A recurring column theme this year has been to reduce exposure to US equities, take profits and rotate into better-value global equity markets.

As I argued last week, European equities are the pick on valuation grounds. My preferred tool for exposure was the iShares Europe ETF (ASX: IEV).

I have also this year argued for a small portfolio allocation to China equities on contrarian grounds, nominating the iShares China Large-Cap AUD ETF (ASX: IZZ).

In January, I outlined a more bullish view on Japan as its economy improves, suggesting readers consider the iShares MSCI Japan ETF (ASX: IJP).

On a year-to-date basis to end-June 2025, IEV is up 16.5%, IZZ has gained 14% and IJP is up almost 7%. So far, so good.

I still like each idea for long-term investors, although I am concerned about booming retail interest in Japanese equities. Some reports I’ve read suggest the rally has attracted an army of finfluencers and other stock promoters in Japan.

One market I haven’t covered in detail this year is the United Kingdom. That’s partly because European equities ETFs usually have a sizeable allocation to the UK. The iShares Europe ETF (ASX: IEV) had a 23% weighting in UK equities at end-June 2025.

Therefore, readers who follow this column, and have increased their exposure to European equities in the past 12 months, already have an allocation to the UK.

That said, it’s worth viewing UK equities on their own, given their prospects. And going ‘overweight’ UK equities within the portfolio’s European equities allocation.

UK equities remind me of Australia. Like this market, the UK bourse is at a record high despite a sluggish economy, poor productivity and weak earnings growth. Buying equities at record prices is hard for contrarians, like me, to reconcile.

Also, like Australia, the UK market is overrepresented by slower-growth sectors – banks and mining – and underrepresented by tech and other high-growth sectors.

UK and Australian equities are no doubt benefiting from a growing rotation out of US equities into other developed markets. Who can blame asset managers for taking profits on US equities when policymaking there is so erratic?

Even a small rotation of capital from the US to smaller markets can be a strong tailwind, given the dominance of US equities in global benchmarks.

Nevertheless, I prefer global to Australian equities at these levels. Yes, there are always company-specific opportunities within and outside the S&P/ASX 200. But our market looks pricey after a few years of low corporate earnings growth.

The UK is a different story. For starters, the relationship between the main barometer of UK stocks – the FTSE 100 Index – and the UK economy is not as clear-cut as it seems, given so many UK companies are giant multinationals that earn a big chunk of their revenue overseas. That’s not the case in Australia.

The Economist last week had an interesting article on UK equities and bonds, describing them as a ‘bargain’. I’m not as bullish but agree that UK equity valuations look attractive relative to their US peers.

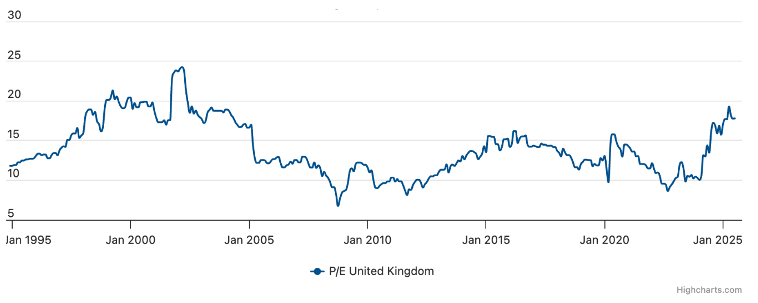

Consider this simple comparison. The trailing Price Earnings (PE) ratio for UK equities is 17.8, In the US, that figure is a whopping 25.5 times.

In absolute terms, UK equities aren’t as cheap as they were at the start of the year, but unlike US equities they are still well off their average PE high.

Average trailing PE ratio – UK equities

The UK equity market’s composition is another attraction. As readers know, I have long thought European banks, including some in the UK, are cheap, certainly compared to their peers in the US and Commonwealth Bank in Australia.

Financials account for almost a quarter of the Betashares FTSE 100 ETF (ASX: F100). Commentators bemoan the high exposure of banks and other financial companies in the index, when they should welcome it on valuation grounds.

HSBC Holdings PLC is the largest single stock weighting in the index at 7.2%. Another key UK bank, Lloyds Banking Group, has a lower weighting.

As asset managers in Australia have noted, Lloyds trades on a forward PE ratio of just 11 times, while CBA trades on a nose bleeding 27 times, making it among the world’s most expensive banks.

Lloyds operates in a market two-and-a-half times larger than Australia and has broadly similar financial metrics in terms of loans and equity to CBA. Yet Lloyds trades on a valuation well below that of CBA. That’s an opportunity.

Another 15% of the Betashares’ F100 is held in energy and mining stocks. Shell PLC, the British multinational oil and gas company, is worth 7.1% of F100.

Other key stock holdings in F100 include AstraZeneca PLC, Unilever PLC, Rolls-Royce Holdings, RELX Plc (a multinational information analytics company), British American Tobacco, BP, BAE Systems and GSK (the pharmaceutical giant). Each is a genuinely global company whose fortunes are not hostage to the UK economy.

F100 is the only ETF on ASX providing pure exposure to UK equities. As mentioned, several ASX-quoted Europe ETFs include UK shares.

F100 has returned 22.2% over one year to end-June 2025, continuing a run of healthy gains since its 2020 lows. F100’s annualised five-year return is 14.2%.

But over 10 years, F100’s annualised return is 7.24%. Although UK equities trade at a record high, the long-term return has been less impressive, suggesting room for further gains, albeit at a slower pace from here.

Betashares FTSE 100 ETF

F100 is a simple tool for UK equities exposure. Bought and sold like a share on ASX, the ETF comes in an unhedged (F100) and hedged (H100) version. H100 costs 0.48% annually, slightly more than F100 due to the hedging.

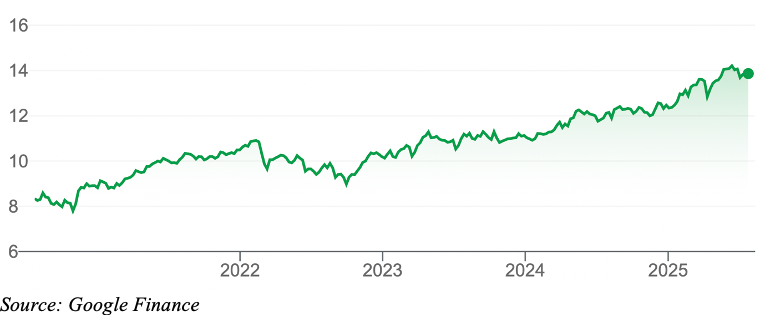

The British pound has rallied against the Australian dollar this year. Our dollar looks oversold, so I favour the hedged version of Betashares’ UK ETF (H100), to eliminate currency risk.

British pound to Australian dollar

Like other European markets, the UK could benefit from a pivoting of Chinese manufacturers towards Europe. A US-UK trade deal is another tailwind, at least relative to other markets, as are signs of improving UK economic data.

To conclude, investors who are overweight European equities, as this column has suggested in the past 12 months, might not need additional UK exposure. For those looking to rotate capital from US equities into fresh position, UK equities still look attractive, given their sizeable valuation discount to US equities.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis 23 July 2025.