Readers know I favour a deep-value or contrarian investment style. That usually means identifying out-of-favour sectors and stocks that have fallen too far.

But contrarian investing is not just about buying beaten-up assets. It also involves buying or holding assets that have rallied and look expensive.

Take the Commonwealth Bank. A chorus of commentators, including me, have argued CBA is overvalued. Yet its share price is up 47% over one year.

Most broking firms have hold or underperform recommendations on CBA. Contrarians who went against that bearish view on CBA have enjoyed stellar returns this year.

Not for a minute am I suggesting CBA is a buy at these levels. I maintain the view that the stock is overvalued, and that better value exists in overseas banks.

Rather, my focus on CBA shows contrarian investing can also involve buying or holding high-performing assets everybody says are overvalued.

The same is true of the portal stocks, REA Group and CAR Group. As readers know, I have long advocated buying those stocks during market corrections or pullbacks. They always look expensive yet have starred this decade.

I continue to rate REA and in particular CAR Group, though, as mentioned, would wait until a bout of market weakness before adding them to portfolios.

Two ideas I retain a bullish view on are global banks and US small-cap equities. I have outlined the case for global banks several times in this column in 2024 and have also made the case for global small-cap equities over Australian ones.

Both assets will benefit from Trump’s victory this month in the US Presidential election. On US banks, the Trump administration is expected to favour less stringent industry regulation, aiding mergers and acquisitions in the sector.

The potential for tax cuts and a stronger economy under Trump is also good for US banks. His threat of higher tariffs is a double-edged sword as it could underpin higher inflation, but also high interest rates that support bank net interest margins.

US small-cap stocks should collectively benefit from the Trump effect on the US economy and risk appetite. His more isolationist nationalist approach to support the US first could help domestic-focused US small-caps.

The market has a similar view. US bank stocks leapt after Trump’s win, as did US small-cap equities. The market clearly sees Trump as good for the US economy.

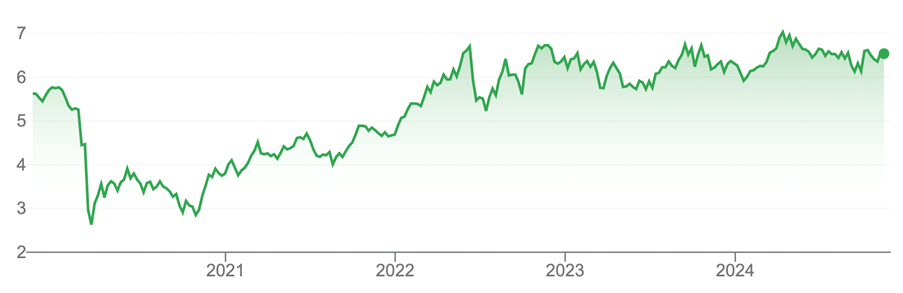

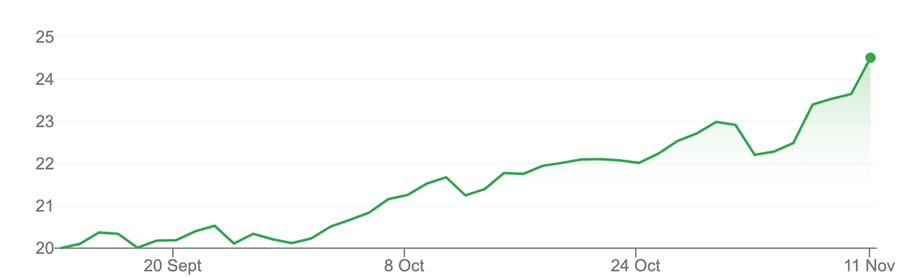

Global energy stocks also rose after Trump’s win, as did defence stocks. Trump’s reference to oil as ‘liquid gold’ and his ‘drill, baby, drill’ comments show his agenda to expand the US energy sector. Meanwhile, a more aggressive foreign policy under Trump should encourage higher defence spending.

In the week before the US election, I nominated the Betashares Global Energy Companies ETF (ASX: FUEL) for energy-stock exposure, and the new VanEck Global Defence ETF (ASX DFND) for defence exposure, on the likelihood of a Trump win.

I thought Trump would narrowly win the US election. Like many, I was surprised at the extent of his victory and mandate. No doubt populist politicians in other nations will follow his playbook, which could have market ramifications.

