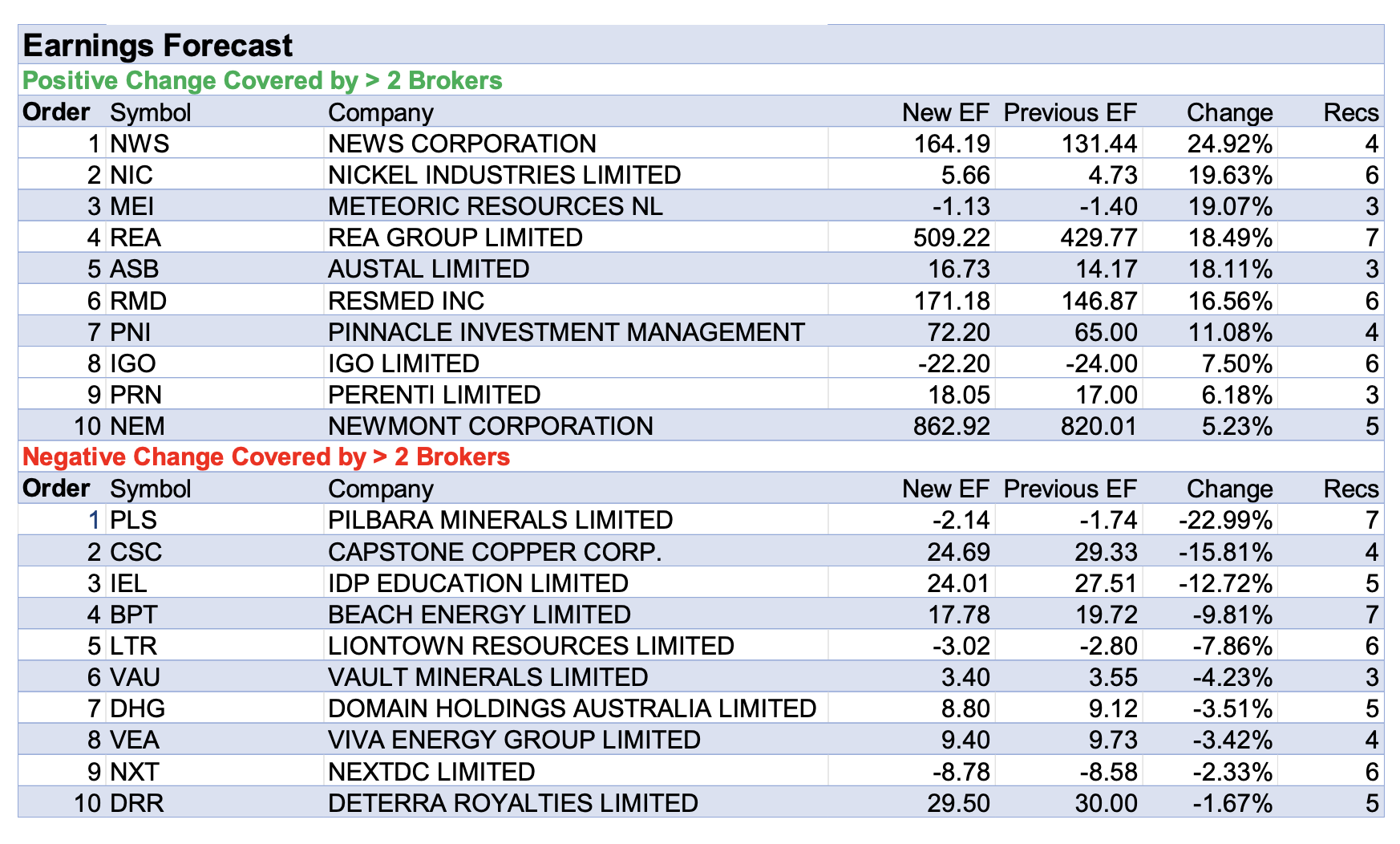

Early reporting season results began drifting in, with ‘beats’ for News Corp and Credit Corp. The Real Estate sector received a 2.8% boost last week, aided by better-than-expected results for Centuria Industrial REIT and Charter Hall Long WALE REIT.

