On Friday I asked my friend Mark Bouris to talk to my team for our Business Development Day that we run here at Switzer on a quarterly basis. Mark was inspirational. However, at one point he conceded that while he’s very comfortable making expert decisions about loans, property and building businesses, the stock market isn’t his speciality.

That said, based on historical observations, he said he was a little nervous about bubbly-looking asset valuations. And he questioned whether it was time to go long gold.

I think it’s too early to worry about this because interest rates are too low, central banks want to keep rates lower for longer (2023 or 2024!) and the economic outlook looks huge. The Federal Reserve is looking at the US growing at 6.5% this year, which has to be good for company profits and share prices.

There will be a time to dump stocks and go long gold, but not now. And that’s what I’ll tell Mark when he interviews me on this subject in the not-too-distant future. (I’ve promised him an interview for his followers soon.)

I’d like to think I’m a genius but I’m too smart to believe that about myself! I do think my strength is that I’m good at picking really smart people, who not only have a lot of grey matter but they have real world, street smarts.

Professor Steve Keen is a really smart guy, who I studied and taught with at the University of New South Wales. But Steve’s big calls since he foresaw how debt issues linked to silly loans in the USA could lead to the GFC, have been wrong. If you took his advice, you would’ve lost a lot until the Coronavirus crash and if you didn’t buy back into the market from April, you’d still be a loser.

Steve’s analysis makes a lot of sense on some levels but he has ignored what governments will do to keep the wheels of economies turning.

One guy I like to learn from is someone Warren Buffett rates very highly, and that’s Howard Marks, the co-founder and co-chairman of Oaktree Capital in the USA. “When I see memos from Howard Marks in my mail, they’re the first thing I open and read,” Warren has been quoted as saying.

In his most recent newsletter, Howard looked at whether the US stock market had bubble-like valuations. And let me throw in that Howard is a bond market man and has a tendency to be a more conservative kind of guy.

He pointed out that for the S&P 500 index, the current ratio of price to projected 2021 earnings is roughly 22. “This seems expensive compared to the historic average in the range of 15-16,” he observed. “But knee-jerk judgments based on the relationship between current valuations and historic averages are too simplistic to be dispositive,” he added.

Howard says you really have to look at the following before you can be comfortable or spooked by this most important index for the US stock market:

(a) the context in terms of interest rates;

(b) the shift in its composition in favour of rapidly growing technology companies, with their higher valuations;

(c) the valuations of the index’s individual components, including those tech companies; and

(d) the outlook for the economy.

Taking all these considerations on board, he concluded: “With these factors in mind, I don’t think most of today’s asset valuations are crazy.”

But he did add: “Of course, a big correction in speculative stocks could have a negative impact on today’s bullish investor psychology.”

I particularly liked his view on interest rates and their significance for stock prices. Think about the following:

“We can look at the relationship between today’s 4.5% earnings yield on the S&P 500 and the yield on the 10-year Treasury note of 1.4%. The implied “equity risk premium” of 310 basis points is very much in line with the average of 300 bp over the last 20 years. Valuations can also be viewed relative to short-term interest rates. The current p/e ratio on the S&P 500 of 22 is slightly below the reading of 24 in March 2000 (the height of the tech bubble), and the fed funds rate is around zero today versus 6.5% back then. Thus, in 2000, the earning yield on the S&P 500 was 4.2%, or 230 basis points below the fed funds rate, while today it’s 450 bp above. In other words, the S&P 500 is much cheaper today relative to short-term rates than it was 21 years ago.”

He said the story is “similar in the credit market” and “over the course of my career, there have been a handful of times when I felt the logic for calling a top (or bottom) was compelling and the probability of success was high. This isn’t one of them.”

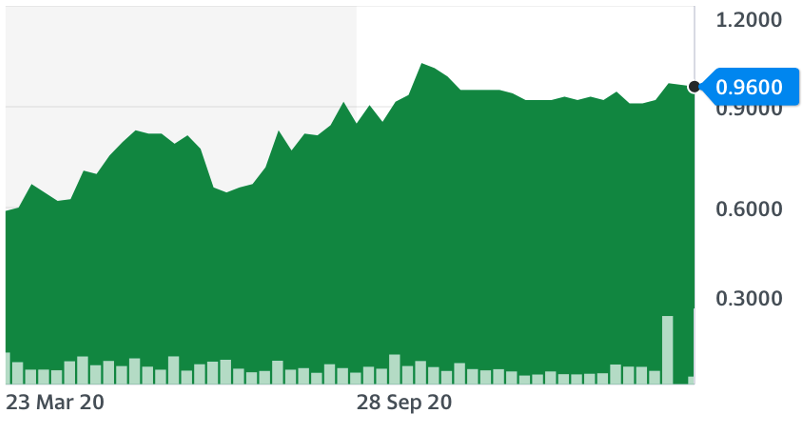

That’s a huge endorsement for my largely positive view on being long stocks. And so is this chart of gold:

Right now, the overall attitude is that gold is less needed, with vaccinations being rolled out around the world. I’d say gold’s latest small kick up is because Europe is still struggling with infections and still has lockdowns. But as the year proceeds, I expect the Coronavirus threat to lessen. This will help economic activity, confidence and should take the gold price down until inflation starts to really kick up, putting pressure on central banks to raise interest rates.

PS: Last week I interviewed the CEO of Redcape Hotel Group for our CEO Masterclass series. These are education pieces that companies pay for to tell their company story. These are not stock tips or companies we have selected. That said, I was impressed with what I heard during the interview. But when I learnt Tony Featherstone (unbeknown to me) wrote about the company last Thursday, I got even more interested.

Redcape Hotel Group (RDC)

This certainly isn’t a core stock but could be a speculative play that I’ve had a small dabble into, mainly on the strength of Tony’s assessment. Its one-year chart looks pretty good considering this is a pubs business. And given all the Covid restrictions, it has been a really hard sector to make easy money.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.