Here’s a question often asked by subscribers and friends and it goes something like this: “How can you invest a recently received windfall of $100,000?”

Of course, I’d be concerned about the questioner’s appetite for risk, their current financial situation, how long they wanted the money invested and a whole pile of other issues that financial advisers like me are legally compelled to know before offering advice.

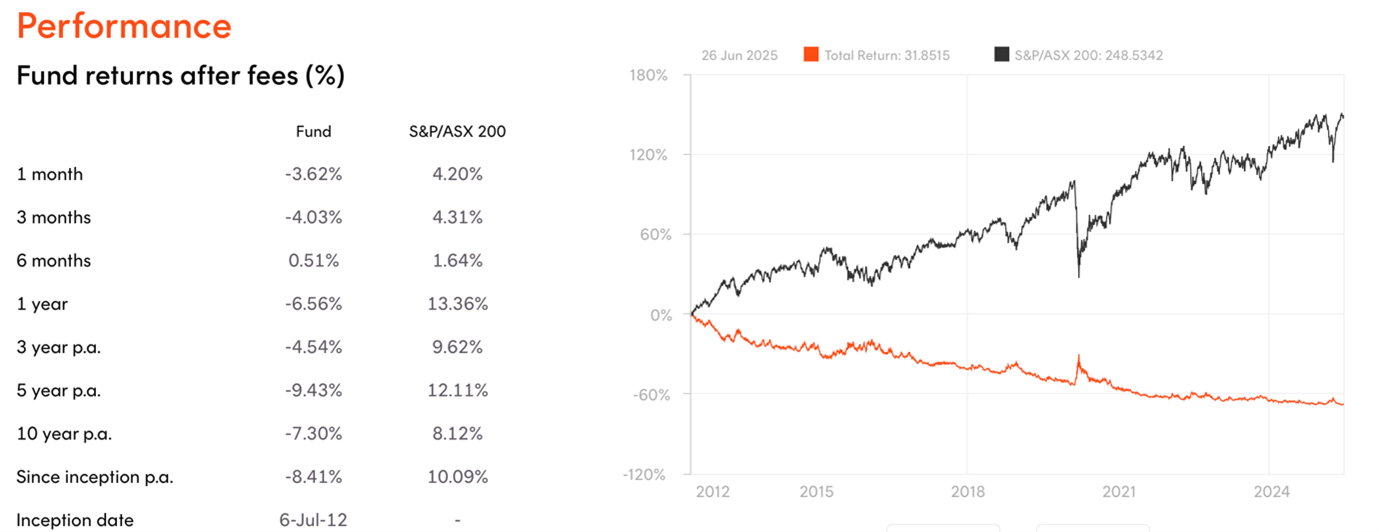

Clearly, my view would change depending on what part of the investing cycle we were in. For example, if I thought we were close to a big sell-off, I’d suggest Betashares BEAR fund, which “seeks to generate returns that are negatively correlated to the returns of the Australian share market. The Fund expects to generate a positive return when the S&P/ASX Accumulation 200 Index falls on a given day (and a negative return when the index rises on a given day).”

It’s the opposite concept to the GEAR fund that I recommended to higher risk investors a few years ago after the Coronavirus crash of the stock market.

The red line shows that the last time BEAR players were on a winner was when that crash happened. However, the gain was short lived because governments threw the kitchen sink at getting economies growing and markets rising to avoid a Covid-created global depression.

That’s why GEAR worked as the chart below shows.

For the courageous who risked buying GEAR at $17 and got out at $32 when I suggested it was time to sell (though it did rise a tick higher), they made around 88% over four and a half years. Most of my higher risk clients got in around $23, as I wanted to see a lower inflation outlook for the US and global economies, including Australia. Even so, it was still about a 35% win for those investors.

I suspect GEAR might work over the next year or two because I think that after the tariff war has been completed, Trump’s policies should help stocks overall. Currently, the combination of the US President and GEAR represents too much of a risky play for me.

So, back to the $100,000 investment question. My aim is to make better than 10% in a year.

I’d take $30,000 and put it into EX20 to capture the companies bound to do well as interest rates fall over the next six months.

For exposure to overseas investments, I’d put another $30,000 into IHVV because if Trump’s policies are good for US stocks, this hedged ETF for the S&P500 index is bound to do 10% plus.

Here is my list of stocks that the analysts think can do better than 10%. I’ll start with high quality companies that will mean if I’m wrong over 12 months, I can just say to give these quality companies time.

- BHP: the BIG Australian

While the analysts think BHP has 10.7% upside, I hope Morgans, which tips 16.4%, will be more on the money. And six out of six experts like the company.

- CSL: a world-class health sector company

CSL has seven out of seven analysts recommending the company, with a consensus rise of 37.3%. The table below from FNArena says it all.

CSL

- James Hardie (JHX): a building industry global giant

Let’s take on the market and buy James Hardie (JHX), which was smashed for buying a US company, but the market is out of step with the analysts. They foresee a 17.4% rise over the year ahead and six out of six like the stock, with the US-based Morgan Stanley its biggest fan, tipping a 36.07% rise ahead.

- Pilbara Minerals (now PLS): a riskier lithium play

PLS, which saw the globally huge fund manager Vanguard buy a big chunk of shares in, saw its share price spike over 13% on Friday. Even after that, the analysts see a 23.6% rise ahead over the year and Macquarie is punting on a 74% rise!

- Chalice Mining (CHN): for the thrill seeker

Finally, for the real thrill seekers, have a look at Chalice Mining (CHN), which was up 15.56% last week as minerals of the future did well. The consensus rise is a big 55.8%. While Bell Potter sees a 218.5% gain ahead, not all analysts agree, as the table below shows.

CHN

FNArena reported what Morgans said about CHN: “Chalice Mining’s enhanced metallurgical processing at the Gonneville deposit is yielding results, with the test work showing improved recovery of palladium (2%), nickel (5%), platinum (2%), gold (3%), while copper was flat. Morgans notes the data also showed recovery of a saleable iron byproduct. The broker lifted recovery assumptions in the forecasts but remains conservative on the byproduct potential and has not factored it in for now.”

In contrast (see table above) “Macquarie has updated forecasts for Chalice Mining following announcement the metals recovery at Gonneville will be via floatation and carbon-in-leach process instead of the hydromet plant.

“The broker now forecasts smaller production and lower pre-production capex to reflect the lower capacity and plant removal. EPS forecasts lifted by 32% and 11% for FY25 and FY26. Target price cut to $1.60 from $2.00 on lower production scenario.”

CHN’s current share price is $1.80. Bell Potter’s call of $5.98 looks attractive, though it comes with risk.

So, what would an investor do with the remaining $40,000 to invest?

A careful investor might split the quality stocks i.e., BHP and CSL for $20,000 a piece, while a riskier player might use BHP or CSL for $20,000 (in total) as the core investment and add PLS, JHX or CHN, for the other $20,000.

The REALLY risky investor might take a punt on PLS or JHX or CHN for the entire $40,000! As mentioned, this is a big risk play on one of these stocks.

Either way, over the next two years, I think all these stocks will deliver good returns.