Australia’s listed funds’ managers provide another avenue for investment – rather (or on top of) using the manager’s skill to run part of your portfolio, you can buy the shares of the company, and enjoy the benefit of many other people choosing the fund manager. By investing in the stock of the operating company, shareholders can benefit from other investors paying fees.

Fund managers can be very profitable companies – much of their costs are fixed, and they can manage more money without doing much different. Most of their key business assets are in their managers’ heads. This means they benefit immensely from economies of scale, and are hugely profitable, generating earnings based on a percentage of their funds under management as well (in some cases) as performance fees. And they also benefit from the billions of dollars that flow into superannuation each week, on the back of Australia’s mandated retirement system, and need to be put somewhere.

Given strong investment markets, such as has been the case for quite a few years now, the value of the funds that the managers oversee increases as markets rise, boosting fee income. It is also expected that over the coming decades, Australian funds management becomes much more of an export industry.

Funds management “headstocks” tend to give a leveraged effect where, if the company’s funds outperform, the listed stock should generate higher returns than investors could expect from investing in the underlying fund.

The two most prominent are the renowned home-grown brands of Magellan and Platinum – but these may not be where the best value lies.

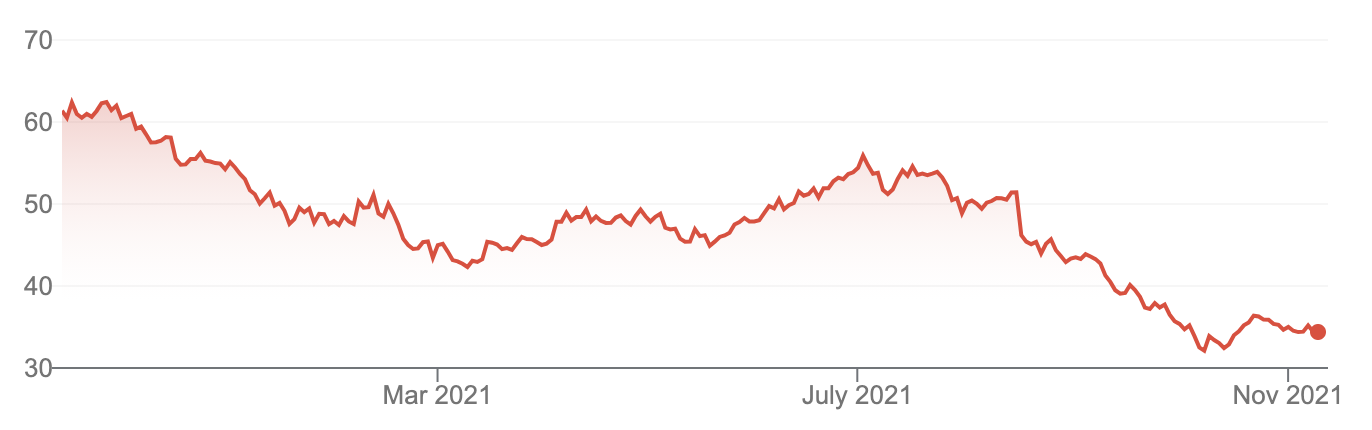

1. Magellan Financial Group (MFG, $35.19)

Market capitalisation: $6.5 billion

Three-year total return: 14.2% a year

FY21 dividend yield: 4.6%, 75% franked (grossed-up, 6.2%)

Analysts’ consensus target price: $36.12 (Thomson Reuters), $37.11 (FN Arena)

Formed in 2006, Magellan Financial is a global investment company specialising in global equities and global listed infrastructure. As of the latest update in October 2021, MFG manages $114.8bn of investors’ money.

Magellan is best-known for its high-profile co-founder Hamish Douglass, the billionaire stock-picker that drives much of its strategy. And that strategy has struggled recently, on the back of underperformance in Magellan’s flagship global fund, which lags a whopping 22.8% behind its benchmark (the MSCI World Index) over the past 12 months, and also trails it over three, five and seven-year periods. To be fair, the global fund’s return targets 9% a year (rather than to beat the MSCI index); and the Magellan fund outperforms over ten years, and since inception (in July 2007), long-term Magellan investors have enjoyed performance almost 4 percentage points better than the MSCI World.

Douglass has confessed to two major mistakes this year: staying in China stocks too long, and not getting into the cyclical stocks, that have surged in value. But the underperformance has hammered the share price, which is down 34% so far in 2017, despite funds under management (FUM) growing – however, so far this financial year, a net $1.8bn has walked out the door.

Underlying net profit fell by 6% in FY21, to $412 million, dragged down by a 63% drop in performance fees, mainly because of the underperformance.

