If you want to invest short-term, then expect a reliable and OK return. But if you want bigger results for your portfolio, you will have to be patient and wait until there is a re-rotation back into tech and growth stocks.

Back in late 2021, I suggested that iron ore miners, financials and energy stocks were the way to go for 2022. These charts show that they have already enjoyed sizeable gains.

BHP Group (BHP)

The bounce back for BHP started on 5 November and has gone from $35 to $48 — that’s a 37% gain.

Westpac (WBC)

Westpac has gone from $20 in November and is now nearly $24, which was about a 20% gain for punting on the worst of the big four banks at the time.

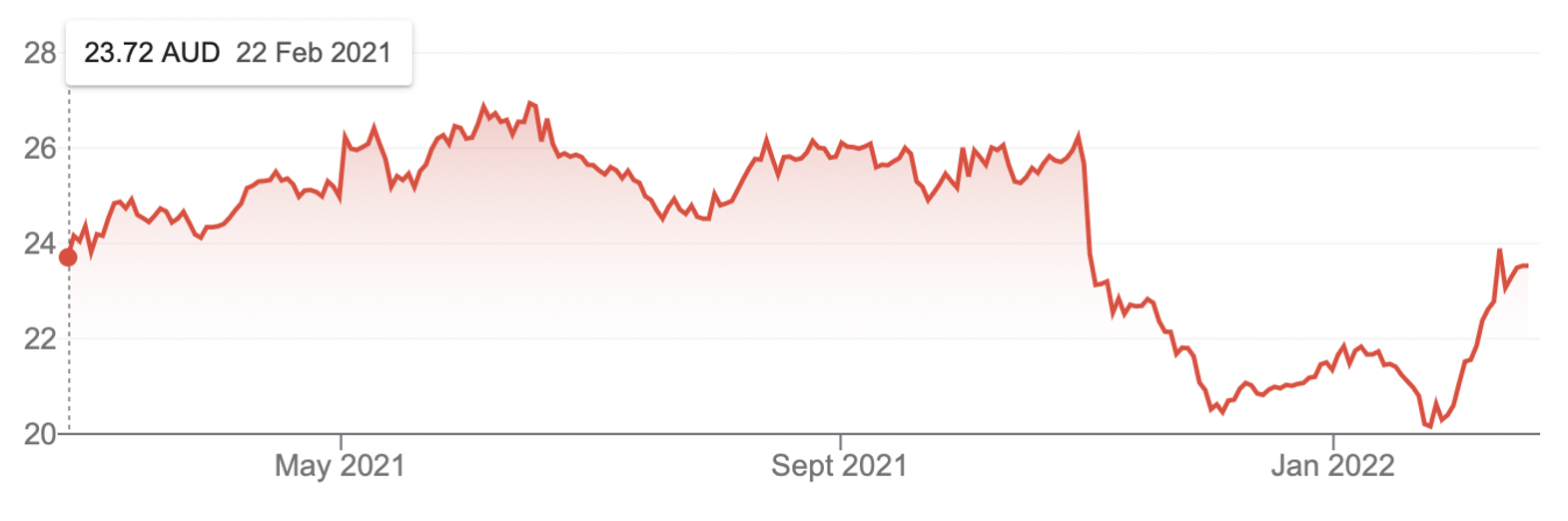

Woodside Petroleum (WPL)

The energy sector’s Woodside Petroleum had two big stock price kick-ups in 2021 — one from September starting at $19.20 and then a second one in December from $21 — but it has put on 30% since the latter.

My calls were on the money but I had to wait to look insightful — stock selecting is often a waiting game.

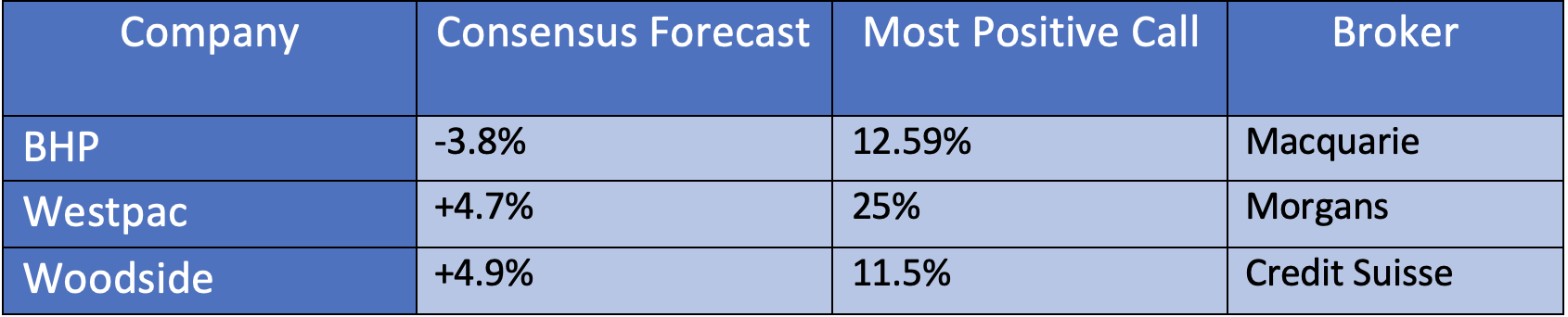

And at the time the analysts backed me, but what are they saying now about these companies?

