Comparing super loans (more correctly known as ‘limited recourse borrowing arrangements’) is fraught with danger because the complexity of individual fund arrangements means that the best loan for my fund may not be the best loan for your fund. For example, the availability of an interest offset account is very high on my list of priorities. However, if your fund keeps minimal cash balances or you are more than satisfied with your current deposit account, it won’t be high on your list. So, before getting to the “winner”, let’s review the features and the fine print.

Super loans – features and the fine print

- How much can I borrow?

Known as the ‘LVR’ or lending valuation ratio, you can typically borrow up to 80% for residential property if your fund has a corporate trustee, and 72% if your fund has individuals as trustees. - Eligibility

Some banks require all the members to be in the accumulation phase, others look for the SMSF to have a minimum net asset position (excluding the proposed property). You should check any eligibility requirements. - Servicing

Can your SMSF service the interest on the loan? Most banks count 80% of the net rental income from the property and any concessional contributions (up to $25,000). More enlightened banks consider dividend and other investment income in the fund. - Interest rates

Most banks use the ‘standard home loan rate’ for loans secured by residential property – some use business rates. Check carefully. - Mortgage insurance

Typically not required, although some of the non-bank lenders require LMI if the LVR is 70% or more. - Offset account

A couple of banks offer an ‘offset account’ for residential property loans – this can be particularly cost effective for an SMSF that holds cash for liquidity or other purposes. - Application fees

Competition is bringing these down – for residential loans, these range from $1,500 to $350. - Loan servicing fees

Typically, these are around $10 per month for loans secured by residential property. - Bank legal fees

Costs charged by the Bank to review your SMSF trust deed and (potentially) your property custodian deed. These range from $1,500 to $2,150, however they can go much higher. Some banks provide a “panel of solicitors” and/or offer a template of the custodian deed, which tends to drive these costs down. - Independent financial advice?

Most banks (not all) require the trustees to obtain advice from a qualified financial adviser to confirm that the loan is in keeping with the fund’s objectives and that the trustees understand the risks. If you haven’t got an adviser, this means an extra upfront cost. - Personal guarantees

Most banks will require the trustees (as individuals) to provide personal guarantees. If providing a guarantee, you may need to get independent legal advice.

The banks

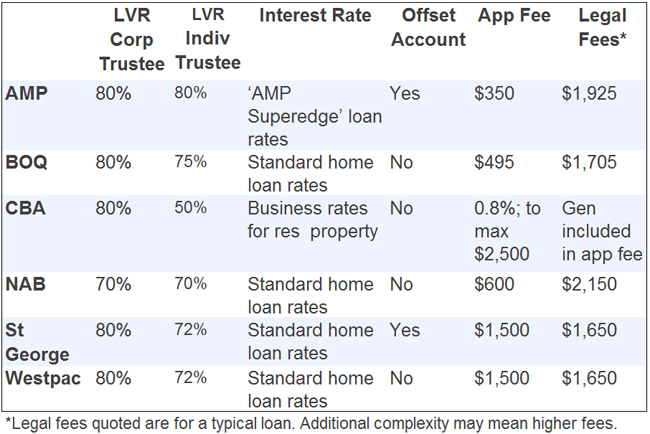

The table below shows the key attributes of super loans secured by residential property from the major lenders – AMP, BOQ, CBA, NAB, St George and Westpac. Other lenders include Bendigo, Liberty Financial, Macquarie, State Custodians and Suncorp.

And the winner is?

And the winner is?

Competition is really increasing in this market and since we started surveying the banks, there has been considerable improvement in their product offerings. Application fees have been crunched, offset accounts are becoming more common, and LVRs are edging higher. Watch this space – it will change further over the next 12 months.

If you are in the market today for a loan secured by residential property, our vote goes to St George ahead of AMP, and then Bank of Queensland followed by Westpac. The offset account for us is a critical feature – the ability to save considerable interest expense by using this as your basic deposit account for your SMSF is a big plus. While the quoted standard variable rates of both banks are largely the same (St George 6.49% and AMP 6.50%), St George has lower fixed rates. With a little more experience in the super borrowing market, St George just edges out AMP – for now!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.