Apart from the flagship global equities strategy, Magellan has some good growth prospects in other areas of its business: MFG Core Series (its cheaper ETF products), FuturePay (a retirement product), ESG/ethical investing, Australian shares, infrastructure and in particular, its move into private investments – the firm owns stakes in three operating businesses, namely investment bank Barrenjoey, Mexican restaurant chain Guzman y Gomez and trading infrastructure fintech FinClear.

Brokers are extremely divided on MFG: the most recent price targets are:

- UBS (November) $29.50

- Macquarie (October) $38.00

- Credit Suisse (October) $35.00

- Morgan Stanley (October) $29.30

- Ord Minnett (October) $36.00

MFG looks quite fully valued for now – but it does offer an attractive dividend, of 6.3%, 75% fully franked (grossed-up, 8.4%) on current prices.

Magellan Financial Group (MFG)

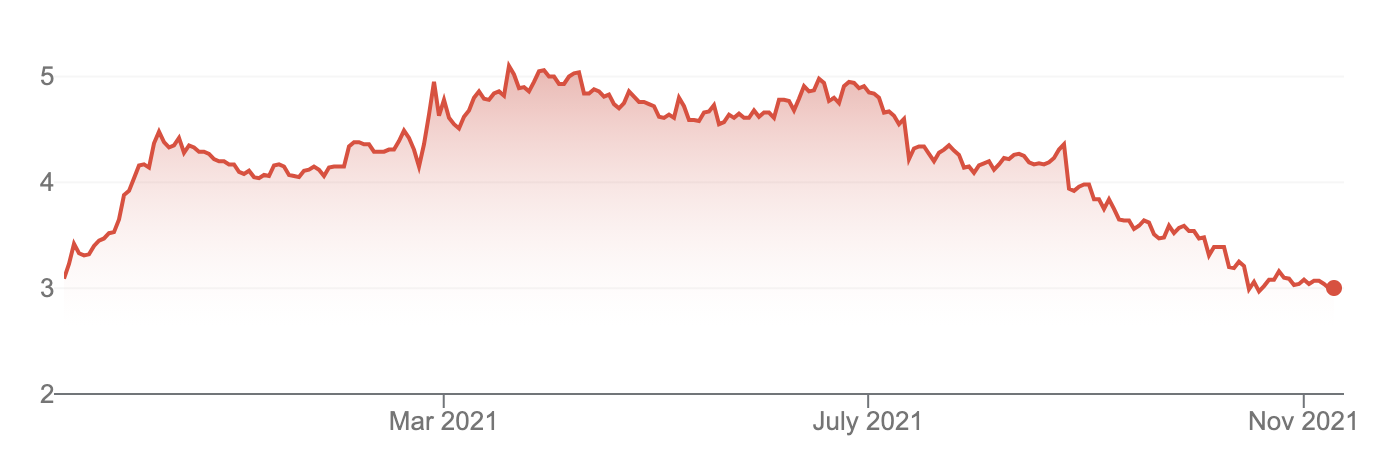

2. Platinum Asset Management (PTM, $3.04)

Market capitalisation: $1.7 billion

Three-year total return: –11.6% a year

FY21 dividend yield: 6.1%, fully franked (grossed-up, 8.7%)

Analysts’ consensus target price: $3.20 (Thomson Reuters), $3.55 (FN Arena)

Global investing specialist Platinum Asset Management is the other big homegrown brand in Australian funds management: the firm, founded by one of Australia’s most respected investors, Kerr Neilson (who is still the company’s largest shareholder, owning about 40%), pioneered overseas investing for mainstream Australian investors, with the Platinum International Fund (currently $7.6 billion), and was one of the first Australian fund managers to move meaningfully into Asian shares, with the Platinum Asia Fund (currently just under $4 billion).

The company runs a range of managed funds, listed investment companies (LICs), ASX-quoted managed funds, mFunds and the Platinum Investment Bond retirement product.

Platinum’s FUM has basically marked time over the last five years, despite surging global share markets over that period. As the company’s value-oriented management style has looked distinctly out of favour – Platinum has largely shunned the “growth” heavyweights that have pushed markets higher. An underweight position in the US has also detracted from performance for some time. Earnings have also been largely stagnant: in FY16, Platinum earned net profit of $200 million, but in FY21, that figure was $163 million, as a result of persistent net outflows, and industry-wide fee compression.

For FY21, Platinum saw gross inflows rise 10%, to $1.7 billion, but net outflows of $2.2 billion (an improvement on the $3 billion net outflow of FY20). Platinum experienced net outflows every month in FY21. But total FUM rose by 10%, to $23.5 billion, as the outflows were more than offset by investment performance as momentum shifted to “value” stocks.

Platinum shares have lost 26%t in 2021 so far. Since the peak of $9.15 in 2015, PTM has lost two-thirds of its market value.

