Compared to individual company shares or actively managed funds, ETFs offer investors several benefits, such as affordability, dividends, diversification, tax efficiency, and the ability to know what you own. But, as with any investment, there are risks and fees involved.

EFTs are affordable

ETFs are much cheaper than actively managed retail funds. Their management fees are often less than 0.5% and generally no more than 1%. This is considerably lower than the 1.5% to 2.5% charged by actively managed retail funds. And yes, a difference of 1% is big, particularly when you think of it sitting in your SMSF for 20 years. In such a scenario, a 1% saving could boost your retirement nest egg by one fifth.

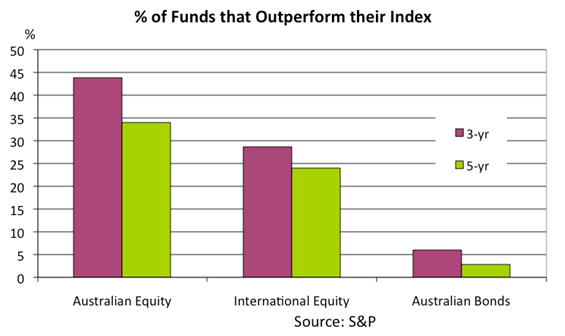

Buying ETFs has become particularly attractive for super fund investors with a long-term investment horizon. This is because ETFs not only offer savings through reduced management fees, but they can generally outperform a managed fund over the long-term. This is made clear in a Standard and Poor’s survey that found, amazingly, that despite all the expertise that goes into selecting stocks for an actively managed fund, 75% of managed funds in Australia failed to beat the overall movement of the S&P/ASX 200 over the previous five years.

ETFs pay dividends

All ETFs provide either quarterly or semi-annual dividends in line with that of the relevant equity benchmark they cover. And as with ordinary company shares, you can generally choose to have dividends automatically re-invested.

Diversification made easy

By following the price movements of a wide selection of stocks, ETFs offer high diversification. Put simply, investors don’t need to buy a heap of different blue chip stocks to get a broad exposure to the market. Instead, they can buy an ETF in a single trade, saving time and administrative cost.

ETFs let you know what you own

Another benefit of ETFs is that they are relatively simple and transparent. They are ‘passively’ managed as opposed to being ‘actively’ managed, which means generally once it has been decided what stocks will form part of that ETF, that selection remains, unlike managed funds that buy and sell shares regularly. It is therefore easy for an investor to know what companies make up their ETF and this information is available from the financial institution that runs the fund.

ETFs are tax efficient

Then there’s the benefit of tax efficiency. Because typical active managers trade stocks more frequently – and have to sell shares when large investor redemptions take place – they generally pay more capital gains tax than ETFs, which turnover stock less regularly. ETFs are also structured so that investors are not liable for capital gains when other investors sell their positions (as this does not trigger sales from the underlying pool of securities held by the ETF provider).

ETFs shed sinking stocks

Last but not least, and unlike a handful of stocks you might hold in the drawer for the long-term, ETFs benefit from survivorship bias. This means an ETF will automatically drop a stock that has lost value to the point it has fallen out of the index the ETF tracks. It will instead be replaced with something that’s gaining in market value.

Watch out! ETF costs and challenges

We’ve taken a look at the many benefits of ETFs, but it is important to recognise that they also have their costs and challenges. These are:

Yes, you have to pay fees

Buying and selling through the ASX involves brokerage costs, which can be large in relation to returns if the parcels traded are relatively small. Another cost is the management fee which is gradually deducted from your returns overtime. Though these expense fees are usually quite small – especially compared to unlisted actively managed funds – but you should still shop around before you buy.

Don’t get ripped off on wide spreads

Low daily trading volumes can also result in large differences between buy and sell prices for some ETFs. This is rarely an issue among the more popular and widely owned ETFs, but in other cases you’ll need to trade carefully and gradually – using limit rather than “market” orders – to avoid transacting at prices unnecessarily far from the ETFs underlying net-asset value.

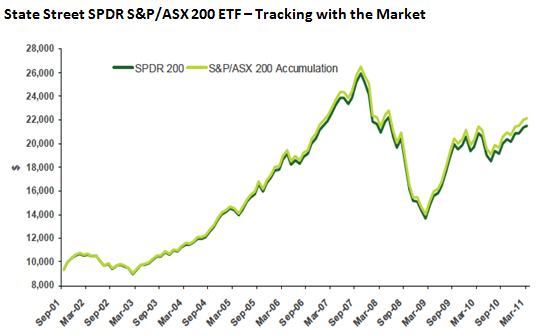

Your ETF might not earn as much as the index

While ETFs track a market or sector index, they can’t guarantee to exactly match the performance of that index. The extent to which they can’t is known as a tracking error. Again, this is generally not an issue for large and well established ETFs. Tracking errors over several years are often less than 1%, but it remains a factor investors need to be mindful of when evaluating different ETFs.

Not all ETFs are bulletproof

ETFs are generally very secure investments because they are backed by underlying assets, such as company shares, which are held in trust by independent third party custodians. In the unusual event of the insolvency of an ETF provider, for example, ETF investors have claim to the underlying securities held by the custodian. However, this is not the case if you happened to have bought a “synthetic” ETF. There are relatively few synthetic ETFs in Australia and those that are available have rules imposed on them by the ASX to limit the degree of counter-party risk to no more than 10% of an ETF’s net-asset value.

You might need to pay foreign tax

Most international ETFs are cross listed with the US market. This is relevant because the US government deducts a 30% withholding tax from all distributions to Australian investors (although this can be reduced to 15% upon submission of the relevant tax declaration form). The tax paid is usually available as a tax credit against any tax that would otherwise have been payable on these distributions in Australia.

Be careful of foreign exchange swings

If you decide to buy an international ETF, then you’ll also want to pay close attention to the currency markets. If, for example, you buy the S&P 500 ETF, you would not only gain exposure to the US stock market, but you would also take on some US dollar risk. This means that if the US dollar fell against the Aussie dollar, then the value of your investment would also decline. On the other hand, if the greenback rose against the Aussie, then the value of your ETF would rise.

Tip: Although it may seem riskier, unhedged international equity returns may often be less volatile than hedged exposure because swings in the Aussie dollar tend to generally move in line with the global equity market.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.