This is the biggest week of the investing year, with critically important economic revelations set to drive stocks down hard or create a surge that could morph into the mother of all Santa Claus rallies. And it could put an end to talk about bear market rallies and even bear markets, or else confirm that Wall Street has been too optimistic since October.

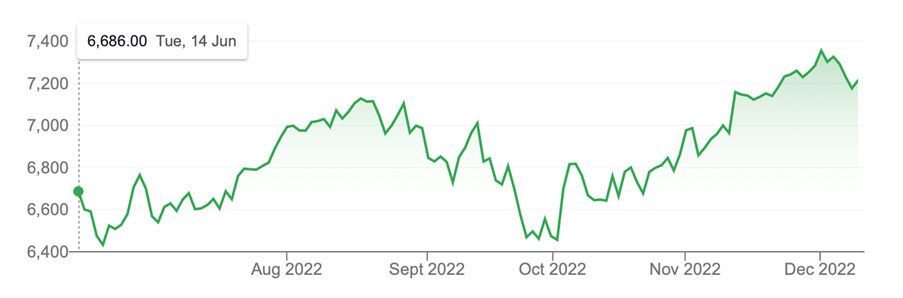

This chart below shows how we’ve benefitted from hopes of inflation peaking in the US, interest rate rises easing and better news from China on its zero-Covid policies.

S&P/ASX 200 (6 months)

This not only shows the 11.7% rise in the index since October 3 but also over the past six months the market is up 7.89%, after being down all of 2022.

Of course, the Yanks have had it harder with the Nasdaq down 35% by October 14 and the S&P 500 was off 25% at its worst. The former is now down 30% and the latter is off 18%, so the Nasdaq is still in a bear market and the S&P 500 is just out of one, making Tuesday’s and Wednesday’s revelations potentially dramatic and impactful for our stocks.

In the US on Tuesday, they see the latest Consumer Price Index. Given the October reading of a less-than-expected 0.4% for the month took the annual number to 7.7%, the market will need to see something more encouraging to believe that US inflation is falling. Last week the Producer Price Index was slightly hotter than was tipped and along with other relatively strong economic indicators, the market went negative, with the S&P 500 down 2.9% for the five trading days and we gave up 2.2%.

This confirms what we already suspected — if the inflation number is bad, Wall Street will dump shares and our market will play follow the leader. That’s why the US inflation stat is crucial to what happens for stocks.

The next big thing for stocks is the Fed’s reaction to that CPI reading on Wednesday. The market expects a 0.5% rise based on its suspicion that inflation is falling, but if that CPI is bigger than expected, then not only might the Fed raise by 0.75%, it could put together a narrative about rate rises for longer, which would really KO stocks. It would also heighten the fears about a US recession.

Right now the US is forecasted to cop a shallow recession but if inflation doesn’t follow the optimists’ script, then too many rate rises could hit this economy for a deep recession-style six.

This is Reuters latest take on the subject: “After raising the federal funds rate 75 basis points at each of the previous four meetings, all 84 economists polled Dec. 2-8 expected the central bank to go for a slightly softer half a percentage point to 4.25%-4.50% this time.”

That consensus was largely predicated on the belief that inflation is on a decent slide, but what if the number disappoints this week?

“Unless inflation recedes quickly, the U.S. economy still appears headed for some trouble, though possibly a little later than expected. The relative good news is that the downturn should be tempered by extra savings,” said Sal Guatieri, senior economist at BMO Capital Markets. “But this assumes the economy’s durability doesn’t compel the Fed to slam the brakes even harder, in which case a delayed downturn might only flag a deeper one.”

The thinking following a disappointing inflation number will be: rate rises will be more damaging, which means recession is more likely and more hurtful and so stocks need to be dumped. Thankfully, stock markets will react the other way if the inflation reading again surprises on the lower side and drops more than expected.

Here’s what the Reuters’ survey said about a US recession: “Around 60% of economists, 27 of 45, who provided quarterly gross domestic product (GDP) forecasts, predicted a contraction for two straight quarters or more at some point in 2023. A large majority of economists, 35 of 48, said any recession would be short and shallow. Eight said long and shallow, while four said there won’t be any recession. One said short and deep.”

So how do you play this week’s data drama and the Fed’s possible actions?

First, you could invest ahead of Wednesday, which would be a down or up day depending on the CPI. That’s the gutsy play based on guessing that the number will be good.

Second, you wait to see the number and, if it’s good, get in ASAP to ride the uptrend that could easily power that Santa Claus rally.

Third, wait and see the inflation reading and think about buying into the sell-off, after the market slides for a while.

A sell-off could be the last real buying opportunity, if real reductions in inflation eventually show up statistically in the early months of 2023.

My view on next year is that it will be a good year for stocks, even if it takes time to prove me right. Why?

Try these:

- The third year of a US presidency is great for stocks, with the S&P 500 up 81.8% of the time since 1928.

- Of the 25 bear markets that have occurred since 1928, 14 (56%) have also seen recessions while 11 have not (44%).

- Research from Kristin McKenna, Managing Director at Boston’s Darrow Wealth Management, looked at US recessions from 1953 and found “during that period, the stock market delivered positive returns in the six months after a recession ended, 82% of the time. In the 12 months following a recession, the stock market achieved a positive return 91% of the time, with an average return of 16%. (fool.com)

- A recession could see the Fed cut rates and that would help growth stocks.

- I expect China to help world economic growth in 2023 as it throws off its extreme zero-Covid policies.

- Lower inflation across 2023 will be an enormous plus for stocks and rates.

- And who knows, Putin’s disastrous war might end!

Clearly, I’m ruling out the worst-case possibility of a deep US recession, which would push the rebound year to 2024, but when you play stocks, it’s always a gamble that’s more likely to pay you back handsomely if you invest for the long term.

When the time is right — inflation is falling and interest rates are close to peaking — I’m going to play hedged ETFs for the US market and especially the Nasdaq. I will invest in local market ETFs as well, which should show both good capital and income gains.

Timing will be tricky and I’m in the hands of the US statistician and the Fed. It’s why this week is crucial.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.