ingenia is not cheap: its Net Asset Value (NAV) of $2.96 at end-December 2020 compares to the current price of $6.44. Ingenia’s valuation reflects its high regard in the market and long-term growth prospects.

I wouldn’t buy Ingenia at these levels, nor sell. Existing investors in Ingenia are better off holding their stock, provided they have a long-term view.

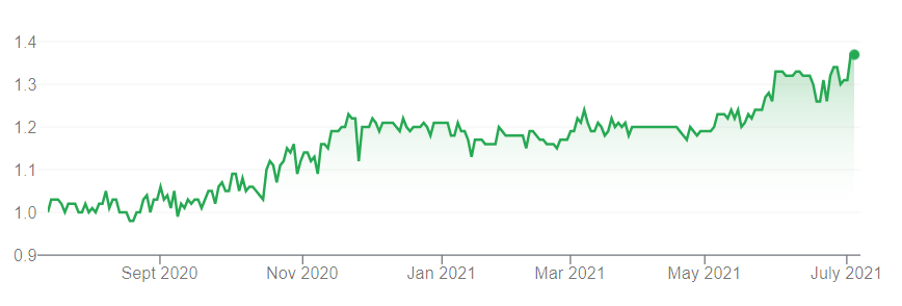

Chart 2: Ingenia (INA)

Source: ASX

3. Aspen Group (APZ)

The Sydney-based company owns dwelling rentals, leases land sites to customers, and sells dwellings and land. Its properties include houses, apartments, mixed-use parks, land-lease communities and co-living facilities.

Aspen has mostly traded at a discount to its NAV in the past few years, restricting its ability to raise capital and grow. However, Aspen now trades at a premium to NAV (the $1.37 share price compares to $1.20 NAV in its latest interim profit result) after an impressive first-half profit.

Some good property judges I know are looking closer at Aspen, believing it has finally reached a position where it will start to attract institutional capital and generate higher liquidity in its stock turnover.

Aspen has an interesting market position. As house prices climb, demand for affordable housing will rise. The average price for an Aspen home-and-land package is $337,000. It had 100 home-and-land sales in the first half of FY21, up 89% on its record FY20 result.

In all, Aspen had 2,361 dwelling and land sites in the first half of FY21. The company said it has a development pipeline of more than 618 sites across its platform. With 23% gearing, Aspen has balance-sheet capacity to buy more dwellings and land.

Aspen has rallied from a 52-week low of 97 cents to $1.37. The market is paying more attention because demand for affordable housing – cheap home-and-land packages, and caravan rentals – is rising as a generation of Australians are priced out of the property market.

In its latest presentation, Aspen said 1.5 million Australians who are paying a mortgage or renting are considered “stressed” – that is, they are paying more than 30% of their income on housing costs. This is a prime market for Aspen’s affordable-housing offerings.

I want to see Aspen better diversify its revenue streams, by product and geography. About 40% of its income is still in short-stay accommodation that has less certainty. I’d like Aspen to have a higher proportion of long-term leases (currently 60% of revenue) that deliver stable cash flows. If it achieves that, further price gains are likely.

Chart 3: Aspen Group

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 6 July 2021.