FUEL and DFND have rallied in the past week. I’m happy to stick with both ETFs, believing their potential gains have further to play out.

Chart: 1: Betashares Global Energy Companies ETF

Source: Google Finance

Chart: 2: VanEck Global Defence ETF

Source: Google Finance

My focus this week, however, is on global banks and US small caps.

- Betashares Global Banks ETF – currency hedged (ASX: BNKS)

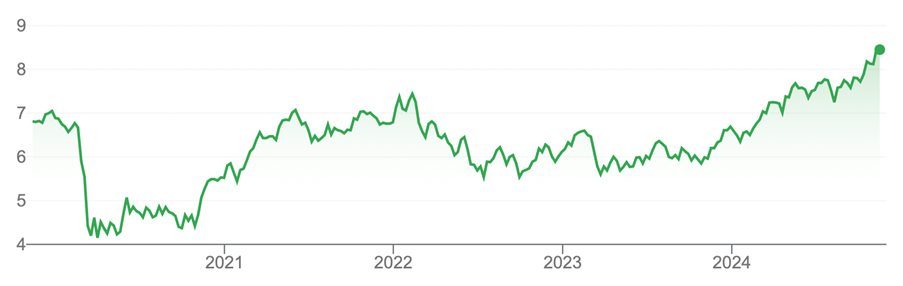

As I have noted several times this year, BNKS remains my preferred index exposure to global banks stocks. I retain a bullish view on global banks and BNKS despite soaring gains this year.

BNKS, which holds 6o of the world’s largest bank stocks (excluding Australia), has returned 43% over one year to 31 October, Betashares data shows. That return would be even higher after accounting for gains since the US election.

Chart 3: Betashares Global Banks ETF – currency hedged (ASX: BNKS)

Source: Google Finance

A casual glimpse of that chart could lead some investors to conclude that global banks have run their race, and that better value exists elsewhere. Not so.

As an aside, BNKS’s return of 43% over one year is only a bit behind that of the CBA. Yet BNKS’s return came from a diversified portfolio of 60 bank stocks, rather than owning a single bank stock and all the company risk that comes with it.

Moreover, BNKS’s average forward Price Earnings (PE) ratio of 8.75 times at 30 September 2024 compares to a forward PE of almost 24 for CBA. Put another way, BNKS provides a similar return to CBA over one year, at far less risk.

A forward PE below 10 for BNKS, which includes many of the world’s highest-quality banks in the US and Europe, is not demanding, especially if Trump can boost the US economy and US banking sector.

BNKS’s holding of European bank stocks, some of which also remain undervalued, could be another performance tailwind in 2025.

Gains in BNKS will be slower from here. Expect some pullbacks along the way, but there is still a good case to bank on BNKS into 2025.

- iShares S&P Small-Cap AUD ETF (ASX: IJR)

IJR, which invests in a portfolio of 662 US small-cap stocks, has returned 25.7% over one year to 30 September 2024.

As I wrote last month, I like the outlook for small-cap equities as global interest rates fall and global growth slowly improves. I prefer global small-caps to their Australian peers, given our nation is lagging on interest-rate cuts.

The US has already had two rate cuts this year worth 75 basis points, with more on the way as US inflation is contained. Australia is still months away from its first rate cut as employment remains strong and inflation too high.

I have argued in this column that rate cuts in Australia will take longer than the consensus view expects, due to persistently higher inflation. Reckless Federal and State government spending is exacerbating our inflation challenge.

Also, the US now has its election behind it and a clear victor, albeit with the uncertainty a Trump administration brings. Australia still has its election ahead in 2025 and all the headwinds that brings for the economy.

Global small-caps, in particular US small-cap equities, will benefit before Australian small-caps due to earlier rate cuts. Although IJR has rallied over one year, it’s three-year average annualised return is only 6.3%.

US small-cap equities have a lot of ground to make up after a lacklustre few years where they have underperformed large-cap equities.

An average PE ratio of 16.7 times for IJR compares to an average PE of 28.6 times for the iShares S&P 500 ETF (ASX: IVV). On key valuation metrics, US small-caps look more attractive than US large-cap equities.

Trump’s win, US rate cuts and renewed US risk appetite could narrow that valuation gap in 2025 and help IJR potentially climb higher.

Chart 4: iShares Core S&P Small-Cap ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 13 November, 2024.