On the other hand, Light & Wonder disappointed against market expectations, along with miners Rio Tinto and Beach Energy.

Infomedia was downgraded to Hold from Buy by Bell Potter and Shaw and Partners after management entered into a Scheme Implementation Agreement with TPG (private equity) to acquire it for $1.72 per share, adjusted for permitted fully franked dividends totalling up to 4.9c.

These include a 2c final and a 2.9c special dividend, which Bell Potter explained could deliver up to 2.1c in franking credits to eligible shareholders.

The cash offer values the company at $579m, with a break fee of -$6.5m and expected completion by late November 2025.

The largest percentage increase in average target price last week went to Austal, following a lift in FY25 earnings guidance and finalisation of the Strategic Shipbuilding Agreement (SSA) with the Commonwealth of Australia.

Shares in Austal, which designs, builds, and maintains commercial ferries and naval vessels, have risen around 35% since the beginning of May, joining in a sector wide rally for defence-related stocks.

COG Financial Services is next, with a near 11% increase in average target price after Ord Minnett upgraded its valuation to reflect the sale of non-core holdings in EarlyPay ((EPY)) and Centrepoint Alliance.

The analyst believes net proceeds of around $26m will further strengthen management’s ability to invest in the growth areas of novated leasing, asset finance brokerage, and insurance broking.

Several avenues for earnings growth identified by the broker include higher novated leasing penetration rates from existing contracts, expansion of complementary insurance brokerage services, and a larger market share in the asset finance brokerage sector.

On the flipside, Beach Energy’s average target fell by around -10% and the stock appears fourth on the table for negative change to average earnings forecasts having released an underwhelming financial report.

Pilbara Minerals, Capstone Copper, and IDP Education appear above Beach Energy on the earnings downgrade table, with respective falls in average FY25 forecasts of around -23%, -16%, and -13%.

Despite a strong operational performance in the fourth quarter, Ord Minnett significantly downgraded its earnings forecasts for Pilbara Minerals across FY25–27.

The broker’s revisions were due to higher depreciation and amortisation, expected losses from the POSCO joint venture in the second half of FY25, and increased expenditure on the newly acquired Colina project, which is being expensed rather than capitalised.

Ord Minnett views the recent price rally for lithium shares as sentiment-driven and not indicative of a sustained recovery.

While UBS lowered its earnings forecasts for IDP Education, the analysts also noted a positive recent announcement by the Australian Government regarding plans for international education in 2026.

Positives include a 9% increase in student enrolment caps and increases for the education and vocational education and training (VET) sectors of 12% and 3%, respectively. Public universities can apply for an additional increase to their individual enrolment caps starting this October.

The government’s commitment to growing international education and enhancing student sentiment will benefit institutions, noted the broker, with a particular focus on Southeast Asia and student accommodation.