Source: FNArena

The consensus forecast shows you’ve missed the boat on big returns, though if the optimists are right, there’s still some nice upside for these quality companies. And all three pay dividends, with BHP’s and Westpac’s not to be dismissed too easily.

After looking at these smaller potential returns from solid companies, I started to think about how you can ramp up your returns for this year. I believe once we get over the Fed’s interest rate rises, the power of the global economic comeback will help stocks spike later this year and I want to think about what I buy today for bigger returns tomorrow.

Clearly, my exposures to BHP, WBC and WPL are bigger than what I might have for tech or other growth stocks because I like steady companies that pay dividends in the core of my portfolio. However, I like to get alpha out of beaten-up companies that I think have a future.

We had a client who was worried about a number of stocks we had in her portfolio, which I might say she had a small exposure to, and one was CSL. All four companies were heavily liked by the expert analysts, which comforted her.

When she contacted us CSL was $243 and I allayed her fears arguing it’s a quality growth company with a great future and the stock has risen 8% since then, despite Vladimir Putin’s impact on stock market fears. And I expect it will be a lot higher by the end of this year and even more by late 2023.

I’m also expecting tech stocks to get forgiven over the course of this year as fund managers look at the stocks they chased recently — energy, mining and financial companies — and then think: “Gee those tech and other growth stocks look oversold!”

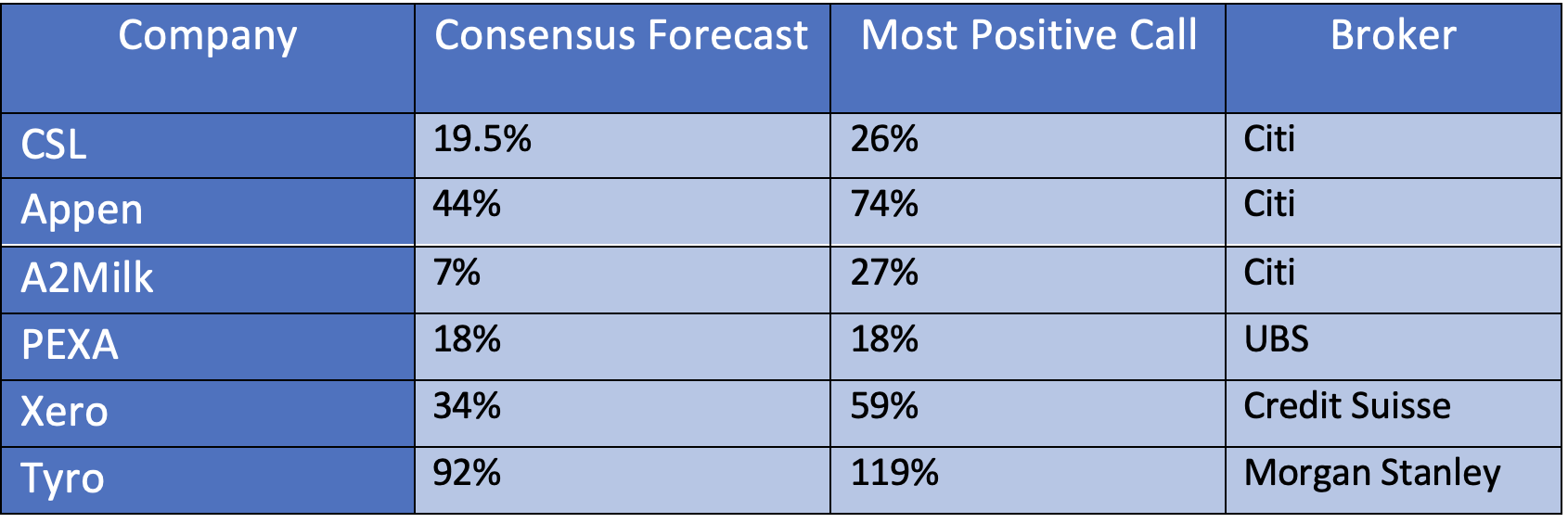

Right now, this is what the analysts are thinking about some interesting growth stocks.

Source: FNArena

Tyro copped it today, as tech and payments stocks keep being sold off, and so if you are not already in this stock, it might pay to wait.

Am I invested in all of these? Yep, and I know I will have to wait for a nice return but as the old saying goes, and I know I’ve said this before: “Good things come for those who wait.”

And note there’s a lot of professional company watchers who agree with me that a re-rotation will eventually come.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.