One statistic more than any other worries me about global equity markets now. And no, it’s not the size of United States debt, though my fears are related.

Rather, it’s the size of US in the MSCI World Index (AUD). At end-May 2025, US equities accounted for 71% of that index by country weighting.

In contrast, Japanese equities comprised 5.5% of the index, UK equities 4% and French equities just under 3%. The US dwarfs other markets many times over.

Put another way, almost $3 in every $4 invested in global equities, via the MSCI World Index, goes to US equities. That’s extraordinary country concentration.

To my thinking, this concentration is part of a broader trend in global equity markets: more funds flowing into largest stocks, sector and countries, regardless of valuation. That’s the downside of indiscriminate index investment where more capital is allocated to the largest stocks and less to smaller ones.

One wonders how far this trend can go before it implodes. What happens when the ‘magnificent seven’ tech stocks are the magnificent two or three? Or when the US accounts for 80% global equity markets, sucking in ever more capital? Or when giant US tech companies are worth more than the combined market capitalisation of entire countries? Think Apple Corp, which is currently more valuable than the entire German share market combined.

In Australia, the Commonwealth Bank (CBA) comprises just over one tenth of the S&P/ASX 200 Index, such has been its extraordinary rise. The 10 largest stocks in the index were worth just under half of that index’s total weighting at end-May.

CBA is among the world’s most expensive banks based on its forward Price Earnings (PE) ratio. Yet it keeps rising to the chagrin of value investors.

In the US, the S&P 500 index – by far, the index that matters most – trades on a forward PE of about almost 24 times yet keeps rising.

More than ever, care is needed with passive investing that relies on exposure to broad-based indices. Owning an ETF over the MSCI World Index means you have most of that capital exposed to overvalued US equities.

Equally, owning an ETF over the S&P 500 Index means having about a third of your capital in ‘magnificent seven’ stocks priced for perfection and then some.

Concentration risk is a growing problem for investors in broad-based ETFs as more capital goes to an ever-narrowing group of stocks, sectors and countries.

Weight of money might drive these asset prices higher in the short term, but it can’t drive valuations ever higher. At some point, the investors in an incredibly crowded trade will rush for the exits at the same time. That never ends well.

Non-US exposure

Given these risks, investors should consider reducing exposure to US equities and rotating into other markets with more favourable valuation metrics.

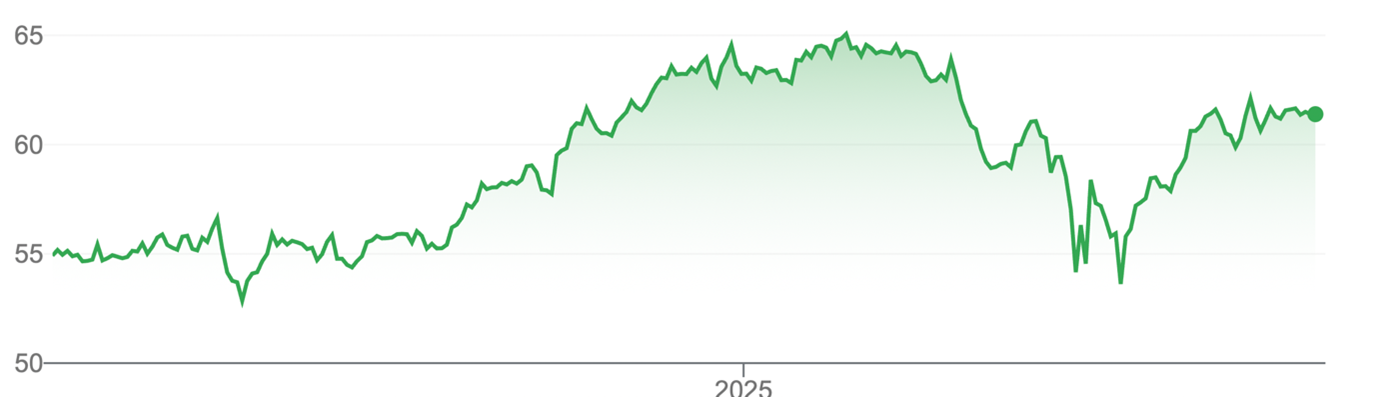

In January 2025, this column made the case to rotate out of US in ‘Time to take some profits from high-riding US equities’.

That column was timely. US equities tumbled in February 2025 after Trump announced his aggressive tariff policy. But the index has since recovered to be in sight of its record high, despite all the problems facing the US.

For those who didn’t heed this column’s suggestion in last January, the latest rally in US equities provides another opportunity to take profits and reallocate capital into other regions and countries trading on lower valuation multiples.

Chart 1: iShares SP 500 AUD ETF (ASX: IVV)

Source: Google Finance

Headwinds facing US equities are growing. President Trump’s tariff policy remains a massive threat to the global economy and thus equity market valuations, particularly if countries cannot agree on trade deals within 90 days.

US debt continues to climb to stratospheric levels with debt at a record US$35 trillion, up sharply higher in the past five years thanks to reckless US spending policies. The so-called bond vigilantes are ready to pounce if growth in US debt quickens.

