Here are two ETFs with global focus that can provide higher, sustainable dividends.

Australia’s preference for investing in homegrown rather than international equities is well known, even if it means being badly underweight global shares.

Nowhere is the ‘home bias’ more apparent than with dividends. When it comes to income investing from equities, all roads lead to Australian dividend payers.

That makes sense. Franking credits make domestic dividends more attractive, particularly for retirees and those in the tax-free pension phase. Moreover, income investors are often conservative. They prefer investing directly in stocks they know in their home country, rather than international shares. Administratively, it’s easier.

But yield seekers should look further afield as income investing in Australia becomes tougher. For some, that could mean portfolio exposure to private credit, which typically has higher yield, albeit with higher risk in many cases.

Others could pinpoint overlooked small- and mid-cap Australian shares with attractive, franked yield. Currency risks of unhedged investments in global stocks for yield is another consideration.

Whatever strategy is used, it’s worth considering the challenges for income investors. Term deposits are not as attractive as they were, with the cash rate cut three times this year and probably at least twice more by year’s end.

With the best 12-month term deposit rates offering a touch above 4%, income investors will watch cash returns fall this year, albeit off a high level.

The phasing out of the bank hybrid market adds other complications. With billions of hybrid capital expected to be returned between now and 2032, hybrid holders will need to reinvest that capital for income, at yields lower than hybrids provide.

Then there are equity dividends. It’s too soon to draw dividend conclusions on the current profit-reporting season. Dividend growth at the mid-way point is slightly better than expected, with 68% increasing their dividends from a year ago, compared to the long-term average of 58%, AMP data shows.

That said, with Corporate Australia expected to report another year of negative earnings growth, I wouldn’t expect too much joy on the dividend front this year.

With our share market at a record high, the yield for prospective investors is waning. The trailing yield on the Betashares Australia 200 ETF, which tracks the largest 200 companies, was 4.1% after franking at end-July 2025.

Put another way, our equities market is yielding, on average, about the same as a term deposit, despite the latter being government guaranteed (up to $250,000).

With annual inflation at 2.1% in Australia, the real return on equity yield is about 2%, on average. That won’t cut it for those who live off portfolio income and face rising living costs, unless they have a lot invested.

Australian shares, of course, offer more than yield. The other part of the total-return equation, capital growth, has powered along this year. Investors who have enjoyed double-digit returns can always sell some shares to use for income.

But my point remains. The yield on key Australian dividend payers is becoming less attractive. The Commonwealth Bank, for example, has a trailing yield of 2.88% before franking. Telstra’s trailing yield is 3.8%.

Of course, there are always income opportunities within the market; property trusts and infrastructure funds, for example.

The Switzer income portfolio is a good place to start for dividend ideas. Its performance tracked just ahead of the S&P/ASX 200 Accumulation Index on a year-to-date basis for 2025, to August.

I use Exchange Traded Funds (ETFs) and Listed Investment Companies (LICs) for income rather than individual shares. I’d prefer to get a similar yield from a fund compared to investing in stocks directly, due to the diversification benefits.

With that in mind, I’ve analysed ASX-quoted ETFs that invest in global companies offering higher, sustainable dividends. The goal: to identify high-yield global ETF funds that compensate for no franking and invest in high-quality companies.

Here are two ETFs that stood out:

1. SPDR S&P Global Dividend Fund (ASX: WDIV)

I wrote favourably about WDIV in March 2025, in ‘taking shelter from market turmoil’. That article emphasised the power of income investing during volatility.

WDIV tracks the S&P Global Dividends Aristocrat Index (AUD), which comprises 100 relatively high dividend-yielding companies across a wide range of countries and sectors, including less than 2% allocated to Australia.

WDIV’s methodology is to invest in companies that have increased dividends or those that have maintained stable dividends for at least 10 years.

WDIV’s trailing dividend yield of 5.27% is broadly comparable to Australian shares, after franking, on average. The big difference is WDIV’s average Price Earnings (PE) is 12.5 times; the average PE on the ASX 200 is almost 20 times.

So, investors get a similar yield from WDIV compared to the average market yield in Australia, at a more attractive value (due to a substantially lower average PE).

WDIV has returned 18.77% over one year, of which 8.5% was distributed income. The rest was capital growth, to end-July 2025.

The ETF is an option for income-focused investors who want a similar yield to local shares on average, through a fund that trades on a significantly lower average valuation than Australian shares.

Chart 1: SPDR S&P Global Dividend Fund

Source: Google Finance

2. Betashares Global High Dividend Aristocrats ETF (ASX: INCM)

INCM invests in a portfolio of 170 high-yielding companies (ex-Australia). INCM has similar methodology to WDIV, seeking global companies that have increased or maintained their dividends for 10 consecutive years.

INCM has returned 17.5% over one year to August 5 and about 19% annualised over three years. Its 12-month trailing distribution yield is 2.8%

On a country weighting, INCM has a much higher allocation to US shares (71%) compared to the WDIV (20%). That explains why INCM’s average forward PE of 17.3 times is substantially higher than WDIV’s (12.5 times) and it’s yield is lower.

Of the two ETFs, I prefer WDIV for global dividends. As readers know, I think US equities are overvalued but am still prepared to have some US equity exposure at these levels. WDIV has allocated only a fifth to US equities by country.

As such, WDIV is the more conservative option of the two for Australian investors who seek exposure to global dividends, to achieve broadly comparable yield at a lower average valuation – and avoid home-bias investment limitations.

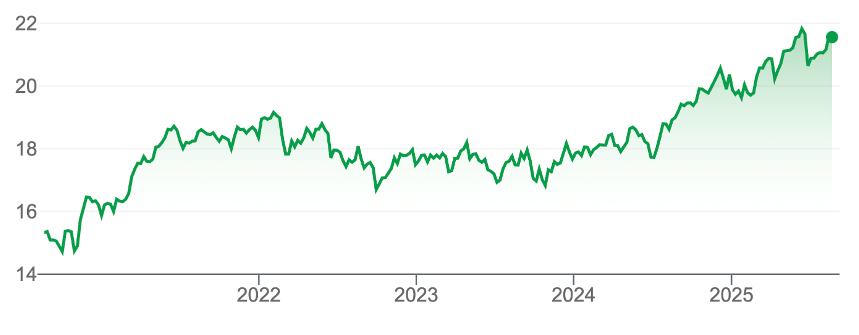

Chart 2: Betashares Global High Dividend Aristocrats ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 20 August 2025.