It also did not help the share price that Judith Neilson, the former wife of Kerr Neilson, sold 97.3 million shares (16.6% of the company) in October, at a 6.5% discount to market price, reducing her holding from 21% to about 6%. You don’t have to worry about the discount when you’re cashing-in $292 million.

Like many successful managers, Platinum has lost “star” stock-pickers: Neilson himself stepped-down as chief investment officer in 2013; deputy CIO and long-time portfolio manager Jacob Mitchell resigned from the firm ahead of launching his own boutique, Antipodes Asset Management, in 2015; and last December, Joseph Lai, lead portfolio manager on the Asia fund, also left, re-emerging in September at the head of his own firm, Ox Capital.

At some point, Platinum Asset Management will turn around its persistent outflows – when, is the million-dollar question. While outflows continue, earnings will continue to struggle.

Brokers see a small degree of upside from here for PTM: FNArena’s four contributors to analysts’ consensus arrive at a target price of $3.55, with a range of $3.20–$3.85. Macquarie is the bullish outlier, but even it noted (in August) that “the relative performance in both the international and Asian funds has turned negative again and this will put pressure on flows.”

PTM does offer a forecast yield of 7.6%, fully franked (grossed-up, 10.9%), on analysts’ expectations – it might be better to base expectations on the FY21 dividend, which gives a still-attractive 6.1% fully franked yield (grossed-up, 8.7%). But if buying PTM, you are hoping for a turnaround.

Again, brokers are divided, with Thomson Reuters’ collation much less bullish than that of FN Arena.

The most recent price targets for PTM in FNArena are:

Ord Minnett (October) $3.60

Credit Suisse (October) $3.20

Macquarie has $3.85, from August, while Morgan Stanley has $3.55, also from August.

Platinum Asset Management (PTM)

However, there are a couple of better-looking options in the local funds management space:

3. Perpetual (PPT, $37.37)

Market capitalisation: $2.1 billion

Three-year total return: 7.9% a year

FY21 dividend yield: 4.6%, fully franked (grossed-up, 6.6%)

Analysts’ consensus target price: $41.70 (Thomson Reuters), $41.41 (FN Arena)

Funds management group Perpetual transformed itself in 2020, buying US-based ESG specialist Trillium and a 75% stake in US investment manager Barrow Hanley, tripling its assets under management and expanding its reach in America. More than 70% of Perpetual’s total assets are now managed offshore as a result, comprising 47% US equities (including Trillium’s 6%), 28% cash and fixed income, 14% Australian equities and 11% global equities.

Until now, Perpetual has been effectively a domestic-only focused business: from now, one-third of its earnings will be generated outside Australia. The company expects these offshore earnings to grow at a faster rate than its local investments. Brokers have recently lifted earnings expectations based on higher FUM projections. From here, Perpetual looks like a nice total-return scenario, getting into the high-teens.

4. Pendal Group (PDL, $6.95)

Market capitalisation: $2.5 billion

Three-year total return: –0.03% a year

FY20 (end September 20) dividend yield: 6.2%, 10% franked (grossed-up, 6.5%)

Analysts’ consensus target price: $8.51 (Thomson Reuters), $8.43 (FN Arena)

The former BT Investment Management also made what it calls a “transformational” acquisition in 2020, buying Thompson, Siegel & Walmsley (TSW), a US-based, long-only value-oriented investment manager, for $US320million (A$413 million). TSW brought with it $US23.6 billion (A$30.5 billion) of FUM.

The company has disappointed the market with recent outflows, but brokers seem to think this is temporary, and incorporating TSW should drive earnings upgrades over FY22 and FY23.

Brokers are bullish on Pendal at current prices:

The most recent price targets are:

- Morgan Stanley (November) has $9.00

- Morgans (November) $7.80

- Ord Minnett (October) $8.60

- Credit Suisse (October) $8.70

- Macquarie (October) $8.55

And even with low franking, the market expects a solid 6%-plus yield for FY21, rising to 7%-plus in FY22. Again, on a total-return basis, Pendal looks attractive buying.

Also in the sector are Janus Henderson plc and Pinnacle Investment Management, with the latter being an incubator and support business for a range of boutique fund managers, rather than a manager in its own right. Right now, the market sees both of these stocks as over-valued.

5. Janus Henderson Group plc (JHG, $63.97)

Market capitalisation: $12.9 billion

Three-year total return: 32.6% a year

FY21 dividend yield: 3.5%, unfranked

Analysts’ consensus target price: $57.58 (Thomson Reuters), $59.57 (FN Arena)

6. Pinnacle Investment Management (PNI, $18.61)

Market capitalisation: $3.3 billion

Three-year total return: 54.3% a year

FY21 dividend yield: 1.9%, fully franked (grossed-up, 2.8%)

Analysts’ consensus target price: $16.75 (Thomson Reuters), $16.76 (FN Arena)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.