Heightened geopolitical tensions, recently described as the second Cold War, add to the risks facing the US. War in the Middle East, if it continues, could send oil prices higher, stoking inflation and delaying US interest rate cuts.

Where to invest

The good news is that even a small amount of capital rotation out of the US could be a tailwind for smaller equity markets. I suspect the Australian share market’s recent strength is partly due to capital being rotated from the US into cheaper markets.

Among other developed markets, I favour European equities, which could benefit from Trump’s trade war if more capital is reallocated to the EU from US, and as Chinese manufacturers pivot towards European banks.

As I have written before, European banks look cheap compared to their US and Australian peers and should benefit as the European economy strengthens, particularly if Chinese consumers and businesses turn more towards European markets given US tariffs barriers.

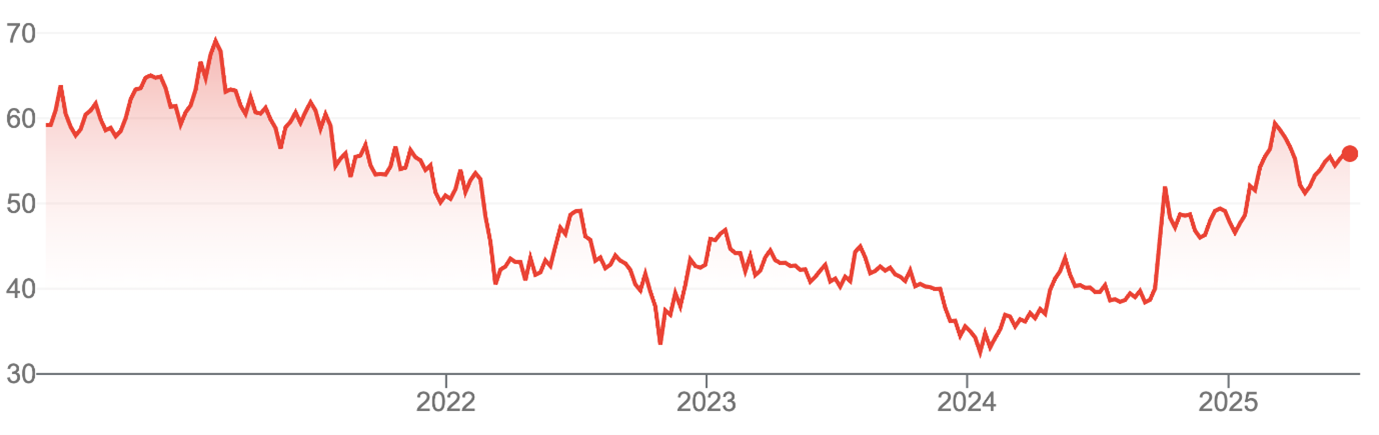

My preferred tool for European equities exposure is the Vanguard FTSE Europe Shares ETF (ASX: VEQ). The ETF held a well-diversified portfolio of 1,241 equities at end-April 2025, mostly across the UK, France, Germany and Switzerland.

I like that just over a fifth of VEQ is invested in European financials, among the world’s most attractive sectors on valuation grounds.

VEQ has done well, returning almost 16% over one year, and about 15% annualised over three years to end-April 2025. The ETF’s average Price Earnings (PE) of 16 times is about a third lower than the average of the S&P 500 Index.

Gains might be slower from here, but European equities look a lot cheaper than US equities and have more valuation upside – and less valuation risk – in the next few years.

VEQ is unhedged for currency movements. It’s annual fee is 0.35%.

Chart 2: Vanguard FTSE Europe Shares ETF

Source: Google Finance

Among emerging markets, I prefer Chinese equities, a controversial call in this column but one that has done well in the past year.

To recap, I became more bullish on Chinese equities last year in an April 2024 column, “Chinese equities a consideration for contrarians”, in this report.

I followed that up with another positive article on Chinese equities in June 2024 and again in September 2024, when I suggested reducing exposure to Indian equities (which at the time had soared) and increasing exposure to struggling Chinese equities.

My preferred tool for Chinese exposure, the iShares China Large-Cap AUD Exchange Traded Fund (ASX: IZZ), is up 43% over one year to end-May 2025.

Yes, China’s economy has serious challenges, notably its struggling property sector and now a US-induced trade war.

In the medium term, China’s ambitions for Taiwan, possibly realised later this decade, are a significant source of uncertainty for its economy – and global financial markets generally.

Longer term, China’s rapidly ageing population could create a demographic timebomb for its labour market and economy.

But every market has its price. IZZ traded on an average PE of 12.3 times at end-May 2025 – or about half that of US equities. Tencent, Alibaba and other Chinese tech giants still trade at deep valuation discounts to their global tech peers, despite recent success by Chinese tech in artificial intelligence.

Chinese equities should trade at a big discount to developed market equities due to heightened regulatory and economic risks there.

But as Beijing rolls out more monetary stimulus through rate cuts; fiscal stimulus through massive infrastructure spending; and as US trade tensions ease, watch more capital flow into Chinese equities, including some capital redirected from the US share market.

Chart 3: iShares China Large-Cap Exchange Traded Fund

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 17 June 2025.