Rail and transport provider Aurizon Holdings Ltd (AZJ) today delivered a profit result that was bang on expectations, arguably marginally ahead of consensus. So it is hard to know why the market knocked it down almost 6% in early trading.

The “headline” was the cut to the final dividend, a reduction of 27% from 14.4c in FY21 to 10.9c in FY22. But this was expected – at least by the broker analysts – with the full-year payout of 21.4c exceeding the consensus forecast of 20.4c. Overall, this represents a yield of 5.3%, almost fully franked (98%), on Friday’s closing price of $4.04.

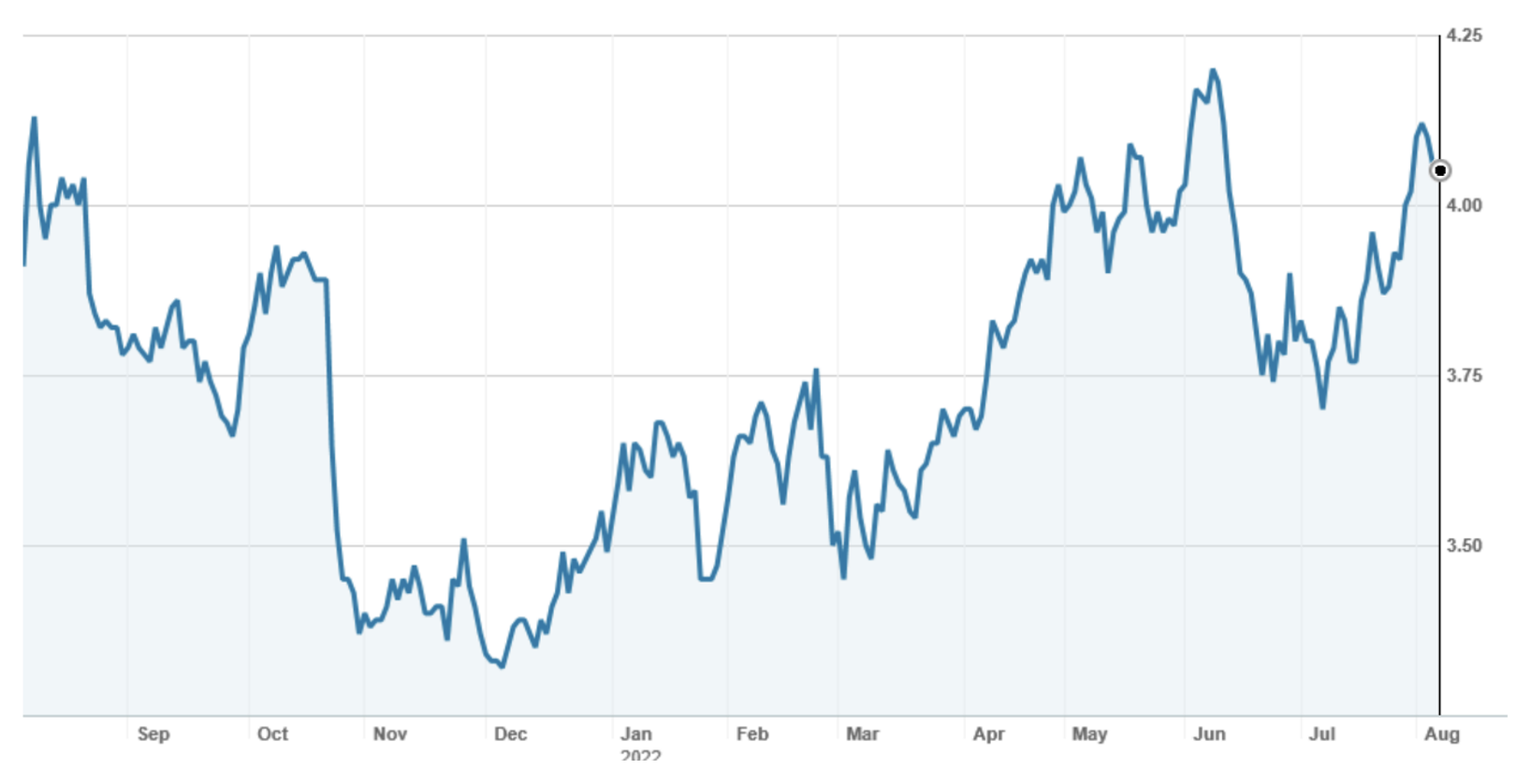

Aurizon Holdings Ltd (AZJ)

Maybe it was the “shock” of recognizing that Aurizon’s dividend was the lowest since 2014 – but they have all been with payout ratios approaching 100%. This year, with Aurizon preserving cash for the integration of the One Rail bulk haulage business, the payout ratio is 75% of underlying NPAT.

Aurizon is Australia’s largest rail-based transport business. 55% of EBITDA comes from its highly regulated ‘below rail’ asset base, where it operates 2,670km of track in Central Queensland supporting 90% of Australia’s metallurgical coal export volume. The other 45% of EBITDA comes from ‘above rail’ operations (haulage etc), supporting thermal coal, metallurgical coal and bulk commodities. Currently, the revenue contribution from metallurgical coal, thermal coal and bulk is evenly split (very close to a third each).