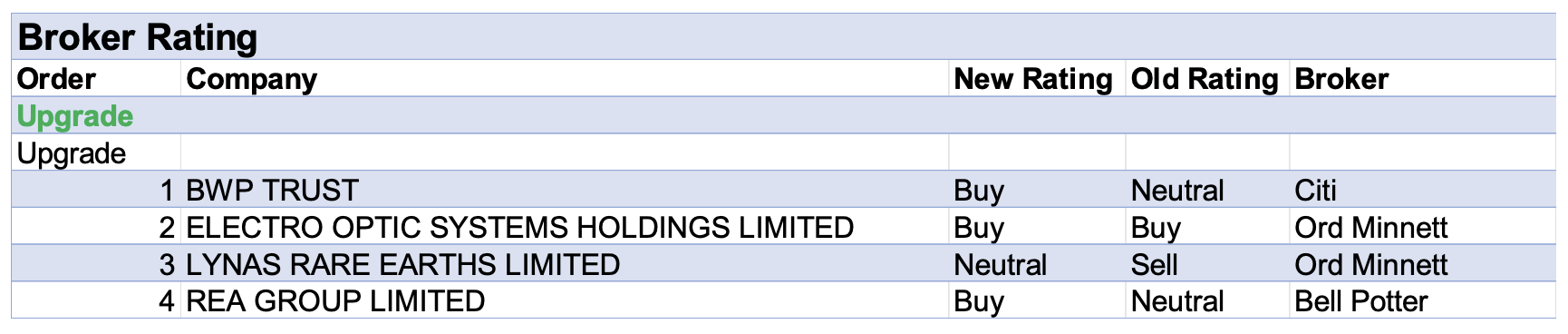

In the good books

Upgrades

BWP TRUST ((BWP)) was upgraded to Buy from Neutral by Citi .B/H/S: 2/1/0

Citi notes the highlight of BWP Trust’s FY25 result announcement was higher-than-consensus distribution guidance for FY26 at 19.41c, up 4.1% y/y. The result also showed the benefit from a shift to internalised management in the past 24 months.

Lease reset at Bunnings ((WES)) at 12 sites achieved a 3.4% average increase and 12 large format retail reviews were completed at a 3.2% average increase. Enhanced lease tenure means more income certainty in the medium term with WALE rising to 4.5 years, up from 0.7 year previously, the broker notes.

For FY25, the distribution of 18.65c was in line with the broker’s estimate and the consensus.

Rating upgraded to Buy from Neutral. Target rises to $4.00 from $3.40. The broker has a 90-day short term upside view on the stock.

ELECTRO OPTIC SYSTEMS HOLDINGS LIMITED ((EOS)) was upgraded to Buy from Accumulate by Ord Minnett .B/H/S: 2/0/0

Ord Minnett raises its target price for Electro Optic Systems to $4.25 from $2.20 and upgrades to Buy from Accumulate following a “transformational” $125m contract.

The company will supply a 100kw High Energy Laser Weapon to a European NATO member, marking the world’s first export of such a system, highlights the broker.

The contract will be fulfilled between 2025 and 2028 via Electro Optic Systems Singapore and positions the company with a first mover advantage in a US$10bn addressable market, explain the analysts. A further $1.3bn in orders is expected by FY32.

While the broker’s FY25 forecasts remain unchanged, FY26 and FY27 revenue projections have been raised 11% and 16% respectively.

Ord Minnett highlights increasing global defence spend and sees Electro Optic Systems as well-positioned across laser, counter-drone, and space tech markets.

LYNAS RARE EARTHS LIMITED ((LYC)) was upgraded to Hold from Sell by Ord Minnett .B/H/S: 2/1/3

Ord Minnett raises its target for Lynas Rare Earths to $10.80 from $7.80 and upgrades to Hold from Sell.

These changes follow reports the US plans to expand price support for rare earths, likely keeping the Lynas share price elevated amid speculation.

The broker notes no confirmed detail but anticipates continued positive momentum until further announcements.

Commentary suggests the US may replicate Operation Warp Speed to boost domestic output, potentially lifting NdPr prices to US$110/kg. A clearer picture is expected in 4–6 weeks.

An investment in Lynas is now seen as speculative grade, as the shares are seen as trading on sentiment rather than earnings.

REA GROUP LIMITED ((REA)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 4/3/0

Bell Potter upgrades REA Group to Buy from Hold, with a rise in target price to $284 from $262, on the back of a roll-forward in the valuation and expected circa 20% growth in EPS across FY26 and FY27.

The FY25 result met the broker’s expectations and consensus, with the 284c final dividend a clear beat on the forecast 234c per share. The company grossed cash of $298m from the sale of its 17.2% stake in Property Guru, which boosted net cash to $358.1m.

A possible sustainable lift in the payout could be implemented if a suitable M&A opportunity does not arise.

Management continues to point to positive operating jaws for FY26, with high-single-digit opex growth versus expectations for double-digit yield growth.

Commentary suggests the AMAX and Luxe add-on products are showing positive trends with monetisation opportunities.