The company is transitioning away from the haulage of thermal coal towards support for bulk commodities (grain, minerals such as copper, rare earths, sand etc). Strategically, it wants to double the size of its bulk business by 2030 and has recently completed the acquisition of One Rail, an integrated rail business with almost 2,500km of track infrastructure in Central Australia. To help pay for the acquisition (and in keeping with ACCC approval), it is currently divesting its East Coast rail business where it hauls thermal coal in the Hunter Valley.

EBITDA for FY22 of $1,468 was consistent with Aurizon’s prior guidance of $1,425 million to $1,500 million, and down 1% on FY21. Underlying NPAT of $525 million was down 2%, with both being small “beats” on broker forecasts. Lower volumes led to a 6% decline in the network (‘below rail’) business EBITDA, while the impact of floods and Covid-19 saw a 7% decline in EBITDA from the bulk business. Coal EBITDA increased by 1%, with a higher revenue yield from contracted CPI increases and cost management offsetting a 4% decline in tonnages.

Looking ahead, the company forecast EBITDA to be in the range of $1,470 million to $1,550 million for FY23. This includes 11 months of contribution from the One Rail business, but no contribution from East Coast Rail. Again, this was broadly in line with market expectations.

What do the brokers say?

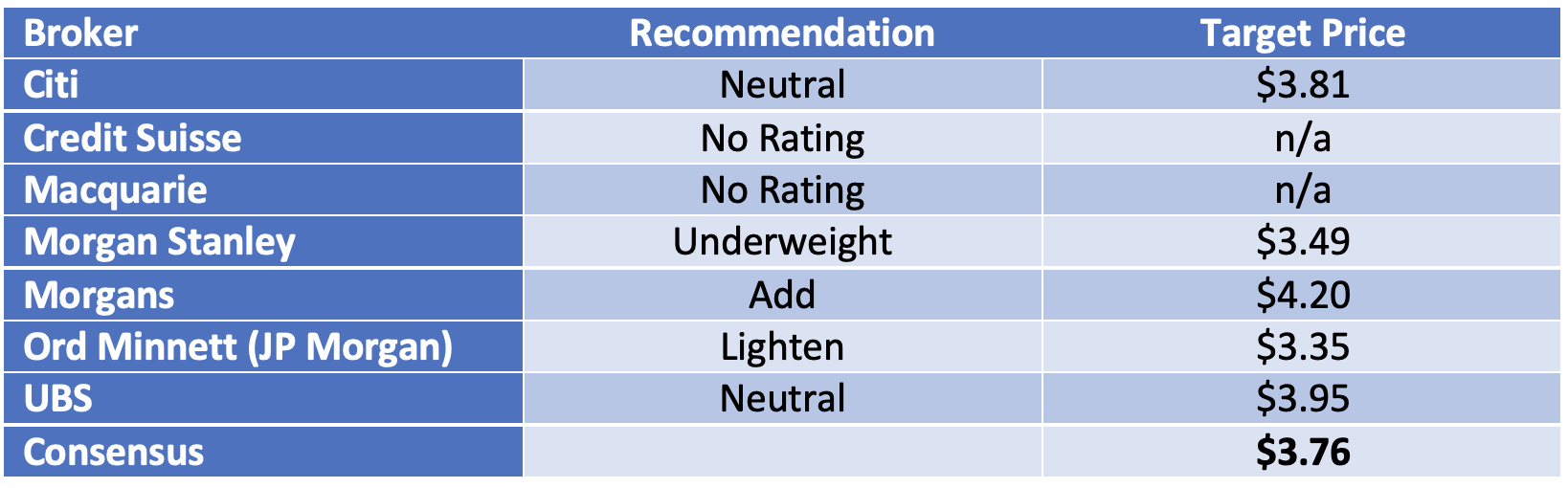

Going into the result, the brokers were neutral to marginally negative on Aurizon. The consensus target price was $3.76, some 6.9% lower than the closing price before the announcement.

Investor aversion to companies involved in fossil fuels, together with near-term implementation risks associated with the purchase of One Rail and divestment of East Coast Rail, were common themes.

On the positive side, Morgans thought that Aurizon would be a beneficiary of higher interest rates and inflation, and over time, the payout ratio would move back towards 100%. They have a target price of $4.20.

Individual recommendations and target prices are set out in the table below.

On multiples, they had Aurizon trading on a multiple of 14.5x FY22 earnings and 13.6x FY23 forecast earnings.

Bottom Line

My hunch is that there will be a negligible revision by the broker analysts to forecasts or target prices. In fact, revisions, if any, will be marginally positive.

So the market’s reaction to the profit announcement will be seen as Aurizon returning to “fair value”. The prospective dividend yield will increase (dividend forecast of 22c for FY23, fully franked, based on a $3.80 share price) to about 5.8%.

However, Aurizon is not without risks. Firstly, it is largely “growth-less”, operating in a highly regulated industry. Secondly, it is still exposed to ESG pressures through its haulage of thermal coal and operation of rail assets that are used by thermal coal producers in Queensland. How much of this is already in the price nobody knows – but one fact is for sure, some investors won’t contemplate buying Aurizon for this reason. And thirdly, it has medium-term exposures to commodity prices (lower prices could lead over time to lower volumes) and short-term weather events.

This all said and despite the dividend cut, Aurizon offers an attractive dividend yield with manageable downside risks. The market sell-off has created value. It is not a stock to chase, but in the “infrastructure” category, there are worse stocks to consider.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.