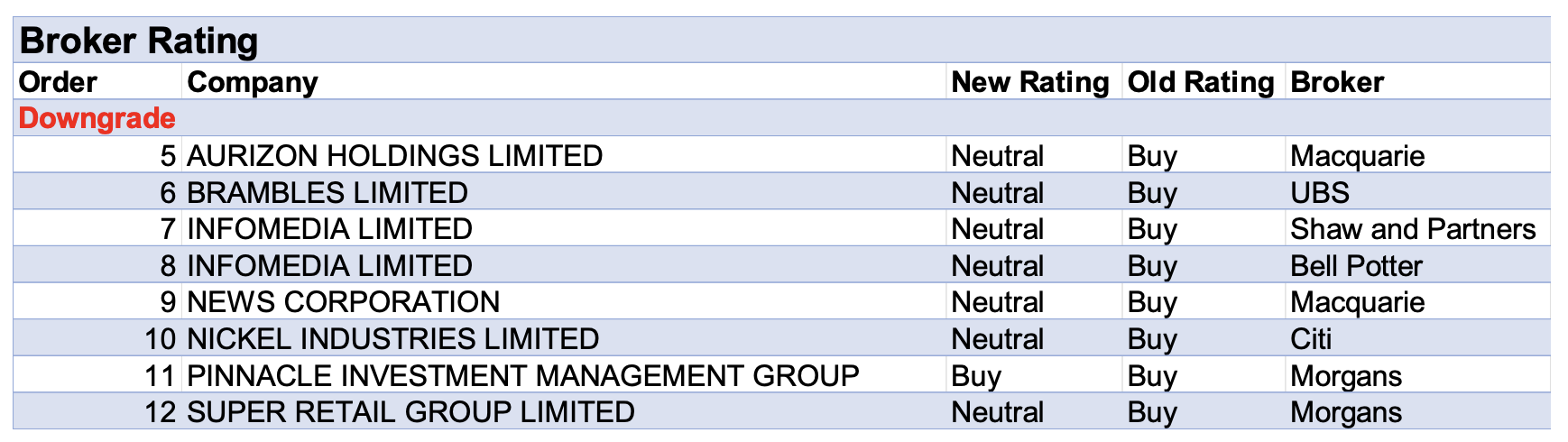

In the bad books

Downgrades

AURIZON HOLDINGS LIMITED ((AZJ)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 0/5/1

Macquarie expects Whitehaven Coal ((WHC)) to consolidate its two contracts with Aurizon Holdings into a single one when it is renewed.

The broker is relying on channel checks in predicting this outcome, noting there has been no formal announcement yet. A consolidation would see $20-30m of EBIT at risk, the broker estimates.

FY27 EPS forecast cut by -3.7% to factor in potential loss from the contracts.

Target cut to $3.31 from $3.39. Rating downgraded to Neutral from Outperform.

BRAMBLES LIMITED ((BXB)) was downgraded to Neutral from Buy by UBS .B/H/S: 3/2/0

UBS’ 2025 Pallet User Survey pointed to a more challenging volume backdrop for Brambles’ CHEP USA in FY26 vs FY25, with price the number one factor, the highest in the survey’s history.

The survey suggests CHEP will find it harder to win new business but price growth in low single-digit is still expected. The broker believes lower volume but higher pricing would still be a decent free cash flow outcome for the company as it means lower invested capital.

So while sales growth could disappoint expectations, EBIT and FCF forecasts could still be supportive of the stock outlook.

Target rises to $24 from $23 on roll forward, with changes to forecasts minor. Rating downgraded to Neutral from Buy following share price gains.

INFOMEDIA LIMITED ((IFM)) was downgraded to Hold from Buy by Shaw and Partners and to Hold from Buy by Bell Potter .B/H/S: 1/2/0

Shaw and Partners downgrades its rating on Infomedia to Hold from Buy after management entered into a scheme with TPG (private equity) to acquire it for $1.72 per share.

The broker’s target is lowered to this level from $21.10 to align with the offer price.

The cash offer values the company at $579m, note the analysts, with a break fee of $6.5m and expected completion by late November 2025.

While the certainty of the offer is appealing in an uncertain environment, Shaw notes the implied valuation is below Infomedia’s historical average and prior M&A offers.

The proposed multiple also lags comparable industry transactions, suggesting to the broker the valuation is not particularly celebratory.

Infomedia has agreed to a scheme implementation with TPG (private equity) offering $1.72 per share in cash, adjusted for permitted fully franked dividends totalling up to 4.9c.

These include a 2.0c final and 2.9c special dividend, which Bell Potter notes could deliver up to 2.1c in franking credits to eligible shareholders.

The board recommends the proposal, with the scheme meeting expected in November and no competing bids anticipated.

The broker has not adjusted its revenue or earnings forecasts, though it now assumes the full 4.9c payout in FY25, changing the dividend mix but not the total.

Bell Potter lowers its target price to $1.72 from $1.75 and downgrades to Hold from Buy.

NICKEL INDUSTRIES LIMITED ((NIC)) was downgraded to Neutral High Risk from Buy High Risk by Citi .B/H/S: 4/2/0

Citi lowers its target for Nickel Industries to 80c from 90c and downgrades to Neutral, High Risk from Buy, High Risk.

The broker sees June quarter results as broadly in line operationally, with stable first-half earnings (EBITDA) but weaker cash conversion due to a working capital build, leaving cash at $145m.

In its modelling, the broker delays the commissioning of the Excelsior Nickel Cobalt (ENC) High-Pressure Acid Leach (HPAL) project to 1H26 and Sampala to 2H26 as management awaits sales and production permits.

Upcoming catalysts, suggest the analysts, include a US$110m VAT refund, circa $250m in ENC payments, working capital unwind in 2H, and bond refinancing over six months.

NEWS CORPORATION ((NWS)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 3/1/0

News Corp announced 4Q25 earnings (EBITDA) of US$322m, a rise of 5% on a year earlier and 4% above consensus forecast, according to Macquarie, due to a beat for Dow Jones and Digital Real Estate Services. Book Publishing and News Media came in lower than expected.

For FY25, earnings (EBITDA) grew 14% on FY24, which was broadly in line. Management announced a US$1.3bn buyback acceleration to capitalise on the view that News Corp’s businesses are undervalued.

Macquarie lowers its EPS estimates by -2% for FY26 and -3% for FY27, with a downgrade in the rating to Neutral from Outperform due to the spot valuation for REA Group ((REA)), which is at the highest level since early 2018, excluding covid.

Target price is set at $57.80.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED ((PNI)) was downgraded to Accumulate from Buy by Morgans .B/H/S: 3/1/0

Morgans downgrades Pinnacle Investment Management to Accumulate from Buy, with the stock viewed as richly priced at current levels.

Like other brokers, Morgans pointed to Life Cycle as the standout from FY25 results, with the affiliate receiving inflows of around $14bn in 2H25 and group funds under management rising 15.4% for the second half to $179.4bn.

Inflows for 2H25 were $16.4bn, comprised of $10.2bn in 4Q25 compared to $6.2bn in 1Q25, with retail $3.2bn, international $4bn, and domestic institutional $9.2bn.

Morgans raises its EPS estimates by 2.6% for FY26 and 2.2% for FY27, with net profit growth largely underpinned by Life Cycle revenue contribution.

Target price is raised to $26.30 from $23.80, with expansion offshore viewed as early in its cycle.

SUPER RETAIL GROUP LIMITED ((SUL)) was downgraded to Hold from Accumulate by Morgans .B/H/S: 2/3/1

The Super Retail share price has rallied over 20% since mid-April, which Morgans believes is driven by market expectations of capital management initiatives by the company, with moderating pressures in the automotive sector.

On the back of some caution around the underlying upcoming FY25 earnings report, the analyst downgrades the stock to Hold from Accumulate and is forecasting sales growth of 3.4% against last year and pressure on the earnings before interest and tax margin of -70bps.

Further cost headwinds are also flagged going into FY26. Target price retained at $16.15 and no change to the analyst’s EPS estimates.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.